Depreciation expense: Methods and calculation

- What is depreciation expense?

- Depreciation expense vs. accumulated depreciation

- Depreciation calculation methods

- Tax implications of depreciation

- How to calculate depreciation expense

- Which assets can be depreciated?

- Impact on financial statements and taxes

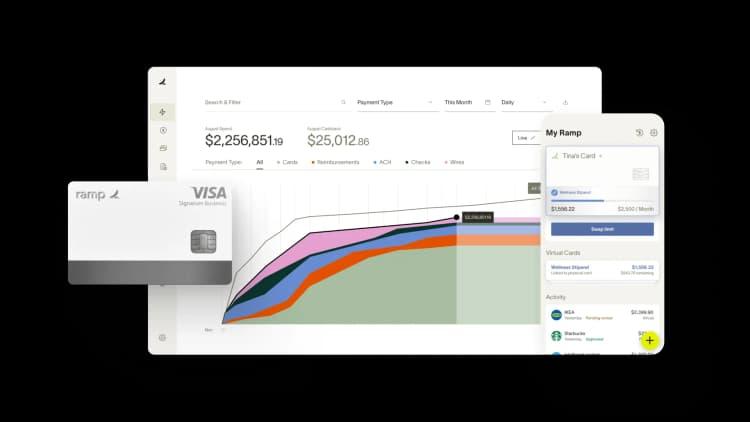

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

When your company buys long-term assets like machinery, vehicles, or buildings, you can’t expense the full cost all at once. Depreciation expense spreads that cost over the asset’s useful life, reflecting how it gradually loses value through use, wear, or obsolescence.

Depreciation affects your income statement, balance sheet, and tax bill in meaningful ways. Businesses that track depreciation accurately make better decisions about capital purchases, replacement timing, and budgets, while lowering taxable income and keeping financial statements compliant.

What is depreciation expense?

Depreciation expense is the portion of an asset’s cost that you recognize as an expense over time. This non-cash expense reflects the gradual reduction in an asset’s value due to wear, use, or obsolescence. By recording depreciation, you match an asset’s cost with the revenue it helps generate, in line with the matching principle in accounting.

On the income statement, depreciation expense appears as an operating expense that reduces net income. On the balance sheet, depreciation accumulates in accumulated depreciation, a contra asset account that reduces the asset’s net book value over time.

Consider an example. Suppose your company purchases machinery for $50,000 with a useful life of 5 years and no residual value. You would calculate the annual depreciation expense as:

Depreciation expense = ($50,000 cost – $0 residual value) / 5 years = $10,000 per year

This annual depreciation reflects how the asset’s book value declines gradually as it’s used in operations.

Why businesses use depreciation

Businesses use depreciation to reflect how assets lose value over time and to produce more accurate financial statements. Beyond basic accounting compliance, depreciation plays a meaningful role in tax planning, performance analysis, and cash flow management.

- Tax benefits and deductions: Depreciation lets you deduct a portion of an asset’s cost each year, reducing taxable income. Instead of taking one large deduction upfront, you spread the tax benefit across the asset’s useful life.

- Accurate financial reporting: Recording depreciation prevents assets and profits from appearing overstated. Without it, large purchases wouldn’t be reflected properly on the income statement.

- Better matching of expenses to revenue: Depreciation aligns the cost of an asset with the revenue it helps generate over time. A delivery truck used for five years supports revenue each year, so the expense should follow the same timeline.

- Cash flow management advantages: Depreciation reduces reported profit without requiring additional cash outlay after purchase. This creates a tax shield that improves cash flow and preserves working capital for operations and growth.

Is depreciation expense an asset or an operating expense?

Depreciation expense is classified as an operating expense on the income statement, reducing net income. However, it does not involve any actual cash outflow, making it a non-cash expense. On the balance sheet, accumulated depreciation is treated as a contra asset, reducing the net book value of your tangible assets.

Depreciation expense vs. accumulated depreciation

Depreciation expense is the portion of an asset’s cost you record each year on the income statement. Accumulated depreciation, by contrast, represents the total depreciation recorded on the asset to date and appears on the balance sheet as a contra asset that reduces its book value.

The key distinction is timing. Depreciation expense reflects a single accounting period, while accumulated depreciation builds over the asset’s entire useful life.

| Depreciation expense | Accumulated depreciation |

|---|---|

| Recorded annually on the income statement | Total depreciation recorded on the balance sheet |

| Reduces net income each period | Reduces the asset’s net book value over time |

| Classified as an operating expense | Recorded as a contra asset account |

Depreciation calculation methods

Businesses use different depreciation methods to reflect how assets lose value over time. Some assets provide consistent value for years, while others lose usefulness quickly in their early life. The depreciation method you choose should align with how the asset is used and how its value declines.

Straight-line depreciation method

The straight-line method spreads depreciation evenly across an asset’s useful life.

Depreciation expense = (Cost of asset – Residual value) / Useful life

Example:

A company purchases equipment for $100,000 with a 5-year useful life and no residual value. Using the straight-line method, the annual depreciation expense is:

($100,000 – $0) / 5 = $20,000 per year

This method is commonly used for long-term assets like buildings and office furniture because it’s simple, predictable, and easy to apply.

Declining balance depreciation method

The declining balance method is an accelerated approach that records higher depreciation in the early years of an asset’s life. The most common variation is the double-declining balance method, which applies double the straight-line rate.

Depreciation expense = (2 / Useful life) * Beginning book value

Example:

For a $100,000 asset with a 5-year useful life, first-year depreciation using the double-declining balance method is:

(2 / 5) * $100,000 = $40,000

This method is well suited for assets like vehicles and technology that lose value quickly after purchase.

Units of production depreciation method

The units of production method ties depreciation directly to asset usage rather than time.

Depreciation expense = (Cost of asset – Salvage value) / Total units produced * Units produced in period

Example:

A company buys a machine for $150,000 with a salvage value of $10,000 and an expected lifetime output of 100,000 units. If the machine produces 10,000 units in the first year, depreciation expense is:

($150,000 – $10,000) / 100,000 * 10,000 = $14,000

This method works best for manufacturing equipment where wear depends on production volume.

Sum-of-years’ digits depreciation method

The sum-of-years’ digits method is another accelerated approach that applies a declining fraction to the depreciable base each year.

Depreciation expense = (Cost of asset – Salvage value) * (Remaining useful life / Sum of years’ digits)

Example:

A company purchases equipment for $150,000 with a salvage value of $10,000 and a useful life of 5 years. The sum of years’ digits equals 15. First-year depreciation is:

($150,000 – $10,000) * (5 / 15) = $46,667

Second-year depreciation would be:

($150,000 – $10,000) * (4 / 15) = $37,333

This method fits assets that lose value quickly early on but more gradually than under the declining balance method.

How to choose the right depreciation method

Choosing the right method depends on how the asset is used and how its value declines over time.

- Straight-line depreciation: Best for assets that lose value evenly, such as buildings or office furniture

- Declining balance depreciation: Best for assets like vehicles or technology that depreciate faster in early years

- Units of production depreciation: Best for machinery where depreciation depends on usage or output

- Sum-of-years’ digits depreciation: Best for assets that depreciate rapidly at first but slow over time

| Depreciation method | Expense pattern | Best suited for | Tax impact |

|---|---|---|---|

| Straight-line | Even each year | Buildings, furniture | Predictable deductions |

| Declining balance | Front-loaded | Vehicles, technology | Higher early deductions |

| Units of production | Usage-based | Manufacturing equipment | Varies with output |

| Sum-of-years’ digits | Accelerated | Specialized equipment | Faster early deductions |

Tax implications of depreciation

Depreciation reduces taxable income by allowing businesses to deduct the cost of long-term assets over time. Each dollar of depreciation expense lowers taxable income by one dollar, which directly reduces income tax owed and improves short-term cash flow.

Two common tax provisions allow businesses to accelerate depreciation and claim larger deductions upfront: Section 179 and bonus depreciation.

Section 179 deduction

For 2026, the Section 179 deduction allows businesses to expense up to $2.5 million in qualifying property purchases. The deduction begins to phase out once total equipment purchases exceed $4 million for the year, reducing the allowable amount dollar for dollar above that threshold.

Businesses claim Section 179 by filing Form 4562 with their tax return and electing which assets to expense immediately. The deduction cannot exceed taxable income for the year, but unused amounts can be carried forward to future tax years.

Section 179 is especially valuable for small and midsize businesses because it provides immediate tax relief instead of spreading deductions over several years. Eligible purchases include office furniture, computers, machinery, certain business vehicles, and qualifying building improvements.

Bonus depreciation

For 2026, bonus depreciation allows businesses to deduct 100% of the cost of qualifying assets in the year they are placed in service, following changes enacted under HR1.

Unlike Section 179, bonus depreciation applies automatically to all qualifying property and does not have a dollar cap or taxable income limitation. Businesses can use bonus depreciation even if they operate at a loss for the year.

Many businesses combine both provisions by applying Section 179 first and then using bonus depreciation for remaining qualifying assets. This approach maximizes first-year deductions while preserving flexibility across asset types.

How to calculate depreciation expense

To calculate depreciation expense, you need a few basic details about the asset before choosing a depreciation method. These inputs determine how much cost you can allocate each year and help ensure your calculations are accurate.

Before calculating depreciation, gather the following information:

- Cost: The purchase price plus any expenses required to place the asset into service, such as delivery, installation, or setup fees

- Salvage value: The estimated amount you expect to recover when the asset is sold or retired at the end of its useful life

- Useful life: The period over which you expect to use the asset in business operations

Even with the right inputs, depreciation calculations can go wrong. Common mistakes to avoid include:

- Forgetting setup costs: Installation, shipping, and modification expenses should be included in the asset’s cost basis

- Overestimating salvage value: Setting salvage value too high understates depreciation expense and overstates profit

- Using the wrong useful life: Tax rules assign specific recovery periods to asset classes, which may differ from internal estimates

- Mixing depreciation methods: Different assets require different methods depending on accounting and tax rules

Depreciation calculation examples

Vehicle depreciation example

A business purchases a delivery van for $45,000 with an estimated salvage value of $5,000 and a useful life of 5 years. Using the double-declining balance method:

Depreciation rate = (100% / Useful life) * 2

Annual depreciation = Beginning book value * Depreciation rate

(100% / 5) * 2 = 40%

- Year 1: $45,000 * 40% = $18,000 (Book value: $27,000)

- Year 2: $27,000 * 40% = $10,800 (Book value: $16,200)

- Year 3: $16,200 * 40% = $6,480 (Book value: $9,720)

- Year 4: $9,720 * 40% = $3,888 (Book value: $5,832)

- Year 5: $5,832 – $5,000 = $832 (Book value: $5,000)

The declining balance method accelerates depreciation in early years, when vehicles typically lose value fastest. In the final year, depreciation stops at the salvage value.

Equipment depreciation example

A manufacturing company buys machinery for $120,000 with an estimated salvage value of $20,000 and a useful life of 10 years. Using the straight-line method:

Annual depreciation = (Cost – Salvage value) / Useful life

($120,000 – $20,000) / 10 = $10,000 per year

The company records $10,000 in depreciation expense each year for 10 years. At the end of the asset’s life, the remaining book value equals the salvage value.

Building improvements example

A company spends $200,000 on HVAC upgrades for its office building. Under IRS rules, qualified improvement property uses straight-line depreciation over 39 years with a mid-month convention.

Annual depreciation = $200,000 / 39 = $5,128.21

First-year depreciation = $5,128.21 * (6.5 months / 12 months) = $2,777.78

In later years, the company claims the full annual depreciation amount. Building improvements use longer recovery periods because they add long-term value to the property.

Which assets can be depreciated?

Assets qualify for depreciation when they meet several basic requirements. In general, you must own the asset, use it for business or income-producing purposes, expect it to last more than one year, and be able to estimate its useful life.

To qualify for depreciation, an asset must:

- Be owned by your business

- Be used in business or income-producing activity

- Have a useful life longer than one year

- Gradually wear out, become obsolete, or lose value over time

Common depreciable business assets

- Office equipment such as computers, printers, furniture, and phone systems

- Vehicles used for business purposes, including delivery trucks and company cars

- Buildings and structures such as offices, warehouses, and manufacturing facilities

- Leasehold improvements like lighting, flooring, partitions, and built-in fixtures

Assets that cannot be depreciated

- Land and land acquisition costs

- Inventory held for sale

- Personal-use assets not primarily used for business

- Assets placed in service and disposed of within the same year

| Depreciable assets | Non-depreciable assets |

|---|---|

| Equipment and machinery | Land |

| Business vehicles | Inventory |

| Buildings and improvements | Personal-use assets |

| Leasehold improvements | Assets held less than one year |

Special considerations for intangible assets

Intangible assets follow different rules than physical property. Patents, copyrights, and certain software qualify for amortization, which spreads cost over a defined period rather than using depreciation.

Goodwill from business acquisitions is amortized over 15 years for tax purposes. Internally developed trademarks and brand names generally do not qualify for amortization, while purchased trademarks may. Because tax treatment varies by asset type, it’s important to confirm how specific intangibles are handled before claiming tax deductions.

Impact on financial statements and taxes

Depreciation affects all three core financial statements by spreading the cost of long-term assets across multiple periods. Instead of recording a large expense upfront, businesses recognize depreciation gradually, which smooths earnings and lowers taxable income over time.

On the income statement, depreciation appears as an operating expense that reduces net income each period. On the balance sheet, accumulated depreciation reduces the book value of long-term assets while the original purchase cost remains unchanged. This approach produces a more realistic picture of asset values and profitability.

The scale of depreciation in business accounting is significant. According to data from the Federal Reserve Bank of St. Louis, U.S. corporations depreciated more than $1.6 trillion in assets in 2022, underscoring how central depreciation is to financial reporting and tax planning.

Tax depreciation often differs from book depreciation because the IRS assigns specific recovery periods and methods for tax purposes. Many companies use accelerated depreciation for tax returns to maximize near-term deductions, while using straight-line depreciation in financial statements to present steadier earnings. These differences create temporary timing gaps between taxable income and book income.

Depreciation and cash flow

Depreciation is a non-cash expense, meaning you already paid for the asset when you purchased it. Recording depreciation each year doesn’t require additional cash, but it does reduce taxable income, which lowers tax payments and improves cash flow.

When calculating operating cash flow, accountants start with net income and add back depreciation because it reduced profit without reducing cash. This adjustment shows how much cash the business actually generates from operations.

Depreciation also affects valuation and performance metrics. Investors often review EBITDA (earnings before interest, taxes, depreciation, and amortization) to compare companies without the effects of different depreciation methods. As assets depreciate, lower book values can also influence ratios like return on assets, shaping how performance is evaluated.

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

To record depreciation expenses, debit the Depreciation Expense account and credit Accumulated Depreciation, a contra-asset account on the balance sheet. This reflects the reduction in asset value while preserving the original cost of the asset.

No, intangible assets like patents and trademarks are amortized, not depreciated. Amortization functions similarly to depreciation but applies to non-physical assets.

When you sell a depreciated asset, you may need to recognize a gain or loss on the sale. If the sale price exceeds the net book value, you will record a gain. If it’s less, you will record a loss.

Depreciation methods vary based on the type of asset and the industry. For example, manufacturing companies may prefer the units of production method for machinery, as it ties depreciation to actual usage. In contrast, businesses with long-term assets like real estate or office buildings often use the straight-line method, which evenly spreads depreciation over the asset's useful life.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits