- What is wire fraud?

- What are some common examples of wire fraud?

- Red flags of wire fraud in business transactions

- How to protect your business from wire fraud

- Steps to take if you suspect wire fraud

- Emerging threats in wire fraud

- Stay ahead of wire fraud with AP automation

Wire fraud is a growing threat, with fraudsters using increasingly sophisticated tactics to manipulate businesses into sending unauthorized payments. A single fraudulent wire transfer can result in significant financial losses, making it crucial to have preventative measures in place.

From secure communication protocols to AI-driven fraud detection, here’s how to protect your business from wire fraud.

What is wire fraud?

Wire Fraud

Wire fraud is a type of fraud that involves using electronic communications—such as phone calls, emails, text messages, or online transactions—to deceive someone for financial or personal gain.

Wire fraud happens when someone intentionally creates a false scheme or misrepresentation to trick another person into giving up money, property, or sensitive information. Because electronic communication often crosses state or national lines, wire fraud is considered a federal crime.

Some key points to remember about wire fraud are that:

- It involves deception: The scam must be based on false promises, misrepresentation, or fraudulent intent.

- It relies on electronic communication: Any use of the internet, phone calls, emails, or digital messaging makes it wire fraud.

- The goal is financial or personal gain: The scammer seeks to steal money, assets, or valuable information.

- It’s a federal offense: Because wire fraud often involves communication across different regions, federal agencies investigate and prosecute it.

What are some common examples of wire fraud?

Wire fraud takes many forms, but some of the most common scams involve email deception, fraudulent payments, and investment schemes.

1. Phishing attacks

One of the most prevalent tactics is phishing, where fraudsters send deceptive emails, texts, or messages that appear to come from a trusted source—such as a bank, supplier, or business partner. These messages often contain malicious links or attachments designed to steal login credentials, credit card details, or financial information.

Variations include voice phishing (vishing) and SMS phishing (smishing), where scammers attempt to extract sensitive data over the phone or through text messages.

2. Business email compromise (BEC)

A more targeted approach is business email compromise (BEC), a scheme where scammers impersonate executives, employees, or vendors to manipulate companies into wiring money.

These fraudsters often spoof real email addresses or hack accounts to send urgent payment requests, usually directed at finance teams or accounting personnel. Because these emails seem legitimate, many businesses unknowingly authorize fraudulent transactions, resulting in significant financial losses.

3. Invoice fraud

Another widespread scheme is invoice fraud, where criminals send fake invoices that closely resemble legitimate ones from real suppliers or service providers. Companies, believing they are paying valid debts, wire money directly to the scammer’s account. Some fraudsters even exploit insider information to make these invoices more convincing.

4. Investment scams

Investment scams are another major form of wire fraud. Here, scammers pose as financial advisors, brokers, or investment firms, promising high returns with little risk. Victims are encouraged to wire money for investments in stocks or other assets—but once the funds are transferred, the scammer disappears.

5. Auction fraud

Online marketplace and auction fraud also rely on deception, typically through fake product listings on e-commerce platforms, classified ads, or auction sites. Scammers convince buyers to wire money for a product that doesn’t exist or is significantly different from what was advertised.

Some fraudsters go further by hijacking real seller accounts to appear more credible, making it even harder for victims to detect the scam before sending payment.

In all these cases, wire fraud relies on electronic communication to deceive victims and steal money. Since wire transfers are often instant and irreversible, once the money is sent, it’s difficult to recover.

Red flags of wire fraud in business transactions

Recognizing red flags early can help prevent wire fraud. Here are key indicators to watch for:

- Urgent requests: Be wary of emails or messages demanding immediate action, especially urgent wire transfers. Fraudsters exploit the fact that domestic wire transfers can complete within hours, creating artificial urgency to bypass standard verification steps before you can catch the fraud.

- Unusual or unexpected transactions: Transactions that don’t align with normal business patterns—such as unusually large payments or requests to send money to an unfamiliar account—should raise concerns.

- Inconsistent communication: Watch for mismatched email addresses, domain variations, or unexpected changes in contact details. Fraudsters often make small but deceptive alterations.

- Requests for secrecy: If someone asks you to keep a transaction confidential or bypass normal approval channels, it’s a major red flag. Scammers try to prevent verification.

- Grammar and spelling errors: Poor grammar, awkward phrasing, or spelling mistakes in emails may indicate phishing or fraud attempts, as legitimate organizations maintain professional communication.

How to protect your business from wire fraud

Wire fraud is a serious threat, but businesses can protect themselves by implementing strong security measures, verifying transactions, educating employees, and using technology. Fraudsters rely on deception and urgency, so having clear processes in place is key to preventing financial losses.

1. Use secure communication channels

Financial data should always be transmitted securely. Businesses should use encrypted emails and secure file-sharing systems while avoiding personal email accounts and unverified messaging apps, which are more vulnerable to hacking.

Enabling multi-factor authentication (MFA) on financial and email accounts adds an extra layer of protection against unauthorized access.

2. Verify all payment requests

One of the most effective ways to prevent wire fraud is to independently verify all wire transfer requests. Fraudsters often impersonate executives, vendors, or employees to trick finance teams into transferring funds. Employees should:

- Call the requester using a verified phone number rather than replying to the email

- Be cautious of last-minute account changes, high-value payments, or urgent demands

For added security, companies should require segregation of duties in their AP process for large transactions to prevent a single employee from authorizing wire transfers alone.

3. Educate employees on fraud tactics

Fraud prevention starts with awareness. Employees should receive regular training on phishing scams, social engineering tactics, and common fraud schemes. Fraudsters often use email spoofing and urgent payment requests to manipulate employees into bypassing security protocols.

Simulated phishing tests can reinforce awareness, and businesses should establish a clear process for reporting suspicious activity to stop fraud attempts before financial losses happen.

4. Strengthen internal financial controls

Strict internal controls for AP help prevent unauthorized transactions. Businesses should:

- Require dual authorization for high-value wire transfers

- Restrict access to sensitive financial accounts and regularly review user permissions

- Implement real-time transaction monitoring to detect unusual payments or unauthorized transfers

5. Verify vendor and account changes

Fraudsters often impersonate vendors to request payments to fraudulent accounts. To prevent this, businesses should verify all vendor account changes through a pre-established contact method rather than email. Keeping a list of authorized financial contacts ensures fraudulent requests don’t slip through.

6. Use AI and fraud detection tools

AI-powered payment processing and fraud detection tools analyze transaction patterns and flag suspicious activity in real time. Behavioral analytics can detect unusual login attempts, unauthorized device access, or abnormal transaction sizes, helping businesses identify fraud before funds are lost. Many banks and third-party fraud prevention services offer additional layers of security.

7. Keep security protocols updated

Since fraud tactics constantly evolve, businesses must regularly update security protocols. Financial and IT systems should always be patched with the latest security updates, and businesses should use firewalls, anti-malware software, and intrusion detection systems to guard against cyber threats.

Multi-factor authentication (MFA) and incident response drills further ensure employees can respond effectively to fraud attempts.

Steps to take if you suspect wire fraud

If you suspect wire fraud, taking immediate action is important to minimizing financial loss. Here are the steps you can take:

- Contact your bank or payment processor immediately: Request to halt or reverse the transaction. The faster you act, the better the chances of recovering funds.

- Report the fraud to authorities: File a complaint with local law enforcement and the FBI’s Internet Crime Complaint Center (IC3) to initiate an investigation.

- Alert key internal teams: Notify finance, security, and IT personnel to assess the scope of the fraud and prevent further damage.

- Inform affected partners or clients: If external parties may be impacted, notify them so they can take precautionary measures.

Time is crucial when dealing with wire fraud—the sooner you act, the higher the chances of stopping or mitigating losses.

Emerging threats in wire fraud

Wire fraud tactics are evolving rapidly with advanced ways to bypass traditional security measures. Nowadays, some concerns of emerging threats in wire fraud include:

- AI-powered scams: Fraudsters now use machine learning algorithms to analyze email patterns and craft highly convincing phishing messages, making them harder to detect.

- Technology to craft fake calls: Cybercriminals can mimic voices, video calls, or even entire meetings with technology, tricking employees into authorizing fraudulent transactions.

- Automated AI-driven scams: Fraud bots can send out thousands of phishing messages at scale, increasing the likelihood of successful attacks.

- Advanced spoofing techniques: Fraudsters create nearly perfect replicas of emails, websites, and phone numbers, making fake requests appear legitimate.

With fraud methods becoming more sophisticated, traditional safeguards are no longer enough. Staying ahead of these threats requires continuous monitoring, rapid response strategies, proactive security upgrades, and layered controls like positive pay, dual authorization, and automated fraud detection.

Stay ahead of wire fraud with AP automation

Wire fraud thrives on urgency, deception, and weak security practices. The best way to prevent fraudulent transactions is to have automated safeguards in place before a payment is ever sent.

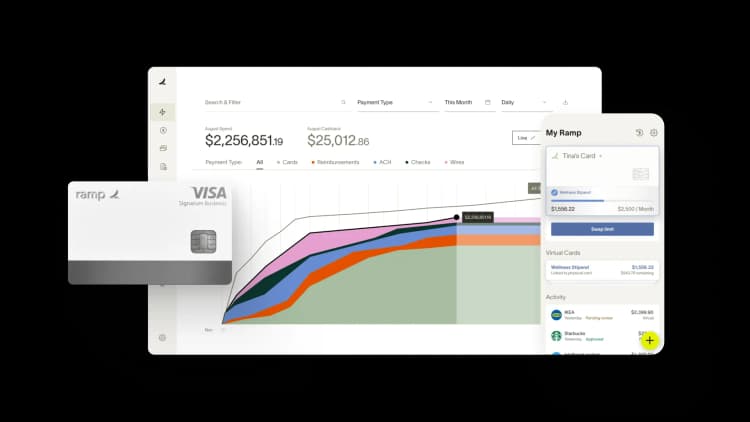

With Ramp’s AP automation software, businesses get built-in fraud protection during the payment process. Ramp helps prevent wire fraud by:

- Automating workflows with set approval controls so unauthorized payments don’t slip through

- Using automated alerts to flag suspicious or duplicate transactions before they’re processed

- Verifying vendor details and payment information to stop unauthorized attempts before money leaves your account

Don’t leave your AP processes vulnerable to fraud. See how Ramp Bill Pay helps your business stay secure while streamlining payments.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits