- What is a general ledger (GL)?

- Why the general ledger matters

- General ledger components

- How the general ledger works

- How to create and maintain a general ledger

- General ledger example

- Automate GL maintenance with Ramp's AI-powered accounting

A general ledger (GL) is the foundation of any company's accounting system. It captures every financial transaction to show how money flows through your business. Think of it as your company's financial diary, recording everything from daily sales and expenses to major investments and loan payments.

But the general ledger isn't just for recordkeeping. It provides insights into financial health and ensures compliance with regulations and internal controls. The data in your GL becomes the building blocks for financial statements, tax filings, and performance reports that help you make informed business decisions.

What is a general ledger (GL)?

The general ledger is the central recordkeeping system in accounting, where you record all your company's financial transactions. It serves as the foundation for creating key financial statements such as the balance sheet, income statement, and cash flow statement, helping you track your business’s assets, liabilities, and equity.

The core purpose of a general ledger is to serve as the central record for all financial transactions. You document every dollar that enters or leaves your business here, creating a complete financial history. This helps accountants track money movements, maintain accurate balances, and provide a clear picture of your company's financial position.

The general ledger fits into the broader accounting process as the hub that connects all financial activities. Individual transactions start in journals or subsidiary ledgers, then you summarize and post them to the GL. From there, accountants use this consolidated data to create financial statements, prepare tax returns, and generate reports for financial decision-making.

Why the general ledger matters

Whether you run a small startup or manage a large corporation, the general ledger is essential to your financial operations. It provides the basis for every financial decision, from daily cash management to long-term planning. Without this record, you'd struggle to track profitability, manage cash flow, or demonstrate financial health to investors and lenders.

The general ledger directly supports three critical business functions: accurate financial reporting, regulatory compliance, and informed decision-making. When tax season arrives or auditors come calling, your general ledger provides the detailed documentation they need.

Transaction confusion disappears when you have a clear record of where money came from and where it went. Human errors get caught more easily through regular reconciliation processes. Most importantly, you gain reliable records that stand up to scrutiny from banks, investors, tax authorities, and other stakeholders who need to verify your financial information.

General ledger components

The general ledger serves as your business's financial command center, bringing together all the essential elements that tell your company's financial story:

- Accounts: These are the organized categories where all your financial transactions live. Assets represent what your company owns; liabilities show what you owe to others; equity reflects the owner's stake in the business. Revenue captures the money flowing in from sales and services, and expenses track all the costs of running your operations.

- Debits and credits: Every transaction involves at least one debit entry and one credit entry, and the total of all debits must always equal the total of all credits. Debits increase assets and expenses while decreasing liabilities, equity, and revenue. Credits work in the opposite direction, increasing liabilities, equity, and revenue while reducing assets and expenses.

- Chart of accounts: This is a comprehensive list of your business's accounts, complete with unique identification numbers and clear descriptions. The chart of accounts provides the structure that determines where you record each transaction, making it easier to find information later and maintain consistency across all your financial reporting.

- Balances and running totals: These show each account's current financial position at any given time. As transactions flow through the GL, each account balance updates automatically, creating a real-time snapshot of your financial health. Running totals help you track changes over time and provide the foundation for generating financial statements.

Account categories in a general ledger system

The general ledger categorizes all financial transactions into five main account types. Understanding these is key to tracking your financial activities and maintaining your books.

1. Assets

This category includes all resources owned by the company that have economic value. Assets can be tangible, such as buildings and machinery, or intangible, such as patents or trademarks.

Examples of asset accounts include:

- Cash and cash equivalents

- Accounts receivable (AR)

- Fixed assets

- Inventory

- Investments

- Intangible assets, such as patents and trademarks

Assets are crucial for generating revenue, and tracking them helps you assess your company’s financial strength.

2. Liabilities

Liabilities are the debts or obligations your company owes to others. These can include short-term liabilities, which you’ll pay within the year, and long-term liabilities, which you’ll pay a year or more in the future.

Liability account examples include:

- Accounts payable

- Leases

- Bank loans

- Payroll

- Taxes

Knowing your liabilities is critical for understanding your solvency and financial commitments.

3. Equity

Equity accounts track the owner’s stake in your company. This includes any initial investments, retained earnings, and stock issued or outstanding.

Equity account examples include:

- Common stock

- Owner's equity

- Retained earnings

- Treasury stock

Equity is a key indicator of your business's financial health and value. It also helps illustrate its overall ownership structure.

4. Revenue

This category records all your business’s generated income, typically from sales of goods or services. It's a primary measure of a business’s financial performance and ability to generate profit.

Revenue account examples include:

- Interest income

- Royalties

- Sales

Revenue can represent an increase in your company's assets, but it can also be a decrease in its liabilities.

5. Expenses

Expenses are all costs incurred in the process of generating revenue. They include both direct costs, such as the cost of sales, and indirect costs, such as operating expenses.

Examples of expense accounts include:

- Cost of sales

- Advertising

- Salaries

- Rent and utilities

Tracking your expenses is vital for understanding and managing the profitability and efficiency of your business.

Chart of accounts

The chart of accounts serves as your business's financial filing system. It's a comprehensive list that categorizes every type of transaction your company makes, from office supplies and rent payments to customer payments and loan proceeds. Each category gets its own unique account number and description, creating a standardized way to record and track all financial activity.

This framework forms the basis of your general ledger because it determines exactly where each transaction gets recorded. The chart of accounts tells you which specific account to debit or credit. Without this structure, your GL would be nothing more than a list of numbers with no meaningful organization.

Most charts of accounts follow a logical numbering sequence. Assets typically start with 1000-level numbers, liabilities begin around 2000, equity accounts use 3000-level numbers, revenue accounts start at 4000, and expenses begin at 5000 or higher. This numbering system makes it easy to locate accounts and maintains consistency across your financial records.

How to create a chart of accounts

When setting up or refining your chart of accounts, start with your industry's standard categories and customize based on your needs. A restaurant will use detailed food cost accounts, while a consulting firm might use more project-based revenue tracking. Keep account names clear and descriptive. Office Rent works better than Facility Costs when you look for a specific expense.

Avoid creating too many accounts initially. You can always add more detail later, but starting with an overly complex system often creates confusion and inconsistent coding. Group similar expenses together when possible, and consider how you'll want to analyze your financial data when making decisions about account structure.

The key is building a system that grows with your business while remaining simple enough for consistent daily use. Your chart of accounts should make financial reporting easier, not more complicated.

Chart of accounts example

A well-organized chart of accounts serves as the financial backbone of your small business, making bookkeeping and reporting much more manageable. Here's an example of what it might look like:

Account number | Account name | Account type |

|---|---|---|

Assets | ||

1000 | Cash - checking account | |

1100 | Accounts receivable | Current asset |

1200 | Inventory | Current asset |

1500 | Equipment | Fixed asset |

1510 | Accumulated depreciation - equipment | Fixed asset |

Liabilities | ||

2000 | Accounts payable | Current liability |

2100 | Credit card payable | Current liability |

2500 | Business loan | Long-term liability |

Equity | ||

3000 | Owner's equity | Equity |

Revenue | ||

4000 | Sales revenue | Income |

4100 | Service revenue | Income |

Expenses | ||

5000 | Rent | Operating expense |

5100 | Utilities | Operating expense |

5200 | Office supplies | Operating expense |

5800 | Wages & salaries | Operating expense |

This basic framework gives you a solid starting point to customize by adding or removing accounts based on your business needs.

How the general ledger works

General ledger accounting serves as your business's financial hub, capturing and organizing every transaction that flows through your company's operations. Here's how the process works:

- Transaction occurs: A business event takes place that involves the movement of money, such as a sale, purchase, payment, or receipt of funds

- Source document created: The transaction generates supporting documentation, such as invoices, receipts, contracts, or bank statements that provide evidence and details

- Journal entry recorded: You document the transaction in the appropriate journal with debits and credits following standard accounting principles and the chart of accounts

- Posting to ledger: Journal entries transfer to individual accounts within the general ledger, updating each account's running balance

- Account balances updated: Each affected ledger account reflects the new transaction, maintaining an accurate record of assets, liabilities, equity, revenues, and expenses

- Trial balance prepared: Account balances compile into a trial balance to verify that total debits equal total credits across all ledger accounts

Double-entry accounting and the general ledger

Double-entry accounting is a fundamental principle that ensures every financial transaction affects two different accounts in equal and opposite ways. It maintains the balance of the basic accounting equation:

Assets = Liabilities + Equity

You record transactions through journal entries, each containing at least one debit and credit line item. Make sure these entries balance. An error in a journal entry, such as misclassifying an expense or overlooking a transaction, can skew your company’s financial outlook.

How journal entries relate to the general ledger

Journal entries are the building blocks of the general ledger. The general ledger is a collection of all these entries, aggregated and organized into a comprehensive record. While a journal entry records a single transaction (debit or credit), the general ledger accumulates all these transactions and provides a broader view of your company’s financial activities.

Sub-ledgers and the general ledger

A sub-ledger, or subsidiary ledger, is a detailed subset of a GL account. While the general ledger provides a summary of all financial transactions, sub-ledgers track specific financial transactions for different accounts in more detail.

For example, an accounts receivable sub-ledger might track individual customer balances, while the accounts payable sub-ledger will monitor what your company owes to its suppliers. These sub-ledgers make it easier to monitor and manage account balances within specific areas without overloading the general ledger with too much detail.

Once you’ve recorded transactions in the sub-ledgers, you periodically summarize and transfer them into the GL. This process helps you make sure that the general ledger maintains accurate and up-to-date financial data, while also simplifying the recordkeeping process.

Posting transactions

Posting moves financial data from specialized journals and sub-ledgers into the general ledger, creating a centralized record of all business activity and account balances. Here's how to do it:

- Gather source entries: Collect completed journal entries from all subsidiary ledgers, including sales, purchases, cash receipts, and cash disbursements journals with verified amounts

- Verify account codes: Check that each journal entry uses the correct general ledger account numbers from your chart of accounts to maintain consistency across postings

- Review debit-credit balance: Confirm that debits equal credits for each journal entry before posting to prevent errors from entering the general ledger system

- Post to individual accounts: Transfer each debit and credit amount to the corresponding general ledger account, updating the running balance with precise calculations

- Record posting references: Document the source journal and entry number in the general ledger account for clear audit trails and easy reference during reviews

- Update account totals: Calculate new account balances by adding debits and subtracting credits, maintaining accuracy by double-checking your calculations

- Cross-reference entries: Mark journal entries as posted and note the general ledger account numbers to create complete documentation links between systems

Checking for errors

Regular reconciliation keeps your general ledger accurate and trustworthy. Start by preparing a trial balance at the end of each accounting period to verify that total debits equal total credits across all accounts. This simple check catches posting errors before they affect your financial statements.

Compare the totals of your subsidiary ledgers with the corresponding control accounts in your general ledger. For example, the balance of your accounts receivable sub-ledger should match the balance of the accounts receivable control account. Any differences signal posting errors or missing transactions that need immediate attention.

Perform bank reconciliations monthly by matching your cash account balance with bank statements. This process reveals timing differences, bank fees, and any unauthorized transactions. Keep detailed records of reconciling items and follow up on outstanding checks and deposits in transit.

Common mistakes and how to avoid them

Several predictable errors can disrupt your general ledger accuracy, but knowing what to look for helps you catch and prevent these issues:

- Transposition errors: It’s easy to transpose digits during data entry, such as recording $1,234 as $1,243. Double-check all entries and use software validation features when available.

- Wrong account classifications: Transactions posted to incorrect general ledger accounts create misleading balances. Establish clear account coding guidelines and provide training on proper account selection.

- Missing transactions: Incomplete records create unbalanced books and gaps in your financial data. Use sequential numbering for source documents and maintain a checklist of recurring entries, such as depreciation and accruals. Review all journals for gaps in sequence numbers.

- Calculation errors: Mistakes in journal entries or account balances lead to trial balance problems and bad reporting. Use accounting software with calculation features when possible. For manual calculations, verify math by having a second person check the work.

- Timing errors: Transactions recorded in the wrong accounting period distort period comparisons and financial analysis. Establish clear cut-off procedures for month-end and year-end closing. Review transactions near period boundaries to verify proper timing and accrual entries.

How to create and maintain a general ledger

Organizing all your transactions into a clear, comprehensive record will make tax time and financial analysis much simpler. Here's how to do it:

Choose or define your chart of accounts

Start with basic categories such as assets, liabilities, equity, revenue, and expenses. Most business accounting software comes with standard templates, but you can customize them based on your industry and business needs. Keep account names clear and specific. Office Supplies works better than Miscellaneous Expenses when you need to track spending patterns.

Set up the ledger (software-based or manual)

Accounting platforms like QuickBooks offer automated features that save time and reduce errors. They also connect directly to bank accounts and credit cards, speeding up transaction entry.

If you prefer manual tracking, use a spreadsheet with columns for date, account, description, debit, and credit amounts. Either way, consistency in your setup prevents confusion later.

Record transactions consistently

Enter every business transaction as it happens, following the double-entry method where each entry affects at least two accounts. Sales increase revenue and cash or accounts receivable. Expense purchases reduce cash and increase the relevant expense category. Daily or weekly recording prevents the overwhelming backlog that comes with monthly catch-up sessions.

Review and reconcile regularly

Monthly reconciliation compares your ledger balances with bank statements and other external records. Look for discrepancies and investigate any unusual patterns in your accounts. This process catches errors early and gives you confidence in your financial reports. Schedule this task at the same time each month to build the habit.

Practical tips for small business owners and beginners

Getting started with general ledger management can feel overwhelming, but these practical approaches will help you build good habits from day one:

- Start simple and grow gradually: Begin with essential accounts and add more detailed categories as your business expands. Too many accounts at the start creates unnecessary complexity.

- Back up your data regularly: Whether digital or physical, protect your financial records with frequent backups stored in secure locations. Cloud-based software often handles this automatically.

- Separate business and personal expenses: Use dedicated business credit cards and bank accounts to avoid mixing transactions that complicate your bookkeeping

- Set a regular schedule: Dedicate specific time blocks each week for ledger maintenance. Consistency prevents small issues from becoming major headaches.

- Learn basic accounting principles: You don't need a degree, but grasping concepts such as debits, credits, and the accounting equation helps you make better business decisions

- Consider professional help when needed: As your business grows, a bookkeeper or accountant can handle complex transactions while you focus on operations

General ledger example

Understanding how transactions flow from initial recording to the general ledger is fundamental to double-entry bookkeeping. Consider this simple example.

Imagine your company purchases $500 worth of office supplies on January 15, paying with cash. Here's how this transaction moves through your accounting system:

Step 1: Initial journal entry

You first record the transaction in the general journal:

- Date: January 15, 2025

- Account: Office Supplies (Asset)

- Account: Cash (Asset)

- Description: Purchased office supplies for cash

- Reference: Receipt #12345

Step 2: Posting to general ledger

You then post this journal entry to the appropriate accounts in the general ledger. Each account maintains a running balance of all related transactions.

Account name | Date | Description | Reference | Debit | Credit | Balance |

|---|---|---|---|---|---|---|

Cash | Jan 14 | Previous balance | $5,000 | |||

Office supplies | Jan 15 | Office supply purchase | J-001 | $500 | $500 | |

Cash | Jan 15 | Office supply purchase | J-001 | $500 | $4,500 |

Key points to remember

Debits vs. credits

- Debit to office supplies ($500): Increases the asset account because you now own more supplies

- Credit to cash ($500): Decreases the asset account because you paid out cash

The balancing act

Notice how the total debits ($500) equal the total credits ($500). This is the basis of double-entry bookkeeping: Every transaction must balance.

General ledger structure

Each account in the general ledger maintains its own running total, making it easy to see the current balance of any account at any time. This organized system ensures accuracy and provides a clear audit trail for every transaction.

From GL to financial statements

Your business would use this GL in accounting to build its financial statements at the end of each accounting period. The $500 office supplies balance would appear as an asset on the balance sheet, while the reduced cash balance of $4,500 would also show up in the assets section.

If you use some of those office supplies during the month, the used portion would become an expense on the income statement, reducing the supplies asset accordingly.

This direct connection between daily transactions and financial statements shows why accurate general ledger maintenance is vital to reliable financial reporting.

How ledger errors create reporting problems

General ledger accounting mistakes can distort your financial statements. Let's say someone accidentally recorded your $500 office supply purchase as $5,000. This error would inflate the office supplies asset by $4,500 on the balance sheet while understating cash by the same amount.

Even worse, if the error goes undetected and you use some supplies, it would overstate the expense on the income statement, making the business appear less profitable than it actually is.

These cascading effects highlight why you need to invest time in regular ledger reconciliations and review processes to catch mistakes before they reach the financial statements.

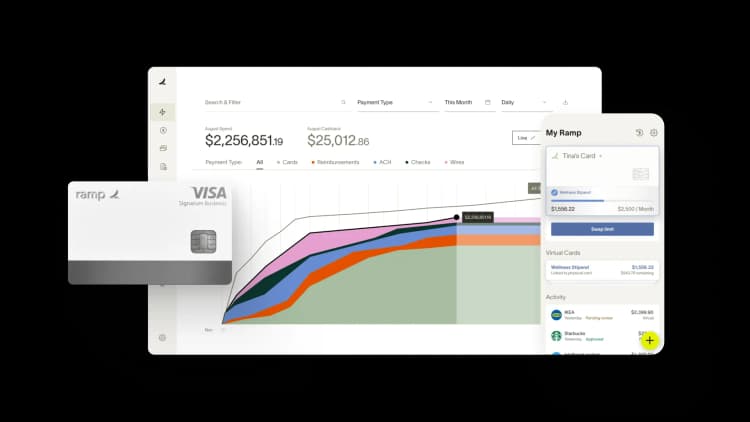

Automate GL maintenance with Ramp's AI-powered accounting

Manual GL maintenance creates bottlenecks, introduces coding errors, and makes reconciliation a monthly headache. Ramp's accounting automation software removes these pain points by automating transaction coding and syncing so your GL stays accurate and audit-ready without constant manual upkeep.

Ramp's AI learns your accounting patterns and codes transactions across all required GL fields in real time as they post. You can review and correct any coding, and Ramp applies your feedback to improve future accuracy, delivering a 67% increase in zero-touch codings compared to rules-only automation. This means fewer miscoded transactions, cleaner books, and less time spent fixing errors during close.

The result? Your GL maintains itself. Transactions flow from card swipe to proper GL account without manual coding, and your team saves 40+ hours on close every month that would otherwise go toward manual data entry, coding corrections, and variance hunting.

Try a demo to see how Ramp automates GL maintenance.

FAQs

A general ledger (GL) is the central recordkeeping system in accounting that tracks all of a company's financial transactions. It includes all account balances and is used to prepare financial statements, such as the balance sheet, income statement, and cash flow statement.

The general ledger organizes financial data from journal entries into various general ledger accounts. It follows the principles of double-entry accounting, where every transaction is recorded as both a debit and a credit to maintain balance. The general ledger helps ensure the accounting equation remains in balance: Assets = Liabilities + Owner’s Equity

The main types of accounts in a general ledger include asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts. These accounts help categorize financial transactions and are important for accurate recordkeeping and preparing financial reports.

The general ledger is critical for generating accurate financial reports, as it consolidates all financial transactions. These reports help businesses assess their financial health, profitability, and financial position, providing valuable insights for decision-making and meeting stakeholder expectations.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits