Best fleet fuel cards in 2025: An in-depth breakdown on choosing the right card

- What are fleet fuel cards and how do they work?

- Top benefits of using a fleet fuel card program

- Best fleet fuel cards for businesses in 2025

- Which fuel card is best for your fleet?

- A corporate card built for total spend control

The best fleet fuel cards combine spending controls, detailed transaction data capture, and accounting system integration to help businesses manage vehicle expenses efficiently. These specialized payment cards prevent unauthorized purchases while automatically organizing fuel spending data that would otherwise need manual receipt management.

This guide compares their features to help you maximize discounts, put in effective controls, and choose reporting tools that reduce administrative overhead.

What are fleet fuel cards and how do they work?

Fleet fuel cards are specialized payment cards designed exclusively for vehicle-related expenses. These cards provide detailed control over fuel and maintenance purchases while capturing detailed transaction data for each purchase.

Fleet fuel cards work through a structured process: businesses apply for cards from providers that serve their operational areas, assign cards to specific drivers or vehicles with customized spending limits, and drivers use the cards at approved locations where transactions are validated against preset rules. The system automatically captures purchase data and creates reports accessible through online platforms.

These cards include several key features that set them apart from regular payment cards, too:

- Purchase restrictions limit spending to fuel and approved maintenance items, while time and location controls prevent usage outside business hours or designated areas

- Detailed analytics track fuel efficiency metrics, and spending caps can be customized for individual drivers or vehicles

- Transaction data automatically links each purchase to specific vehicles and drivers, and accounting system integrations provide instant alerts for rule violations

This approach maintains spending oversight without needing manual data entry or receipt collection.

Top benefits of using a fleet fuel card program

Fleet fuel card programs deliver measurable improvements in cost control, administrative efficiency, security, and reporting capabilities that change vehicle expense management.

Operational aspect | Without fleet fuel cards | With fleet fuel cards |

|---|---|---|

Cost control | Manual receipt review, limited spending visibility, no negotiated discounts | Automated spending limits, real-time monitoring, negotiated fuel discounts, volume rebates |

Administrative workload | Paper receipt collection, manual data entry, spreadsheet management, time-consuming reconciliation | Digital receipt capture, automated categorization, instant reporting, streamlined reconciliation |

Security | Limited unauthorized purchase prevention, delayed fraud detection | Customizable purchase restrictions, real-time alerts, driver/vehicle-specific controls |

Reporting | Basic transaction data, manual report creation, limited analytics | Detailed transaction data, automated custom reports, comprehensive analytics |

These operational improvements create measurable business value in several key areas:

Fuel cost savings

Fleet cards create immediate savings through negotiated fuel discounts ranging from $0.01 to $0.15 per gallon based on purchase volume and network participation. High-volume fleets compound these direct savings over time, while volume rebates typically increase with fleet growth. The cards also prevent unauthorized purchases by getting rid of off-route fueling and personal use through customizable spending restrictions.

Administrative efficiency

Fleet cards get rid of time-consuming administrative tasks associated with manual expense tracking. Instead of collecting paper receipts and manually entering transaction data, these systems automatically capture and categorize every purchase. This automation typically saves several hours of administrative work weekly while making sure you get complete accuracy in expense tracking and getting rid of spreadsheet-based fuel expense management.

Enhanced security

Sophisticated control mechanisms prevent unauthorized spending before it happens. Cards can be set up to work only at specific stations, during designated hours, or for certain products. Real-time alerts notify managers of unusual activity patterns such as multiple transactions within short timeframes or purchases outside service areas. These proactive controls address potential issues before they impact budgets.

Better reporting

Advanced reporting capabilities provide detailed visibility into fleet operations beyond basic transaction lists. Analytics show spending patterns, fuel efficiency trends, and cost allocation by driver, vehicle, or route. Custom reports are created instantly rather than needing manual creation, providing immediate insights for operational decision-making.

Best fleet fuel cards for businesses in 2025

Fuelman

Fuelman is a fleet fuel card program focused on giving businesses flexibility, control, and visibility over vehicle spending. Companies can earn fuel rebates at gas stations on the Fuelman Network and manage costs through plan options designed for different fleet needs. The Discount Network advertises savings of 8¢ per gallon on diesel and unleaded at 40,000+ locations.

Fuelman provides driver- and vehicle-level reporting to support decision-making, including detailed fuel and tax reporting for time savings during reconciliation. Organizations can choose among Basic, Pro, and Enterprise plan tiers.

Pros:

- Fuel rebates on the Fuelman Network, including 8¢/gallon savings at 40,000+ Discount Network locations

- Driver- and vehicle-level reporting with detailed fuel and tax reporting

- Customizable fuel controls, driver profiles, and real-time fraud/misuse alerts

Cons:

- Monthly plan fees (Basic, Pro, Enterprise) add fixed costs; maintenance program may be additional fee on lower tiers

- Actual savings depend on use of the Discount Network and may vary by location and plan

- Broader acceptance and benefits outside participating merchants can differ by configuration, requiring careful setup of controls and policies

Coast

Coast takes a software-forward approach on the Visa network, focusing on broad retail acceptance with modern controls. The admin experience focuses on clarity: create physical or virtual cards, set merchant and category rules, and act on real-time alerts. Reporting focuses on intuitive dashboards and automated exports, with integrations oriented toward popular small business stacks. Pricing and incentives vary by plan and usage, with an emphasis on transparent terms.

Pros:

- Broad retail acceptance via the Visa network

- Merchant/category rules and real-time alerts

- Clean dashboards with automated exports

Cons:

- Savings depend on plan incentives and merchant participation

- Feature depth for heavy-duty/enterprise needs can be lighter than specialized providers

- Broad acceptance may require tighter controls to limit non-fuel spending

WEX

WEX offers a fleet fuel card designed to help businesses manage fuel spend with purchase controls, real-time monitoring, and automated accounting. They provide broad acceptance at about 95% of U.S. gas stations. WEX advertises potential savings of up to 15¢ per gallon through its nationwide savings network, plus up to 3¢ per gallon everywhere else, though specific pricing, fees, and terms depend on the account and program details.

Administrators can set purchase controls, need driver PINs, and limit transactions by amount, time of day, and more. WEX provides fuel accounting and expense tracking, with reporting and detailed transaction capture. The mobile app lets managers look up driver PINs and spot potential misuse.

Pros:

- 180,000+ locations and ~95% gas station acceptance in the U.S.

- Savings of up to 15¢/gallon in-network and up to 3¢/gallon elsewhere

- Spend controls with real-time monitoring

- Automated accounting and detailed transaction data

Cons:

- Savings depend on network participation and program terms; actual results vary

- Paying the balance in full each month is encouraged to maximize savings

Voyager

Voyager (U.S. Bank Voyager Mastercard) is a dual-network fleet card that runs on both the Voyager and Mastercard networks, giving fleets broad acceptance across the U.S. and in Canada and Mexico. It's designed to cover routine fuel purchases as well as unexpected on-the-road needs, letting drivers handle contingencies with a single card.

Administration happens on one management platform where fleet teams can issue cards to drivers or vehicles, set spend controls and pump prompts, and view detailed, accurate transaction data for fuel and maintenance. The program also supports tracking and control of pre-purchased fuel, mobile refueling, driver training expenses, and the use of negotiated discounts.

Pros:

- Dual-network acceptance (Voyager + Mastercard)

- Supports fuel, maintenance, and unplanned expenses

- Single platform for card administration, spend controls, reporting, and detailed data capture

Cons:

- Savings depend on merchant participation and any negotiated discounts

- Broad acceptance may require careful control settings to limit non-fuel spend

- Cross-border use is subject to network and merchant availability

Chevron and Texaco

Chevron and Texaco Business Cards provide corporate accounts that channel fuel purchasing through branded station networks while delivering volume-based discounts and operational transparency.

Three card options address different operational needs: the standard Business Card restricts purchases to Chevron and Texaco locations exclusively, working as a charge account that needs full monthly payment with no fees. The Business Access Card maintains the same payment terms while expanding to partner stations and offering volume-based rebates up to 6¢ per gallon. The Business Access Flex Card works as a credit account allowing balance carrying, accepted at 95% of U.S. fuel stations with variable interest rates.

Pros:

- Volume-based discounts up to 6¢ per gallon

- Dual verification security system

- Comprehensive transaction data capture

- Geographic boundary controls

Cons:

- Limited to branded network for maximum discounts

- Variable interest rates on credit option

- Requires consistent volume for meaningful savings

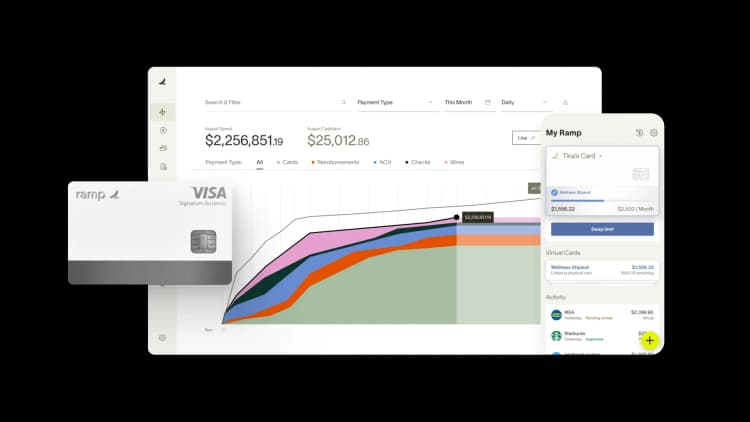

Honorary mention: Ramp corporate card

Ramp is not a traditional fleet card—it’s a corporate card and expense management platform built to help businesses track, control, and optimize employee spend, including fuel.

For companies that operate multiple teams and want visibility into all purchases, Ramp offers features like purchase restrictions, real-time policy alerts, and automated receipt matching. Since it’s accepted anywhere Visa is, Ramp works at almost every gas station.

Ramp also integrates with accounting systems to streamline reconciliation, and offers flat cashback on almost all purchases. There are no annual fees and no personal guarantee required.

Key features:

- Save more by preventing out-of-policy spend: Preset controls on corporate cards for specific vendors and categories.

- Be free from expense reports: Easily submit expenses through SMS, mobile app, and integrations.

- Unlock savings in real time: Get insight into spend as it happens, with a platform that pays off immediately.

- Grow your business with the right terms: Get rewards and perks, like 5% savings*. There’s no personal credit checks or personal guarantee.

Considerations:

- Requires a $25,000 minimum in a U.S. business bank account

- Not available to sole proprietors

- Full monthly payment required (charge card)

What's the difference between business gas credit cards and fleet fuel cards?

Business gas credit cards focus on earning rewards or cash back at the pump and work like standard credit cards. Fleet fuel cards are designed for managing multiple vehicles, offering per-gallon discounts, spend controls, and detailed reporting. In short, gas cards reward purchases, while fleet cards give businesses oversight and cost management.

Which fuel card is best for your fleet?

The best fleet fuel card for your business depends on your fleet size, operational patterns, and management requirements.

Fleet cards for small fleets

Small fleets with unpredictable routes need cards providing universal acceptance without complex management requirements. For technicians or service personnel traveling to different customer locations daily, the best fleet cards for small businesses include Ramp, Voyager, or Coast offer strong options. Universal acceptance prevents time waste searching for specific stations, while simple interfaces let you manage cards without dedicated fleet personnel.

Fleet cards for mid-sized fleets

Mid-sized fleets (21-100 vehicles) should focus on meaningful discounts, strong controls, and reporting with accounting integration. For businesses with established routes but growing operational complexity, Fuelman's discount network can deliver up to 8¢ per gallon savings while providing customizable controls. WEX offers extensive network coverage with potential savings up to 15¢ per gallon in-network, making it suitable for fleets needing both flexibility and cost control. Ramp provides expense management integration that scales with growing fleet operations.

Fleet cards for large fleets

Large enterprises with complex reporting needs should prioritize data capabilities and integration features. For diverse vehicle management across multiple locations, WEX delivers advanced reporting and connections with 180,000+ location acceptance.

Fleet cards for regional delivery fleets

Regional delivery fleets with fixed routes benefit from location controls and predictable pricing. For vehicles following regular routes in defined service areas, Fuelman's location restrictions prevent off-route purchases while fixed pricing programs maintain cost consistency. The focused network aligns with predetermined routes and regular fueling stops.

How to evaluate your options carefully

When picking a fleet fuel card, consider these key questions to assess:

- Where do your vehicles operate? Figure out whether universal acceptance or a focused network better serves your needs

- What is your monthly fuel volume? This affects discount potential and fee structures

- What controls do you need based on drivers, vehicles, and security concerns?

- What reports do you use for management, taxes, and optimization?

- Which systems need integration, such as accounting, dispatch, or fleet management software?

Evaluation criteria:

- Network coverage alignment with operational areas

- Fee structure appropriateness for your volume

- Purchase controls addressing specific security concerns

- Reporting providing actionable insights

- Integration compatibility with existing systems

- Discount structure matching consumption patterns

- Customer support meeting service expectations

- Implementation process fitting your timeline

- Contract terms providing appropriate flexibility

- Mobile capabilities supporting driver needs

Other important considerations beyond advertised rates include:

- Hidden fees: Monthly card fees, program administration costs, transaction charges, and report creation fees can offset savings

- Minimum purchase requirements: Discounts often apply only after reaching volume thresholds, typically 500-1,000 gallons monthly for basic programs and over 5,000 for premium tiers

- Network limitations: If drivers must detour to reach in-network stations, extra time and mileage can reduce overall savings. Universal acceptance programs may offer lower discounts but provide better value for unpredictable routes

A corporate card built for total spend control

Choosing a business credit card isn’t just about earning rewards, it’s about gaining control over one of your largest recurring costs. Businesses often overspend on fuel and other operational expenses not because they’re using more, but because they can’t see who’s spending what, where, or when.

Ramp’s corporate card is built to handle real-world business spend—from travel to fuel and beyond. Accepted wherever Visa is, it comes with no annual fee and is available to businesses with at least $25,000 in a U.S. business bank account. With centralized controls and automation, Ramp gives finance teams visibility across all employee spend.

See how Ramp helps you manage expenses. Try the Ramp corporate card.

*We calculate average savings as a percentage of an illustrative customer's total card spending when using Ramp features designed to reduce business expenses. Keep in mind that this percentage is an estimate, not a guarantee. Ramp delivers savings from more than just card spending; savings can also come from non-card expenses so we may factor decreases to non-card spending into our calculation. For example, savings may result from reduced time spent on manual expense tracking, the financial benefit of cash back or other rewards, smarter expense monitoring, and eliminating costs associated with alternative solutions. Our calculations are based on platform data, industry research, customer surveys, and info on alternative options. Your actual savings may vary.

**Information about third-party card providers is based on publicly available sources and may change over time. Details have not been independently verified or endorsed by the providers themselves.

**Information about third-party card providers is based on publicly available sources and may change over time. Details have not been independently verified or endorsed by the providers themselves.

FAQs

Fleet fuel cards are designed specifically for vehicle expenses while business credit cards handle general purchases. Fleet cards capture vehicle-specific data including odometer readings and fuel grades, restrict purchases to approved categories, and create specialized reports that regular cards can't provide. This gives businesses significantly more control over driver spending locations and purchase types.

Small businesses gain major advantages even with few vehicles by getting rid of manual receipt tracking and spreadsheet-based tax reporting. Basic controls prevent unauthorized personal use without needing complex systems, while universal acceptance cards provide route flexibility. Consolidated billing reduces payment processing time and improves cash flow management.

Fleet cards automatically separate fuel taxes from purchase totals for accurate deductions and create IFTA-compliant reports for interstate purchases. Every transaction record includes essential tax data: dates, locations, gallons, and tax amounts. Many providers export this tax data directly into accounting systems or tax software.

Fleet cards use multiple security layers including driver PINs or ID numbers for transaction verification beyond physical card possession. Purchase restrictions limit transactions to approved products, locations, and times. Real-time alerts notify managers of unusual activity, while spending limits can be set at driver, vehicle, or account levels.

Network coverage directly impacts daily operations. Universal acceptance cards work everywhere but may offer lower discounts, while focused network cards provide deeper savings but limit fueling locations. Choose based on your routes: predictable paths work well with focused networks, while varied or nationwide operations typically need universal acceptance.

Branded cards tied to single fuel brands typically offer better discounts at their locations but limit driver fueling options. Universal cards work at most stations but may have smaller discounts. If vehicles regularly pass specific brand locations on routes, branded programs can save more money. However, if routes vary or cover wide areas, universal coverage prevents wasted time and detours.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°