- What are FinOps KPIs?

- Why finance teams need FinOps KPIs

- How to choose KPIs that fit your budget goals

- FinOps KPI framework at a glance

- 10 FinOps KPIs every finance team should track

- Best practices to measure and report KPIs

- Common pitfalls and how to avoid them

- Bring your FinOps KPIs to life with Ramp

Cloud spending can spiral out of control faster than a new workload can auto-scale. One month, you’re comfortably within your cloud budget; the next, you’re explaining a 40% cost overrun to your CFO. The difference often comes down to whether your team is tracking the right FinOps KPIs.

FinOps, short for financial operations, brings financial accountability to cloud cost management. It aligns finance, engineering, and business teams around shared metrics that reveal how every dollar of cloud spend contributes to business value. But without clear key performance indicators, even the best FinOps practices fall short.

The right FinOps KPIs turn your cloud bill from a black box into a transparent, controllable expense category. They highlight inefficiencies, improve forecast accuracy, and enable smarter decision-making about cloud resources.

What are FinOps KPIs?

FinOps, short for financial operations, is the practice of applying financial accountability to cloud financial management. It is a collaborative approach where finance, engineering, and operations teams work together to manage cloud costs while maintaining agility and innovation.

FinOps KPIs, or key performance indicators, are measurable FinOps metrics that track cloud spend efficiency, resource utilization, and cost optimization across your environment. These aren't abstract financial ratios; they're actionable signals that show whether your cloud services are delivering business value.

With the right KPIs in place, teams gain a shared language to evaluate cloud performance, improve forecast accuracy, and make data-driven decisions that link engineering activity to business results.

Why finance teams need FinOps KPIs

Cloud costs have a tendency to grow unpredictably. Without proper metrics, you won't know what drove an increase in spending or how to prevent it next month.

Lack of visibility into cloud spending creates budget chaos. Traditional expense categories don't capture the dynamic nature of cloud consumption, and you can't forecast accurately when you don't know which teams use what resources or why costs spike at certain times.

FinOps KPIs solve these problems by providing transparency and accountability for cloud investments. Proper metrics deliver:

- Cost visibility: Track where money goes across cloud services, from compute and storage to AI services

- Budget control: Prevent overspending through early warning signals that flag unusual consumption patterns before they hit your P&L

- Business alignment: Connect cloud costs to revenue and growth metrics, proving that infrastructure investments drive real business outcomes

How to choose KPIs that fit your budget goals

Not every FinOps KPI carries the same weight for every organization. A startup optimizing for growth needs different metrics than an enterprise focused on improving margins. Your KPI selection should reflect your company's cloud maturity, spending profile, and overall financial strategy:

- Growth-focused teams might emphasize scalability, cost per customer, and performance efficiency

- Cost-conscious teams might track waste reduction, discount utilization, and workload efficiency

- Finance-led teams preparing for IPO or acquisition should prioritize accuracy in allocation, forecasting, and reporting

Start by building a foundation of reliable data. If you can't accurately track total cloud spend by department, focus there first. Once you establish visibility, you can move toward advanced metrics such as unit economics or cost per transaction. Build your FinOps efforts progressively:

- Early stage: Focus on basic visibility and cost allocation metrics. Identify who owns what resources and track spending by business unit.

- Mid-stage: Add cost optimization and forecast accuracy metrics to control spending and predict trends with automated finance automation workflows

- Mature stage: Incorporate advanced KPIs such as cost per transaction or cost per active user to connect cloud costs to business value

FinOps KPI framework at a glance

Every FinOps program should measure performance from three angles: cost optimization, resource efficiency, and financial accountability. Together, these categories give a complete view of cloud financial management and help teams connect day-to-day decisions to long-term business value.

| Category | Primary focus | Key question answered |

|---|---|---|

| Cost optimization | Reducing unnecessary spending and maximizing savings opportunities | Where can we lower costs without affecting performance? |

| Resource efficiency | Improving utilization of provisioned resources | Are we fully using what we're paying for? |

| Financial accountability | Aligning cloud costs with budgets and business goals | Can we predict and control our cloud spending effectively? |

These categories work together to make cloud cost management measurable:

- Cost optimization helps identify savings opportunities across cloud services

- Resource efficiency ensures every cloud workload delivers value relative to its cost

- Financial accountability ties those insights back to budgets, forecasts, and FP&A

10 FinOps KPIs every finance team should track

1. Cloud spend forecast accuracy

Cloud spend forecast accuracy measures how closely your predicted cloud costs match actual spending. Calculate it by comparing forecasted costs to actual costs and expressing the difference as a percentage. For example, a 95% accuracy rate means your forecasts are within 5% of reality.

This metric is critical for budgeting, cash flow forecasting, and financial planning. Weak forecast accuracy leads to budget surprises, last-minute approvals, and reduced credibility with leadership. Strong forecasting improves confidence, enables smarter resource allocation, and strengthens financial control.

2. Resource utilization rate

Resource utilization rate measures how much of your cloud resources are actively in use versus what has been provisioned. For example, if you pay for 10TB of cloud storage but you only use 5TB, your utilization rate would be 50%.

Low utilization rates point to over-provisioning and underutilized resources, both major drivers of waste. Tracking utilization by instance type or service helps you find optimization opportunities and improve overall cloud cost efficiency.

3. Cloud waste percentage

Cloud waste percentage shows the share of your cloud spend tied to idle resources or unnecessary capacity. Examples include stopped instances still incurring storage costs or unattached volumes consuming space.

Calculate this by dividing waste spending by total cloud costs. For example, a 20% waste rate means one-fifth of your cloud budget delivers no business value.

4. Cost allocation rate

Cost allocation rate measures how much of your cloud spend can be traced to specific teams, projects, or business units. Without accurate allocation, it's impossible to hold teams accountable or calculate project ROI.

A high allocation rate improves spend visibility and enables chargeback or showback models. An allocation rate of 90% or higher means nearly all costs are owned and managed by responsible teams.

5. Unit cost per customer or transaction

Unit cost per customer or transaction connects cloud costs to business outcomes. It divides your infrastructure cost by operational metrics such as customers served or transactions processed.

For a SaaS business, this could mean dividing monthly cloud expenses by the number of active users. This KPI helps SaaS finance and engineering teams see whether cloud costs scale efficiently with growth and where cost optimization can improve margins.

6. Discount coverage percentage

Discount coverage percentage measures how much of your cloud spending benefits from savings plans, reserved instances, or other long-term pricing commitments.

A 70% coverage rate means 70% of your eligible workloads receive discounted pricing. Increasing discount coverage directly reduces your unit cost and improves your overall cloud cost optimization strategy.

7. Budget variance

Budget variance tracks the difference between budgeted and actual spending. Express this both in dollar terms and as a percentage. Positive variance means overspending; negative variance shows underspending.

This KPI functions as an early warning system for cloud cost overruns. A variance analysis that shows consistent upward variance signals the need for investigation, while a downward trend may suggest conservative forecasting or unused opportunities for innovation.

8. Mean time to cost anomaly resolution

Mean time to cost anomaly resolution measures how quickly your team identifies and fixes unexpected cost spikes. Start the clock when an anomaly appears and stop it when it's resolved.

Shorter resolution times protect your cloud budget from runaway costs. Tracking detection and resolution separately can uncover whether delays stem from data visibility or response speed.

9. Tagging coverage

Tagging coverage measures the share of cloud resources with proper cost allocation tags. Tags identify ownership, environment, and cost center. They form the foundation for all FinOps metrics, including allocation, forecasting, and optimization.

A tagging coverage rate above 95% enables complete reporting and accountability. Anything less leaves gaps that obscure true cost drivers and hinder cloud financial management.

10. Rightsizing opportunity value

Rightsizing opportunity value quantifies how much you could save by adjusting resource sizes. It highlights over-provisioned workloads you can scale down without affecting performance.

Calculate this by reviewing usage patterns and comparing current configurations to smaller, more efficient options. If your analysis shows a potential savings of $50,000 per month, that's your rightsizing opportunity value. This metric defines how much cost reduction is available through optimization alone.

Best practices to measure and report KPIs

Tracking FinOps KPIs is about building repeatable systems that improve cloud financial management, strengthen accountability, and support faster decision-making. These best practices will help you get accurate data, align teams, and sustain long-term progress:

- Tag every resource accurately from day one: Create tagging policies before provisioning your first resource. Require consistent labels for cost center, project, owner, and environment. Enforce these rules through automated checks that block untagged resources.

- Automate usage and cost collection: Manual tracking is slow and error-prone. Use automation to pull real-time cloud cost data directly from your providers through APIs or native tools like AWS Cost Explorer or Azure Cost Management. Automate alerts for anomalies or thresholds so that spikes in cloud spend trigger immediate action.

- Set baselines and realistic improvement targets: Gather at least 3 months of KPI data to establish a baseline. Understanding natural variations in cloud usage and resource utilization helps you identify real trends rather than reacting to noise. From there, set quarterly targets for achievable improvement and annual stretch goals.

- Build dashboards everyone can use: Combine financial and technical data into shared dashboards that visualize KPIs clearly. Finance teams should see cost optimization progress; engineering teams should see utilization trends and workload efficiency. Keep dashboards simple enough for non-technical stakeholders to interpret, and update them in real time.

- Review KPIs regularly and iterate: Monthly reviews keep performance visible without overwhelming teams. Assess which metrics are improving, which are flat, and where anomalies persist. During periods of rapid growth or major migrations, weekly reviews may be necessary.

- Create accountability across teams: Assign clear ownership for each KPI. Finance leaders might own forecast accuracy; engineering might own resource utilization. Hold brief performance reviews where both sides discuss results and agree on next steps. Shared accountability builds stronger alignment and faster progress.

Common pitfalls and how to avoid them

Overlooking unallocated spend

Untagged or unallocated resources create blind spots in cloud expense management. These orphaned costs often hide significant cloud waste, such as forgotten test environments or abandoned workloads.

Establish strong tagging governance with clear accountability for every team. Run weekly reports to identify untagged resources, and automate alerts that flag noncompliance. Create a cleanup process that assigns ownership or terminates unallocated resources within 30 days.

Relying on static budgets

Cloud usage changes daily, but static budgets rarely do. Annual or quarterly budgets can't adapt to the dynamic nature of cloud spend, which leads to either unnecessary cost restrictions or runaway expenses.

Replace static budgets with rolling forecasts that update monthly based on actual spending and usage trends. Build variance thresholds that trigger automatic reviews when spending exceeds expectations, and use automation to improve forecast accuracy.

Ignoring engineering buy-in

Finance teams cannot optimize cloud costs alone. Engineers control the infrastructure choices that drive spending, such as instance types, storage tiers, and scaling configurations. Without their engagement, optimization initiatives lose momentum.

Involve engineering teams from the beginning of every FinOps initiative. Frame cost optimization as a shared goal rather than a finance directive. Recognize engineering contributions publicly and share credit for cost savings.

Treating KPIs as one-time reports

Collecting KPI data once or twice a year isn't enough. Cloud environments evolve constantly, and metrics lose relevance without continuous tracking. A one-time analysis may find savings, but those gains will disappear without consistent follow-up.

Embed KPI reviews into your regular financial and operational cadence. Assign ownership for each metric, track changes over time, and document lessons learned. Make FinOps KPIs a standing agenda item in both finance and engineering meetings.

Bring your FinOps KPIs to life with Ramp

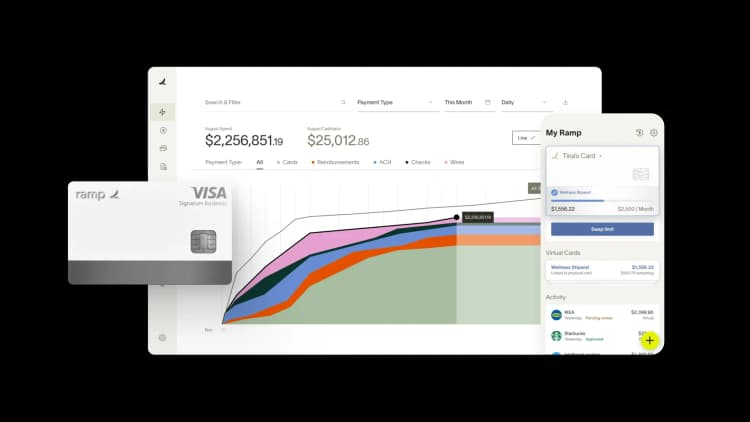

Tracking FinOps KPIs manually is slow and error-prone. Ramp automates the hard work of data collection and analysis, giving finance teams real-time visibility into every dollar of cloud spend.

Ramp's expense management automation software tracks every dollar you spend on cloud resources, enabling real-time visibility into your FinOps KPIs. Finance and engineering teams can track unit costs, measure budget variance, and identify cloud cost optimization opportunities across all services.

By combining automation with actionable insights, Ramp turns FinOps metrics into daily decision tools. You gain the visibility to control cloud costs, the data to drive accountability, and the confidence to plan budgets that scale with your business.

Try an interactive demo and see how Ramp's reporting capabilities can improve your FinOps tracking.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°