- New capabilities for effortless expense management

- Frictionless software that automates expense management for you

- Unlock more time for growth in 2025

We recently crunched the numbers and found that the average 200-person company now spends over 330 hours per year processing expense reports. Managing expenses and other everyday financial processes have long been a source of wasted time and money. And with the cost of goods and labor on the rise and finance talent in short supply, finance leaders must look for ways to streamline their operations in 2025.

Ramp helps customers recoup these hours by making expense reporting unbelievably efficient for every single employee. Today, we’re rolling out new expense intelligence to help admins catch out-of-policy spend better than humans can, smart transaction routing and review experience to help employees and managers save time on the go, and enterprise-grade integrations for Microsoft and ADP Workforce Now® to make expenses even easier to manage.

New capabilities for effortless expense management

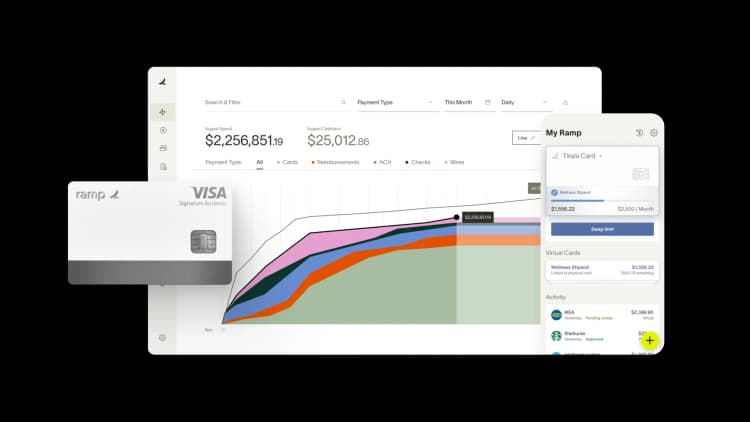

Traditional corporate cards and expense management tools force you to audit spend after transactions take place and burden employees with paperwork. Through combining corporate cards and expense management into a single platform, however, Ramp allows finance teams to set controls that activate before employees spend, which ultimately helps businesses spend smarter—all while eliminating expense reports to save time for employees. Here’s what we’ve built recently to help you save even more:

Get expenses done faster in Microsoft Teams

Ramp is now available where hundreds of millions of people love to work: Microsoft Teams. No more toggling between systems—employees on Microsoft 365 can submit receipts right within Teams while managers and admins can review new spend requests and transactions.

And because Ramp is an early partner building on Teams Copilot for Microsoft 365, admins and employees can use natural language in Teams to ask questions about spending policies and have Copilot complete a wide range of smart actions on Ramp, from analyzing spending patterns (e.g., “how much has Sales spent on T&E this month?”), to setting spend controls (e.g., “limit Uber transactions to < $150 per trip”), creating real-time alerts (e.g., “notify me if a transaction is > $1000”) and much more. Learn more

“We’re pleased to work with Ramp to unlock even more value for these businesses through intelligent financial automation.” - Srini Raghavan, Vice President of PM, Microsoft Teams Ecosystem

Catch out-of-policy expenses better than humans can

Some prohibited spending is simply impossible for a finance admin to catch, like out-of-policy charges buried at the bottom of line-item receipts. Finance teams used to only catch other common issues—like excessive tipping, weekend transactions, and unapproved alcohol purchases—if they scrutinized expense reports line by line. With Ramp, finance teams can designate these scenarios and more as out-of-policy, and let our expense intelligence automatically flag them.

Easily keep employee data in sync with our new ADP® integration

Our new integration with leading HR and payroll provider ADP Workforce Now® helps admins on ADP simplify how they onboard new employees, bulk-issue benefits, and spin up new corporate cards. ADP clients can find Ramp on ADP Marketplace for a simpler way of managing all payroll and non-payroll spend, without having to coordinate between tens of different solutions, manually add new employees to disparate systems, and track individual expenses and reimbursements.1

Set up controls for every dollar & let Ramp automatically apply the right ones

Admins can confidently issue spend programs and cards with custom controls, knowing Ramp will route transactions to the right limit. Employees need only swipe with their single credit card, and the transaction will be approved or declined depending on available spend limits and their parameters. No more digging through Ramp for the right one.

Easily review transactions with our mobile app

Ramp’s mobile app supports expense review to help busy admins and managers monitor their team’s reimbursements, spend requests, and transactions while on the go. Managers can even lock cards for non-compliant employees.

Frictionless software that automates expense management for you

Our new capabilities combined with all the finance automation that we’ve built since day one unlock an entirely new approach to expense management—one where finance teams can simultaneously control spend before it happens and allow employees to do their job without expense reporting slowing them down. Let’s break it down.

Unlock more time for growth in 2025

The data shows our first-principles approach to expense management is working. Today, over 30,000 customers save 5% of their spend on average as a result of switching to Ramp’s corporate cards with built-in expense controls, software pricing insights, and direct accounting integrations.2

From local businesses like Smart City Apartment Locating to software platforms like TaskHuman and Shopify, companies are breaking free of the old mindset where finance teams controlled spending with reactive reimbursements and cards distributed to a select few. A new generation of finance teams controls spending in real time by counterintuitively issuing software-powered corporate cards to every employee, automating expense reporting at the same time.

After all, the best use of time for you and your employees in the new year is to find pathways for growth. With the ability to “set and forget” expense management, you can focus your energy analyzing the impact of that spend and working hand-in-hand with employees to scale the business.

Want to experience this kind of frictionless finance? Sign up for Ramp today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°