Celebrating four years and $400M+ saved for our customers

- Ramp’s finance automation platform is built for immediate savings

- The future of finance is here

- Ramp is the platform for businesses that value operational and financial rigor

- We are here to serve

This month, Ramp turned four years old. In the past 1472 days since Ramp incorporated, we’ve helped our 15,000+ customers, from small businesses to leading enterprises, reduce their spend by over $400,000,000 and save 5.8 million hours of labor. Today, Ramp remains the only company in our industry that measures how much money and how much time we’ve saved customers.

We drive value for customers through our counterintuitive model: creating a finance automation platform designed to help businesses spend less. By obsessing over our customers and the value we deliver for them—and helping these businesses get more out of every dollar and hour—Ramp continues to achieve industry-leading growth. In 2022, Ramp’s revenue closed at 4x our prior year revenue, maintaining our position as America’s fastest growing corporate card and bill payment software.

We’re just getting started and we’re here to serve you.

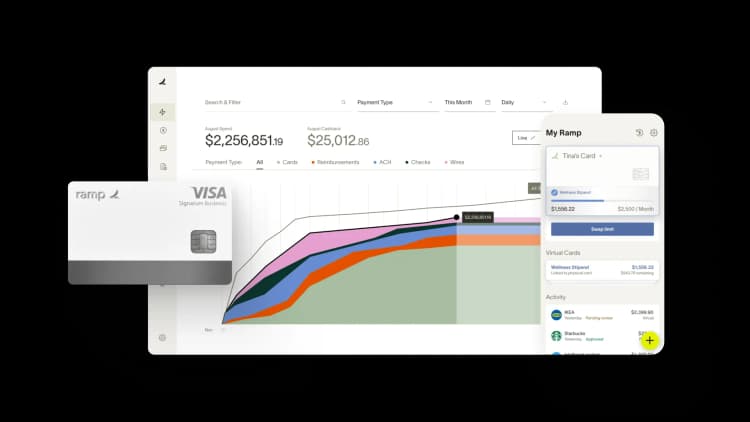

Ramp’s finance automation platform is built for immediate savings

What matters most to finance leaders is conserving their organization's most valuable assets: time and money. Rather than asking businesses to spend big on exorbitant initial costs only to provide lackluster results, we’ve created a finance automation platform that delivers at the outset.

From day one, we believed combining intelligent spend management software and corporate cards would help our customers build more sustainable businesses.

This is a paradigm shift from the status quo; the old world of corporate cards disconnected from software is obsolete. For too long, companies have suffered with siloed card and expense management solutions, creating inefficient, burdened finance teams that lacked an automated and tightly coupled system of reporting and control. This in turn saddled regular employees with monotonous, low-value work. It's time for a better way.

Time savings: To date, Ramp has saved teams 5.8 million hours of painstaking, low-value work—including 87 thousand hours of finance teams' time mapping transactions to accounting categories and 1.1 million hours of employee time manually submitting expenses. In the last six months alone, we’ve saved employees over 60 working years that would have been spent on submitting receipts and filing expense reports. We are proud of every single minute that we save for customers, including accounting leaders like Kay Coolican at Clearbit, who shared, “Before Ramp, our month-end close took approximately 10 days. Now it takes three to four days—it's unbelievable.”

Money savings: Our commitment to saving businesses their most precious resources has paid off for our customers. We've saved businesses over $405 million through a combination of actionable, personalized savings insights and cashback. Each dollar saved is a dollar that can go to our customers’ bottom lines, or go towards growth and strategic investment. We continue to work hard for entrepreneurs building businesses like Nick Greenfield of Candid, who shared, “Ramp found over $250,000 in savings right out of the gate. That is far more valuable than any points program.”

The future of finance is here

These time and money savings didn’t come from automating the status quo. We achieved these outcomes by innovating both software advances and new financial products that drive real customer savings.

At Ramp we are working to create the best version of finance operations with a corporate card anchored by software that generates efficiency and savings with every swipe. We are fortunate to partner with forward-thinking finance teams who value operational rigor, especially in the current economy. Leading companies like Webflow have used Ramp to reduce their reconciliation time by 75% while also achieving better financial control and deeper spend visibility.

Each of the capabilities we launched over the last year—from flexible financing for all bills to AI-powered receipt matching integrations—are indicative of this strategy, and represent the customer-centric thinking that we use as the north star for our products. Why couldn’t businesses get 30-day payment terms when they were paying bills by ACH or check? Why were employees still spending hours uploading receipts that were sitting in their inbox?

By tackling these kinds of questions, we’ve helped our customers save more via consistent spend controls, real-time reporting insights, and improved visibility across all accounts.

Ramp is the platform for businesses that value operational and financial rigor

Ramp is helping complex, scaled modern businesses more efficiently manage more than $1 billion per month in spend—from beloved consumer brands like Barry’s Bootcamp, Caraway, and 818 to tech companies like TaskRabbit, Quora, and Attentive.

Ramp customers share a desire to be more efficient, to achieve a better bottom line, and to outperform for their employees and shareholders. As they succeed, we do too. In 2022, Ramp’s revenue closed at 4x our prior year revenue andwe believe this industry-leading growth is a direct reflection of our commitment to customers. Leaders across all industries, from those at the forefront of defense (Anduril), to self-driving cars (Waymo), to remote hiring (Deel) and beyond see the value and are picking Ramp. More than a third of our customers today are from word of mouth, demonstrating that we’re driving real outcomes that truly make a difference to businesses.

We are here to serve

Ramp is building a new way forward for finance, and we’ve only just scratched the surface. We will continue to deliver meaningful time and money savings for our customers so they can grow. Our customers all look to Ramp for the same value: run their business more efficiently. Every company has a mission—and we help them achieve that mission faster.

We are confident that our strategy is working because we see our customers win. They’re making smarter decisions via intelligent, real-time data and freeing up their teams to work on meaningful work by automating laborious, low-value tasks.

The future of finance is here, and it’s running on Ramp. Sign up today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°