- How long do wire transfers take?

- How long do domestic wire transfers take?

- How long do international wire transfers take?

- Factors that cause delay in either transfer

- Tracking and managing wire transfers

- Key takeaways

- Easily send wire transfers—or other payments—with Ramp

Domestic wire transfers typically complete within the same day or one business day. International wire transfers take longer, usually 1–5 business days. These timelines vary based on factors like banking networks, regulations, currency exchange, and how many banks are involved in the process.

This guide explains how long different wire transfers take, what affects their processing speed, and how you can track your transfers and handle any delays.

How long do wire transfers take?

Wire transfer timing depends on where you're sending money. For transfers within the United States, most complete the same business day or by the next business day. These move quickly because of established national networks and standard procedures, especially when you send them before the bank's daily cutoff time (usually between 2pm and 5pm local time).

International wire transfers are slower, typically taking 1–5 business days. Some countries may need even more time. International wires take longer because they move through global banking networks, often passing through multiple banks and compliance checks in different countries.

How long do domestic wire transfers take?

Domestic wire transfers move quickly through the U.S. banking system. Systems like Fedwire and CHIPS (Clearing House Interbank Payments System) connect banks and credit unions across the country, making transfers efficient.

Most domestic wires complete on the same business day if you send them before the bank's cutoff time, typically between 2pm and 5pm local time, though some go as late as 11pm. If you send a transfer after the cutoff, or on weekends or holidays, processing starts on the next business day.

Several factors affect domestic wire timing such as:

- Cutoff times at both banks: Each bank sets its own daily deadline for processing wires. Missing this window means the transfer processes the next business day. Most cutoffs fall between early afternoon and 5pm local time.

- How your bank processes wires: Some banks use automated systems that work quickly, while others rely on manual reviews that take longer

- Federal Reserve hours: The Fedwire system, which handles many domestic wires, only operates from 9am to 7pm Eastern Time on business days. Wires can only move during these hours.

Banks must make wire funds available by the next business day after deposit. This prevents them from holding onto your money longer than necessary.

You'll likely use domestic wire transfers when you need to make urgent payments, like paying vendors who need immediate payment or funding payroll on tight deadlines. They're ideal when timing matters.

How long do international wire transfers take?

International wire transfers move through complex global banking networks that connect banks in different countries and time zones. Each step requires coordination and compliance checks.

Most international wires take 1–5 business days, though transfers to some regions can take longer. Sending money to countries with close banking ties to the U.S.—like Canada, Western Europe, or Japan—is typically faster. Transfers to developing countries or those with strict currency controls may need extra time.

Here's what affects international wire speed:

- Currency conversion: When money crosses currency lines, banks need to convert the funds at current market rates. This adds time, from several hours to a full business day, depending on the currencies involved.

- Time zone differences: Banks only process wires during their local business hours. If you send a wire from New York to Tokyo late in the U.S. day, it might not process until the next day in Japan.

- Intermediary banks: International wires often pass through one or more middleman banks. Each adds processing steps and potential delays.

- Compliance checks: International transactions undergo strict anti-money laundering, sanctions, and fraud checks. These reviews can add time, especially for larger transfers or those to higher-risk regions.

The SWIFT (Society for Worldwide Interbank Financial Communications) network serves as the main communication system for international wire instructions. SWIFT doesn't move money itself—it sends secure payment messages between banks. Each bank in the chain must process the payment, which can add hours or days to the total time.

You'll use international wires when paying overseas suppliers or making cross-border investments where timing and payment records matter.

Factors that cause delay in either transfer

Despite standard timelines, both domestic and international wires can face unexpected delays for various reasons.

Common reasons for wire transfer delays include:

- Bank review and authorization: Many banks manually review wires, especially for large amounts or new recipients. Staff workload can add hours or even days, with high-value wires often requiring extra verification.

- Incorrect recipient details: Errors in account numbers, routing numbers, SWIFT codes, or names can cause rejection or delay. Even small mistakes can make a transfer bounce back or trigger time-consuming manual reviews.

- Bank holidays and weekends: Wires only process on business days. Transfers sent before weekends or holidays will wait in queue until banks reopen. International wires are especially affected by holidays in different countries.

- Intermediary banks: Each middleman bank adds its own processing time. Domestic wires may involve one intermediary; international wires often pass through two or more. Problems at any bank in the chain can slow things down.

- Verification processes: Banks must follow regulations to prevent wire fraud and money laundering. Unusual amounts, new recipients, or anything that triggers security flags may require extra checks, creating delays.

To minimize wire transfer delays:

- Plan ahead for international transfers; allow at least 3–5 business days for important payments

- Double-check all recipient details before submitting your transfer

- Schedule important wires early in the business day and well before the bank's cutoff time

Tracking and managing wire transfers

Tracking your wire transfers helps ensure your money arrives as expected and lets you quickly spot and fix any issues. It provides better visibility into cash flow and helps you address problems promptly.

For domestic wires, banks issue unique IMAD (Input Message Accountability Data) and OMAD (Output Message Accountability Data) numbers. IMADs are assigned when you send the transfer, and OMADs when the receiving bank accepts the funds. These references help customer service teams trace your wire through the Federal Reserve system.

International wires use the SWIFT network's tracking features. Each transfer has a unique transaction reference number (UTRN) that follows it throughout the process. The MT103 message provides proof that the payment instruction was received. For even better visibility, SWIFT gpi (Global Payments Innovation) offers near real-time tracking across participating banks, so you can see exactly where your wire is at any time.

If a wire transfer is delayed, try these troubleshooting steps:

- Contact both banks: Ask the bank to trace the transfer using the reference numbers. Both your bank and the recipient's bank can check the status and see where the transfer might be stuck.

- Check with intermediary banks: For slow international wires, have your bank reach out to any middleman banks. Sometimes these intermediaries hold funds for compliance checks without telling the sender.

- Verify the details: Double-check all recipient information. Even small errors can cause delays, and fixing them may require canceling and resubmitting the transfer.

For effective wire tracking and management:

- Start a trace as soon as your wire exceeds the expected timeframe

- Keep complete records of all transfer details and reference numbers

- Build relationships with your bank's wire department contacts to solve issues faster

Key takeaways

Criteria | Domestic wire transfers | International wire transfers |

|---|---|---|

Typical processing time | Same day to next business day | 1–5 business days |

Key influencing factors | Cutoff times, Federal Reserve hours, bank processing systems | Currency conversion, time zones, intermediary banks, compliance requirements |

Common delay reasons | After-hours submission, bank holidays, information errors | Regulatory reviews, multiple intermediaries, currency controls, verification processes |

Tracking methods | IMAD/OMAD reference numbers, bank portal tracking | SWIFT tracking, MT103 receipts, SWIFT gpi, transaction reference numbers |

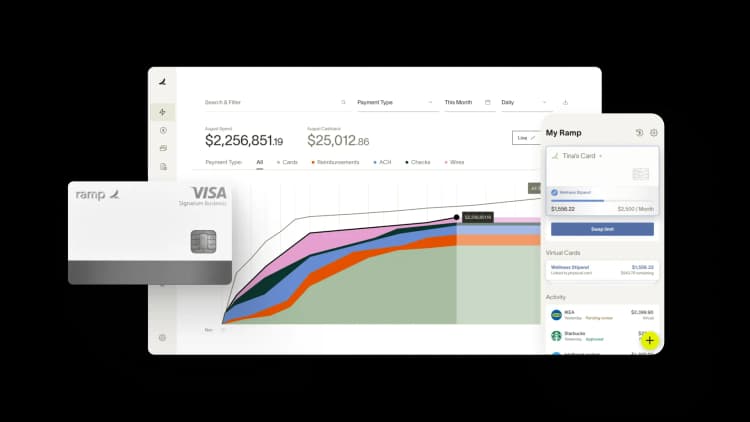

Easily send wire transfers—or other payments—with Ramp

Wire transfers play a strategic role in business payments. While more expensive than some other methods, wire transfers are ideal for one-time, high-value, or time-sensitive transactions where speed and certainty matter most.

With Ramp Bill Pay, you don’t have to choose just one payment method. Ramp supports a wide range of payment types to help your business move money exactly how—and when—you need to:

- Domestic wire transfers: Great for large, time-sensitive payments. Ramp enables same-day domestic wires for eligible transactions, with secure processing through the Fedwire network.

- International wire transfers: Ramp supports payments to vendors abroad in U.S. dollars or payments to international vendors in their local currency

- ACH (direct deposit): Ideal for payroll, recurring vendor payments, and predictable disbursements. Ramp supports both regular and same-day ACH for faster delivery on eligible bills.

- Check payments: For US-based vendors who still prefer checks, Ramp can issue and mail checks on your behalf

- Ramp cards: Pay vendors by card—either with your existing cards or one-time-use Ramp cards—to earn cashback for vendors that accept Visa

By combining control, speed, and ease of use, Ramp helps you streamline every payment, whether it’s recurring or last-minute, small or large, domestic or international.

Whatever the need, Ramp Bill Pay makes it easy to pay your vendors smarter.

This post includes general information about domestic and international payments. For help with domestic and international payment functionality specific to Ramp, visit Ramp Support for more details.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°