The ultimate guide to travel and expense management in 2025

- What is travel and expense (T&E) management?

- How to design a travel and expense policy

- Tips for managing business travel expenses

- Key travel solutions and benefits

- Challenges of manual travel and expense management

- Travel expense management software solutions

- How Ramp simplifies business travel expense management

Key takeaways

- Travel and expense (T&E) management refers to the processes and policies you use to handle all costs associated with business travel, from booking to reimbursement.

- An effective T&E policy is a living document that clearly outlines approved expenses, spending limits, and reimbursement timelines for your employees.

- Manual T&E management creates challenges like data entry errors, lost receipts, slow reimbursement cycles, and a lack of real-time visibility into spending.

- T&E management software helps you control costs and improve compliance with features like real-time spend controls, automated policy enforcement, and mobile receipt capture.

- Ramp helps you simplify T&E management from end to end with corporate cards that have built-in controls and software that automates receipt matching and expense categorization.

When your team is on the road, they rack up expenses. And it’s only a matter of time before you’re overwhelmed with receipts to reimburse and reconcile.

Efficiently managing business travel expenses is crucial for a company to thrive. The best way to accomplish this is through an effective travel and expense (T&E) policy. Fortunately, there are also a number of software solutions that can help.

In this article, we walk you through effective T&E best practices, from building a foolproof T&E policy to leveraging software to streamline the reimbursement process.

What is travel and expense (T&E) management?

Travel and expense management refers to the processes and policies a company uses to handle the costs associated with business travel. This includes booking travel arrangements, tracking and categorizing business travel expenses, and reimbursing employees for out-of-pocket spending.

T&E management is crucial for controlling costs, complying with tax regulations, maintaining financial visibility, and ensuring employee satisfaction.

In the past, T&E processes were primarily manual, which often led to slow reimbursement and sometimes fraud. Today, automated expense reporting software streamlines expense management and reimbursement, improving efficiency and reducing errors.

How to design a travel and expense policy

The travel expense management process involves setting clear guidelines and policies for employee travel and then enforcing them effectively, using tools such as employee credit cards and expense management solutions.

There are critical steps to writing an effective travel and expense management policy:

Drafting the policy

Creating a comprehensive corporate travel policy is a foundational step in managing travel costs. The purpose of a travel and expense management policy is to outline:

- Approved expenses

- Company spending limits

- Documentation needed

- Non-reimburseable expenses

- Preferred vendors or booking platforms

- Reimbursement workflows and timelines

Typically, approved travel expenses include airfare, hotels, meals, transportation, and client entertainment. Out-of-policy expenses could include personal items, non-required upgrades like first-class airfare, and alcohol, depending on the circumstances.

Communicating the policy

Once you have a travel policy, make sure your employees are aware of it. Share your policy with all employees, regardless of whether they’re likely to travel. Ensure it's easily accessible and send out reminders before business trips for travelers to review it.

Make your T&E policy required reading as part of the onboarding process for new hires. A clear and thorough travel policy will help prevent confusion when it comes time for expense reimbursements.

Updating and enforcing the policy

Lastly, be sure to review your policy regularly to confirm it still meets your business needs. Collect employee feedback on the process and approval timeline to see if things work on both ends. Treat your policy like a living document; update it so it’s always relevant and enforceable.

Lean on your expense management software to enforce policy, which can flag violations in real-time. Establish documented consequences for repeated violations, such as requesting reimbursement for non-reimbursable expenses or neglecting proper documentation.

Tips for managing business travel expenses

These are some practical tips for managing travel expenses:

- Encourage timely expense submissions: Set deadlines for submitting expenses, including automated reminders if you’re using expense management software. And be transparent about the reimbursement timeline, including any causes for delay.

- Use digital tools for receipt capture and reporting: Using mobile receipt scanning apps that automatically sync with your expense management tools means efficient processing and automatic categorization

- Set clear approval workflows: Your policy should clearly define the workflow from expense to reimbursement. Make sure to include who the approvers are and if any exceptions speed up the process.

- Educate employees on policy details: Train your team on your company expense policies and make sure they are always readily available via company portals. Provide real-world examples so that what is and isn’t acceptable is clear to everyone.

Key travel solutions and benefits

T&E software solutions help lower costs and give you more control over your travel budget. These are a few of the key features and how they can benefit your business:

Real-time controls

Real-time spend controls with preset limits within your system allow you to curb overspending before it happens. And enforcement is easier as the platform will flag or block any inconsistencies or out-of-policy spending.

Compliance and security

The Association of Certified Fraud Examiners (ACFE) estimates that companies can lose more than $250,000 on average to fraud, and it often goes undetected for up to 18 months under manual processes.

Modern solutions solve this by automating compliance, checking every expense against company policies. They encrypt the data to keep any personal or financial information secure, tracking all changes and approvals so you’re audit-trail-ready if you need it. And automatic fraud detection flags any suspicious or duplicate charges.

Simple employee onboarding

Intuitive platforms make it easy to onboard employees and familiarize them with policies and processes. Many software solutions offer self-service training that walks your team through everything they need to know about travel expenses. There’s also in-app guidance to help if team members submit expenses incorrectly or leave out documentation.

Mobile-friendly features

Mobile apps allow your team to submit their expenses on the go. They can scan receipts as soon as they receive them, approve expenses, and check on the real-time status of reimbursements or policy flags. Everyone stays compliant, and expense approvals are efficient.

Challenges of manual travel and expense management

Managing travel expenses manually with spreadsheets and shoeboxes full of crumpled-up receipts might work in the early days of your small business. But as you grow, the inefficiencies and risks become clearer.

These are a few of the most impactful pain points of manual T&E management:

Manual data entry errors and lost receipts

When you enter your expenses by hand, this can lead to human error, including duplicating entries, miscategorizing expenses, and typos. And it’s all too easy to lose or damage paper receipts.

For example, after your marketing manager attended a conference, he submitted an expense report for all his meals, but they became smudged when he was caught in the rain. You now have no way to verify if the receipts match his report numbers, since there is no digital copy.

Lack of visibility into spending

Organizations often struggle to gain real-time insights into travel and expense budget use. This lack of visibility makes it challenging to identify cost-saving opportunities and optimize spend.

Suppose your team submits manual expense reports weeks or months after trips. This means you may not know you’re over your travel budget until it’s too late to make changes.

Slow reimbursement cycles

Manual T&E processes that bog down your staff mean reimbursements take longer to reach employee bank accounts. This can lead to frustration and low morale.

For example, your sales manager completed three client trips using her own credit card last month. She submitted her manual expense report on time with all of the proper documentation.

However, your manual process means emailing, printing, scanning, and signing every document. That takes time. Now she’s frustrated because the deadline for her credit card payment is approaching, and she hasn’t received her reimbursement.

Difficulty enforcing policies

Without a strong system in place, it’s difficult to make sure employees follow your company's expense policies. This opens the door to potential tax compliance issues.

When you’re not properly training your team on the company policies, they become difficult to enforce. An employee could easily book a first-class plane ticket, expecting reimbursement, without a clear policy in place prohibiting that kind of behavior.

Travel expense management software solutions

Travel and expense management software simplifies the process of expense reporting, automates approval workflows, and organizes your financial expense data so it’s easy to review.

Key features to look for in travel and expense management systems include:

- Automated expense tracking and reporting

- Integration with travel booking platforms

- Policy enforcement

- Customizable controls

- Analytics and spending insights

These are some of the leading software platforms you can use to manage travel and expenses:

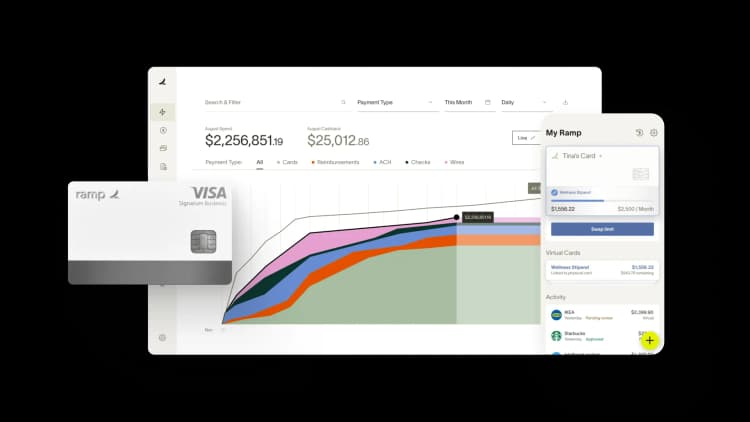

Ramp

Ramp Travel is an all-in-one expense management platform with powerful automation features to streamline your travel expenses. With Ramp, you get:

- Automated receipt capture and tracking

- Real-time visibility into spending with customizable reports

- A corporate card with built-in spend controls

- Accounting software integrations (QuickBooks, Xero, NetSuite, and more)

Zoho Expense

Zoho Expense automates expense reporting, approval, and management. Key features of Zoho Expense include:

- Receipt capture via mobile app

- Customizable workflows

- Detailed analytics and reporting

- Support for multiple currencies and tax regulations

SAP Concur

SAP Concur is one of the oldest and largest digital travel management platforms on the market, with tools to help manage spending and streamline expense tracking and approval workflows. SAP Concur offers:

- Travel booking

- Invoice processing

- Compliance and policy enforcement

- Analytics and reporting

How Ramp simplifies business travel expense management

Managing business travel expenses often feels like herding cats: Receipts go missing, expense reports pile up weeks after trips, and finance teams spend countless hours chasing down documentation and reconciling transactions. For growing companies, these manual expense processes drain productivity and create compliance risks that can come back to haunt you.

Ramp transforms this inefficient process into a streamlined workflow through intelligent automation and real-time controls. The platform's virtual and physical corporate cards automatically capture and categorize every travel transaction, from airline tickets to client dinners.

When employees make purchases, Ramp instantly matches receipts to transactions using OCR technology, eliminating the dreaded month-end receipt hunt. Your team members can simply snap a photo of their receipt through the mobile app, and Ramp handles the rest. No more crumpled papers or lost documentation.

Ramp also integrates seamlessly with your existing accounting software, automatically syncing approved expenses with the correct GL codes and cost centers. This eliminates hours of manual data entry and reduces errors that come from transcribing information between systems. The result? Your team spends less time on administrative tasks and more time on strategic financial planning.

Simplify your travel expense management from end to end

Ramp Travel is designed for business travel management. It simplifies the booking process from end to end, giving your team a unified dashboard for flights and hotels on the front end and saving your finance team time on the back end by automatically enforcing your T&E policy.

Ramp's customers save an average of 5% a year with our suite of modern finance tools. Try an interactive demo to see why.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits