- Why businesses need to keep tax records

- What records should corporations keep?

- How long should you keep corporate tax records? Understanding the period of limitations

- Exceptions to the corporate record retention period

- Business records to retain for non-tax purposes

- Disposing of corporate tax records safely

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Managing corporate tax records is a pillar of sound financial management for all companies, from small businesses to large corporations. Retaining important records ensures compliance with IRS regulations and legal guidelines, protects you in the event of an audit, and helps you make smarter financial decisions.

A big part is knowing how long to keep corporate tax records and other business documents. These records include business tax returns, receipts, payroll files, bank statements, and other records showing your income, expenses, and overall financial activity. In other words, they're the proof of your business's financial operations.

Why businesses need to keep tax records

Tax records are important for tax compliance and for protecting your small business in general. They also serve as proof in case of an IRS inquiry or legal dispute and help you claim deductions accurately. Here’s why:

- Compliance: The IRS requires you to keep adequate business tax records as documentation for income, business tax deductions, and tax credits. You also need to hold onto receipts for any business expenses you claim. Failure to do so could lead to fees, penalties, or rejected deductions.

- Audit protection: Audits are stressful and can be time-consuming. But if you keep accurate and thorough records, you’ll have a solid audit trail to help justify your tax deductions and claims to avoid penalties.

- Financial management: Outside of legal or IRS regulations, keeping good records also helps you budget appropriately, monitor cash flow, make better financial decisions, and share accurate financial statements with investors and lenders

Risks of poor recordkeeping include:

- IRS audits

- Rejected deductions

- Fees or penalties

- Legal issues and reputational damage

- Poor financial visibility

What records should corporations keep?

The main categories of records your business should keep include:

- Income tax returns and supporting documents

- Expense receipts and invoices

- Bank statements and canceled checks

- Payroll records and employment tax records

- Property and asset records

There may also be industry-specific recordkeeping requirements, so check with legal counsel or tax professionals in your space to understand additional documents you should retain. For example, healthcare providers must follow HIPAA rules, while manufacturers often keep inventory and production records for a longer period of time to meet compliance standards.

If you manage a retail or inventory-based business, you should keep supporting documents that track inventory purchases, sales, and adjustments. This includes receipts, invoices, shipping logs, and inventory reports. These financial records are essential for calculating your cost of goods sold (COGS), directly affecting your taxable income.

Employment tax records

The IRS requires you to keep records for at least 4 years for employment taxes. This includes payroll tax filings, employee wage documentation, and proof of tax payments. These records are critical for both compliance and potential audits related to payroll.

Key records to retain include:

- Employee information, including name, address, and Social Security number

- Dates of employment

- Compensation records and withholding amounts

- Records of benefits and retirement plans

- Timesheets or timecards

Records connected to property or equipment

For property or equipment, you should keep records for as long as you own the asset, plus the period of limitations after it’s sold or disposed of. This is usually 3 to 7 years.

Key records include:

- Purchase records, contracts, or invoices

- Titles and deeds

- Depreciation schedules

- Documented improvements

- Sale or disposal records

All of these records support any claims you’ve made on your tax return for cost basis or depreciation expenses. When you sell or dispose of the asset, these records also help calculate any losses or capital gains accurately.

How long should you keep corporate tax records? Understanding the period of limitations

The IRS has specific rules for how long you should hold onto records, which they define as the “period of limitations.” This is the amount of time you can amend your tax return for credits or refunds, and during which the IRS can assess additional taxes or initiate an audit.

IRS Publications 583, 542, and 463 lay out the specific recordkeeping guidelines for businesses. Generally, the IRS advises that you keep your tax records for at least 3 years from the date you file your return. This 3-year period matches the statute of limitations. If you file early, the clock starts from the official tax deadline, not your filing date.

Exceptions to the corporate record retention period

While you should retain most corporate tax records for 3 years, there are a few records you'll have to hold on to a little longer. These are the key exceptions to be aware of:

Handling underreported income

If you underreport your income by more than 25%, the IRS requires you to retain your records for 6 years. For example, if your income is $100,000, but you fail to report $26,000 or more, this rule applies. You should keep all the relevant tax documents for at least 6 years in such cases.

Worthless securities

If you claim worthless securities or bad debt deductions, you need to keep records for 7 years. These deductions often require extra documentation to substantiate the claim, and the IRS might need more time to review them.

Let’s say your company acquires a company that then fails. The shares in that company are now worthless. But to substantiate the loss, you need to keep records of stock certificates and valuations for 7 years.

Property and asset documents

If you own property or long-term assets, keep records as long as you own the asset, plus the period of limitations after you sell or dispose of the asset. These documents help establish your basis, calculate depreciation, and determine capital gains or losses.

For example, if you own your office space, keep all the purchase records and other improvement and depreciation documents until you sell the building, plus at least 3 more tax years after you file your return.

Fraud or unfiled returns

You should keep these records indefinitely if you file a fraudulent return or don’t file a tax return. The IRS can investigate and pursue action on cases like this at any time, so retain your records forever to ensure you have proof of your financial activity if questioned.

Business records to retain for non-tax purposes

The IRS lays out clear guidelines for how long to retain tax records. Still, there are other non-tax business records you should keep even longer—and maybe indefinitely—for legal protections, business continuity, and strategy.

Records such as contracts, payroll documents, and asset records can impact your IRS audits and legal disputes. Beyond compliance, retaining these records also enhances your operational efficiency. Organized documentation streamlines audits, accelerates financing processes, and ensures you can respond quickly to inquiries from regulators, lenders, or partners.

This is a list of non-tax documents and how long to keep business records:

- Corporate formation documents (articles of incorporation, etc.): Permanently

- Board and shareholder meeting minutes: Permanently

- Stock and ownership records: Permanently

- Contracts: 7 years after expiration

- Employment records: 7 years after employee termination

- Insurance policies: 6 years after expiration

- Litigation records: 7 years after resolution

- Real estate records: Permanently

- Trademarks, patents, and IP documentation: Permanently

- Business licenses and permits: 3–7 years after expiration

If you’re ever in doubt, hold onto documents, just in case you need them one day.

Disposing of corporate tax records safely

You must securely destroy records you no longer need to protect sensitive information and comply with data privacy laws. Failure to do so can result in data breaches, fines, or legal problems.

Shred all physical records with a cross-cut shredder that cuts documents into tiny, unreadable pieces for records with financial, employee, or client information. For digital records, use secure deletion methods that make the files unrecoverable. If you store records in the cloud, follow your provider's deletion steps to fully remove files from their servers. Use a professional data destruction service for old hard drives or devices to ensure you erase all data completely.

Make sure to follow data protection and privacy laws such as the Gramm-Leach-Bliley Act, HIPAA (if applicable), the FTC’s Disposal Rule, and state privacy laws.

You should also record when and how you destroyed the documents, especially if they contained sensitive or regulated information. This documentation protects your business in case compliance questions come up later.

Transitioning from physical to digital records

Making the move to digital records from physical files can help you save space and is often more secure with file backups. Here’s how you can make the shift:

- Scan important documents: Digitize your files using high-resolution scanners, saving in non-editable formats such as PDFs, and create a consistent and sensible naming convention so you can easily find files

- Choose a secure storage solution: Look for cloud storage that includes end-to-end encryption and multifactor authentication as well as permissions and access controls

- Make sure to back up: Come up with a plan for backing up your files regularly, especially for your most important records

- Create a retention and deletion policy: Set rules for how long you need to store certain files, and then securely delete any you no longer need. Keep records of who destroyed them and when.

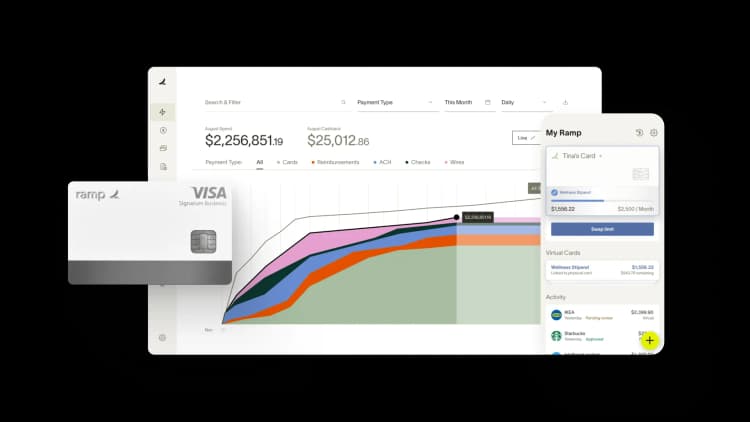

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

The information provided in this article does not constitute accounting, legal, or financial advice and is for general informational purposes only. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits