Gross working capital vs. net working capital: what's the difference?

- Working capital definition

- Net working capital

- How to calculate your net working capital

- Examples of net working capital

- 5 tips to increase net working capital

- Obtain and put your working capital to work with Ramp

Working capital is the fuel you need to grow your business, but its effects on operations aren't always understood.

The solution is to understand the difference between gross working capital vs. net working capital. While these terms may sound similar, only one is truly useful in a business context.

Working capital definition

Working capital, also known as gross working capital, is a financial metric that represents the operating liquidity available to a business. It's a measure of a company's short-term financial health and its ability to cover its short-term obligations.

The formula used to calculate working capital is:

Working Capital = Current Assets − Current Liabilities

Working capital only considers the value of your business's current assets. We feel this can be misleading as it doesn’t pay attention at all to what your business owes in the short term. In contrast, net working capital considers both current assets and current liabilities in its calculation, which gives a more complete picture of your business's short-term health.

To further illustrate the difference, let’s say your business has $750,0000 of cash in the bank and has bills due that are worth $800,000.

If your business was just looking at gross working capital, you'd only look at your assets and see that you have a positive gross working capital of $750,000. Based on that, you may think everything is great because there’s a bunch of cash in the bank.

But, if you considered net working capital instead, you’d look at your cash compared to what you owed. In this case, you’d have a real reason to worry since you'd owe more than you have in the bank.

Because we don’t feel that gross working capital is helpful at all, the rest of this article will discuss net working capital in more detail.

Net working capital

Net working capital (NWC) represents the difference between current assets (such as cash, inventory, and accounts receivable) and current liabilities (such as accounts payable and short-term debt). In simple terms, net working capital represents the funds available for day-to-day operations. Effective working capital management drives revenue growth, cash flow, customer service and shareholder value.

Examples of current assets included in your net working capital ratio:

- Cash

- Inventory

- Prepaid expenses

- Marketable securities

- Accounts receivable (AR)

Current assets are assets that can be converted to cash within the year. These are your cash inflows.

Examples of current liabilities included in your net working capital ratio:

- Short-term debt

- Accounts payable (AP)

- Accrued expenses

- Deferred revenue

Current liabilities are liabilities that are due within the year. These are your cash outflows. You can find both your current assets and current liabilities on your balance sheet.

Sales, costs, and, therefore, profits don’t always coincide with your cash inflows and cash outflows, which is why understanding working capital is so important.

Having enough net working capital means having the ability to pay bills, understanding when to seize opportunities to grow, and having enough of a buffer or contingency fund to keep your business running.

How to calculate your net working capital

Working capital management is a balancing act between controlling expenses and optimizing revenue collection. You can calculate net working capital using this formula:

Net working capital = current assets – current liabilities

A useful measure of this balancing act is your working capital ratio. Also called the current ratio, you can calculate a more practical version of your working capital using this formula:

Working capital ratio = current assets/current liabilities

This metric gives business owners a snapshot into their company's liquidity and its ability to meet short-term financial obligations. A positive working capital ratio indicates that a company has enough resources to cover its short-term expenses, while a negative working capital may signal potential cash flow issues.

Generally, it’s recommended that you aim for a working capital ratio of 1.5 to 2.0. Anything higher than a 2.0 suggests you aren’t optimizing your ROI on assets and revenue. Anything less than 1.5 is a red flag that you may not be able to pay your short-term payables and payroll.

What are the limitations of net working capital?

That said, the working capital ratio or current ratio has limitations depending on the context within which it is calculated. For example, if you operate a business with high seasonality, the current ratio might not offer the best picture of your liquidity; often why I might recommend using the cash conversion cycle or even the quick ratio (or acid test) instead. Your quick ratio excludes your inventory from the working capital ratio:

Quick Ratio = (current assets – inventory)/current liabilities

Tip: only include your most collectible AR in the quick ratio. Let’s assume anything over 90 days may not be collectible and could cause you to overestimate cash flow.

Another limitation of NWC is that it counts all inventory in the assets value. If your business holds a lot of inventory (maybe even too much inventory?) then that will inflate your asset value, which increases your NWC value. But if most of your NWC value is from dusty old inventory that you can’t really sell for cash, then you may not be able to pay your bills or cover payroll despite a positive NWC. This is why your quick ratio may paint a more accurate picture for lenders or management.

Examples of net working capital

Can you have a negative working capital but still be financially healthy?

The relevance of NWC may depend on your business model and your cash conversion cycle (CCC). This is where the context within which you calculate your NWC becomes important. There are cases where a business might have a negative working capital but is, in fact, financially healthy.

For example, an eCommerce company that makes a sale online and gets payment upfront (i.e., cash upfront), never has accounts receivable and generates a lot of cash. Having a fast CCC like this is your best-case scenario. Now, if this company decides to distribute cash to owners as well, they may experience a scenario where their current assets are low, but they may still have AP on a 30-day term. This can make their NWC look negative but because they’re receiving cash right away, their business will be able to generate more cash before their bills are due.

This is often the case with grocery stores and restaurants as well. In both examples, they get paid in cash at the time of sale, but they typically get about 30 days to pay their suppliers, and they pay their payroll every two weeks in arrears.

Here's another example with a client of ours. Back in 2018, one of our clients was carrying a lot of long-term debt from many prior years of losing money. Around this time, they shifted their model from selling via wholesalers to selling direct to customers via ecommerce. This allowed our client to collect 100% of the cash upfront when the sale was made, even before they fulfilled their orders. And because they had 30-day terms with their suppliers, we changed their payment priority to use the cash they had on hand to pay off long-term loans before paying their current outstanding bills. We could do this knowing their cash conversion cycle (CCC) was fast enough to generate more cash before the terms came due on their short-term debt.

Does a positive net working capital always mean you’re in good financial standing?

In most cases, you would assume a positive working capital is a good thing. That’s not always the case.

Because people often pay their lawyers last, law firms frequently have large outstanding accounts receivable. This inflates their current assets but the equally large salaries they pay their team does not show up in liabilities. So even though a law firm may have a positive working capital, in this case all it indicates is that they are doing a terrible job of collecting invoices.

Additionally, as mentioned earlier, a positive net working capital that’s a result of just holding onto old and dusty inventory is another scenario where the company isn’t in good financial standing.

5 tips to increase net working capital

To increase your net working capital, focus on what you can do to increase your current assets and reduce current liabilities. Both or either will help:

- Increasing sales to new customers to reduce the negative effect of churn.

- Replace short-term debt with long-term debt so you can defer your debt payments until the business generates more cash.

- Optimize production to avoid idle employees and equipment, which increases your manufacturing throughput and builds up inventory for your fastest turning items.

- Lower monthly expenses to increase cash balances and lower payables.

- Shorten your billing/cash conversion cycle: collect a larger upfront free or do more progress-billing rather than just invoicing in arrears after all the project work is completed.

So, as seen in the tips above, there are many benefits to improve your net working capital, using it as your sole measure of liquidity is not recommended for many business models due to its limitations. Instead, I recommend NWC as one tool in your financial arsenal and tracking it compared to a baseline to measure how you are improving (hopefully) over time.

Obtain and put your working capital to work with Ramp

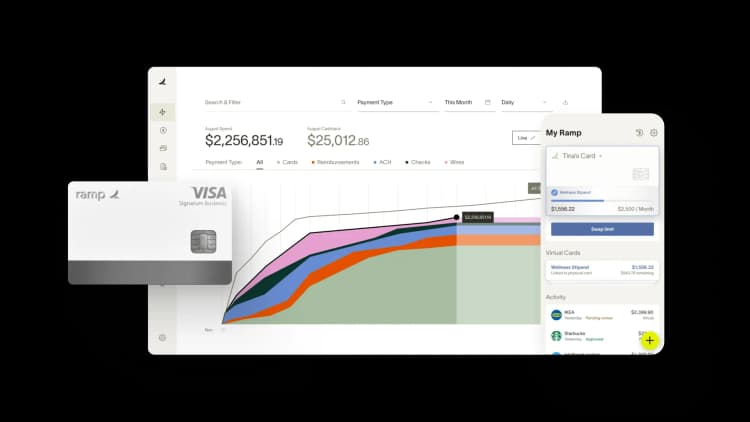

Unlock the full potential of your business finances with Ramp's working capital solutions. Experience the freedom of paying vendors later and keeping vital cash on hand, fueling your business growth where it matters most.

- Effortless cash flow management: Manage your cash flow in seconds, not hours. With Ramp, you get transparency and simplicity, knowing exactly what you'll pay upfront. Plus, benefit from our prorated fees if you choose to pay early.

- Set up in a flash: Forget tedious paperwork and long waits. Ramp offers quick, hassle-free financing when you need it the most, ensuring you're always ready for business opportunities.

- Flexible payment options: Pay your vendors your way. Whether it’s by check, ACH, or international wire, Ramp Flex adapts to your needs.

- Enhanced capital efficiency: Say goodbye to lengthy conversion cycles. Free up your cash with Ramp Flex, and invest it back into growing your business at a faster pace.

Time is money. Save both. Read more about Ramp's flexible financing.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits