- What is FinOps?

- Why FinOps matters: Cloud cost challenges

- The FinOps framework

- FinOps principles and capabilities

- FinOps maturity model

- Key FinOps stakeholders and roles

- FinOps tools and technologies

- Getting started with FinOps

- FinOps: Common pitfalls

- FinOps best practices

- Scale your FinOps discipline with Ramp

FinOps, short for cloud financial operations, is an operational framework and cultural practice that brings finance, engineering, and business teams together to maximize the business value of cloud spending through collaboration, automation, and continuous improvement.

Cloud costs now rank among the largest expenses for growing businesses, yet nearly one-third of that spend is wasted, according to Flexera’s 2024 State of the Cloud Report. Finance leaders often struggle to see where budgets go or connect cloud usage to business outcomes.

What is FinOps?

The FinOps Foundation defines FinOps as:

“An operational framework and cultural practice which maximizes the business value of cloud, enables timely data-driven decision making, and creates financial accountability through collaboration between engineering, finance, and business teams.”

This framework establishes structured processes for managing cloud spending, often integrating with your enterprise resource planning (ERP) system, while the cultural component emphasizes collaboration and shared accountability. Finance teams no longer operate separately from engineering. Instead, both groups work together to balance cost efficiency with performance and innovation.

The term FinOps combines Finance and DevOps:

Finance + DevOps = FinOps

Like DevOps, which breaks down silos between development and operations, FinOps bridges the gap between finance and technology teams. It focuses on real-time decision-making, continuous optimization, and shared responsibility for financial outcomes.

Unlike traditional IT financial management, which centered on fixed capital expenditures and annual budgeting cycles, FinOps is built for the cloud’s variable, usage-based cost model. Because cloud spending fluctuates in real time, organizations need operational processes that adapt just as quickly.

You may also see FinOps referred to as cloud financial operations or cloud financial management. These terms describe the same discipline: managing cloud spending strategically to maximize business value rather than simply minimizing costs.

The FinOps Foundation

The FinOps Foundation serves as the primary governing body for FinOps standards and best practices. It operates under the Linux Foundation and provides guidance, certifications, and community resources to help organizations implement FinOps successfully. Its frameworks and definitions are widely recognized across the industry.

The organization standardizes FinOps practices by offering:

- Certification programs for FinOps practitioners that validate expertise in cost management principles

- Framework documentation that defines core processes, maturity models, and terminology

- Community collaboration opportunities that enable organizations to share case studies and best practices

Major cloud providers including Amazon Web Services (AWS), Google Cloud, and Microsoft Azure actively participate in the FinOps Foundation community. Their involvement helps ensure alignment between cloud pricing structures and FinOps methodologies.

Why FinOps matters: Cloud cost challenges

Cloud spending inefficiencies are widespread. According to Flexera’s 2025 State of the Cloud Report, 84% of organizations surveyed identified managing cloud spend as their top cloud challenge.

One reason for overspending is the shift from capital expenditures to operational expenditures. Traditional IT investments required upfront hardware purchases, making costs predictable and controlled. Cloud computing replaced fixed investments with pay-as-you-go pricing, which offers flexibility but increases the risk of uncontrolled spending.

Cloud pricing models are also highly complex. Organizations must navigate multiple pricing tiers, reserved instance commitments, usage-based billing, and dynamic scaling. Combined with rapid adoption and decentralized decision-making, this complexity makes cost control difficult without a structured approach like FinOps.

Common cloud cost management problems

Your teams might struggle with several recurring challenges when managing cloud spending:

- Lack of visibility into spending: Teams often cannot see which departments or projects drive costs, making it nearly impossible to identify waste or inefficiencies

- Decentralized purchasing decisions: Engineering teams can provision resources independently, which accelerates innovation but reduces financial oversight and accountability

- Unused or underutilized resources: Idle virtual machines, unattached storage volumes, and redundant services frequently accumulate without detection

- Difficulty forecasting costs: Dynamic scaling and usage variability make it challenging to predict future cloud expenses accurately

The FinOps framework

The FinOps framework revolves around three continuous phases: Inform, Optimize, and Operate. Together, these phases help you build visibility, improve efficiency, and maintain ongoing cost control.

FinOps operates as an iterative cycle rather than a one-time initiative. Organizations continuously refine their strategies based on new data, changing workloads, and evolving business priorities.

Phase 1: Inform

The Inform phase focuses on creating transparency into cloud spending. Organizations establish clear visibility into where costs originate and how resources are used.

During this phase, teams define benchmarks and budgets based on historical usage patterns. They align financial goals with business objectives and establish baseline metrics for performance.

Reporting mechanisms typically include:

- Cost allocation tagging systems that categorize spending by department or project

- Real-time dashboards that provide visibility into usage patterns

- Budget alerts that notify teams when spending exceeds thresholds

- Forecasting tools that predict future expenses based on trends

Phase 2: Optimize

The Optimize phase identifies opportunities to reduce waste and improve efficiency. Teams analyze usage data to determine where spending exceeds actual requirements.

Right-sizing resources plays a key role in optimization. This involves adjusting compute capacity, storage allocation, and service configurations to match actual demand.

Automation enhances optimization efforts by implementing dynamic scaling policies and automated resource scheduling that prevent unnecessary spending.

Phase 3: Operate

The Operate phase ensures continuous monitoring and improvement. Organizations establish governance policies to maintain financial discipline across teams.

Governance includes defining approval processes, spending limits, and accountability structures. These policies ensure cloud usage aligns with your business priorities.

Key performance metrics often include:

- Cost per customer or transaction to measure business value

- Utilization rates to evaluate efficiency

- Budget variance tracking to identify overspending

- Return-on-investment (ROI) metrics linking cloud spending to revenue outcomes

FinOps principles and capabilities

The FinOps Foundation identifies six core principles that guide successful implementation. These principles emphasize collaboration, real-time decision-making, accountability, and continuous optimization.

FinOps depends on strong collaboration between finance, engineering, and business teams. Finance provides budgeting oversight and forecasting discipline, engineering manages infrastructure decisions and usage patterns, and business leaders ensure cloud investments align with strategic priorities.

Successful FinOps programs typically operate across three dimensions:

- People: Cross-functional collaboration between finance, engineering, product, and leadership

- Process: Structured phases such as Inform, Optimize, and Operate, along with governance policies and performance metrics

- Technology: Cloud cost management tools, automation platforms, and standardized billing data

When these three elements work together, organizations can scale financial accountability without slowing innovation.

The FOCUS framework

FOCUS stands for FinOps Open Cost and Usage Specification. It defines a standardized format for cloud cost and usage data across providers.

Because cloud vendors structure billing data differently, comparing and analyzing costs across platforms can be difficult. FOCUS reduces that friction by establishing a common data schema, which improves transparency, simplifies reporting, and supports more consistent multi-cloud financial management.

Many cloud vendors support FOCUS standards, helping organizations streamline cost analysis and integrate cloud data into broader financial systems.

FinOps maturity model

The FinOps maturity model follows a crawl, walk, run progression.

In the crawl stage, you focus on basic visibility and reporting. In the walk stage, you implement optimization strategies and automation. In the run stage, you achieve full integration of financial accountability into engineering workflows.

Each stage delivers measurable outcomes such as improved forecasting accuracy, reduced waste percentages, and stronger cross-team collaboration.

| Stage | Characteristics | Typical outcomes |

|---|---|---|

| Crawl | Basic cost visibility, manual reporting, inconsistent tagging | Improved awareness of spending patterns |

| Walk | Automated reporting, rightsizing processes, budget ownership by teams | Measurable waste reduction and improved forecast accuracy |

| Run | Real-time accountability embedded into engineering workflows, automated governance policies | Optimized unit economics and strong cost-to-value alignment |

Assessing your organization’s maturity

Understanding your FinOps maturity requires evaluating operational behaviors, collaboration patterns, and financial visibility.

Key indicators for each maturity level include:

- Crawl stage indicators: Limited cost visibility, inconsistent tagging practices, reactive cost management, and siloed decision-making between finance and engineering teams

- Walk stage indicators: Established cost allocation frameworks, automated reporting systems, and collaboration between finance and engineering teams

- Run stage indicators: Real-time financial accountability embedded into engineering workflows, automated governance enforcement, and proactive cost forecasting

Most organizations begin by focusing on visibility and reporting, then shift toward automation and governance, and finally integrate financial accountability into daily operational workflows.

Progress through maturity stages typically takes 12 to 24 months, depending on cloud complexity and organizational structure.

Key FinOps stakeholders and roles

FinOps succeeds because it creates shared financial accountability across teams. Engineering, finance, executive leadership, and product owners each play a critical role in aligning cloud usage with business outcomes.

Engineering teams implement cost-efficient architectures and monitor usage patterns, while finance teams oversee budgeting, forecasting, and financial reporting related to cloud spending.

Executive leadership ensures cloud investments support strategic priorities. Product owners contribute by defining cost targets tied to product profitability and monitoring efficiency metrics linked to product performance.

Building a FinOps team

A FinOps practitioner serves as the central coordinator responsible for aligning finance, engineering, and business teams around cloud cost management goals. This role combines financial analysis skills with technical knowledge of cloud infrastructure and pricing models.

Cross-functional collaboration is essential because FinOps decisions affect multiple stakeholders. Engineering teams must understand cost implications when provisioning resources, while finance teams need technical insight to interpret spending data accurately.

Regular communication channels, shared dashboards, and joint decision-making processes help maintain alignment between operational efficiency and financial objectives.

Organizations can structure their FinOps teams in several ways depending on size and cloud maturity:

- Centralized FinOps team: A dedicated group manages all cloud financial operations across departments. This model provides consistent governance and standardization but may limit responsiveness to team-specific needs

- Embedded FinOps specialists: Individual business units include FinOps experts within engineering teams. This approach enables closer collaboration and faster decision-making while maintaining accountability at the team level

- Hybrid structure: A central FinOps leadership team establishes policies while embedded specialists support implementation across departments. This model balances consistency with flexibility and is common among large enterprises

FinOps tools and technologies

FinOps relies on a mix of cost management, optimization, automation, and forecasting tools. These platforms help teams gain visibility, reduce waste, enforce governance, and improve financial planning.

| Tool category | Primary function | Key benefits |

|---|---|---|

| Cost management platforms | Provide real-time dashboards, spending visibility, and allocation tracking | Improve transparency and enable faster decision-making |

| Optimization tools | Identify underutilized resources and recommend cost-saving actions | Reduce waste and improve efficiency |

| Automation solutions | Enforce governance policies and automate resource scaling | Prevent overspending and minimize manual intervention |

| Forecasting and analytics tools | Predict future spending trends based on usage patterns | Support budgeting accuracy and strategic planning |

Native cloud provider tools offer integrated capabilities, while third-party solutions provide more advanced analytics and multi-cloud visibility.

Key features to evaluate include cost allocation accuracy, automation capabilities, forecasting precision, and integration support.

Popular FinOps platforms

Major platforms include cloud provider tools and independent cost management solutions. Each offers capabilities tailored to different organizational needs.

| Discipline | Primary focus | How FinOps principles apply |

|---|---|---|

| Cloud infrastructure | Usage-based compute, storage, and network resources | Apply FinOps frameworks for visibility, rightsizing, forecasting, and cost allocation across cloud providers |

| SaaS management | Subscription costs and user licenses | Use FinOps tools and automation to monitor usage, eliminate unused licenses, and ensure spending aligns with business value |

| IT asset management (ITAM) | Hardware and software inventory tracking | Combine data-driven decision-making with cross-functional collaboration to optimize asset lifecycles and maintenance costs |

| IT financial management (ITFM) | Budgeting and planning across all technology spend | Apply FinOps KPIs to track performance, link spend to business outcomes, and maintain financial accountability |

| Procurement and vendor management | Negotiation and contract visibility | Use FinOps insights to improve vendor negotiations, identify cost-saving opportunities, and strengthen financial operations |

Selection criteria typically include scalability, data integration capabilities, and reporting flexibility. Integration with financial systems remains critical to ensure accurate budgeting and forecasting.

Getting started with FinOps

A typical FinOps implementation roadmap follows a structured progression from visibility to governance and optimization.

- Establish visibility into cloud spending: You need clear insight into where your cloud dollars go before making optimization decisions. Implementing cost allocation frameworks helps uncover inefficiencies quickly.

- Define governance policies and accountability structures: Governance policies set clear rules for resource provisioning, spending approvals, and cost ownership. They ensure teams understand their financial responsibilities and help prevent uncontrolled cloud usage.

- Implement optimization processes: Optimization involves continuously identifying waste and leveraging cost-saving pricing models. Regular reviews ensure cloud spending aligns with actual business needs.

- Integrate financial metrics into engineering workflows: Embedding cost metrics into engineering tools allows teams to evaluate financial impact alongside performance. This integration supports faster, data-driven decisions that balance innovation with cost efficiency.

Quick wins often include eliminating idle resources, implementing automated scaling policies, negotiating reserved instance commitments to secure lower pricing, and improving tagging consistency across resources.

FinOps: Common pitfalls

Avoid these common pitfalls when implementing FinOps in your organization.

Lack of cross-team collaboration

When teams operate independently, cost management becomes reactive rather than proactive. Misaligned priorities can lead to overspending or missed optimization opportunities.

Inadequate tagging systems

Without consistent tagging, organizations struggle to allocate costs accurately and identify which teams or projects drive spending. This lack of visibility reduces accountability and limits the effectiveness of FinOps initiatives.

Overemphasis on cost reduction

Organizations often focus exclusively on reducing costs rather than optimizing value. While eliminating waste is important, FinOps aims to maximize business value by balancing performance, scalability, and cost efficiency. Ignoring this broader perspective can undermine long-term growth and innovation.

FinOps best practices

Follow these best practices to build a sustainable and effective FinOps practice.

Start with visibility

Full visibility into cloud spending and expense tracking should be your first priority when implementing FinOps. Without accurate data, you cannot identify inefficiencies or make informed financial decisions.

Visibility requires consistent tagging, real-time reporting dashboards, and detailed cost allocation systems that link spending to specific teams and projects. These tools help stakeholders monitor trends, detect anomalies, and track budget performance continuously.

Focus on largest cost drivers first

Prioritizing the largest cost drivers helps organizations achieve meaningful savings quickly. Instead of attempting to optimize every resource at once, focus on high-impact areas such as compute workloads, storage usage, and data transfer costs.

Addressing major contributors delivers faster financial returns and builds confidence in FinOps practices. This focused approach also prevents teams from becoming overwhelmed by complex optimization initiatives.

Establish clear accountability

Clear accountability ensures teams take ownership of their cloud spending decisions. Each department should understand its financial responsibilities and have access to usage data that reflects its impact.

Establishing accountability requires defining cost ownership structures, implementing budget controls, and aligning financial incentives with organizational goals. When teams understand the financial implications of their actions, they become more proactive in optimizing resource usage.

Create feedback loops

Continuous feedback loops allow organizations to refine FinOps processes and adapt to changing cloud environments. Regular reviews of spending data, optimization outcomes, and business performance metrics help identify improvement opportunities.

Effective feedback mechanisms include cross-functional meetings, automated alerts, and performance dashboards that provide actionable insight. These loops enable teams to respond quickly to emerging trends and maintain financial discipline over time.

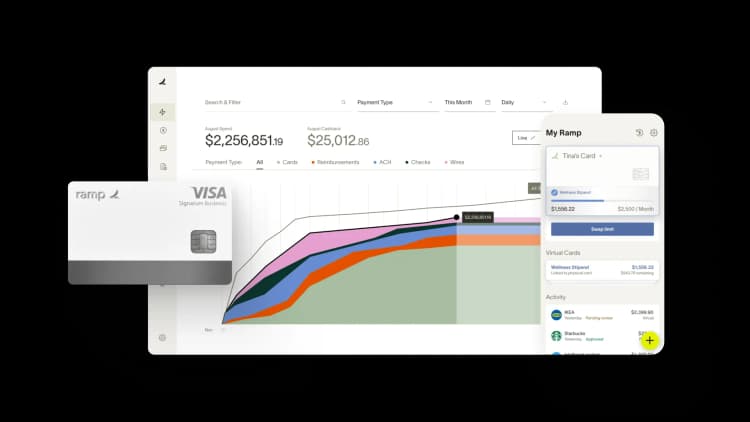

Scale your FinOps discipline with Ramp

FinOps is essential for cloud-first organizations that want stronger financial accountability and operational efficiency. It represents both a technical framework and a cultural shift that aligns teams around shared financial goals.

Ramp’s integrated platforms and expense management solutions help extend FinOps principles beyond cloud spending by delivering real-time visibility, automated expense tracking, and actionable financial insights. With unified reporting and automation tools, you can optimize spending across your entire business.

If you’re ready to gain complete financial visibility and maximize value from every dollar spent, explore how Ramp’s interactive demo can support your FinOps journey.

FAQs

Traditional IT financial management focuses on fixed budgets and capital expenditures. FinOps, by contrast, manages variable cloud costs that fluctuate with cloud usage. It relies on real-time data and cross-functional collaboration among finance, engineering, and business teams to align spending with business value.

The same FinOps principles that govern cloud infrastructure—visibility, accountability, and data-driven decision-making—apply to SaaS and other recurring technology expenses. Many organizations extend FinOps practices to manage total technology spend, including SaaS, IT assets, and licenses.

A company typically needs a FinOps practitioner once cloud expenses become complex enough to require specialized tracking and forecasting. Mid-sized businesses often start with part-time FinOps responsibilities within existing roles, then transition to full-time positions as FinOps adoption grows.

FinOps improves cost efficiency, forecast accuracy, and financial accountability. It helps teams balance performance and cost, strengthen collaboration between departments, and make faster, better-informed decisions about cloud investments.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°