- Understanding different types of business gas cards

- Why your business needs a dedicated gas credit card

- Fleet cards vs. business gas credit cards

- How to choose the right business gas card for your needs

- 8 of the best business gas credit cards

- How to start applying for a business gas card

- Are there any easy-approval business gas cards available?

- Cut fuel costs and take control with the right business gas card

Fuel is one of those unavoidable business expenses that adds up fast. The card you choose can make the difference between earning cash back and overpaying with little visibility into where that money goes.

Whether you’re fueling a few company vehicles, reimbursing employees for regular travel, or managing a growing fleet, the right business gas credit card helps you cut fuel costs, simplify tracking, and control who’s spending, where, and on what.

This side-by-side comparison ranks the best business gas, fleet, and fuel cards by rewards, savings, approval requirements, and control features, making it easier to choose the right option for how your business fuels and operates.

Best business gas credit cards by business type

If you want a quick answer, here’s how the top business gas and fleet cards compare based on how different companies actually use fuel.

| Business type | Best card | Key benefit | Approval requirements |

|---|---|---|---|

| Small fleets (3–20 vehicles) | Ramp Business Credit Card | Built-in spend tracking + average 5¢/gallon savings | $25K business bank balance, EIN only, no credit check |

| High-volume fuel users | Shell Small Business Card | Up to 6¢/gallon at Shell stations | Good credit required |

| Mixed business spending | U.S. Bank Triple Cash | 3% back on gas + office supplies | Good to excellent credit |

| New businesses | WEX Fleet FlexCard | No credit check, wide acceptance | EIN only, no credit check |

| Costco members | Costco Anywhere Visa | 4% back on gas worldwide | Costco membership + good credit |

Want a deeper look at each option? Jump straight to our full reviews of the top business gas cards below.

How we evaluated the best business gas credit cards

To determine the best business gas credit cards, we evaluated each option across four core criteria: fuel rewards or savings, spending controls, approval requirements, and overall usability for growing businesses.

We prioritized cards that make fuel spending easier to track and manage, not just those with the highest advertised rewards. That meant weighing tradeoffs between flexibility, acceptance, reporting depth, and how well each card supports real-world business operations.

Cards were also assessed based on who they’re best suited for, whether that’s small teams reimbursing employee fuel expenses, businesses managing multiple vehicles, or companies looking to establish business credit without relying on personal guarantees.

Understanding different types of business gas cards

Business gas cards generally fall into two categories: business gas credit cards and fleet fuel cards. Both help manage fuel spending, but they’re designed for different types of businesses and levels of oversight.

Business gas credit cards work like traditional business credit cards, offering cash back or rewards on fuel purchases while also earning rewards on other categories such as travel or office supplies. They’re widely accepted and are often the better fit for smaller teams or businesses that want flexibility beyond fuel.

Fleet fuel cards are built specifically for companies managing multiple vehicles or drivers. These cards typically include features like driver IDs, fuel-only purchase restrictions, and detailed reporting to help monitor usage, prevent misuse, and control costs across vehicles or job sites.

If your priority is maximizing rewards and broad acceptance, a business gas credit card is usually the better choice. If you need tighter controls and deeper visibility into fuel usage, a fleet card may be the stronger option. A more detailed comparison appears later in this guide.

Why your business needs a dedicated gas credit card

If your business spends more than $500 a month on fuel, using personal cards or generic business credit cards costs you both money and control. A dedicated gas card is designed to solve those problems.

Here’s what the best business gas credit cards help you do:

Get immediate control over fuel spending

- Prevent misuse with fuel-only purchase restrictions and real-time alerts

- Eliminate manual receipt collection with automated expense tracking

- Reduce fuel costs through cashback cards or per-gallon discounts

- Simplify tax prep with clearly categorized fuel expenses

Unlock long-term operational benefits

- Build business credit separate from personal finances

- Present a more professional experience for employees on the road

- Improve cash flow with predictable billing and payment terms

- Scale spending controls easily as your team or fleet grows

Unlike general business credit cards, gas cards are built specifically for fuel oversight. Many let you set limits by driver or vehicle, restrict purchases to fuel or maintenance categories, and track usage across teams or locations.

They also generate detailed spend reports, automate receipt matching, and make it easier to allocate fuel costs by department, project, or vehicle. For businesses that rely on vehicles to operate, a gas card turns fuel from a messy expense into a predictable, trackable cost.

Fleet cards vs. business gas credit cards

Fleet cards and business gas credit cards both help manage fuel spending, but they’re built for different operating needs. The right choice depends on how many vehicles you manage, how much control you need, and whether fuel is your primary expense.

| Feature | Business gas credit cards | Fleet fuel cards |

|---|---|---|

| Best for | Small teams, mixed spending, flexible rewards | Multiple vehicles, strict fuel oversight |

| Rewards model | Cash back or points on gas and other expenses | Per-gallon discounts or rebates |

| Acceptance | Widely accepted anywhere major cards are used | Accepted at specific networks or most gas stations |

| Spending controls | Category limits and basic controls | Driver IDs, fuel-only limits, transaction rules |

| Reporting depth | Expense-level tracking | Vehicle- and driver-level reporting |

Business gas credit cards function like traditional business credit cards, with elevated rewards on fuel purchases and broad acceptance across gas stations and merchants. They’re often easier to manage for smaller teams and businesses that want flexibility beyond fuel, including rewards on travel, dining, or office expenses.

Fleet fuel cards are designed for businesses operating multiple vehicles or managing field teams. They offer tighter controls, deeper reporting, and fuel-specific restrictions that help prevent misuse and monitor consumption at the driver or vehicle level.

In short:

- Choose a business gas credit card if you want flexible rewards, broad acceptance, and simpler expense management

- Choose a fleet card if you need strict controls, detailed fuel reporting, and oversight across multiple vehicles

Some businesses use both. A fleet card can handle vehicle-specific fuel spending, while a business gas credit card covers reimbursed fuel purchases, travel, and other day-to-day expenses.

Do business gas cards build business credit?

Yes, many business gas credit cards report payment activity to business credit bureaus, which can help establish or strengthen your business credit profile over time. Fleet cards may also report to business credit bureaus, but reporting practices vary by provider.

If building business credit is a priority, look for cards that explicitly state they report to business credit bureaus and don’t rely solely on personal credit history.

How to choose the right business gas card for your needs

The best gas card for your business depends on more than just rewards. It should match how your team fuels, how you manage spending, and which features actually save time and money. Here’s what to evaluate.

Control and track fleet spending: Best for businesses with 5+ vehicles

If you’re losing money because you can’t see where fuel dollars are going, prioritize cards built for oversight. Look for real-time alerts, fuel-only restrictions, and detailed reporting. Options like the Ramp Business Credit Card and WEX Fleet FlexCard provide full transaction visibility and help prevent unauthorized purchases.

Maximize rewards on necessary spending: Best for consistent fuel users

If fuel is an unavoidable expense, rewards matter. Focus on cards with strong gas reward rates, simple redemption, and no annual fees. Cards like the Costco Anywhere Visa and U.S. Bank Triple Cash turn regular fuel spending into predictable savings.

Establish business credit and legitimacy: Best for new businesses

New businesses often need tools that help build business credit without relying heavily on personal credit. Prioritize cards with business credit reporting, EIN-based approval, and minimal personal guarantees. Secured business credit cards and select charge cards can help establish credit while maintaining spend controls.

Simplify operations and reduce admin: Best for time-strapped owners

If managing expenses takes too much time, automation is key. Choose cards with automatic expense categorization, accounting integrations, and mobile apps that make it easy to track purchases on the go. Features like automated receipt matching and real-time notifications can significantly reduce administrative work.

Security features to consider

- Real-time transaction alerts and fuel-only limits

- Driver ID verification or odometer tracking

- Location-based restrictions to reduce misuse

Are fuel cards worth it for small businesses?

Yes. Fuel cards can significantly reduce administrative work for small businesses by automatically tracking and categorizing fuel purchases, which eliminates manual receipt collection and reimbursement workflows.

When combined with fuel rewards or per-gallon discounts that can lower costs by 3–6¢ per gallon, these cards often deliver savings that outweigh any setup effort. For businesses spending $500 or more per month on fuel, the efficiency gains alone can justify the switch.

Fuel cards also give small businesses better control as they grow. Features like spending limits, real-time alerts, and transaction visibility help maintain cash flow discipline and prevent misuse before it becomes a problem.

How much fuel spending makes a business gas card worth it?

For most businesses, spending around $500 or more per month on fuel is enough to justify a dedicated gas card. At that level, fuel rewards, per-gallon discounts, and time saved on expense tracking often outweigh any setup effort.

Businesses with higher fuel spend or multiple drivers tend to see even greater value from spending controls and real-time visibility.

8 of the best business gas credit cards

The best business gas credit card isn’t one-size-fits-all. The right option depends on how much fuel you buy, how many vehicles or employees you’re managing, and whether you care more about rewards, controls, or reporting.

Below is our detailed breakdown of the top business gas and fleet cards, selected for their rewards, savings, approval requirements, and best fit for different business needs.

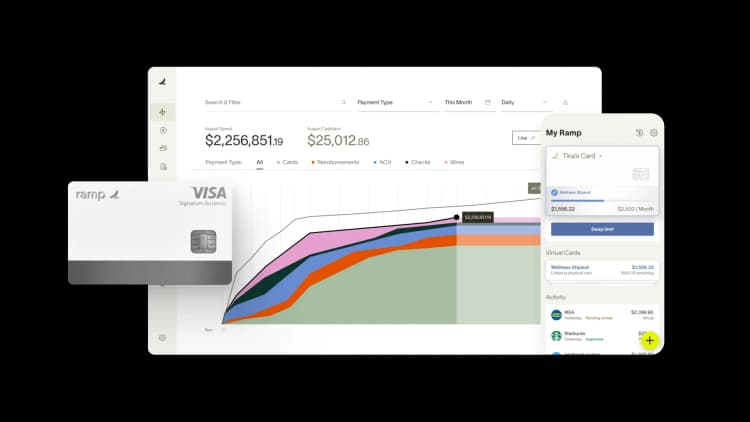

Ramp Business Credit Card

- Advanced tracking and management tools for fuel expenses

- No fees or interest charges

- Savings on fuel purchases

- Not available to sole proprietors or unincorporated businesses

Best for businesses that need centralized controls and clean accounting integration

The Ramp Business Credit Card is a strong fit for teams that care as much about controlling fuel spend as they do about earning rewards. Instead of optimizing purely for cashback rates, Ramp emphasizes visibility, policy enforcement, and automation, which makes it especially effective for businesses with multiple drivers or employees expensing fuel.

Ramp allows you to restrict cards to fuel-only purchases, monitor transactions in real time, and automatically match receipts to expenses. That reduces manual cleanup at the end of the month and helps finance teams spot issues as they happen rather than after the fact.

Why it wins for control and tracking: Ramp is designed to eliminate guesswork around company spending. Real-time alerts, customizable spend limits, and detailed reporting make it easier to enforce policies and understand exactly how fuel dollars are being used across your business.

Ramp also separates business spending from personal credit. Approval is based on business financials rather than personal credit scores, which makes it a good option for incorporated businesses with steady cash flow that want modern controls without fees or interest charges.

Ideal for: Businesses with three or more vehicles, regular employee fuel purchases, or finance teams that prioritize control, automation, and clean accounting over maximizing category-based rewards.

Costco Anywhere Visa Business Card by Citi

- High cashback rate on gas purchases

- No annual fee with a Costco membership

- Includes dining and travel rewards

- Rewards are redeemable only once a year

- Requires a Costco membership

Best for businesses that want high gas rewards and already have a Costco membership

The Costco Anywhere Visa Business Card stands out for its gas rewards rate, which is among the highest available for business cards. For businesses that consistently spend on fuel and can maximize the rewards cap, it delivers strong value with minimal effort.

Where this card shines is straightforward rewards. Gas purchases earn a high percentage back, and the card is accepted broadly, which makes it easy to use across locations. It can also be a good fit for teams that mix fuel spending with travel or dining, since those categories earn elevated rewards as well.

Why it wins for rewards: Few business cards match this card’s gas rewards rate without charging an annual fee. For Costco members who already pay for a membership, the return on fuel spend can be substantial.

That said, the tradeoffs matter. Rewards are issued once per year as a certificate that can only be redeemed at Costco, which limits flexibility. The card also lacks the spending controls, reporting, and automation features that finance teams often need as they grow.

Ideal for: Costco members with high fuel spend who want simple, high rewards and don’t need advanced controls or frequent reward redemption.

U.S. Bank Business Triple Cash Rewards World Elite Mastercard®

- High cashback rates in practical business categories

- Includes an annual SaaS credit

- Long 0% intro APR period

- High APR after the intro period

- Limited elevated cashback categories

Best for businesses with mixed spending across fuel, office, and everyday expenses

The U.S. Bank Business Triple Cash Rewards card works well for businesses that want to earn solid rewards on fuel without committing to a fuel-only or fleet-specific card. It’s a practical option if gas is one of several major expense categories rather than the primary one.

The strength of this card is balance. It rewards fuel purchases while also covering common operational costs like office supplies and dining, which makes it easier to earn consistently across day-to-day spending. That simplicity can be appealing for businesses that don’t want to juggle multiple cards for different categories.

Why it wins for flexible rewards: This card turns multiple core business expenses into predictable returns, not just fuel. For businesses with diversified spend, that flexibility often matters more than maximizing a single category.

The tradeoff is control. Compared with cards built specifically for fuel oversight, this option offers fewer spending restrictions, reporting tools, and automation features. It’s best suited for teams that value straightforward rewards over detailed tracking.

Ideal for: Businesses with steady fuel spend alongside office, dining, or service expenses that want a single, easy-to-manage rewards card.

Bank of America Business Advantage Customized Cash Rewards Credit Card

- Customizable cashback categories

- Introductory 0% APR on purchases

- No annual fee

- Cashback categories capped at $50,000 annually

- 3% foreign transaction fee

Best for businesses with changing or seasonal spending patterns

The Bank of America Business Advantage Customized Cash Rewards card is a good fit for businesses whose expenses shift throughout the year. Instead of locking you into a single rewards structure, it lets you choose which category earns the highest return, including gas.

That flexibility is the main appeal. If fuel is a priority some months and other categories matter more at different times, this card adapts without requiring you to open multiple accounts. For businesses that are still dialing in their spending patterns, that can be more useful than a rigid rewards structure.

Why it wins for customization: The ability to change your highest-earning category gives you control over how rewards are earned as your business evolves. It’s especially useful for seasonal operations or businesses experimenting with different cost structures.

The downside is that rewards are capped, and the card doesn’t include the fuel-specific controls or reporting features found in dedicated gas or fleet cards. It’s best used as a flexible rewards tool rather than a primary fuel-management solution.

Ideal for: Seasonal businesses or companies with fluctuating expenses that want customizable rewards without committing to a fuel-only card.

Chase Ink Business Cash Credit Card

- High cashback rates in key categories

- Generous $750 welcome bonus

- No annual fee

- Spending caps on elevated cashback categories

- 3% foreign transaction fee

Best for office-focused businesses that also need gas rewards

The Chase Ink Business Cash Credit Card is a strong option for businesses that spend heavily on office supplies, internet, cable, and phone services, but still want to earn rewards on fuel purchases.

The card’s value comes from how well its bonus categories align with common operating expenses. While gas earns a solid return, it’s not the headline feature. Instead, this card works best when fuel is part of a broader mix of spending that includes office and utility costs.

Why it wins for everyday business expenses: Chase Ink Business Cash turns routine operational spending into meaningful rewards, which can add up quickly for businesses with ongoing office and service expenses.

The limitation is flexibility. Bonus categories are capped, and the card doesn’t offer the fuel-specific controls or reporting tools that dedicated gas or fleet cards provide. It’s best used as a general-purpose rewards card rather than a fuel-management tool.

Ideal for: Businesses with significant office and utility spending that want a simple rewards structure and don’t need advanced fuel controls.

Shell Small Business Card

- No annual fee

- Flexible fuel savings structure

- Detailed fuel tracking and management tools

- Fuel discounts limited to Shell stations

- Higher savings require large fuel purchases

Best for businesses that consistently fuel at Shell stations and want predictable per-gallon savings

The Shell Small Business Card is a practical choice for businesses with routes or operations that regularly pass Shell locations. Instead of traditional rewards, it offers straightforward per-gallon discounts that can add up quickly for high-volume fuel users.

The appeal here is simplicity. Businesses that purchase large amounts of fuel at Shell stations can reduce costs without tracking categories or redeeming rewards. The card also includes basic spending limits and reporting tools, which provide more oversight than reimbursing employees for fuel purchases.

Why it wins for fuel savings at Shell: For businesses that can concentrate their fueling at Shell stations, the per-gallon discount model delivers consistent, easy-to-understand savings without the complexity of points or cashback programs.

The tradeoff is flexibility. Discounts apply only at Shell locations, which makes this card less suitable for businesses with unpredictable routes or teams that fuel across multiple brands.

Ideal for: Businesses with predictable routes near Shell stations, high monthly fuel volume, and a preference for simple, per-gallon savings over flexible rewards.

Marriott Bonvoy Business American Express Card

- High points rate for gas and travel-related expenses

- Free Night Award and Elite Night Credits annually

- No foreign transaction fees

- $125 annual fee

- Points-based rewards require redemption through Marriott Bonvoy

Best for travel-heavy teams that want to earn hotel rewards on fuel and business spend

The Marriott Bonvoy Business American Express Card is best suited for businesses that travel frequently and prefer hotel rewards over straightforward cash back. While it earns points on gas purchases, fuel rewards are a secondary benefit rather than the primary reason to carry the card.

Where this card stands out is in long-term travel value. Businesses that stay at Marriott properties regularly can combine points earned from fuel, dining, and other expenses with hotel benefits like elite status and free night awards. For the right user, those perks can outweigh simple cash back.

Why it wins for travel value: This card turns everyday business spending, including fuel, into hotel rewards that are most valuable when redeemed for Marriott stays. For teams already loyal to the brand, the benefits compound quickly.

The limitation is flexibility. Rewards are points-based, not cash, and the card carries an annual fee. It also lacks fuel-specific controls, reporting, or automation, making it a poor fit for businesses looking to actively manage fuel spend.

Ideal for: Businesses with frequent Marriott stays that want to earn hotel rewards on fuel and travel-related expenses, and that can justify an annual fee through ongoing travel benefits.

WEX Fleet FlexCard

- Broad acceptance at U.S. gas stations

- Supports business credit building

- Flexible payment options

- Discount rate depends on the fuel provider

- Extended payment terms incur additional fees

Best for fleet operators that need strict fuel controls and broad station acceptance

The WEX Fleet FlexCard is designed for businesses that manage multiple vehicles and want detailed oversight of fuel spending. Rather than focusing on traditional rewards, it prioritizes control, security, and reporting across drivers and locations.

The card is accepted at most major gas stations, which makes it easier to support fleets with varied routes. Features like driver IDs, purchase restrictions, and transaction-level reporting help businesses monitor fuel usage closely and reduce misuse. For companies that need vehicle-level visibility, this kind of oversight is often more valuable than earning cash back.

Why it wins for fleet management: WEX offers some of the strongest fuel controls available, making it easier to enforce policies and track fuel spending by driver or vehicle. That level of detail is especially useful for businesses with larger or distributed fleets.

The tradeoff is rewards flexibility. Discounts can vary by fuel provider, and the card doesn’t offer cash back across non-fuel categories. It’s best used as a dedicated fleet tool rather than a general-purpose business card.

Ideal for: Businesses with multiple vehicles or drivers that need strict fuel controls, wide station acceptance, and detailed reporting instead of rewards-based incentives.

How to start applying for a business gas card

Once you’ve identified the card that fits your fuel needs, oversight requirements, and budget, the next step is applying. While requirements vary by issuer, the process is generally straightforward.

Check eligibility

Most business gas cards require a valid EIN and basic business information. Some issuers run a personal credit check or require a personal guarantee, while others evaluate business financials such as cash flow or bank balances instead.

Complete the application

Applications are typically completed online. You’ll be asked for your legal business name, EIN, contact information, and business bank account details. Some providers may also request ownership or entity information.

Get approved and set up controls

If approved, activate your card and configure spending limits, purchase categories, and employee cards as needed. If your provider supports it, connect accounting software or expense tools to automate tracking from day one.

Start using your card

Begin fueling and monitoring expenses. Many gas and fleet cards offer real-time transaction alerts, receipt capture, and fuel-only controls, which are especially useful for teams with multiple vehicles or drivers.

Are there any easy-approval business gas cards available?

Yes. Some types of business gas cards are easier to qualify for than traditional business credit cards, especially for newer businesses or those with limited credit history. The tradeoff is usually fewer rewards or more limited features.

Here are the most common easy-approval options and when they make sense.

Prepaid fuel cards

Prepaid gas cards don’t require a credit check because you load funds onto the card in advance. They’re useful for businesses that want basic spend control without taking on credit risk. However, prepaid cards typically don’t offer rewards or help build business credit, and acceptance may be limited to specific fuel networks.

Secured business credit cards

Secured cards require a cash deposit and are designed to help build or rebuild credit. Some secured business cards offer modest rewards on gas purchases, but they’re better suited for long-term credit building than for maximizing fuel savings or managing fleets.

Business cards with alternative underwriting

Some business gas cards evaluate factors like cash flow or bank balances instead of relying on personal credit. These options can work well for incorporated businesses with steady finances but limited credit history. For example, the Ramp Business Credit Card evaluates business financials rather than personal credit scores and does not require a personal guarantee.

Cut fuel costs and take control with the right business gas card

Most businesses don’t overspend on gas because they’re fueling too often. They overspend because:

- They lack visibility into who’s buying what, where, and when

- They can’t enforce policies or set limits in real time

- Reconciling receipts is messy and time-consuming

- They’re using a rewards card built for consumers, not companies

These aren’t credit card problems, but operational ones. And the right gas card should solve them.

That’s why Ramp designed its business credit card around control, not just cashback. With tools like built-in spend controls, real-time alerts, receipt matching, and automated reporting, Ramp helps finance teams take back control without adding admin work.

There are plenty of cards that reward you for spending. Ramp helps you spend less in the first place and know exactly where every dollar went.

Get started with a Ramp Business Credit Card.

*Information about each card has not been confirmed by the providers mentioned. Details may change as providers update their terms and conditions.

FAQs

The best gas card depends on your specific needs. If you manage a fleet and need fuel controls, the Ramp Business Credit Card or WEX Fleet FlexCard are strong options. For cash-back rewards across multiple categories, the U.S. Bank Business Triple Cash or Costco Anywhere Visa can offer more value.

If fuel makes up a large portion of your expenses, a gas-specific card provides better discounts and oversight. For mixed spending, a general business card with gas rewards may be the better fit.

Most do. Cards from major issuers (Chase, Bank of America, Citi) report to business credit bureaus. Fleet-specific cards like WEX and Ramp also report business payment history. Avoid prepaid cards if credit building is important.

Many business gas cards allow you to apply using just your EIN. However, depending on the card issuer, some may still ask for your Social Security number or personal credit information for verification or guarantee purposes.

Most business gas cards allow you to restrict spending by merchant type, so you can limit usage to fuel only. Some also allow transaction limits or controls by time and location.

While it’s technically allowed, mixing personal and business expenses can complicate bookkeeping and tax reporting. It’s best to keep purchases separate to simplify accounting and ensure that fuel expenses remain fully deductible for business purposes.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°