Capital expenditure (CapEx): Definition, calculation, and examples

- What is capital expenditure?

- CapEx calculation formula

- How to calculate CapEx step by step

- Where to find CapEx on financial statements

- CapEx vs. OpEx

- Types of capital expenditures

- Examples of capital expenditures

- How CapEx affects financial statements

- How CapEx affects taxes

- When to capitalize vs. expense a purchase

- What is a good CapEx ratio?

- Best practices for CapEx budgeting

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Capital expenditure (CapEx) refers to the money a company spends on acquiring, upgrading, or maintaining long-term physical assets such as buildings, equipment, or technology. These investments typically provide value for multiple years rather than immediate consumption.

Business leaders who grasp CapEx principles make better decisions about resource allocation and growth opportunities. Proper CapEx management directly affects cash flow, tax obligations, financial reporting accuracy, and the company's ability to scale operations sustainably.

What is capital expenditure?

Capital expenditure (CapEx) is money you spend to acquire, upgrade, or maintain long-term physical assets. These investments in fixed assets provide value beyond 1 fiscal year, unlike operating expenses that cover day-to-day costs.

CapEx typically includes three main categories of assets known as PP&E:

- Property: Land and buildings

- Plant: Manufacturing facilities and infrastructure

- Equipment: Machinery, vehicles, and technology

Recognizing what qualifies as CapEx helps you categorize expenses correctly, plan budgets effectively, and comply with accounting standards such as generally accepted accounting principles (GAAP).

CapEx calculation formula

The core formula for calculating CapEx is:

CapEx = PP&E (Current Period) – PP&E (Prior Period) + Depreciation Expense

You add depreciation back because it represents the value of assets consumed during the period. Without adding it back, you'd understate your actual capital spending since depreciation reduces PP&E on the balance sheet but doesn't represent a cash outflow.

Direct method

Use the direct method when you have access to actual purchase records. This approach works best for internal tracking where you know exactly what assets you bought and sold. The direct method formula is:

Net CapEx = Cost of Asset 1 + Cost of Asset 2 + ... – Price of Assets Sold

For example, if you purchased equipment for $50,000 and a vehicle for $30,000, then sold old machinery for $10,000, your net CapEx would be $70,000.

$50,000 + $30,000 – $10,000 = $70,000

Indirect method

The indirect method uses the core formula and is the standard approach when analyzing companies from the outside using financial statements. You'll pull PP&E from the balance sheet and depreciation from the income statement.

In practice, this indirect capex calculation can differ from the cash flow statement when a company has asset disposals, reclassifications, impairments, or business combinations. These events can change net PP&E without representing new capital spending. If your result doesn’t tie closely to “Purchases of property, plant, and equipment,” scan the investing section and footnotes for proceeds from asset sales and other PP&E-related line items that explain the variance.

This method is most common for external analysis because financial statements are publicly available, while detailed purchase records typically aren’t.

How to calculate CapEx step by step

Here's a practical walkthrough using the indirect method. We'll use these example numbers: Beginning PP&E of $10,000, ending PP&E of $15,000, and depreciation expense of $20,000.

1. Locate PP&E on the balance sheet

Find net property, plant, and equipment for both the current and prior periods. This line item is typically listed under non-current assets or long-term assets. Make sure you're using net PP&E (after accumulated depreciation), not gross PP&E.

2. Calculate the change in PP&E

Subtract prior period PP&E from current period PP&E. This shows the net change in asset value on your books.

Using our example: $15,000 – $10,000 = $5,000 change in PP&E

3. Find depreciation expense

Locate depreciation expense on the income statement, usually under operating expenses. You can also find it in the notes to financial statements or on the cash flow statement as an add-back to net income.

In our example, depreciation = $20,000.

4. Apply the CapEx formula

Combine the components using the formula:

CapEx = Change in PP&E + Depreciation

CapEx = $5,000 + $20,000 = $25,000

A positive result indicates cash outflow to acquire assets. In this case, the company spent $25,000 on capital expenditures during the period.

5. Verify against the cash flow statement

Cross-check your calculation by looking at purchases of property, plant, and equipment under investing activities on the cash flow statement. This figure should match or closely approximate your calculated CapEx. Any significant variance may indicate asset disposals or acquisitions you need to account for.

Where to find CapEx on financial statements

CapEx data appears across multiple financial statements. Knowing where to look makes your analysis faster and more accurate.

Cash flow statement

This is your most direct source. Look under cash flow from investing activities for line items labeled purchases of property, plant, and equipment or capital expenditures. The number appears as a negative (cash outflow) and represents actual cash spent on fixed assets.

Balance sheet

The PP&E line item under non-current assets shows the cumulative value of fixed assets. You'll need both current and prior period values, plus depreciation expense, to back-calculate CapEx using the indirect method.

CapEx vs. OpEx

Understanding the difference between CapEx and OpEx is essential for accurate financial reporting and tax planning. Here's how they compare:

| Factor | CapEx | OpEx |

|---|---|---|

| Definition | Long-term asset investments | Day-to-day operations |

| Accounting treatment | Capitalized on balance sheet | Expensed immediately |

| Tax impact | Depreciated over asset life | Fully deductible in current period |

| Examples | Equipment, buildings, vehicles | Rent, utilities, salaries |

Types of capital expenditures

Capital expenditures fall into two main categories based on their purpose. Understanding this distinction helps you interpret what your CapEx numbers actually mean for your business.

Maintenance CapEx

Maintenance CapEx is spending required to keep current operations running and replace worn-out assets. This includes replacing broken machinery, upgrading outdated equipment to meet safety standards, or routine facility repairs that extend an asset's life.

If your CapEx roughly equals your depreciation expense, you're likely just maintaining your existing asset base without expanding capacity.

Growth CapEx

Growth CapEx is spending to expand capacity or capabilities. This includes purchasing additional delivery vehicles, building new manufacturing facilities, or acquiring equipment to enter new markets.

If your CapEx exceeds depreciation, you're investing in growth. You can calculate growth CapEx specifically:

Growth CapEx = Total CapEx – Depreciation

Examples of capital expenditures

Capital expenditures span a wide range of investments depending on your industry and business needs:

- Real estate: Office space, warehouses, retail locations, land purchases

- Machinery and equipment: Manufacturing equipment, production lines, industrial tools

- Vehicles and fleet: Delivery trucks, company cars, specialized transport

- Technology and infrastructure: Servers, network equipment, major software implementations

- Furniture and fixtures: Office buildouts, leasehold improvements, retail displays

How CapEx affects financial statements

CapEx creates a ripple effect across all 3 financial statements. Understanding these connections helps you see the full picture of how capital investments affect your financial position.

- Balance sheet: Increases PP&E (assets); may increase liabilities if financed through debt

- Income statement: No immediate effect; depreciation expense is recognized over the asset's useful life, gradually reducing net income

- Cash flow statement: Reduces cash from investing activities, showing the actual cash outflow for asset purchases

This interconnected effect explains why financial analysts track CapEx closely when evaluating a company's investment strategy and financial health.

How CapEx affects taxes

CapEx isn't immediately deductible on your taxes. Instead, you depreciate the cost over the asset's useful life, spreading the tax benefit across multiple years. Common depreciation methods include straight-line (equal amounts each year) and accelerated methods (larger deductions in early years).

However, two important exceptions allow faster write-offs:

- Section 179: Lets you deduct the full purchase price of qualifying equipment and software in the year you buy it, up to annual limits

- Bonus depreciation: Allows you to deduct a significant percentage of qualifying asset costs in the first year, with the remainder depreciated normally

These provisions can significantly affect your tax planning, so consult with your tax advisor to determine which approach makes sense for your situation.

When to capitalize vs. expense a purchase

Deciding whether to capitalize a purchase as CapEx or expense it immediately as OpEx depends on three key criteria:

- Useful life: Does the asset provide benefit beyond one year? If yes, it's typically capitalized.

- Dollar threshold: Does it exceed your company's capitalization policy? Most organizations set a minimum amount (often $1,000–$5,000) below which purchases are expensed regardless of useful life.

- Nature of spend: Is it an acquisition or improvement, or a repair or maintenance? New assets and significant improvements are capitalized; routine repairs are expensed

When in doubt, consider whether the spending extends the asset's life or increases its value (capitalize) versus simply maintaining its current condition (expense).

What is a good CapEx ratio?

There is no single “good” capex ratio that applies to every business. Appropriate levels of capital spending vary widely based on industry, growth stage, and business model. Capital-intensive industries such as manufacturing, utilities, and transportation typically require higher capex than service-based or software businesses.

One commonly used benchmark is the capex-to-depreciation ratio. A ratio close to 1.0 suggests a company is primarily replacing existing assets. A ratio consistently above 1.0 may indicate investment in growth, while a ratio below 1.0 can signal underinvestment or a shrinking asset base.

Another useful metric is the capex-to-revenue ratio, which measures capital spending relative to sales. This ratio helps assess how much reinvestment is required to support a given level of revenue and is most meaningful when comparing companies within the same industry.

Operating cash flow-to-CapEx ratio (Operating cash flow / CapEx) shows whether a company can fund capital spending from its core operations. A result above 1.0 generally suggests operating cash flow can cover capex without relying heavily on financing, while a result below 1.0 may indicate the business is funding capex through debt, equity, or existing cash reserves.

Best practices for CapEx budgeting

Effective CapEx management requires clear processes and regular oversight. Here's how to get it right.

Establish clear capitalization thresholds

Set a dollar amount above which purchases must be capitalized. This creates consistency across your organization and simplifies decision-making for your team. Document the threshold in your accounting policies and communicate it clearly.

Create a standardized approval workflow

Define who approves CapEx requests at different spend levels. A $5,000 equipment purchase might need only a department manager's approval, while a $500,000 facility expansion requires executive sign-off. Automate routing to reduce bottlenecks and maintain audit trails.

Track CapEx by department or project

Categorize spending for better visibility into where capital is being deployed. This helps you identify which areas are driving investment and whether spending aligns with strategic priorities.

Align CapEx with strategic goals

Tie capital requests to business objectives. Every significant CapEx proposal should explain how it supports growth initiatives, improves efficiency, or addresses a specific business need. This discipline helps prioritize competing requests.

Review and adjust quarterly

Compare actual CapEx to budget regularly. Reallocate unused funds to higher-priority projects or request additional budget when opportunities arise. Quarterly reviews keep your capital allocation responsive to changing business conditions.

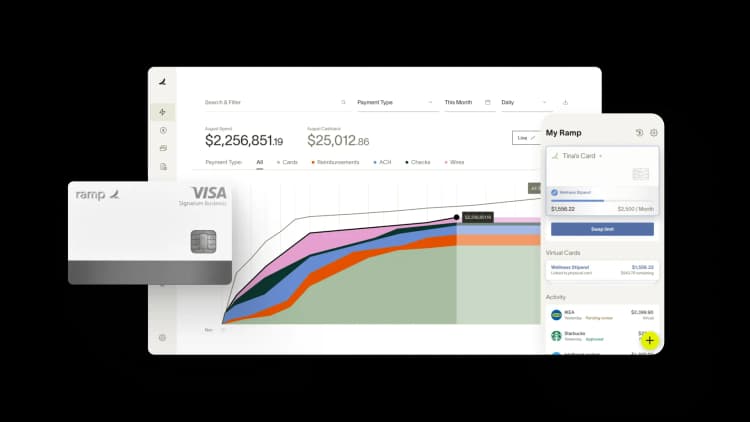

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

Gross CapEx is your total spending on fixed assets. Net CapEx subtracts proceeds from asset disposals. Net CapEx gives you a clearer picture of actual capital investment since it accounts for assets you've sold or retired.

Start by reviewing historical CapEx trends and assessing planned projects. Consider asset replacement cycles—when will current equipment need replacing? Many companies forecast CapEx as a percentage of revenue or based on specific growth initiatives in their strategic plan.

The most frequent errors include forgetting to add back depreciation, using gross PP&E instead of net PP&E, and overlooking asset disposals. Always verify your calculation against the cash flow statement's investing activities section to catch discrepancies.

Yes, if you sell more assets than you purchase in a period, net CapEx can be negative. This may indicate intentional divestment, downsizing, or a strategic shift away from capital-intensive operations. It's not necessarily a red flag, but it warrants investigation into the underlying business decisions.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits