- How FinOps differs from other financial roles

- Examples of FinOps responsibilities

- Examples of tasks that don’t fall under FinOps

- How Ramp automates financial operations to scale with your business

- Why you should start building a FinOps team early

As your company matures, your financial team will also grow and develop, with team members taking on more specialized roles. Some of those roles will focus on financial operations, or FinOps, which has become an integral part of any financial team that’s helping to scale a business.

Traditionally, FinOps has not been a high priority for many businesses, particularly at the startup stage.

“People usually don't invest in their financial suite, because this is not a money-driving department,” says Ramp controller Edwine Alphonse. “We're typically a cost center, not a revenue center.”

However, once companies truly understand the roles and responsibilities associated with FinOps, the case for investment becomes clearer. That’s even more important as organizations continue rewriting their best practices for a “new normal” world of hybrid work and asynchronous, digital interactions.

Strong FinOps creates companies that are more productive and more efficient than their competitors.

How FinOps differs from other financial roles

While FinOps often grows out of the accounting and FP&A functions, FinOps jobs focus more on building recurring organizational processes than on deep decision-making or pure accounting. Successful management, and a focus on procedures for day-in-day-out tasks and an emphasis on finance automation, rather than the manual processes, is essential to a healthy finance department.

Examples of FinOps responsibilities

Companies today increasingly need a dedicated person or team thinking about how different tools integrate across the finance department to ensure maximum efficiency.

While moving away from manual processes is a key step in any company’s digital transformation, it also means that the company must now make sure that it is working with the best possible tech partners—and that those partners can integrate with each other.

FinOps is the best function to build a modern, integrated tech stack because it oversees the following:

Real-time financial reporting and forecasting

FinOps focuses on putting processes and tools in place that offer visibility into all business expenses—as they happen. For example, instead of waiting until you have to reconcile receipts to see what your team is spending, you’ll be able to view the spend in real-time. This functionality allows organizations to easily see important data and use that data to make better decisions faster. The ability to make quick, smart decisions is a competitive advantage that can fuel growth as a company scales.

Financial technology integration

Choosing the right technology partners is one of the most important decisions that startups can make. It’s up to those working in FinOps to conduct due diligence on potential vendors and oversee the crucial onboarding process while also maintaining the employee or user experience. A FinOps manager may also oversee vendor management, to ensure a seamless procurement process and to do so at a price that makes sense.

Faster accounting and EOM close process

While the accounts payable team typically conducts the accounting and end-of-month (EOM) close, FinOps can look at the process for areas of improvement using finance automation technology. It’s an area that requires particular focus in the hybrid environment that many teams now work. Nearly a third of finance teams say they’ve struggled with EOM close in a virtual setting.

Optimizing EOM close can create a more seamless process for the year-end close. Ensuring that books always close on time can minimize mistakes and surface potential problems for areas that need attention from management.

Expense management

By using real-time data on company spending, FinOps can identify areas where enhanced procedures could save companies both time and money. This requires leveraging both new technology and more traditional approaches such as benchmarking against peers and vendor negotiations.

These expense management improvements can also help employees feel more empowered over their spending, as they can encourage a healthy spend culture that allows your company to successfully enable decentralized spending and empower employees, while still keeping expense guardrails in place to protect the company. Improved expense management can also help add transparency to financial accountability processes and ensure that the appropriate checks and balances are in place.

Automated expense reporting

By setting rules around expenses and empowering employees to follow those rules, FinOps can reduce waste and improve the efficiency of expense management processes. That allows employees to focus on higher-value work, rather than spending unnecessary time managing their own expenses. It also fosters a better working relationship between employees, managers, and the finance team.

Streamlined bill payments

FinOps uses processes and tools to make the tasks of bill payment more efficient and accurate. Using a platform like Ramp, FinOps can harness the power of artificial intelligence to automate bill payments while also maintaining flexibility in payment methods and reconciling ledgers automatically.

Examples of tasks that don’t fall under FinOps

FinOps provides operational support for different finance functions, but it does not typically engage in strategic activities, such as:

Capital budgeting

Capital budgeting requires determining the best time to acquire assets and the best method for funding those purchases. FinOps, by contrast, focuses more on the process of paying for and tracking capital improvements or purchases, rather than the critical, holistic decision-making that goes into capital budgeting.

Risk management

Risk management requires identifying uncertainties that could impact a business and putting a plan in place to mitigate those risks. While some FinOps activities might improve a company’s risk management, the primary emphasis is instead on streamlining processes and increasing efficiency.

Corporate strategy

FinOps does not create, build, or execute corporate strategy, but when done properly, FinOps does allow a company to adhere to a corporate strategy without letting the day-to-day tasks of financial management slow down progress. FinOps involves constant iteration, so as corporate strategy evolves, so will FinOps’ processes and approach to optimization.

Financial planning

FinOps provides the up-to-date data that CFOs and other stakeholders use to conduct proper financial planning and analysis. Good financial planning helps optimize the way an organization manages its money and surfaces important insights for future needs. FinOps is not involved in this planning process.

Treasury

While you may not need a treasury policy early on, it becomes increasingly important to manage capital as your company scales and begins to build up unallocated cash. While FinOps does not manage the capital itself, it can help put treasury policies in place, so that the treasury team can optimize its function.

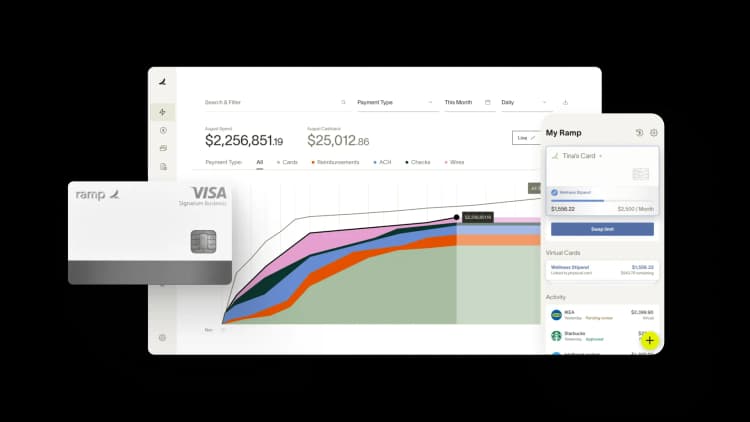

How Ramp automates financial operations to scale with your business

As companies grow, finance teams often find themselves drowning in manual processes that worked fine with 20 employees but become overwhelming at 200. You're probably familiar with the pain: Expense reports pile up, approval chains slow to a crawl, and month-end close stretches from days into weeks. The real challenge isn't just the volume—it's that traditional financial operations weren't built to scale efficiently.

Ramp's automated expense management transforms how growing companies handle spend. Instead of chasing down receipts and manually coding transactions, Ramp automatically captures and categorizes expenses in real time. When an employee makes a purchase with their Ramp card, the platform instantly matches receipts, applies the correct accounting codes, and routes approvals based on your predefined rules. This means your team spends minutes, not hours, on expense management—even as transaction volumes multiply.

Accounts payable automation takes this efficiency further by eliminating the manual work that bogs down accounts payable. Ramp automatically extracts data from invoices, matches them to purchase orders, and routes them through customized approval workflows. You can set up rules that automatically approve invoices under certain thresholds or from trusted vendors, while flagging others for review. The platform syncs seamlessly with your accounting software, so every payment is properly recorded without manual data entry.

These automated workflows don't just save time—they create a financial operations system that scales naturally with your business. As you add employees, vendors, and complexity, Ramp's automation ensures your finance team can focus on strategic work instead of drowning in manual tasks. The result is a finance function that grows more efficient, not more chaotic, as your company scales.

Why you should start building a FinOps team early

The sooner you start thinking about FinOps, the sooner you'll see the benefits. Many companies wait until they're either mature enough or forced to address financial operations—but that's already too late.

"People don't think about their FinOps function until they are either mature enough or until they absolutely have to," Alphonse says. "If you want to start right, you need to start investing in your FinOps from day one, because otherwise you'll just always be playing catch up."

Starting early means building the right foundation before you need it. This might even happen before you hire your first CFO or controller. When you prioritize FinOps from the beginning, you avoid the financial pitfalls that typically hit growing companies. You're not scrambling to fix broken processes while trying to scale—you're already ahead of the curve.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°