What is payroll management? Definition, process, and examples

- What is payroll management?

- Why payroll management matters for finance

- Key payroll management activities across the payroll process

- Payroll management methods: Manual, software, or outsourcing

- Core functions of a payroll management system

- Benefits of automating payroll management solutions

- How to choose the right payroll management solution

- Common payroll challenges and how to fix them

- 6 steps to launch a payroll management system

- Integrate your payroll management system with Ramp for full visibility

Payroll management is the process of paying employees accurately and on time while handling tax withholdings, benefits, and payroll records. It touches every employee and is one of the largest expenses in any business. However, many companies still rely on manual payroll processing, which increases compliance risks, payroll errors, and administrative burden.

Effective payroll management ensures correct wages, proper tax withholding, and well-organized records. It also protects against noncompliance with tax regulations and labor laws. Whether you’re moving beyond spreadsheets or upgrading to automated payroll management systems, payroll management helps streamline operations, save time, and improve employee satisfaction.

What is payroll management?

Payroll management is the process of calculating employee wages, managing deductions, withholding taxes, and issuing paychecks or direct deposits. It also involves maintaining payroll records that meet tax and labor law requirements.

A payroll management system supports this process by tracking employee data, applying pay rates, and calculating gross pay to net pay. It ensures accurate payments each pay period while meeting obligations for payroll taxes, benefits, and reporting.

Effective payroll management gives businesses a reliable way to handle employee pay and reduces the risk of errors or compliance penalties.

Why payroll management matters for finance

Effective payroll management impacts every part of your business:

- Employee satisfaction: On-time, accurate paychecks build trust and morale. Errors or late payments hurt confidence and can increase turnover.

- Legal compliance: Payroll must follow federal, state, and local tax regulations. Missing deadlines or filings can result in costly penalties and audits.

- Financial accuracy: Detailed payroll records reveal how labor costs, payroll taxes, and benefits affect your bottom line. This insight supports cash flow management, budgeting, and hiring decisions.

- Operational efficiency: Automated payroll systems reduce manual work, prevent errors, and free HR and finance teams to focus on higher-value projects.

Key payroll management activities across the payroll process

The payroll management process follows three main phases: data collection, wage calculations, and post-payroll reporting. Each stage builds on the last, so accuracy early in the cycle prevents costly errors later.

1. Pre-payroll data collection and validation

This stage involves gathering employee details such as hours worked, salary changes, new hires, and benefit elections. Your team will need to verify timesheets, overtime, and PTO usage, and confirm onboarding documents like W-4 forms, state withholding forms, and direct deposit details. Accurate data entry here prevents payroll errors later in the process.

2. Gross-to-net calculations and deductions

Your team calculates gross pay, subtracts payroll taxes, and applies deductions. This includes income tax withholding, Social Security, Medicare, and state or local tax obligations. You'll also need to include pre-tax benefits such as retirement contributions and post-tax deductions like garnishments. The result is the net pay your employees receive each pay period.

3. Post-payroll filing and reporting

After paychecks or direct deposits are issued, payroll teams make tax payments, file reports with federal and state agencies, and reconcile payroll data with the general ledger. Compliance steps include filing quarterly Form 941s and annual W-2s and 1099s. Accurate records support audits, maintain tax compliance, and keep financial statements aligned.

Payroll management methods: Manual, software, or outsourcing

Businesses typically choose among three payroll management approaches. The right fit depends on company size, payroll complexity, budget, and how much control you want:

| Method | Best for | Pros | Cons |

|---|---|---|---|

| Manual payroll management | Very small businesses | Low cost, full control | Time-consuming, error-prone, compliance risks |

| Payroll management software | Growing businesses that need efficiency and accuracy | Automation, tax compliance support, reporting | Subscription cost, setup, learning curve |

| Outsourced payroll services | Companies looking to offload payroll entirely | Expertise, reduced administrative burdens, compliance coverage | Less control, vendor dependence, per-employee fees |

Manual payroll management

Manual payroll relies on spreadsheets and hand calculations. It can work for very small businesses with a handful of employees but becomes time-consuming and error-prone as headcount grows.

Pros:

- Low cost

- Full control over data and calculations

Cons:

- High risk of errors

- Significant time investment

- Constant need to track changing tax laws

Payroll management software

Payroll management software automates calculations, tax filing, and reporting while keeping payroll in-house. Many platforms integrate with time tracking, benefits, and accounting systems.

Pros:

- Greater efficiency through automation

- Built-in tax compliance and reporting

- Real-time visibility into labor costs

Cons:

- Subscription costs and setup effort

- Requires initial training and configuration

Outsourced payroll services

With outsourcing, a payroll service provider handles everything from calculations to tax filing and year-end reporting. This approach reduces administrative work but requires trust in the vendor’s accuracy and responsiveness.

Pros:

- Expert support and compliance coverage

- Minimal administrative burden

- Scales easily with headcount growth

Cons:

- Less direct control

- Ongoing per-employee fees

- Dependent on vendor accuracy and timelines

Core functions of a payroll management system

A payroll management system does more than issue paychecks. It centralizes employee data, automates business tax filing, and secures records to keep payroll operations accurate and compliant. These core functions form the backbone of effective payroll administration and help small and growing businesses maintain accuracy, reduce workload, and stay audit-ready:

Employee payroll data management

A payroll management system keeps detailed employee information in one secure location. This includes tax withholding preferences, direct deposit details, gross pay rates, benefits elections, and status changes such as terminations or leaves of absence. Accurate payroll data ensures wages, deductions, and benefits are calculated correctly every pay period, reducing payroll errors and administrative burdens.

Time tracking integration

Payroll systems often integrate directly with time clocks or time-tracking software. This eliminates manual entry, reduces mistakes, and streamlines payroll processing. Accurate hours, overtime, and PTO data feed automatically into the payroll system, which applies labor laws and pay rules across jurisdictions.

Payslip generation and distribution

Employees need transparent records of their earnings and deductions. Payroll management systems automatically generate digital pay stubs or pay slips that break down gross pay, net pay, tax withholdings, and year-to-date totals. Providing employees with easy access to their pay information improves satisfaction and reduces support requests.

Tax compliance and filing automation

Payroll taxes are complex and vary across federal, state, and local jurisdictions. A payroll management system calculates payroll taxes accurately, withholds the right amounts, and files tax forms on schedule. Many systems also manage quarterly filings, such as Form 941 and year-end forms such as W-2s and 1099s, lowering the risk of non-compliance with tax authorities.

Secure payroll recordkeeping

Payroll records contain sensitive employee data that you must store safely, keeping it accessible for audits or employee requests. Payroll systems provide encryption, role-based access, and audit trails to track changes. They also organize records for quick retrieval, ensuring compliance with IRS, labor laws, and state tax regulations.

Benefits of automating payroll management solutions

Moving from manual payroll to automation delivers measurable gains in accuracy, efficiency, and compliance. Here are three core benefits of adopting payroll management software:

Save time and reduce payroll errors

Automation eliminates manual calculations that are both time-consuming and error-prone. Instead of entering hours and deductions by hand, the payroll system pulls data directly from integrated HR and time-tracking tools and applies current tax rates automatically. This reduces payroll errors, accelerates processing, and frees finance teams to focus on higher-value work.

Strengthen compliance and audit readiness

Payroll systems automatically update with new tax regulations and labor laws, keeping withholding and filings compliant across federal, state, and local levels. Built-in alerts flag missing employee information or incorrect tax elections before payroll is finalized. With organized digital records and clear audit trails, you can demonstrate compliance quickly during reviews or audits.

Improve real-time visibility into labor costs

Modern payroll systems provide real-time reporting on employee wages, payroll taxes, and benefits. Dashboards highlight trends in labor costs, overtime, and tax liability by department or location. This visibility helps business leaders make better budgeting and workforce planning decisions based on up-to-date data.

How to choose the right payroll management solution

Selecting payroll software or services requires weighing more than just price. The right solution should meet your current needs while scaling with your business as regulations, headcount, and complexity grow.

Security and data privacy standards

Payroll systems store sensitive employee information, including Social Security numbers, bank details, and pay data. Look for platforms with bank-level encryption, role-based permissions, and SOC 2 compliance. Strong vendors also have clear data breach protocols and carry cyber liability insurance to protect employee and company information.

Integration with HR and finance tools

Payroll shouldn’t operate in a silo. The best systems connect seamlessly with time tracking, HR platforms, and accounting software for small businesses. These integrations eliminate duplicate data entry, improve accuracy, and give finance teams a unified view of wages and expenses.

Scalability for multi-state or global teams

As your company grows, your payroll solution must manage multiple tax jurisdictions, pay frequencies, and labor laws without disruption. Make sure your provider supports compliance across states and countries so you can expand confidently.

Total cost and ROI considerations

Compare subscription fees, setup costs, and per-employee charges against potential returns from time savings, fewer errors, and reduced compliance risks. Even small efficiency gains add up quickly for businesses running recurring payroll cycles.

Common payroll challenges and how to fix them

Even well-managed payroll operations face recurring challenges that create compliance risks and consume time. Most of these issues can be solved with the right payroll system or service provider.

| Challenge | Why it happens | How to fix it |

|---|---|---|

| Late filings and penalties | Missed deadlines for tax payments or required reports can cause automatic fines from the IRS or state agencies | Use payroll software with automated filing features and reminders to meet every deadline |

| Multi-state and international tax complexity | Different jurisdictions have unique tax laws and filing rules, which multiply as your business expands | Choose payroll systems with built-in multi-jurisdiction compliance or outsource to providers experienced in state and global payroll |

| Payroll data silos | Payroll, HR, and accounting systems don’t always sync, creating duplicate data and reconciliation errors | Integrate payroll tools with HR and finance platforms or use APIs to connect existing systems |

| Contractor and 1099 management | Employees and contractors require different payroll workflows and tax treatments, and mixing them up risks audits | Select payroll solutions that manage both W-2 employees and 1099 contractors with separate workflows and automated reporting |

6 steps to launch a payroll management system

Implementing a payroll management system requires careful planning. Follow these steps in sequence to ensure a smooth setup and long-term compliance:

- Define payroll policies: Document pay schedules, overtime rules, time-off accruals, and approval processes. Clear policies set expectations and reduce payroll errors.

- Collect and verify employee information: Gather tax forms, direct deposit details, benefit elections, and salary data for each employee. Confirm accuracy early to prevent payment delays and compliance issues.

- Configure earnings, deductions, and taxes: Set up system rules for gross pay, overtime, deductions, and tax withholdings. Include special cases such as bonuses, commissions, or garnishments.

- Test payroll calculations before going live: Run sample payrolls to confirm gross-to-net results match expectations. Test hourly, salaried, and contractor scenarios to catch errors before they affect paychecks.

- Communicate changes to employees: Explain new processes clearly, including pay dates, access to pay stubs, and how to update direct deposit details. Good communication builds trust and reduces confusion.

- Review metrics and optimize over time: Track error rates, processing time, and employee satisfaction. Regular reviews highlight opportunities for automation, training, and tighter compliance controls.

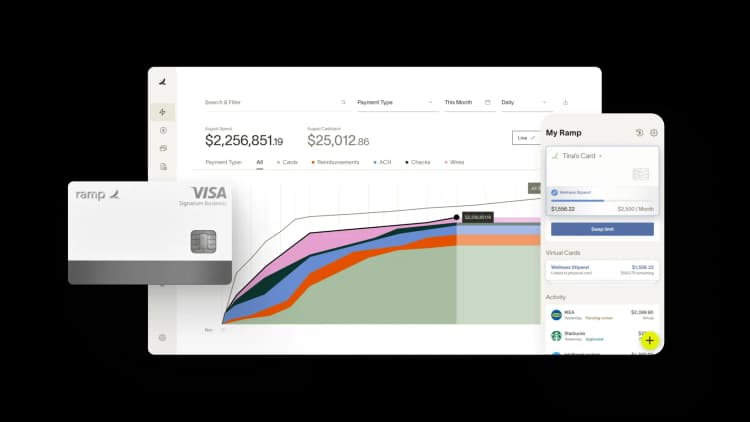

Integrate your payroll management system with Ramp for full visibility

With a reliable payroll management process, Ramp can help improve your other financial operations, from expense reporting and approvals to stronger spend management controls.

With Ramp’s corporate cards, overseeing employee spending is a snap from day one. For example, you can generate unique spend programs to manage employee benefits like remote work stipends or continuing education funds. And integrations with popular ERPs like NetSuite and Sage Intacct mean every transaction is automatically synced to your accounting records, speeding up monthly close.

Ready to learn more? See how Ramp can help streamline your accounting process using our AI-powered software and out-of-the-box integrations.

FAQs

Federal law requires payroll records to be retained for at least three years, while the IRS mandates four years for tax forms and wage statements. Some states have longer requirements; New York requires six years, for example.

To stay compliant, small businesses should follow the longest applicable retention period and keep records organized and accessible for audits or employee requests.

Payroll management software calculates employee wages, tax withholdings, and payroll deductions. It generates paychecks, pay stubs, and tax filings. Accounting software manages broader financial data, including accounts payable, accounts receivable, and financial statements.

Many businesses integrate the two so payroll data flows directly into the general ledger for accurate reporting without duplicate entry.

Small businesses and startups often use cloud-based payroll systems or outsource payroll to a service provider. These solutions handle payroll processing, tax filing, and compliance without requiring a dedicated HR team.

As the company grows, you can transition to an in-house payroll management system while continuing to automate time tracking, direct deposits, and reporting.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°