Fixed asset depreciation: What it is and how it’s calculated

- What is fixed asset depreciation?

- Common depreciation methods (and when to use each)

- How to depreciate fixed assets?

- Depreciation schedules and asset tracking

- Fixed asset depreciation compliance

- Good depreciation records make better business decisions

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Fixed asset depreciation helps you track how business assets lose value over time. It’s a core part of accounting that affects your balance sheet, tax filings, and long-term planning.

If you manage finances, run reports, or file taxes, it is essential to understand how depreciation works. It helps you spread the cost of equipment, vehicles, buildings, and other fixed assets across their useful life. This keeps your finances accurate and decisions grounded.

What is fixed asset depreciation?

Fixed Asset Depreciation

Fixed asset depreciation is the process of spreading the cost of a long-term asset over the period it’s expected to generate value. It reflects how assets, such as machinery, vehicles, or equipment, lose value due to use, age, or wear.

Depreciation applies to tangible, long-term assets you don’t plan to sell quickly. These include office furniture, fleet vehicles, or production equipment. According to IRS guidelines, the asset must last more than a year and be used for business to qualify for depreciation.

In financial reporting, depreciation is reflected on both the income statement and the balance sheet. It reduces your reported earnings each period while lowering the asset’s book value over time.

Common depreciation methods (and when to use each)

Not all assets lose value in the same way. Some wear down with heavy use. Others hold steady for years before dropping sharply. That’s why depreciation isn’t one-size-fits-all. Different methods exist to match how each asset delivers value over time.

The method you choose affects your expenses, tax reporting, and how asset value appears on your financial reports.

Straight-line

Straight-line depreciation spreads the asset’s cost evenly across each year of its expected use. You deduct the same amount annually until the asset reaches its salvage value. It’s simple, consistent, and widely used for assets that lose value at a steady pace.

Here's the formula you use for calculating straight-line depreciation:

Annual Depreciation Expense = (Cost – Salvage Value) ÷ Useful Life

So, for example, an asset that costs $20,000, has a salvage value of $2,000, and a 5-year life will depreciate by $3,600 per year.

This method is best suited for assets that provide equal utility over time, like buildings, office furniture, or leasehold improvements. Because of its simplicity, it’s also the easiest method to maintain and audit. Many businesses default to straight-line for financial reporting, even if they use accelerated methods for tax purposes.

Declining balance

Declining balance is an accelerated method that front-loads depreciation. It deducts more in the earlier years when the asset typically delivers higher productivity or loses value faster. Each year, you apply a fixed percentage to the asset's remaining book value, not its original cost.

To calculate declining depreciation, you can follow this formula:

Depreciation = Book Value at Start of Year × Depreciation Rate

The most common version is a double declining balance (200% of the straight-line method), but 150% is also accepted under IRS MACRS rules. So, for example, a $10,000 asset with a 5-year life under double declining balance depreciates by 40% in year one (2 × 20%), then 40% of the remaining balance in year two, and so on.

This method is useful for technology, vehicles, and other assets that become obsolete or wear out quickly. Declining balance methods boost early-year deductions, which can reduce taxable income during periods of high-expense growth.

However, it can also lead to smaller deductions in later years, which may impact long-term planning.

Units of production

Units of production ties depreciation directly to asset usage. Instead of spreading cost over time, you match expense to actual output. This can be measured in miles driven, units manufactured, or machine hours logged.

Here's how this works:

Depreciation per Unit = (Cost – Salvage Value) ÷ Total Estimated Units

Annual Depreciation = Depreciation per Unit × Actual Units Used

So, for example, if a machine costs $50,000, has a salvage value of $5,000, and is expected to produce 100,000 units, each unit depreciates $0.45. If the machine produces 20,000 units per year, the depreciation is $9,000.

This method works well for factory machinery, delivery fleets, or tools used based on workload. It provides the most accurate reflection of value consumed, especially when asset use fluctuates from year to year.

You’ll need reliable tracking of usage data and total expected output to apply this method correctly. While it’s less common in financial reporting, it’s often used in internal cost accounting, where precision matters most.

Sum-of-the-years'-digits

This accelerated method weights early years more heavily without applying a fixed rate. It uses a fraction based on the sum of the years in an asset’s life.

So, to calculate sum-of-the-years depreciation, you can follow this formula:

Depreciation = (Asset Cost – Salvage Value) × (Remaining Life ÷ SYD Total)

For an asset that costs $30,000 with a $5,000 salvage value and a 5-year life, you first calculate the total depreciable amount: $30,000 minus $5,000 equals $25,000. Then, in year one, you apply 5/15 of $25,000, which gives you $8,333. In year two, you apply 4/15 of $25,000, or $6,667. In year three, it’s 3/15 of $25,000, or $5,000, and the pattern continues until the asset is fully depreciated.

It’s ideal when the asset delivers most of its value in the first few years but doesn’t fit the steep curve of a double-declining balance. This method offers more flexibility and can provide a middle ground between straight-line and more aggressive schedules.

Although less commonly used today, the sum-of-the-years’-digits method still has value in industries with heavy asset use early on and gradual tapering later.

How to depreciate fixed assets?

Depreciation is an ongoing part of managing your books. Once you add an asset to your depreciation schedule, you will record its expense regularly, usually monthly or annually, for the rest of its useful life. This period can last anywhere from three years for tech equipment to nearly four decades for commercial property.

1. Identify the asset

Start by confirming that the asset qualifies as a depreciable fixed asset. It must be tangible, used in your business, and expected to last more than one year.

Common examples include computers, vehicles, furniture, and machinery. Assets like land and inventory don’t qualify. Land isn’t depreciated because it doesn’t wear out, and inventory is considered a short-term current asset. If the asset meets the criteria, it can be added to your depreciation schedule.

2. Determine the asset's useful life

You then need to estimate how long the asset will provide value to your business. This is referred to as its useful life. The estimate should be realistic, based on how you intend to use the asset, its expected lifespan, and industry standards.

For example, the IRS assigns a 5-year life to computers, 7 years to office furniture, and up to 39 years for commercial buildings. Internal company policies or IRS depreciation tables can help guide your estimate. Your chosen useful life will directly shape the depreciation schedule.

3. Calculate the depreciable base

Once you have determined the useful life, calculate how much of the asset’s cost is depreciable. This is the original cost of the asset minus its estimated salvage value. The salvage value is the amount you expect to recover when the asset is sold, traded in, or disposed of at the end of its life.

For instance, if you buy a machine for $20,000 and expect to sell it for $3,000 after five years, your depreciable base is $17,000. This is the amount you will spread over the asset’s life using your chosen depreciation method.

4. Select the correct method of depreciation

Different assets lose value in different ways. Choosing the right depreciation method helps you align expense recognition with the actual performance of your assets.

Straight-line depreciation is the most common method and spreads the cost evenly across the years. Accelerated methods, such as the declining balance or sum-of-the-years’-digits method, load more expense into the early years. These are often preferred for assets like vehicles or tech equipment, which lose value rapidly, like computers, for example, can depreciate by nearly 40% in the first year.

Usage-based assets may call for the units of production method, which ties expense directly to output. Your choice should reflect how the asset delivers value and align with accounting standards or tax rules relevant to your business.

5. Apply the depreciation formula

Now, it’s time to calculate the actual depreciation expense. Use the appropriate formula based on your selected method. For example, the straight-line method uses equal annual amounts, while the declining balance method applies a fixed percentage to the book value each year.

If the asset was purchased partway through the year, you will need to calculate partial-year depreciation. Accuracy ensures that your financial statements accurately reflect asset value each period.

6. Record the depreciation expense

Once you have calculated the depreciation, you need to enter it into your accounting system. This is done through a journal entry that includes two parts:

- Debit the Depreciation Expense account on your income statement

- Credit the Accumulated Depreciation account under assets on your balance sheet

This entry reduces your reported profit while lowering the asset’s book value over time. Most businesses record depreciation monthly or annually, depending on reporting needs. Regular entries keep your financials accurate, support tax compliance, and make audit reviews smoother.

Depreciation schedules and asset tracking

A depreciation schedule is a detailed record that shows how each fixed asset loses value over time. It includes the asset's cost, purchase date, depreciation method, useful life, and the depreciation expense recorded each period. This schedule is key to accurate reporting and audit readiness.

Approximately 56% of small businesses fail to track fixed assets effectively, which increases the risk of errors and lost value. Building a clear, up-to-date depreciation schedule paired with accurate asset tracking keeps your reporting clean and your records audit-ready.

Building and maintaining a depreciation schedule

To create a depreciation schedule, begin with a list of all depreciable assets you own. For each asset, record the purchase date, cost, expected useful life, salvage value, and the depreciation method you've selected. This becomes the foundation of your schedule.

Once you have the inputs, calculate the annual or monthly depreciation for each asset. Update the schedule regularly to reflect new purchases, asset disposals, changes in use, or revised estimates. This ensures your books stay aligned with real asset performance.

Your depreciation schedule should include for every asset:

- Asset name or ID

- Purchase date

- Original cost

- Salvage value

- Useful life

- Depreciation method

- Depreciation to date

- Current year’s depreciation

- Net book value

If you're using spreadsheets, ensure that formulas are accurate and carry over cleanly across reporting periods. Errors in spreadsheet-based tracking are common.

For larger asset volumes, use accounting software with fixed asset modules. These tools automate calculations, flag inconsistencies, and generate reports for auditors or tax filing.

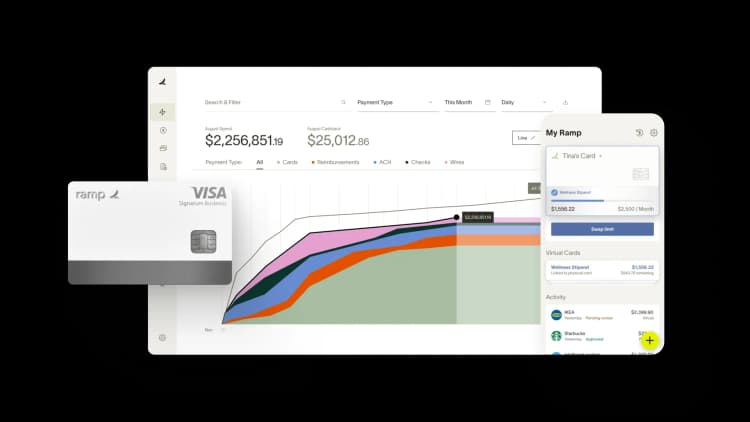

If you're managing a growing asset base, Ramp can help automate depreciation schedules and sync fixed asset entries directly into your accounting system. This helps you eliminate the need for manual tracking and errors.

Tracking fixed assets across teams and locations

When fixed assets are shared across departments or job sites, tracking becomes more complex. Without a clear process, assets can get lost, misreported, or depreciated under the wrong team.

To stay in control, you need a system that tracks asset location, ownership, and movement in real-time. Here’s how to build and maintain one:

- Set up a centralized asset register. Use a spreadsheet, ERP system, or fixed asset software to create a single source of truth. Include asset ID, name, category, purchase date, cost, current location, assigned team, and status (active, retired, or disposed). Choose a format your team can update consistently.

- Tag every asset at acquisition. Assign a unique ID to each asset and apply a physical tag, like a barcode, RFID, or QR code. This makes tracking easier while managing your audits, transfers, and check-outs. Tagging should happen before the asset is deployed.

- Assign asset owners by location or team. Each asset should have a designated owner who is responsible for verifying its use and status during audits. This helps prevent assets from being orphaned or misused.

- Use a check-in/check-out process for shared assets. Create a log that records when assets move between teams or sites. This can be manual or software-based. Make it a standard part of your internal handoff process, especially for mobile items like tools, laptops, or vehicles.

- Update location and usage data regularly. Whenever an asset is moved, reassigned, or retired, update the register immediately. Include the date, reason for the move, and the name of the person who approved it. Set reminders for quarterly or biannual reviews to catch missing changes.

- Run scheduled physical audits. Conduct full asset audits at least once a year or more frequently if you experience frequent movement. Use scanning tools or mobile audit apps to speed up the process. Cross-check audit results against your register and correct any discrepancies.

- Link assets to cost centers. Track which team or department is using each asset by linking it to a cost center. This allows you to allocate depreciation and maintenance costs to the right part of the business.

Fixed asset depreciation compliance

Fixed asset depreciation compliance involves adhering to the accounting and tax rules that govern the treatment of long-term assets in your financial records. It includes how you classify assets, calculate depreciation, apply methods, and report those details to regulators or auditors.

Here’s what compliance requires:

- Classify assets correctly. Only depreciate assets that are physical, used in business operations, and expected to last more than one year. Exclude items like land and inventory, which follow different accounting treatments.

- Apply methods consistently. Once you assign a depreciation method to an asset or asset class, use it consistently across reporting periods. If you change methods, document the reason and disclose it in your financial statements.

- Support useful life estimates. Maintain a written record of each asset’s useful life. You can reference IRS guidelines, industry benchmarks, or internal usage data. Auditors may ask to see how you arrived at your assumptions.

- Track and update depreciation schedules. Maintain a centralized record that includes cost, method, start date, useful life, and accumulated depreciation. Update it regularly to reflect asset sales, retirements, or impairments.

- Retain records for audit and tax. The IRS requires businesses to keep depreciation records for the full life of the asset plus three additional years. This includes documentation of the original cost, calculation method, and any adjustments made over time.

Tip

Ramp helps enforce compliance by automatically flagging transactions that are misclassified or missing asset details. If a capital purchase isn’t properly coded, Ramp suggests the correct category based on past patterns. This keeps your depreciation records accurate from day one.

Good depreciation records make better business decisions

Fixed asset depreciation is a core part of managing your financial health. The IRS allows depreciation deductions for most capital assets used in business, but those benefits come with clear reporting rules. Missteps, like using the wrong method, missing an update, or overreporting depreciation, can lead to penalties or audit flags.

Maintaining clean, up-to-date depreciation schedules helps you stay compliant and reduce risk. But more than that, it gives you a clearer picture of how your business is spending and when to reinvest.

Good depreciation records do not just support compliance. They make reporting easier and decision-making faster. Ramp’s automation helps teams maintain audit-ready fixed asset data, eliminate manual entries, and stay on top of asset changes without adding extra work during month-end or tax season.

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits