Chase 5/24 rule: What it is and how it works

- What is the Chase 5/24 rule?

- Why does Chase have the 5/24 rule?

- Which cards are affected by the Chase 5/24 rule?

- How to check your Chase 5/24 status

- Strategies for navigating the Chase 5/24 rule

- How Ramp simplifies your business spending

If you're thinking about applying for a Chase credit card, it's important to understand the Chase 5/24 rule. This unofficial policy can significantly impact your chances of getting approved. Because it affects both personal and sometimes business cards, knowing the 5/24 rule upfront can help you plan smarter applications and avoid automatic denials.

What is the Chase 5/24 rule?

The Chase 5/24 rule is an unofficial policy that means if you’ve opened five or more credit cards from any issuer in the past 24 months, Chase will likely deny your application. Sometimes called the Chase 24/5 rule, it applies mostly to personal credit cards.

Business credit cards typically don’t appear on your personal credit report, but there are exceptions. For example, business credit cards from Capital One, Discover, and TD Bank may count toward your 5/24 status because those issuers sometimes report business activity to credit bureaus.

The rule exists to discourage “churning,” which is the practice of opening cards just for welcome bonuses and then shelving them. By knowing how the 5/24 rule works, you can plan applications more strategically and avoid automatic denials.

How the Chase 5/24 rule works

Your 5/24 count includes:

- Credit cards where you’re the primary account holder

- Credit cards where you’re an authorized user

- Cards opened in the past 24 months, even if they’re now closed

It does not include mortgages, auto loans, student loans, or applications that were denied.

Here’s an example of how it plays out:

- You’re approved for a credit card on Jan 15, 2025

- That account stays on your 5/24 count for 24 months

- On Feb 1, 2027, the card drops off your 5/24 tally

- At that point, you may qualify for a new Chase card, though approval is never guaranteed

If getting a Chase card is a priority, apply before hitting the five-card threshold in two years—or wait until a card naturally ages out of the 24-month window.

Why does Chase have the 5/24 rule?

Chase likely introduced this policy to protect its bottom line. Credit card churning—opening cards just for sign-up bonuses and leaving them unused—costs banks money. Even dormant accounts require customer service, security, and infrastructure, which create expenses without generating revenue.

The 5/24 rule also acts as a safeguard against excessive debt. By limiting how many cards someone can open in a short period, Chase reduces the risk of overextended borrowers defaulting on payments.

Which cards are affected by the Chase 5/24 rule?

The following Chase credit cards are generally subject to the 5/24 policy:

Chase personal credit cards

- AARP Credit Card from Chase

- Aer Lingus Visa Signature Card

- Aeroplan Credit Card

- British Airways Visa Signature Card

- Chase Freedom

- Chase Freedom Flex

- Chase Freedom Student Credit Card

- Chase Freedom Unlimited

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Chase Freedom Rise Credit Card

- Chase Slate

- Disney Premier Visa Card

- Disney Visa Card

- DoorDash Rewards Mastercard

- Iberia Visa Signature Card

- Instacart Mastercard

- IHG One Rewards Premier Credit Card

- IHG One Rewards Traveler Credit Card

- Marriott Bonvoy Bold Credit Card

- Marriott Bonvoy Boundless Credit Card

- Marriott Bonvoy Bountiful Card

- Prime Visa

- Southwest Rapid Rewards Plus Credit Card

- Southwest Rapid Rewards Premier Credit Card

- Southwest Rapid Rewards Priority Credit Card

- Starbucks Rewards Visa Card

- The New United Explorer Card

- The New United Club Card

- The New United Quest Card

- The New United Gateway Card

- United TravelBank Card

- World of Hyatt Credit Card

Chase business credit cards

- Ink Business Cash Credit Card

- Ink Business Preferred Credit Card

- Ink Business Premier Credit Card

- Ink Business Unlimited Credit Card

- IHG One Rewards Premier Business Credit Card

- Southwest Rapid Rewards Performance Business Credit Card

- Southwest Rapid Rewards Premier Business Credit Card

- The New United Business Card

- United Club Business Card

- World of Hyatt Business Credit Card

If you plan to apply for any of these cards, review your credit report first to confirm you’re under the 5/24 threshold.

How to check your Chase 5/24 status

Chase doesn’t share your 5/24 status directly, but you can find it by reviewing your credit report. Here’s how:

- Get a free credit report from Experian, Equifax, or TransUnion at AnnualCreditReport.com

- Review the “accounts” section for all open and closed credit cards

- Note the opening dates of any cards added in the past 24 months

- Count all new personal credit cards, including store cards and those from all issuers, not just Chase

- Include authorized user accounts, since they may also be factored into your 5/24 total

Once you know your number, you can plan your next Chase application more strategically.

FAQCan I appeal an application denial?If you waited until you were out of the 5/24 period and were still denied, you can contact Chase and ask them to reconsider your application. The procedure for this should be included in the denial letter you receive.

Strategies for navigating the Chase 5/24 rule

Here are a few ways to stay on top of your credit activity and make smarter application decisions:

Limit your credit card applications

Focus on applying only for cards you truly want. If you’re close to the 5/24 threshold, prioritize Chase cards before hitting five new accounts in 24 months. This strategy helps you avoid automatic denials and improves your odds of being approved for the cards that best fit your needs without overextending your credit or lowering your score.

Track your card opening dates

Keep a detailed record of when each of your credit cards was opened. Tracking this timeline helps you see when accounts will fall outside the 24-month window. A simple spreadsheet or dedicated app works well, especially if you set reminders for when cards will stop counting toward your 5/24 total.

Manage authorized user roles

If you’re listed as an authorized user on someone else’s card, that account counts toward your 5/24 number. You may want to remove yourself if it helps keep you under the limit. If you’re denied for this reason, you can also ask Chase not to consider the account in your application, though there’s no guarantee they’ll agree.

Exceptions and workarounds

There are a few limited situations where you might still be approved for a Chase card even if you’re at or above the 5/24 limit. Pre-approved credit offers are one example. These are generated from a soft credit inquiry, though Chase still runs a hard inquiry before final approval.

If you’re already a Chase cardholder, you may also be able to complete a product change instead of applying for a new card. For example, you could ask Chase to switch one of your existing cards to a card within the Ultimate Rewards program. Keep in mind that you generally must have held the card for at least a year, and Chase may still check your credit.

Every hard inquiry affects your credit score, so use these exceptions carefully. In some cases, it may be better to wait until you’re under the 5/24 threshold rather than risk another application denial.

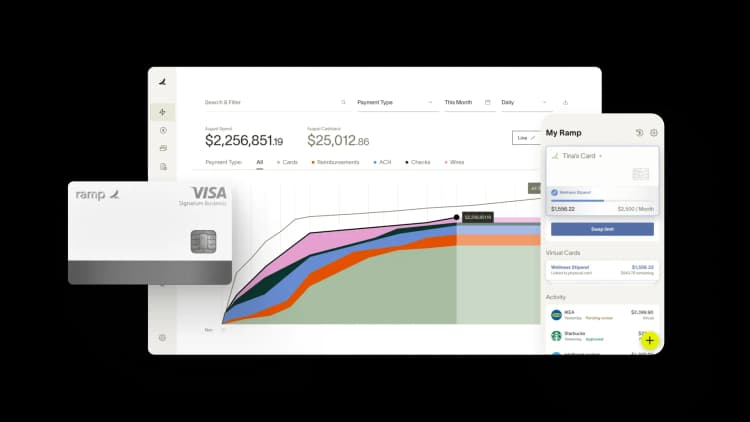

How Ramp simplifies your business spending

The Chase 5/24 rule can limit your options, especially if you're growing a business and need flexible access to credit. If traditional cards are holding you back, the Ramp Business Credit Card offers a better way to manage spending, with no personal credit checks or guarantees required.

Issue unlimited virtual and physical cards, restrict spend by category or vendor, and streamline approvals with personalized workflows. Even submitting expenses is simple: Just text a receipt to a dedicated number, use the mobile app, or let smart integrations handle it for you.

With no impact on your personal credit and access to over $350,000 in partner perks, Ramp is designed to help you move fast without sacrificing control. Try an interactive demo and see how companies that choose Ramp save an average of 5% a year.

Disclaimer: The information provided in this article has not been officially confirmed by Chase and is subject to change.

FAQs

Yes. Authorized user accounts typically appear on your credit report and are included in Chase’s 5/24 count.

Most business credit cards don’t appear on your personal credit report, but some issuers—like Capital One, Discover, and TD Bank—may report them. Those accounts could still count toward your 5/24 number.

Once an account drops off your 24-month timeline, you may apply right away. There’s no guarantee you’ll be approved, but timing your application after a card falls off generally improves your chances.

Yes. If you were under 5/24 and still denied, you can contact Chase and ask them to reconsider. The procedure is usually outlined in the denial letter you receive.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°