Non-reimbursable expenses: What they are, types, and how to manage them

- What does non-reimbursable mean?

- What are non-reimbursable expenses?

- Reimbursable vs. non-reimbursable

- Examples of non-reimbursable expenses

- Managing non-reimbursable expense policies

- Manage non-reimbursable expenses with Ramp

Non-reimbursable expenses can catch even the most diligent of finance teams off guard. How do you decide which expenses will be covered and which won’t? Getting this right helps you keep your budget balanced and avoid surprises during an audit. A clear policy answers those questions, reduces incorrect expense reports, and saves everyone time and energy.

In this post, we'll explain what non-reimbursable expenses are, provide common examples, and discuss how to manage them and make your job a whole lot easier.

What does non-reimbursable mean?

Non-reimbursable means not being eligible for repayment or reimbursement. In a business context, it typically refers to expenses that won't be repaid by another party, usually an employer, insurance company, or other organization. These expenses fall outside the organization's approved spending guidelines and won't be covered through per diem, expense reports, or reimbursement requests.

You might see these expenses referred to by several other terms: unreimbursable, not covered, excluded expenses, out-of-pocket costs, or non-allowable expenses. Each term essentially describes the same concept—costs that remain the employee's financial responsibility.

What are non-reimbursable expenses?

Non-reimbursable expenses are costs incurred by an employee for products or services that their company won’t reimburse. These expenses are typically personal in nature, unauthorized, or otherwise fall outside the company’s approved reimbursement policy.

Several key factors drive the decision to exclude certain expenses from reimbursement. Company policies form the primary framework, establishing spending limits and acceptable expense categories based on business needs and budget constraints.

Tax regulations play an equally important role. The IRS requires businesses to distinguish between legitimate business expenses and personal costs to determine tax deductibility. Expenses of a personal nature, such as family meals during business travel or personal shopping, are excluded because they don't serve a direct business purpose.

Who decides what’s non-reimbursable?

The responsibility for determining non-reimbursable expenses typically involves multiple parties working together. Finance teams often develop the foundational policies and spending guidelines that govern expense classifications. HR departments contribute by communicating these policies to employees and handling disputes or clarification requests.

External factors also influence these decisions. IRS Publication 463 and other tax code requirements set legal boundaries that companies must follow. Industry standards and best practices may also shape company policies, particularly in regulated sectors where compliance requirements are strict.

What are the risks of misclassifying expenses?

Misclassifying expenses carries significant risks that extend beyond simple accounting errors. If you incorrectly claim personal expenses as business costs, you can be subject to compliance violations, potentially triggering IRS penalties or further scrutiny.

Tax audits become more likely when expense classifications appear questionable or inconsistent, leading to costly reviews and potential back-tax assessments. Employee disputes may arise when legitimate business expenses are incorrectly denied, creating workplace tension and administrative burden.

Clearly defining the difference between non-reimbursable and reimbursable expenses helps you manage your company finances effectively, align expenses with your policies, and more easily resolve or avoid disputes.

Reimbursable vs. non-reimbursable

Breaking down the differences between reimbursable and non-reimbursable expenses will help employees navigate company policies while protecting both their personal finances and the business’s budgets.

Reimbursable expenses are business-related costs that employees pay upfront with the expectation that they’ll later be reimbursed. These expenses directly support company operations, client relationships, or employee development within approved guidelines.

Non-reimbursable expenses are personal or business expenses that fall outside the company’s reimbursable expense policy. Employees absorb these costs themselves, even if they occur during work activities.

Here's a comparison of common reimbursable vs. non-reimbursable expenses:

Reimbursable expenses | Non-reimbursable expenses |

|---|---|

Business meals during travel; client entertainment | Personal meals and entertainment |

Business travel and lodging | Commuting to your regular workplace; personal travel during business trips |

Company uniforms or equipment | Personal clothing and accessories |

Company mobile phone | Personal phone bills |

Office supplies for remote work | Home office furniture (unless specified) |

Professional development courses (if approved); conference registration fees | Personal education, subscriptions, and memberships |

Mileage for business trips | Traffic tickets and parking violations |

Required safety equipment | Personal insurance premiums |

Why this distinction matters

The difference between reimbursable and non-reimbursable expenses is just as important for employees as it is for the business.

For employees:

- Protects personal finances by ensuring business costs don't become personal burdens

- Provides clear boundaries about what expenses qualify for reimbursement

- Helps with tax planning since reimbursed expenses typically aren't taxable income

- Enables better budgeting by separating business and personal spending

For finance teams:

- Maintains accurate financial reporting and budget allocation

- Ensures compliance with tax regulations and accounting standards

- Controls company spending through clear policy boundaries

- Streamlines expense processing with defined approval criteria

Even with an expense policy in place, employees may still have questions about what is reimbursable and what's not. Being prepared for these kinds of questions will help you communicate the company's policy more clearly, and avoid any disputes with employees.

- Can I expense my dinner if I'm working late? Generally no, unless you're traveling for business or entertaining clients with prior approval.

- What about my home internet, since I work remotely? This varies by company policy. Some reimburse a portion of internet costs, while others consider it a personal expense.

- Are parking fees at the office reimbursable? Typically no, as commuting to your regular workplace is considered a personal expense.

- What if I buy supplies for a company event? Yes, with proper documentation and pre-approval, these qualify as legitimate business expenses.

- Can I expense professional development books? Often yes, especially if they relate directly to your role and have manager approval.

- What about cell phone bills for business use? Many companies reimburse a portion of cell phone costs when employees use personal devices for business purposes.

The key for employees is checking the company's expense policy and getting approval when in doubt. When expenses clearly benefit the business and follow established guidelines, they're typically reimbursable.

Examples of non-reimbursable expenses

Business expenses can quickly add up, especially when your team is traveling for a conference, event, or sales meeting. But only business-related travel costs, meals and entertainment, and personal needs should be submitted on an expense report. Be sure to review your company’s policy on incidental expenses for a more complete list.

Travel expenses

- Airline upgrades to business or first class without approval

- Airport lounge access fees

- Airfare or hotel costs for spouses or family members

- Extra baggage for personal items

- Non-business side trips

- Optional travel insurance

- Hotel room amenities like in-room movies, minibar drinks or snacks, or other services

- Rental car upgrades or costs related to personal travel

- Parking or traffic violations

- Costs related to a personal vehicle or personal property

- Personal shopping, souvenirs, or gifts

- Personal medical expenses or medications

- Laundry or dry cleaning for personal clothing (unless on extended trips, per policy)

- Personal phone calls or excessive mobile data charges

- Fitness center fees

- Restaurant meals that exceed per diem limits

- Tips that exceed standard business guidelines

- Travel comfort items like neck pillows, blankets, or personal electronics

- Extended hotel stays for personal reasons beyond business requirements

- Personal Wi-Fi charges in hotels or during travel

Meal and entertainment expenses

- Alcohol, although there may be exceptions

- Extravagant meals

- Meals with no business purpose

- Meals or entertainment for spouses or family members

- Personal entertainment, side trips, or sporting events unrelated to the business trip

- Meals when other food is already provided (like during conferences with included catering)

- Room service charges that exceed reasonable meal costs

- Personal celebration meals like birthdays or anniversaries

- Meals during personal time or vacation days added to business trips

- Personal dietary supplements or specialty health foods

- Entertainment expenses without proper business documentation or attendee lists

- Social club memberships or dues for personal networking

Personal expenses

- Childcare, babysitting, or daycare during business trips or work hours

- Clothing or luggage costs

- Toiletries

- Non-essential electronic accessories like headphones, smartwatches, or other gadgets

- Health club or gym costs

- Personal services like dry cleaning, nail salons, or haircuts, even if during business travel

- Pet care

- Medical expenses, prescriptions, or over-the-counter medications

- Insurance premiums (health, life, disability, or property insurance)

- Debt payments, credit card interest, or loan payments

- Investment or financial planning services

- Legal fees or tax preparation services

- Home maintenance, utilities, or household supplies

- Education expenses like courses, books, or training not required for work

Other non-reimbursable costs

- Expenses purchased with reward points (airline miles, credit card rewards, etc.)

- Late fees on credit cards

- Personal gifts

- Professional continuing education tuition or fees (unless approved)

- Professional license or certification fees (unless approved)

- Political or charitable contributions, regardless of the cause

- Bank fees, ATM charges, or currency exchange fees for personal transactions

- Interest charges on personal credit cards or loans

- Subscriptions to magazines, newspapers, or streaming services

- Software licenses or app purchases not required for work

- Home office equipment or furniture not approved by the company

- Communication expenses like excessive personal phone calls or data overages

It's important to note that some of these expenses, such as professional continuing education or even gym memberships, may be reimbursable if the company's expense policy allows it. These exceptions vary from business to business and should be noted in the expense policy to avoid misunderstandings.

Managing non-reimbursable expense policies

Effective expense management starts with a clear policy. Your company's travel and expense policy should outline which expenses qualify for reimbursement and which don’t. The section on non-reimbursable expenses should include specific categories and examples, making it easier for your team to know what's acceptable to claim and what's off-limits.

Create a policy

Creating clear non-reimbursable expense policies requires careful planning and input from multiple departments to ensure comprehensive coverage and regulatory compliance.

- Define non-reimbursable expenses: List specific categories and examples that employees cannot claim for reimbursement, including personal meals, commuting costs, and non-business entertainment

- Involve key stakeholders early: Engage finance, HR, and legal teams to provide expertise on budget implications, employee relations, and compliance requirements throughout the policy development process

- Align with tax and regulatory requirements: Ensure your policy meets IRS guidelines and industry-specific regulations to avoid compliance issues and potential audit problems

- Establish approval workflows: Create clear processes for reviewing borderline expenses and handling policy exceptions, including designated decision-makers and escalation procedures

- Plan communication and training: Develop rollout strategies to educate employees about new policies, including training sessions, documentation, and ongoing support resources

- Set review and update schedules: Build in regular policy reviews to address changing business needs, regulatory updates, and employee feedback for continuous improvement

Well-crafted policies protect both employees and organizations by establishing clear boundaries while providing the flexibility needed for effective business operations.

Enforcement and auditing

Effective expense policy management requires the right tools and processes to identify non-compliant expenses while maintaining positive employee relationships and ensuring consistent application.

- Use software or tools to flag non-reimbursable expenses: Use expense management software that automatically identifies policy violations, flags suspicious submissions, and routes questionable expenses for manual review before approval

- Conduct regular audits and handle exceptions: Schedule periodic reviews of expense reports to ensure policy compliance, identify patterns of non-compliance, and address exceptions through consistent procedures and clear documentation

- Establish clear consequences and corrective actions: Define progressive disciplinary measures for policy violations, from coaching conversations for first-time offenses to formal warnings for repeated non-compliance

- Train managers on enforcement procedures: Equip supervisors with the knowledge and tools needed to identify policy violations, conduct difficult conversations, and escalate issues appropriately

- Document violations and resolutions: Maintain detailed records of policy breaches, corrective actions taken, and outcomes to ensure consistent treatment and support future policy refinements

- Create appeal processes: Provide employees with fair procedures to contest expense rejections or policy interpretations, including designated reviewers and timeline expectations

- Monitor policy effectiveness: Track metrics like violation rates, appeal outcomes, and employee feedback to identify areas where policies may need clarification or adjustment

Consistent enforcement paired with fair processes helps maintain policy integrity while preserving employee trust and ensuring equitable treatment across the business.

Educate your team

Clear communication and comprehensive training help employees navigate expense policies confidently, reducing confusion and ensuring consistent compliance across the business.

- Communicate policies clearly to all employees: Distribute written policies through multiple channels, including employee handbooks, intranet portals, and team meetings, ensuring every team member receives consistent information about expense guidelines

- Provide comprehensive training and resources: Offer interactive workshops, online modules, and quick reference guides that walk employees through real-world scenarios and help them apply policy rules to their specific situations

- Address common questions and disputes proactively: Create FAQ documents and host regular Q&A sessions to clarify confusing policy areas, share updates, and resolve misunderstandings before they become compliance issues

- Develop role-specific guidance: Tailor training materials for different departments and job functions, since sales teams, remote workers, and executives may have unique expense scenarios requiring specialized guidance

- Create accessible support channels: Establish help desks, chat support, or designated policy experts who can answer employee questions quickly and provide guidance on borderline expense situations

- Update training for policy changes: Schedule refresher sessions whenever policies are revised, ensuring employees stay current with new guidelines and procedures

- Gather feedback on policy clarity: Collect input from employees about confusing policy areas or common pain points to improve future training and policy documentation

Well-informed employees make better expense decisions, reducing administrative burden while maintaining positive relationships and ensuring smooth policy implementation throughout the business.

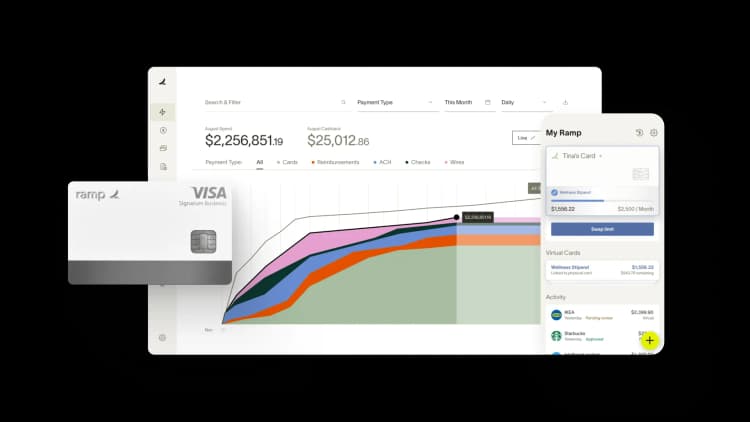

Manage non-reimbursable expenses with Ramp

Tracking non-reimbursable expenses manually is a challenge. But Ramp’s expense management software automatically flags potential non-reimbursable items, making it easier for you to maintain compliance and avoid mistakes.

Ramp offers a unified solution to simplify the entire process with customizable expense policies, real-time expense tracking, streamlined approval workflows, and detailed reporting, so you can efficiently manage and optimize your financial operations.

Try an interactive demo and see for yourself how Ramp simplifies expense management.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits