What is cost control? Methods, examples, and best practices

- What is cost control?

- Why is cost control so important?

- Types of business costs to control

- Cost control methods

- Cost control in project management

- Cost control examples

- Common cost control challenges

- Best practices for controlling expenses

- Cost control software and automation

- How Ramp's automated expense controls help drive profitability

- Get cost control right with technology

Every dollar you spend is a dollar you can't count as profit or reinvest in your business. If you aren't actively controlling your costs, you're leaving money on the table.

Cost control gives you the framework to monitor spending, catch overruns early, and take corrective action before small problems become big ones.

What is cost control?

Cost control is the process of monitoring actual business expenses against a budget and taking corrective action when spending exceeds planned limits. Its goal is to maintain financial discipline, protect margins, and ensure resources are used efficiently.

At a practical level, cost control works as a continuous feedback loop with three core steps:

- Monitoring: Tracking actual spending against budgeted amounts

- Analyzing: Identifying variances and understanding why they occurred

- Correcting: Taking action, such as renegotiating contracts, tightening policies, or reallocating resources

Some examples of cost control in action include:

- Placing restrictions on reimbursements for travel and entertainment (T&E) expenses

- Renegotiating contracts with vendors for lower prices

- Bringing on automation software to drive efficiencies

- Outsourcing marketing, accounting, or other functions

- Cutting programs or project costs from your budget

Effective cost control transforms scattered spending into strategic decisions, helping you protect your profit margin and redirect savings toward growth opportunities.

Cost control vs. cost management

Cost control focuses on executing against an approved budget, while cost management covers the broader work of planning, estimating, budgeting, and governing costs over time.

| Aspect | Cost control | Cost management |

|---|---|---|

| Primary role | Execute against an approved budget | Plan, forecast, and govern costs |

| Timing | Ongoing, during spending | Before and during spending |

| Key activities | Budget vs. actual tracking, variance analysis, corrective action | Cost estimation, budgeting, forecasting, and control |

Cost control is a subset of cost management. You need cost management to set the plan, and cost control to make sure the plan holds.

The difference between a cost and an expense

A cost is the price paid for raw materials, labor, or a particular asset. Accountants use the term cost when planning production or creating a budget. When a cost is posted in the accounting records, it becomes an expense.

To illustrate, let's say you're a furniture manufacturer. You purchase $10,000 of maple wood as a raw material to produce doors. The wood is a cost, and you budget for the cost of each door by adding in labor costs and overhead costs.

When you use the wood to manufacture doors, you record $10,000 as an expense for maple wood. The revenue from the door sale is matched with the wood and other expenses to determine the profit.

Why is cost control so important?

To understand why cost control is so important, we need to look at the formula for calculating business profit:

Profit = Revenue – Expenses

While maximizing revenue is important, limiting your business expenditures is also critical. After all, that's the only part of the equation that's under your direct control. The more money you save via cost control, the higher your profits, which you can then reinvest into your business and employees.

Effective cost control delivers three key benefits:

- Protects margins: Every dollar saved goes directly to your bottom line

- Enables growth: Freed-up capital can fund new initiatives

- Maintains quality: Smart cost control cuts waste, not value

Lowering your business expenses by avoiding overspending also allows you to charge your customers less for your products and services without compromising your quality or profit margin. In other words, cost savings can be a competitive advantage, helping you attract new customers while retaining your existing base.

Types of business costs to control

Understanding the different types of business costs helps you prioritize where to focus your control efforts. Not all costs behave the same way, and each type requires a different approach.

Fixed costs

Fixed costs stay the same regardless of output. Rent, salaries, and insurance premiums fall into this category. These are harder to reduce quickly but are worth reviewing periodically, especially when leases come up for renewal or you're evaluating headcount.

Variable costs

Variable costs fluctuate with production or sales volume. Materials, shipping, and commissions are common examples. These offer more immediate control opportunities since they scale with activity. When revenue dips, you can often reduce variable costs in tandem.

Direct costs

Direct costs are tied directly to producing a product or service, like raw materials and production labor. These are easier to trace and manage because you can attribute them to specific outputs.

Indirect costs

Indirect costs are overhead expenses not tied to a specific product—utilities, administrative salaries, and office supplies. These often get overlooked but can add up significantly. Regular audits help you spot inefficiencies.

Cost control methods

Cost control methods help you plan spending, detect overspending early, and correct issues before they hurt your margins. Each technique addresses a different part of the cost control process, from setting expectations to enforcing discipline.

Budgeting and forecasting

Setting financial targets and predicting future costs is the foundation of all cost control. You can't control what you haven't planned for. Start each period with clear budgets by department or project, then use historical data to forecast where spending is likely to land.

Variance analysis

Variance analysis compares budgeted vs. actual costs to find discrepancies. When you spot a variance, dig into the root cause. Was it a one-time event or a systemic issue? This helps you take corrective action quickly rather than waiting until the problem compounds.

Spend categorization

Grouping expenses by type—travel, software, supplies—lets you spot trends and outliers. It also makes it easier to enforce policies by category. When you can see that software spending jumped 40% quarter-over-quarter, you know where to investigate.

Vendor negotiation and management

Getting competitive bids, renegotiating contracts, and consolidating vendors is one of the fastest ways to reduce costs. Review your vendor relationships at least annually. You may find opportunities to bundle services, eliminate redundant suppliers, or leverage volume discounts.

Policy enforcement

Setting clear spend policies—travel limits, approval thresholds, preferred vendors—only works if you enforce them consistently. Automation can help significantly here by blocking out-of-policy purchases before they happen rather than catching them after the fact.

Cost control in project management

In project management, cost control involves tracking budgets, monitoring spend throughout the project lifecycle, and adjusting scope or resources when variances occur. Projects often have fixed budgets and deadlines, making cost control especially critical.

A key technique is earned value management (EVM), which compares the planned value of work to the actual cost and progress.

- Planned value (PV): Budgeted cost of scheduled work

- Earned value (EV): Budgeted value of completed work

- Actual cost (AC): Actual cost incurred

From these values, project teams track:

- Cost performance index (CPI): EV / AC, which indicates cost efficiency

- Schedule performance index (SPI): EV / PV, which indicates schedule efficiency

Project managers should build cost control checkpoints into their workflows—weekly budget reviews, milestone-based variance analysis, and clear escalation paths when spending exceeds thresholds.

Cost control examples

Here are concrete scenarios showing cost control in action, particularly relevant for finance teams managing company-wide spending.

Expense policy enforcement

Setting per-diem meal limits or requiring pre-approval for expenses over a certain threshold prevents overspending before it happens. For example, you might cap meal reimbursements at $75 per day for domestic travel and require manager approval for any single expense over $500.

SaaS subscription management

Auditing software subscriptions to eliminate unused licenses or duplicate tools is a common win for mid-market companies. You might discover that 3 departments each have their own project management tool when 1 would suffice, or that you're paying for 100 seats when only 60 employees actively use the software.

Travel and entertainment controls

Requiring employees to book through approved channels or setting caps on airfare keeps travel expenses predictable. You might mandate economy class for flights under 4 hours or require travelers to choose from a list of preferred hotels that offer negotiated corporate rates.

Common cost control challenges

Even with the right methods in place, you'll likely encounter obstacles. Acknowledging these challenges helps you design systems that address them head-on.

- Lack of visibility: You can't control costs you can't see. Manual tracking creates blind spots, especially when spending is spread across multiple systems or credit cards.

- Delayed reporting: Waiting until month-end to review spend means catching problems too late. By the time you see the variance, the money is already gone.

- Policy workarounds: Employees may find ways around unclear or unenforced policies. If your expense policy is buried in a handbook no one reads, don't be surprised when people ignore it.

- Decentralized spending: Multiple teams purchasing independently leads to duplicate spend and missed volume discounts. Without coordination, you lose negotiating leverage with vendors.

Best practices for controlling expenses

Effective cost control depends on consistent processes, real-time visibility, and clear accountability. While your exact approach will depend on your size and complexity, these best practices apply across most businesses.

1. Start with your budget

The first step in the cost control process is creating a budget that accurately and realistically details your expected income and expenses for the period. If your goal is to cut business expenses, start with forecasting how to spend money over the coming month, quarter, and year.

When you know how your business intends to deploy capital, it becomes easier to prioritize the expenses and initiatives you believe will truly move the needle while deprioritizing everything else.

2. Monitor your expenses

When do your employees submit expense reports and reimbursement requests? If it's once a month—or worse, once a quarter—that means those expenses aren't represented on your balance sheet. This makes it hard to tell whether you're staying on budget.

The good news is that modern financial management tools can eliminate this lag. Tracking business expenses in real time improves cash flow, increases transparency, eliminates discrepancies, and lets you see how your actual costs are stacking up against your projections.

3. Categorize your expenses

Assigning expense categories consistently lets you analyze spend by type and reveals patterns and outliers. When you can see exactly how much you're spending on travel, software, or office supplies, you can make informed decisions about where to cut back.

4. Automate your expense approval process

Automating your company's expense approval process not only streamlines your workflows, it also helps cut down on excess spending by fairly and consistently enforcing your expense policy.

5. Take a closer look at SaaS vendor spending

As businesses grow, it's common for different teams and departments to become increasingly siloed. If you aren't keeping an eye on software spending, you could wind up with redundant tooling that unnecessarily inflates your SaaS costs.

Cost control software and automation

Technology simplifies cost control by automating approvals, flagging out-of-policy spend, and syncing data to accounting systems. The right software eliminates manual work and gives you real-time visibility into where your money is going.

Key capabilities to look for include:

- Automated receipt matching

- Real-time spend alerts

- Policy enforcement at point of purchase

- Accounting integrations

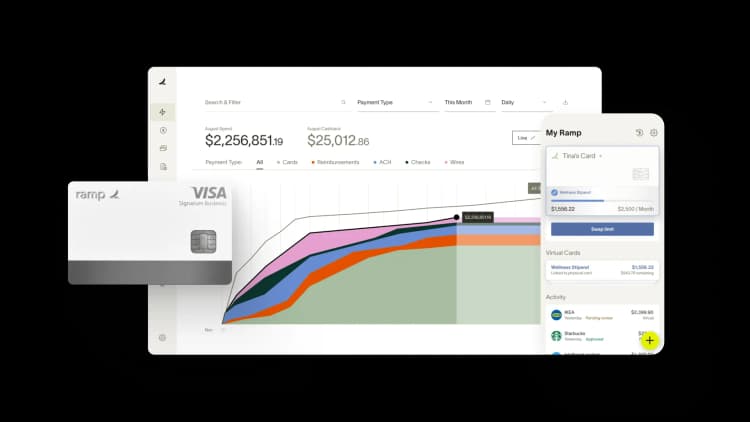

How Ramp's automated expense controls help drive profitability

Managing business expenses effectively can feel like a never-ending task—just when you think you've got spending under control, another unauthorized purchase or duplicate subscription slips through. For finance teams, the constant manual review of receipts, chasing down policy violations, and reconciling statements eats up valuable time that could be spent on strategic growth initiatives.

Ramp transforms this reactive approach into proactive expense control through intelligent automation. Our modern expense management automation software offers real-time spending controls that let you set precise limits and rules before purchases happen, not after.

You can configure spending limits by category, vendor, or employee level, ensuring that your lunch stipend cards can't accidentally be used for office supplies. When an employee tries to make a purchase outside these parameters, the transaction is automatically declined—no awkward conversations or retroactive policy enforcement needed.

Beyond prevention, Ramp's AI-powered receipt matching and expense categorization eliminates the tedious back-and-forth of expense reports. Employees simply snap a photo of their receipt, and Ramp automatically extracts merchant details, amounts, and categories while checking for policy compliance. The platform even identifies duplicate subscriptions and unused software licenses that silently drain budgets.

This combination of upfront control and intelligent automation doesn't just reduce unauthorized spending; it fundamentally changes how finance teams operate. Instead of spending days chasing receipts and investigating policy violations, you gain real-time visibility into spending patterns and can make data-driven decisions that directly impact profitability. The result is a finance function that drives strategic value rather than simply processing transactions.

Get cost control right with technology

Cost control isn’t a “set it and forget it” strategy for your business. It’s an ongoing process. You can find easy ways to cut back and become more profitable by consistently monitoring and tracking business expenses.

Ramp’s modern finance platform gives you the tools and visibility you need to take control of your business expenses. Watch a demo video and see why Ramp customers save an average of 5% a year.

FAQs

The three main areas are labor costs, material costs, and overhead costs. In services and SaaS-heavy businesses, this often shows up as people costs, vendor or subscription spend, and administrative overhead.

The five rules of cost control are: set clear budgets, track spending in real time, analyze variances regularly, enforce policies consistently, and review and adjust frequently.

A cost controller monitors budgets, analyzes variances between planned and actual costs, and recommends corrective actions. In smaller organizations, this role often falls to the controller or VP of finance.

You measure success using metrics like budget variance percentage, savings realized versus forecast, reduction in out-of-policy spend, spend under management, and time saved through automation.

Cost control focuses on keeping spending within planned budgets, while cost reduction aims to permanently lower the cost base. Cost control maintains discipline; cost reduction improves the baseline.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits