E-commerce financing: how online businesses can fuel growth with working capital

- What is e-commerce financing? + the unique challenges it presents

- How does e-commerce financing work?

- 4 reasons why e-commerce companies may seek funding

- 5 long-term funding options for e-commerce companies

- A simpler alternative from Ramp: commerce-based sales underwriting

There are likely over one million e-commerce businesses in the United States alone. And this is just an estimate because the exact number is hard to pinpoint since it fluctuates so often. Even so, with those numbers, you’d think that banks would be lining up to offer business loans and credit cards to e-commerce businesses but unfortunately that’s not the case. Many new e-commerce businesses struggle to take off and maintain a steady stream of revenue since it's difficult for them to access traditional funding.

So when it comes time to look for outside working capital, e-commerce businesses need to get creative. In this article, we're going to outline some of the most popular funding options for e-commerce specifically, the challenges with those options, and what exactly you can fund with this working capital.

What is e-commerce financing? + the unique challenges it presents

E-commerce financing is a loan, line of credit, or other form of funding intended for online merchants. Funding for an e-commerce business can come in many forms. Like most industries, companies in the e-commerce space need funding to run their operations, purchase inventory, and market their services. Advertising and promotions are costly, particularly in the early stages when the company is trying to get their brand out there.

The disadvantage that e-commerce businesses have when applying for traditional bank loans is that they don’t typically have “hard assets” that can be used as collateral. They also operate with small margins, so most of the incoming revenue goes back out for manufacturing or sourcing. That’s a red flag for traditional banks that want to see actual cash on hand.

Due to the nature of their business models, most e-commerce businesses are forced to seek alternative financing outside of traditional lending institutions. Oftentimes, they look at revenue-based funding and equity financing, both of which come in several forms. Ideally, e-commerce merchants want to use incoming revenue as leverage for those two funding models.

How does e-commerce financing work?

Amazon owns fulfillment centers around the world and has a multi-billion dollar revenue stream. They’re also a public company, so they don’t need to rely on banks to give them funding if they need it. They can simply issue more stock, split the existing stock (which they are doing in June), or launch a new fundraising series to acquire venture funding.

Unfortunately, small e-commerce startups don’t have those options. If revenue hasn’t started coming in yet, their only choice outside of banks is to ask family and friends for help. If they do seek a loan from the bank, their personal credit score needs to be good, and they need to show that the business is likely to turn a profit. That’s not easy in an ultra-competitive space.

Another financing solution that newer e-commerce businesses lean heavily on is business credit cards. Merchandise to sell on their website can be purchased or financed using a business credit card, buying the company at least thirty days to post, market, and sell those items. Growth will be limited by the purchase power of the card, but it can be a good way to get things rolling. To get the highest limits possible, e-commerce businesses should look for cards that do commerce sales-based underwriting.

Other financing options for e-commerce sellers require the use of equity or future revenue in return for immediate financing. Private companies that don’t have a public market value should use their 409a valuation as a guideline for any equity deals.

4 reasons why e-commerce companies may seek funding

When it comes to financing, whether business or personal, there’s a difference between wants and needs. Don’t make the mistake of confusing the two. If the business is failing, funding might not be the right answer. You want to save it, but is that realistic? Consider the following situations as reasons to think about seeking financing:

1. Planning accelerated growth

Accelerated growth can happen for any number of reasons. The “planned” variety usually occurs when you discover that your marketing and sales process works and can be scaled. That’s a good time to seek out equity investment funding. You’ll dilute your equity to get it, but the growth should more than make up for that.

2. Peak season is nearing

Peak season is when your sales numbers are at their highest, so there’s a need for additional inventory. This is not sustained growth, though you might pick up a few new repeat customers. Plan for a spike followed by a return to normal. Programmatic funding is the best option for this scenario. A line of credit from the bank would work well also.

3. Planning business expansion

Business expansion is defined as adding more employees or opening another facility. If you’re buying real estate, go through the bank and take out a mortgage. They may have equipment financing also. An expansion of the workforce, if you’re doing it for the right reasons, should lead to higher sales volume. Revenue-based financing could be the right choice for that.

4. Launching a new product line

Launching a new product line is not the same as expanding the business. There’s no certainty on whether the product will sell, no matter what your market research tells you. Online consumers are unpredictable and trends can end without notice. Use a safer alternative funding option for product launches such as programmatic funding.

5 long-term funding options for e-commerce companies

A loan can provide you enough money to build your e-commerce platform and buy your first round of inventory. A business credit card could help you pay day-to-day expenses or serve as a working capital source until steady revenue comes in. But to truly grow, it’s likely that you’ll need more.

Loans and credit cards are classified as “debt financing.” Alternatives to debt include equity investments, programmatic funding, revenue-based funding, invoice/purchase order financing, and cash floats (aka merchant cash advances). Let’s dive into each of these options:

1. Equity investments

The term “equity investment” describes the acquisition of funds in exchange for equity in your company instead of direct repayment. Equity investors can be private parties, venture fund companies, or angel investors. This type of financing is typically done for the first time in the pre-seed or seed rounds of a company’s development. It can also be used in growth rounds to fuel expansion.

Equity investments fall into the category of “dilutive funds” because the shares of the existing owners of the company are reduced in value by the issuance of new stock to the investors. That’s an important concept to keep in mind. Too much dilution can lead to ownership losing control of their company. In short, use this funding method sparingly and only take what you need.

2. Programmatic funding

Programmatic funding can come from a venture fund, but it’s non-dilutive and doesn’t require the issuance of new shares to the investor. Programmatic funding works like a hybrid line of credit. You can draw funds when you need them and pay a flat fee, not an interest rate or an equity exchange. This gives the company greater flexibility.

Another way to look at this from an e-commerce perspective is that programmatic funding provides bandwidth for product launches and expansion. These actions each classify as a “program” where you’ll need a set amount of money to get off the ground.

3. Revenue-based funding

A seed-round of equity investing can get you started and programmatic funding could be helpful for product launches and one-time expansions. Fueling real growth is typically done with revenue-based funding. It should come as no surprise that e-commerce merchants have better leverage and more funding options once the money starts rolling in.

Revenue streams are what separates good ideas from functioning businesses. Traditional banks are more open to loans and lines of credit. Alternative lenders no longer look at the owner’s credit score in their approval criteria. Showing steady revenue over multiple reporting periods opens doors that were closed when you were just getting started.

4. Invoice/purchase order financing (or factoring)

Factoring is similar to recurring revenue loans, but it’s more of a transfer of revenue than simply using cashflow to prove creditworthiness. With invoice-based or purchase order financing, the company agrees to surrender future revenue from outstanding accounts receivables in exchange for a percentage of that revenue now.

This type of financing can be expensive. Factors take a percentage of the outstanding invoices as their fee. That percentage is based on risk, so if your company is assigned a higher risk score, you’ll pay a higher fee. You’ll also be trading future cash flow for cash in-hand today. That could disrupt the flow of your bookkeeping and accounting departments, so make sure you have a good handle on your e-commerce cash flow before you elect for this type of business funding.

5. Cash float (Merchant cash advances)

Credit card payments don’t show up in a merchant’s bank account right away. They typically take anywhere from one to three days to process. That “gap” can be troublesome when e-commerce companies have big sales days and need to order new inventory. Cash floats, aka merchant cash advances, are a way to get around that.

Cash floats are borrowing money that you already have coming to you but there’s a fee attached to doing that. E-commerce business owners should ask whether they truly need the money now before initiating this action. If so, a short-term loan or line of credit from the bank is more cost-effective. You could also use a business credit card if the amounts are small enough.

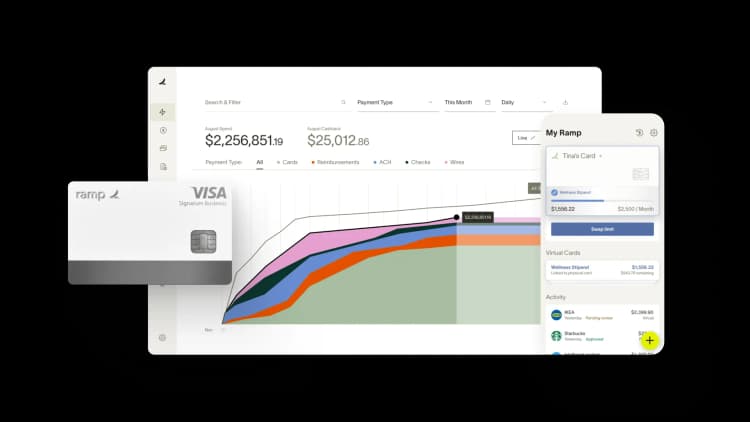

A simpler alternative from Ramp: commerce-based sales underwriting

For many businesses, but particularly e-commerce businesses, acquiring funding to pay for essential business expenses can be difficult. This is mostly due to very stringent approval requirements that include minimum bank balances and years of audited financials to be considered for funding.

Now, with our commerce sales-based underwriting, businesses can unlock credit limits higher tha n traditional corporate cards thanks to streaming sales data from platforms such as Stripe, Shopify, and Amazon Business. Together with our finance automation tools that give you total control over your expense management, vendor contracts, bill payments, and more, you can access the capital you need now and manage it better.

Visit Ramp.com to learn more.

FAQs

E-commerce financing is any funding that is used to build, operate, or expand an e-commerce business. Examples of e-commerce financing include traditional loans and lines of credit, equity financing, programmatic funding, revenue-based funding, factoring, and cash floats.

The primary benefit to using e-commerce funding is that it can accelerate growth. It’s also a good way to start a company without having to use your own money.

There are risks with each type of e-commerce financing. Equity funding could lead to excessive dilution of ownership shares. Loans and lines of credit, along with business credit cards, accumulate debt. Revenue-based funding and cash floats are expensive.

The most common way to finance an e-commerce business is to use a revenue-based funding approach, but you may need a loan or some equity funding to get started.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits