Chase Business Credit Card requirements and approval guide

- Basic Chase business credit card requirements

- What credit score is needed for Chase business credit cards?

- Specific requirements of the Chase Ink business credit cards

- What documents are required to apply for a Chase business credit card?

- Factors that impact approval odds

- Tips to improve your approval chances

- Get a Ramp Business Credit Card with no credit check or personal guarantee

Chase business credit cards are known for their generous rewards, high limits, and valuable travel perks. To qualify, though, you’ll need to meet specific personal and business requirements. Understanding these upfront can save time and improve your approval odds.

Chase offers several popular Ink business credit cards—Premier, Preferred, Cash, and Unlimited—each designed for different spending patterns and rewards goals. This guide covers what you need to qualify for any Chase business card, including required credit scores, income expectations, documentation, and other key approval factors.

Basic Chase business credit card requirements

You’ll need to meet a few baseline criteria to qualify for a Chase business credit card:

- Be at least 18 years old (21 in some states for co-signers or corporate entities)

- Be a U.S. citizen or lawful permanent resident with a valid U.S. address

- Operate a registered business (LLC, corporation, partnership, or sole proprietorship). Freelancing or a side hustle qualifies if it earns income.

- Provide a Tax Identification Number (TIN): either an Employer Identification Number (EIN) or, for sole proprietors, your Social Security Number. For a refresher, see how to locate your Employer Identification Number (EIN).

| Requirement | Applies to | Notes |

|---|---|---|

| Age | All applicants | 18+ (21 in some states for co-signers/entities) |

| Citizenship/status | U.S. citizen or lawful resident | Must provide a valid U.S. address |

| Business status | LLC, corporation, partnership, sole prop | Side hustles and freelancers qualify if income-generating |

| Tax ID | Business owners | EIN or SSN (sole proprietors) |

Personal vs. business credit requirements

Chase typically reviews both your personal and business credit when you apply. If your business is new or lacks established business credit, your personal credit score carries more weight. Expect a hard inquiry on your personal credit as part of the decision process. As your business matures and builds its own credit history, revenue, financial stability, and payment history play a larger role.

Minimum business revenue requirements

Chase doesn’t publish a strict minimum revenue figure. Consistent monthly revenue strengthens an application, and higher, predictable cash flow can lead to better approval odds and limits. If your business is newer or revenue is still building, a strong personal credit profile and documented personal income can help offset limited business history.

What credit score is needed for Chase business credit cards?

Chase generally looks for good personal credit for business cards. As a rule of thumb, aim for a FICO® score of 670 or higher. “Good” typically falls around 670–739; 740+ is considered “excellent,” which can improve approval odds and potential limits.

Chase considers more than your score. Business revenue, cash flow, on-time payments, and any existing relationship with Chase also factor into decisions.

Credit score requirements for Chase Ink business cards

- Ink Business Premier: 670+ recommended

- Ink Business Cash: 670+ recommended

- Ink Business Preferred: 670+ recommended

- Ink Business Unlimited: 670+ recommended

How to check your credit score before applying

Check your current FICO score before you apply. Note that some free tools show VantageScore, which can differ from FICO. Knowing your FICO helps you gauge eligibility more accurately.

Specific requirements of the Chase Ink business credit cards

Each Chase Ink business card has different credit score requirements, perks, and approval odds. The table below breaks down what you’ll need for each card and which one might be the best fit for your business:

| Card | Recommended credit score | Best for | Rewards | Annual fee |

|---|---|---|---|---|

| Ink Business Premier | 670+ | Businesses with large, infrequent purchases seeking simple high-rate rewards | 2.5% cash back on purchases of $5,000+; 2% on all other purchases | $195 |

| Ink Business Preferred | 670+ | Businesses with frequent travel and advertising spend | 3X points on the first $150,000 in combined annual purchases on shipping, select advertising, travel, and internet/cable/phone | $95 |

| Ink Business Cash | 670+ | Businesses with steady office, internet, or utility expenses | 5% cash back at office supply stores and on internet/cable/phone (first $25K/year), then 1%; 2% at gas stations and restaurants (first $25K/year), then 1% | $0 |

| Ink Business Unlimited | 670+ | Newer or smaller businesses wanting flat-rate cash back | 1.5% cash back on all purchases | $0 |

At a glance: Chase Ink Business Premier suits large one-off purchases, Preferred favors travel and digital spend, and Cash/Unlimited fit everyday expenses without an annual fee.

Add current welcome bonuses

Insert the latest welcome offer details for each Ink card here (amount, spend threshold, timing). Verify on Chase.com before publishing.

What documents are required to apply for a Chase business credit card?

When you apply for a Chase business credit card, you’ll need to provide personal, business, and financial information so the bank can verify your identity and assess your company’s creditworthiness.

Personal information

Chase asks for standard details to confirm identity and evaluate risk, including:

- Full legal name

- Home address

- Social Security number (for credit check and verification)

- Date of birth

- Personal annual income

Like most business card issuers, Chase typically requires a personal guarantee, meaning you’re personally responsible for any debt if the business can’t repay.

Business information

You’ll also provide details about your business:

- Legal business name and contact information

- Industry type (for example, services, retail, or manufacturing)

- Years in operation

- Annual revenue and number of employees

If you’re a newer business, having at least three months of consistent revenue can improve approval odds. Chase may also request a business license or registration documents to verify legitimacy.

Business financials

Chase may review recent financial documentation to gauge your company’s stability:

- Bank statements

- Tax returns

- Profit and loss (P&L) statements

| Documentation | Purpose |

|---|---|

| Business license/registration | Confirms business legitimacy |

| Bank statements | Verifies cash flow and account activity |

| Tax returns | Confirms revenue and expenses |

| P&L statements | Shows profitability and financial trends |

| Owner ID and TIN/EIN | Confirms identity and tax verification |

Legal and ownership details

Chase will also require information about your business's legal standing and ownership structure, such as:

- Business structure: Type of business entity (LLC, corporation, sole proprietorship, etc.)

- EIN: Federal tax identification number for your business

- Ownership details: Information about the business owners and their stake in the company

Application timeline

Most Chase business credit card applications receive a decision within minutes. If additional verification is needed, processing may take up to 7–10 business days.

Factors that impact approval odds

Several factors influence whether you’ll be approved for a Chase business credit card, including your personal credit, business revenue, and relationship with the bank.

Businesses with strong financials and owners with good to excellent credit typically have higher approval odds. Having a Chase checking or business account also helps, since it gives the bank visibility into your deposits and cash flow.

Chase evaluates your business age and industry as well. Newer businesses or those in higher-risk industries, such as real estate investment or cryptocurrency, may face closer scrutiny and need stronger personal credit or income to qualify.

If your application is denied, Chase will send a written notice explaining why. You can use that feedback to strengthen your profile before reapplying.

Tips to improve your approval chances

Strong credit and organized documentation can go a long way toward a successful application. A few small steps can improve your odds of approval:

- Improve your credit score: Pay down existing balances, avoid late payments, and keep utilization below 30%. Even a small FICO increase can help.

- Build a relationship with Chase: Opening a Chase business checking account or maintaining regular deposits shows financial stability

- Time your application: Avoid applying right after opening several new credit cards or taking on new financing. Waiting 3–6 months between applications can help.

- Use Chase’s prequalification tools: Chase doesn’t offer full online preapproval for business cards, but you can check targeted offers in your account or at a branch

Before you apply checklist

- Check your FICO score (670+ recommended)

- Prepare bank statements, tax returns, and revenue documentation

- Keep credit utilization under 30%

- Confirm you haven’t opened more than five credit cards in the past 24 months

- Gather your EIN or SSN and business registration documents

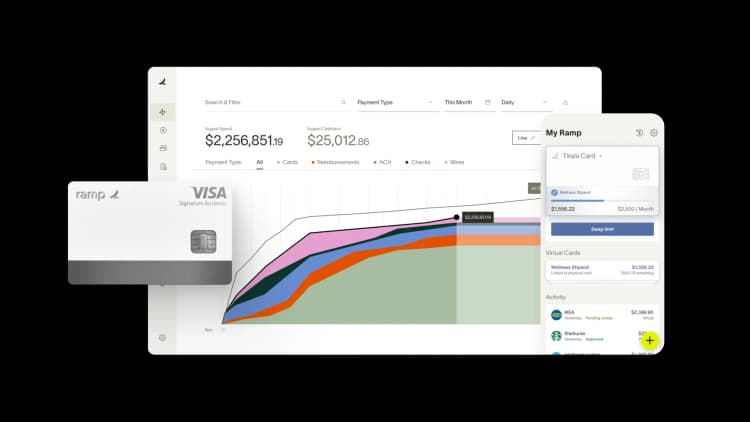

Get a Ramp Business Credit Card with no credit check or personal guarantee

If you're looking for a business credit card without the need for a credit check or personal guarantee, consider the Ramp Business Credit Card. Our streamlined, hassle-free application process focuses on your business's financial health rather than your personal credit score.

Our card can help you save an average of 5% across all business spending, while offering global acceptance through Visa, compatibility with Apple Pay and Google Pay, and access to over $350,000 in partner discounts.

You also get access to an all-in-one spend management platform. Set custom controls to prevent out-of-policy spending, issue virtual or physical cards for specific vendors or categories, and submit expenses effortlessly through SMS, mobile app, or integrations with Gmail, Lyft, and Amazon.

Want to learn more? Get started with a free interactive product demo.

FAQs

Approval depends on your personal credit score, business revenue, and overall financial profile. Chase typically looks for applicants with good to excellent credit and a stable business income, so meeting those standards can make the process easier.

It’s possible but less likely. While some applicants with scores in the mid-600s could be approved, Chase usually prefers scores of 670 or higher, especially for its Ink business cards. Strong business financials or an existing relationship with Chase can help improve your odds.

Chase doesn’t list a specific income requirement, but they consider your business revenue and personal income when reviewing your application. Showing steady cash flow and the ability to repay balances will strengthen your case for approval.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°