- What is a contract management process?

- Who owns the contract process?

- Key stages of the contract lifecycle management process

- How do you streamline your contract management process?

- Optimize your contract management process to boost efficiency

Contracts sit at the core of every business relationship. Yet, managing them is often slow, manual, and full of gaps. Breaking down the contract management process helps teams understand where delays happen, who owns each step, and how to reduce risk without slowing things down.

What is a contract management process?

A contract management process is the end-to-end workflow a business uses to manage a contract's lifecycle. It includes contract creation, reviewing, approving, signing, storing, and tracking contracts to ensure terms are met and risks are controlled.

A well-designed contract management process assigns clear responsibilities at each contract stage, eliminating approval bottlenecks and preventing document loss. Companies with optimized contract workflows close deals faster, capture early payment discounts, and avoid costly compliance violations.

Poor contract management comes at a cost. Companies lose part of their annual revenue from missed obligations, outdated terms, and poor visibility into contract status.

Who owns the contract process?

Contract ownership is a cross-functional effort with shared responsibilities across legal, finance, procurement, sales, and operations teams.

Legal establishes the framework by defining approved language, managing risk, and ensuring compliance with regulations. Procurement often initiates vendor contracts and handles negotiations. Finance reviews payment terms and ensures budget alignment. Sales owns customer-facing agreements and drives deal velocity. Operations track service levels and fulfillment.

Ownership shifts depending on the contract type. For example, sales leads the process for customer contracts, while procurement takes the lead on vendor agreements.

However, when roles are not defined, contract approvals stall, risks go unnoticed, and accountability breaks down. To solve this, companies implement role-based workflows and approval matrices that assign responsibilities and keep contracts moving.

Key stages of the contract lifecycle management process

Every contract moves through a set of defined stages before it's considered complete. These stages reduce risk, ensure compliance, and maintain business momentum.

1. Pre-contract requests

The contract process starts well before legal gets involved. Pre-contract requests are where internal teams flag the need for a new agreement, whether for a vendor, customer, partner, or contractor.

This stage sets the tone for everything that follows. If details are missing or scattered, downstream delays will occur later. A standardized intake form helps teams collect the correct information upfront, including business purpose, contract type, value, and key dates.

Procurement or business operations usually own this stage, but it depends on the contract type. Sales may initiate customer agreements. Finance might request contracts tied to large spending. The legal team defines what must be included before a contract can move forward.

Without structure at this stage, legal teams waste valuable time chasing down missing data. Most legal departments say poor intake processes slow down contract cycles. A strong pre-contract request process reduces back-and-forth, improves response time, and ensures that contracts are reviewed in the proper context from day one.

Using Ramp's vendor management system during the pre-contract request phase, all relevant vendor details are captured upfront, including contract start and end dates, pricing information, and specific service level agreements. This streamlined intake process reduces the time spent chasing down key contract data, allowing teams to move forward quickly and avoid delays caused by missing or incomplete information.

2. Drafting contracts

After the request approval, legal or procurement creates the first agreement version using approved templates and standardized language.

Standardized templates play a critical role in this stage as they help teams move faster and reduce legal risk. While legal owns the drafting framework, content comes from multiple stakeholders:

- Finance defines payment schedules and fiscal terms

- Procurement outlines performance metrics and delivery expectations

- Sales provides pricing structures, scope details, and timeline requirements

Without centralized drafting controls, teams risk introducing inconsistent language or outdated clauses. Poor version control can also lead to confusion when contracts are shared across email or stored in multiple locations.

A well-managed drafting process, on the other hand, ensures contracts reflect company policies, legal standards, and operational realities. It also gives downstream teams, like finance and operations, clear expectations once the agreement is signed.

3. Internal review

Internal review is the stage where cross-functional teams assess the contract for accuracy, risk, and alignment with business goals. This step ensures the contract works for everyone.

Legal teams check for compliance and liability issues. Finance confirms pricing, payment terms, and budget alignment. Operations or procurement teams verify that service levels and delivery timelines are realistic. Without a coordinated contract review, contracts are more likely to move forward with errors, misaligned terms, or hidden risks.

Centralizing the review process in a shared platform improves visibility and speeds up approvals. It also reduces version confusion and eliminates manual tracking through spreadsheets or email threads.

A structured internal review helps teams move fast without skipping critical checks. It’s where risk is managed, and accountability is shared across the business.

4. Negotiation and approval

Negotiation aligns both parties on final terms. This stage often creates the most back-and-forth and potential delays in the contract lifecycle. At this stage, legal teams work closely with external counsel or vendors to revise clauses, resolve conflicts, and protect the business. Key terms under review often include liability, termination rights, and payment schedules.

Contract negotiations can take up to 50% of the total contract cycle time, especially when manual processes are involved. Without precise version control and audit trails, teams risk losing change history or introducing errors.

Approval processes follow negotiation. Each revision must be signed off by the right stakeholders, including legal for compliance, finance for budget impact, and business leads for operational feasibility.

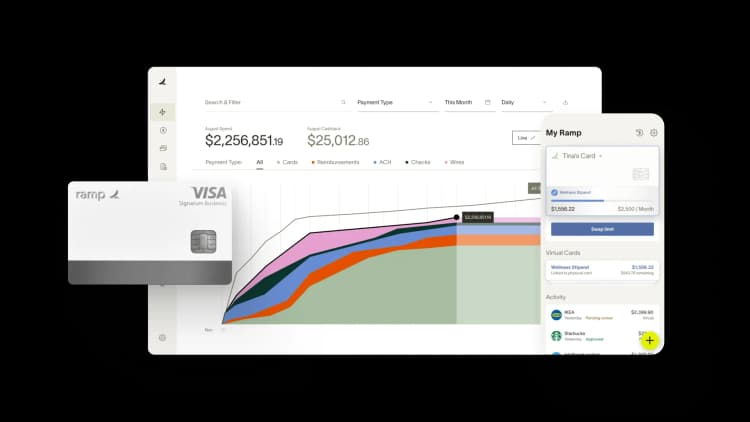

Automated approval workflows and role-based matrices help reduce delays and enforce accountability. Solutions like Ramp streamline this process by enabling tailored approval flows for different contract types, ensuring the right people are looped in at the right time.

Smart workflows eliminate manual follow-ups and idle contracts by clearly defining ownership and automating the next steps. This minimizes the risk of outdated terms, missed clauses, or unauthorized commitments.

5. Execution

Execution transforms the contract into a legally binding agreement. Once both parties agree on the final terms, they sign the contract digitally or on paper to formalize the deal.

Speed and accuracy at this stage directly impact business operations. Delays at this stage often come from unclear signatory rules or routing issues. If the wrong person signs or the right person isn’t looped in, execution stalls and may need to be repeated.

Legal or business operations typically manage this step, ensuring all required approvals are in place before the contract is signed. Using an e-signature tool integrated with your CMS eliminates manual steps, provides an audit trail, and ensures faster execution without errors.

Once signed, the contract should be stored immediately in a centralized repository with full visibility and version control. This keeps teams aligned and reduces the risk of lost documents or missed obligations.

When it comes to contract execution, Ramp’s platform makes the process more efficient by integrating e-signature capabilities and tracking tools. Once a contract is signed, Ramp automatically stores the contract in a centralized repository and sends automated reminders for key milestones such as contract renewals, payment terms, or other deadlines. This ensures that nothing is missed and your business stays compliant.

6. Post-signature management

Once a contract is signed, the work shifts to managing the terms and obligations it outlines. Post-signature management ensures that every commitment is tracked, deadlines are met, and risks are controlled.

This stage includes monitoring renewals, enforcing compliance, and tracking performance against the contract. Without a structured approach, teams often miss critical dates, overlook key terms, or fail to act on penalties and incentives.

Responsibility is shared across departments. Legal teams manage risk and ensure compliance. Finance monitors payments and penalties. Operations track service levels and delivery timelines.

A centralized contract repository helps teams access the latest version of each contract and find the information they need quickly. Alerts and automated reminders ensure that teams follow through on renewals, expirations, and key milestones. Businesses gain better control over risk, improve accountability, and extract more value from every agreement by actively managing contracts after they’re signed.

How do you streamline your contract management process?

A streamlined contract management process removes inefficiencies and reduces friction throughout the contract lifecycle. It ensures that contracts move quickly through each stage while minimizing risks, errors, and delays.

- Map out your current workflow. Document how contracts move through your organization today, from initial requests to approvals and renewals. Identify where delays happen, who’s involved, and where work is duplicated or unclear. This creates a clear starting point for improvement.

- Standardize contract templates. Use pre-approved templates for common agreement types. This ensures consistency in language, reduces legal review time, and lowers the risk of errors or missing terms. Templates also help non-legal teams move faster without reinventing the wheel.

- Automate intake with structured request forms. Set up smart forms to collect key information upfront, such as contract purpose, value, business owner, and deadline. This prevents back-and-forth with legal and ensures each request includes the context needed to move forward quickly.

- Define roles, ownership, and approval paths. Use role-based permissions and approval matrices to make sure the right people review and approve each contract. Clear accountability reduces bottlenecks and keeps the process moving without confusion or delay.

- Integrate with your core business systems. Connect your contract platform with tools like your CRM (for sales), ERP (for finance), and e-signature providers. This eliminates double entry, keeps records up to date, and gives all stakeholders visibility into contract status.

- Set automated alerts and reminders. Use notifications to stay ahead of key milestones, like renewals, terminations, and payment obligations. Proactive tracking reduces missed deadlines, revenue leakage, and compliance issues.

- Monitor and optimize with contract performance metrics. Track KPIs like contract cycle time, time-to-approval, and renewal rates. These insights help you spot inefficiencies and continuously improve the process as your business grows.

Optimize your contract management process to boost efficiency

Optimizing your contract management process is essential for maintaining efficiency, reducing legal risks, and ensuring contract compliance. By examining each stage of your contract lifecycle, you pinpoint exactly where handoffs break down and implement targeted solutions that keep contracts moving.

When companies actively refine their contract processes, they reduce approval times, prevent missed deadlines, and ensure that obligations are met on time.

Implementing standardized templates, automated workflows, and clearly defined role ownership ensures that each contract is handled efficiently and accurately. This boosts operational efficiency and gives your team more time to focus on strategic goals rather than administrative tasks.

Businesses can optimize their vendor management process by adopting a finance automation tool, like Ramp. With automated workflows, centralized contract storage, and seamless integration of key vendor data, Ramp helps businesses track contract milestones, monitor vendor performance, and ensure compliance. The result is faster, more efficient contract management, with fewer missed deadlines, lower legal risks, and better overall vendor relationships.

FAQs

An effective contract management system requires tools that support document storage, workflow automation, e-signatures, and reminder systems.

Inefficient contract management can lead to missed renewal deadlines, compliance issues, and disputes with vendors or clients. This often results in financial losses, strained business relationships, and unnecessary legal risks.

The contract management process involves multiple stakeholders, including legal, finance, procurement, operations, and sales teams. Each department has specific responsibilities, from drafting to approval and ongoing management.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits