- Understanding financial due diligence

- What's included in a financial due diligence review?

- Common questions about financial due diligence

- Putting it all together

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Securing venture capital funding is a dream for most startups. However, the due diligence process that precedes funding can be tedious and complex, especially regarding financial scrutiny. Having worked with dozens of startups going through this phase, one thing is for certain. Preparation from day 1 can help startups navigate this process more smoothly and increase their chances of successful funding.

Too often, startups take the cheap and easy path in their early days only to have sudden VC activity. When a VC sees a mess internally, the first inclination is to pass on the investment, even if the company may appear like a winner.

Understanding financial due diligence

Financial due diligence takes various forms, depending on the stage of the company. Generally, this is a comprehensive appraisal of a startup’s economic health, conducted by potential investors to get comfortable with the company’s financial statements and projections. The earlier the stage of the company, the more assumptions are in their forecasts, and the more investors will poke holes and interview founders.

Venture capitalists understand there is inherent risk in their business. However, they use the due diligence process to properly assess and underwrite that risk. The more issues or questionable items they find in due diligence, the worse off the company will be from a valuation or term perspective.

What's included in a financial due diligence review?

From our experience, VCs focus on the following areas in a due diligence review:

- Historical financial performance (if applicable)

- Cash flow forecasts and projections

- Unit economics (if applicable)

- Accounting practices and internal controls around cash

- Tax compliance, tax structure, and tax risks

Historical financial performance

From the outset, startups should maintain a formal accounting system. Maintaining the company books in Excel or informally is generally a bad idea that will only cause problems down the line.

Investors will want to see a full, detailed financial history, sometimes dating back to its inception. While they understand there can be errors, a lack of quality or professionalism will be a red flag for the VCs.

- Accounting practices: Use accounting software from day 1 and either outsource or have dedicated accountants who are accountable to monthly reporting.

- Financial metrics: If you are able to track key financial metrics such as gross margins, operating expenses, and net income over time, this will help you sell the story to the investors.

- Accounting method: We often are asked, cash or GAAP? Ultimately, you will end up on GAAP if you scale. However, it is OK to start cash basis and later convert once you have funding (as GAAP accounting is more expensive). Always ensure that your financial reporting is consistent and aligns with generally accepted accounting principles (GAAP). this consistency builds investor confidence in the accuracy of your financial statements.

Financial statements review

Most investors will hire an outside accounting firm to review the financial statements of the company to ensure they understand the history and any risks from a financial statement perspective. Depending on the size of the investment, this can be a tedious and time-consuming process.

Investors and their outside accountants will scrub the balance sheet, as that contains the full financial history of the company. Before this process begins, your accounting team should ensure there are dedicated and detailed financial workpapers that explain the balances in each balance sheet account. This will go a long way to providing credibility and will help the outside accountants trace balances and transactions.

Cash flow management and projections

The first thing to understand is your projects are certainly wrong. The VCs just want to get comfortable with how wrong they may be.

Early on, strong cash flow management is of obvious importance for the startup’s viability. Investors will examine how well the company manages its cash flow and whether its projections have been realistic over time.

- Cash flow projections: We always advise creating multiple projections including your base case, best base and worst case. Your base case should be a realistic cash flow projections for the next 12-24 months. Beyond 24 months is typically useless but some investors may ask for a more detailed 3-5 year picture.

- Assumptions: Don’t just make up numbers that point to a rosy picture! Document the assumptions underlying your cash flow projections, such as sales growth, market conditions, and expense changes.

- Cash reserves: If your startup is bleeding cash, this may affect the investors' terms or decisions. Showing them you have a history of adequate cash reserves could go a long way. Thus, it is important to maintain adequate cash reserves to cover unexpected expenses.

Unit economics

Unit economics is overlooked, but very important in the VC due diligence process. They provide insight into the profitability and scalability of the startup’s business model.

- Customer acquisition cost (CAC): calculate your CAC, which includes all costs associated with acquiring a new customer and track how CAC changes over time.

- Customer lifetime value (CLTV): determine your CLTV, which is the total revenue expected from a customer over their relationship with your company.

- Break-even analysis: conduct a break-even analysis to determine when your startup will become profitable and present this analysis to investors to demonstrate the long-term scalability of your business model.

Accounting practices and internal controls

As you may imagine, financial controls are a large portion of the financial due diligence process. Implementing sound accounting practices and strong internal controls are day 1 strategies that can go a long way for your startup. Internal controls can be difficult to implement in the early days if there are only 1-2 people involved. However, document processes and procedures as you scale and ensure there are clear financial authorities in place.

Tax compliance and tax history

Startup tax compliance seems simple on the surface but we have seen startups trip up here. Investors are going to want to ensure they are not invested in a company that has tax risk, whether income, payroll, or sales tax.

From day 1, startups should understand their full tax compliance obligations and work with outside CPAs to ensure they are meeting these standards. Further, most startups are formed as C Corporations which are eligible for IRC 1202 QSBS. This important gain exclusion attracts investors but will also become a target of their due diligence process to ensure the startup has not done anything to jeopardize this status.

Common questions about financial due diligence

What are the 3 types of diligence?

The three main types of due diligence are financial, legal, and operational due diligence. Each plays a unique role in the overall evaluation process.

Financial due diligence focuses on the target company's financial health. This includes:

- Revenue streams

- Profitability trends

- Debt obligations

- Cash flow patterns

This process helps pinpoint financial risks and confirms the company’s stated financial position.

Legal due diligence covers all legal aspects of the business, such as:

- Contracts

- Intellectual property rights

- Pending litigation

- Regulatory compliance

- Employment agreements

It’s designed to uncover legal liabilities that could impact the value of the transaction.

Operational due diligence examines daily business functions, with a focus on:

- Operational efficiency

- Supply chain management

- Technology infrastructure

- Organizational structure

This reveals whether the business can sustain its performance and highlights opportunities for improvement.

While these three categories form the foundation of most due diligence processes, you may also encounter specialized types—like environmental, technical, or cultural due diligence—depending on the industry and deal specifics.

Is financial due diligence worth it?

Financial due diligence is absolutely worth the investment, especially for deals involving significant capital.

Typically, the process costs between 0.25% and 1% of the transaction value, but it can help you avoid costly financial mistakes.

The main benefits include:

- Risk identification and mitigation: Financial due diligence uncovers hidden liabilities, accounting irregularities, and unsustainable revenue trends. These findings may affect valuation or even lead you to walk away from a risky deal.

- Negotiation leverage: By spotting financial weaknesses, buyers gain solid data to negotiate better terms or price adjustments.

- Integration planning: The process gives you a clear financial baseline, making post-acquisition integration smoother.

Skipping financial due diligence can lead to unpleasant surprises down the road, often undermining expected returns. The upfront cost is minimal compared to the potential losses from an uninformed investment.

What is a due diligence checklist?

A due diligence checklist is a thorough document that outlines all the information and documents

needed to evaluate you need to evaluate a potential transaction. Think of it as a roadmap that ensures nothing critical gets missed.

A standard checklist usually covers:

- Financial documentation: Financial statements, tax returns, revenue breakdowns, debt schedules, capital expenditure history, and financial projections.

- Legal documents: Contracts with customers and suppliers, employment agreements, intellectual property registrations, litigation history, and regulatory compliance documents.

- Operational information: Organizational charts, business processes, technology systems, physical assets, and operational metrics.

- Market and commercial data: Customer lists, market analysis, competitive positioning, sales pipelines, and marketing strategies.

- Human resources: Employee records, compensation structures, benefit plans, turnover rates, and workforce capabilities.

Putting it all together

The day the VC comes knocking will be one of the best days for your startup. However, don’t be caught off guard by the tedious and in-depth financial due diligence process that will follow.

Effective preparation for financial due diligence is crucial for startups seeking venture capital funding. From the early days, maintaining accurate financial records with a dedicated accounting team, managing cash flow projections, optimizing & tracking unit economics, and adhering to tax obligations, will help your startup be proactively prepared for this process

Early and proactive preparation not only simplifies the due diligence process but also builds investor confidence in your startup's potential for success.

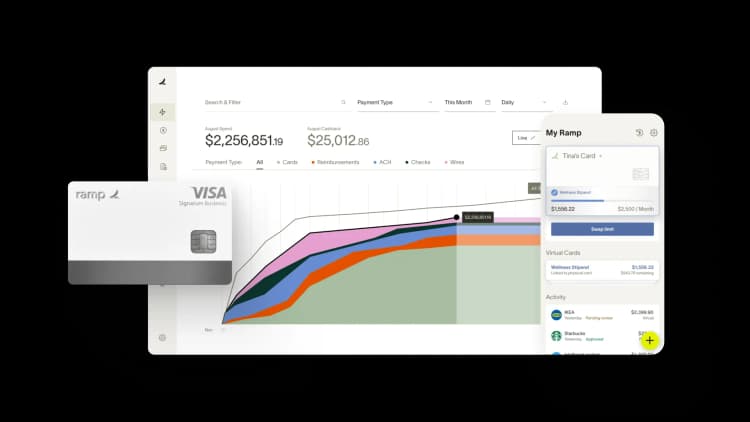

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits