- What are expense reimbursement laws?

- Federal expense reimbursement requirements: The baseline

- States with comprehensive expense reimbursement laws

- States with conditional or limited reimbursement requirements

- What qualifies as a ‘necessary’ business expense?

- Multi-state compliance: Strategy for distributed workforces

- The cost of non-compliance

- Creating a compliant expense reimbursement policy

- Automate compliance with expense management technology

- How Ramp simplifies expense compliance for remote teams

Key takeaways:

- Federal law generally requires reimbursement only when unreimbursed expenses reduce an employee’s pay below minimum wage.

- Several states, including California and Illinois, require employers to reimburse all necessary business expenses regardless of wage level.

- Remote work expenses such as internet access, cell phone use, and required home office equipment may be reimbursable when remote work is mandatory.

- Expense reimbursement obligations depend on where the employee works, not where the employer is headquartered.

Managing employee expense reimbursements gets complicated quickly when your workforce spans multiple states. While federal law sets a narrow baseline, many states impose their own reimbursement requirements, often with different rules around what counts as a necessary business expense and how quickly employees must be paid back.

Those differences matter even more for remote teams, where costs like internet access, cell phone use, and home office equipment are part of doing the job. Understanding which state laws apply and how they interact with federal standards is essential to staying compliant and avoiding unnecessary risk.

What are expense reimbursement laws?

Expense reimbursement laws require employers to pay employees back for work-related costs they incur while performing their jobs. At their core, these laws are designed to prevent companies from shifting operating expenses onto employees in a way that effectively reduces take-home pay.

To apply these laws correctly, employers need to understand a few foundational concepts that show up repeatedly in state statutes and enforcement actions:

| Concept | What it means | Why it matters |

|---|---|---|

| Mandatory vs. voluntary | Some states legally require reimbursement for certain expenses, while in others it is left to employer discretion. | The rules depend on where the employee works, not where the company is headquartered. |

| Necessary expenses | Costs an employee must incur to perform their job duties. States with reimbursement laws generally require employers to cover these. | What counts as “necessary” varies by state and is a common source of disputes, especially for remote work. |

| Wage protection | Unreimbursed business expenses can illegally reduce an employee’s effective wages below minimum wage. | This principle underpins both federal law and many state reimbursement requirements. |

| Reimbursement vs. deduction | Reimbursement adds money to an employee’s pay to cover expenses, while deductions subtract money from wages. | These concepts are governed by different laws and are often confused in compliance reviews. |

Federal expense reimbursement requirements: The baseline

Federal law does not require employers to reimburse employees for all business expenses. Instead, reimbursement obligations arise indirectly through the Fair Labor Standards Act (FLSA), which is designed to ensure that work-related costs do not reduce an employee’s earnings below the federal minimum wage.

Fair Labor Standards Act (FLSA)

Under the Fair Labor Standards Act (FLSA), employers must reimburse expenses when those costs would cause an employee’s effective hourly pay to fall below the federal minimum wage of $7.25 per hour. For example, if an employee earns $9.00 per hour but regularly incurs $3.00 per hour in required work expenses, their effective wage drops to $6.00 per hour. Because this falls below the federal minimum, the employer must reimburse the difference.

This protection is narrow. Employees earning well above the minimum wage may have no federal reimbursement rights at all, even if they incur significant job-related costs. That limitation is the primary reason many states have adopted broader reimbursement laws.

IRS accountable plan requirements

To keep reimbursements tax-free for employees and deductible for the business, an employer’s reimbursement program must qualify as an IRS accountable plan. An accountable plan generally meets three conditions:

- Expenses have a clear business connection and are incurred while the employee is performing job duties

- Employees substantiate expenses with appropriate documentation, such as receipts or invoices, within a reasonable time frame, commonly around 60 days

- Any reimbursement that exceeds the substantiated amount is returned to the employer within a reasonable period, often around 120 days

If a reimbursement program does not meet these requirements, it is treated as a non-accountable plan. In that case, reimbursements are considered taxable wages and are subject to income and payroll taxes.

States with comprehensive expense reimbursement laws

Several states have enacted laws that go beyond federal minimum wage protections and require employers to reimburse employees for necessary business expenses, regardless of pay level. These laws generally apply to all employees working in the state, including remote workers:

| Jurisdiction | Reimbursement rule | Applicable law |

|---|---|---|

| California | Employers must reimburse all necessary expenditures and losses related to job duties. | Labor Code Section 2802 |

| Illinois | Employers must reimburse all necessary expenditures within the scope of employment. | Wage Payment and Collection Act |

| Montana | Employers must reimburse all necessary expenses incurred in performing job duties. | Mont. Code Ann. § 39-2-701 |

| North Dakota | Employers must reimburse necessary expenses or losses caused by job duties or employer directives. | N.D. Cent. Code § 34-02-01 |

| South Dakota | Employers must reimburse all necessary expenditures or losses related to job performance. | S.D. Codified Laws § 60-2-1 |

California: The strictest standard

California Labor Code Section 2802 requires employers to indemnify employees for all necessary expenditures or losses incurred as a direct result of performing their job duties. Courts interpret “necessary” broadly, making California the most demanding state for reimbursement compliance.

The law covers required work costs such as tools, equipment, and a reasonable portion of remote work expenses like internet service and cell phone use. In Cochran v. Schwan’s Home Service, the court held that employers must reimburse a percentage of an employee’s personal cell phone bill when the phone is used for work, even if the employee has an unlimited plan and does not incur extra charges.

Reimbursement must be made promptly, which is commonly interpreted as within 30 days. Failure to comply can expose employers to significant penalties, including waiting time penalties and responsibility for the employee’s attorney’s fees.

Illinois: Broad coverage with procedural requirements

Illinois law requires employers to reimburse all necessary expenditures or losses incurred by employees within the scope of their employment. Expenses must be authorized by the employer or reasonably related to the employee’s job duties.

Employees generally have 30 days to submit reimbursement requests with supporting documentation, unless the employer’s written policy allows more time. For remote employees, necessary expenses are reimbursable when remote work is required rather than optional.

Other states with broad reimbursement requirements

Montana, North Dakota, and South Dakota also impose broad reimbursement obligations, though the statutory language varies slightly by state.

| State | Statutory language | Practical takeaway |

|---|---|---|

| Montana | “All necessary expenses incurred… in the course of employment.” | Assume most required job-related expenses are reimbursable. |

| North Dakota | “All necessary expenses or losses resulting from job duties.” | Reimbursement is tied closely to employer direction. |

| South Dakota | “All necessary expenditures or losses.” | Language suggests a broad obligation similar to California. |

States with conditional or limited reimbursement requirements

Some states require expense reimbursement only under specific conditions, such as when expenses are authorized in advance, when they reduce wages below the legal minimum, or when the employer has committed to reimbursement in a policy or agreement. In these jurisdictions, reimbursement obligations are narrower than in states with broad “necessary expense” statutes.

New York

New York does not generally require employers to reimburse business expenses unless reimbursement is promised in a written policy, employment agreement, or offer letter. When an employer makes that promise, it becomes an enforceable contractual obligation, and failure to reimburse can result in penalties under state wage payment laws.

Massachusetts

Massachusetts requires reimbursement only when unreimbursed expenses would cause an employee’s pay to fall below the state minimum wage. As a result, higher-wage employees may have no statutory reimbursement rights unless reimbursement is required by company policy.

Iowa

Iowa requires employers to reimburse expenses they have authorized. If an employer denies a reimbursement request, it must provide written notice explaining the reason for the denial. Iowa law also imposes a 30-day payment timeline once a valid claim is approved.

New Hampshire

New Hampshire requires employers to reimburse employees for necessary job-related expenses within 30 days after the employee submits proof of payment. The requirement applies regardless of wage level, but only to expenses that are required for the job.

Minnesota

Minnesota law requires reimbursement for certain expenses, such as consumable supplies and uniforms, when an employee’s employment ends. The requirement is limited in scope and does not function as a broad reimbursement mandate during active employment.

Pennsylvania

In Pennsylvania, expense reimbursement is treated as a fringe benefit rather than a statutory requirement. If an employer agrees to reimburse expenses, payment must generally be made within 60 days of a valid claim.

Local requirements

Some cities impose their own reimbursement rules that go beyond state law. For example, Washington state does not broadly require reimbursement, but the city of Seattle mandates reimbursement for all necessary business and remote work expenses incurred by employees working within city limits.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

What qualifies as a ‘necessary’ business expense?

Whether an expense is considered “necessary” is the central question in most reimbursement disputes. While definitions vary by state, a necessary expense is generally one an employee must incur to perform their job duties, rather than a cost driven by personal preference or convenience.

In states with broad reimbursement laws, the focus is less on whether an expense is common and more on whether the work could reasonably be done without it.

Remote work expenses

Remote work has made this analysis more complex, particularly in states that require reimbursement for all necessary job-related costs. When remote work is required, many home office expenses are treated as necessary because they enable the employee to perform their role.

Expenses that are commonly reimbursable in stricter states include:

- A reasonable percentage of home internet service

- A reasonable percentage of a personal cell phone plan used for work

- Required home office equipment, such as a desk, chair, monitor, or keyboard

- Office supplies needed to perform job duties

For example, if an employee pays $100 per month for a personal cell phone plan and reasonably uses 30% of that plan for work, an employer in a strict reimbursement state may be required to reimburse $30 per month.

Vehicle expenses and car allowances

Vehicle-related expenses are another common area of confusion. In states with broad reimbursement laws, employers may be required to reimburse employees for mileage or other vehicle costs when driving is necessary to perform job duties, such as visiting clients or traveling between job sites.

Flat car allowances can create compliance risk if they do not reasonably reflect an employee’s actual business expenses. If an allowance is too low to cover required driving costs, the employer may still be responsible for reimbursing the shortfall, particularly in states that require reimbursement for all necessary expenditures.

Expenses that may or may not be reimbursable

Some costs fall into a gray area and depend heavily on state law, employer policy, and whether the expense is truly required to do the job. These may include:

- A portion of utility costs, such as electricity or heating

- Ergonomic or specialty equipment

- Coworking space memberships when no company office is available

Expenses that are generally not reimbursable

Even in states with strong reimbursement laws, some expenses are typically excluded because they are not considered necessary business costs:

- Rent or mortgage payments

- Daily commuting costs to a primary office

- Personal upgrades that go beyond what the job requires

Employer-required vs. employee-chosen remote work

The distinction between required and voluntary remote work is critical. If an employee chooses to work from home for convenience while a fully equipped company office is available, home office expenses are less likely to be considered necessary.

By contrast, when a company operates as fully remote or has closed its physical offices, home office and connectivity expenses are more likely to qualify as necessary because employees have no alternative way to perform their work.

Multi-state compliance: Strategy for distributed workforces

For employers with teams spread across multiple states, expense reimbursement compliance hinges on one key rule: the laws of the state where the employee works generally control, not the location of the company’s headquarters. As workforces become more distributed, applying the right rules consistently becomes a growing operational challenge.

Most multi-state employers take one of two approaches to managing reimbursement obligations.

The ‘highest standard’ approach

Some companies adopt a single reimbursement policy based on the most stringent state laws, most often California’s. This approach treats all employees as if they are subject to the strictest requirements, regardless of location.

Pros:

- Simplifies administration and reduces the risk of non-compliance

- Creates a consistent employee experience across states

- Limits the need to track changing state-specific rules

Cons:

- Increases reimbursement costs in states with minimal requirements

- May result in reimbursing expenses that are not legally required everywhere

This approach often works best for companies with a significant presence in strict states or those prioritizing simplicity over cost optimization.

State-specific policy addendums

Other employers maintain a core reimbursement policy and supplement it with state-specific addendums for jurisdictions with unique requirements. This allows companies to tailor reimbursement rules to local law.

Pros:

- Avoids over-reimbursement in states with limited or no statutory requirements

- Provides greater cost control for highly distributed teams

Cons:

- Requires more complex administration and employee location tracking

- Increases the risk of errors if policies are not updated promptly

This approach is most effective when supported by strong HR and finance systems capable of tracking employee location changes and applying the correct rules automatically.

The cost of non-compliance

Failing to comply with expense reimbursement laws can expose employers to costs that far exceed the value of the unpaid expenses themselves. Enforcement actions often combine back pay, statutory penalties, and legal fees, creating significant financial and operational risk.

Legal penalties and financial exposure

When reimbursement obligations are not met, employers may be responsible for more than simply repaying the employee:

| Consequence | Potential impact |

|---|---|

| Back pay | Repayment of all unreimbursed business expenses |

| Waiting time penalties (California) | Up to 30 days of the employee’s wages |

| Liquidated damages (FLSA) | An amount equal to unpaid wages or expenses |

| PAGA penalties (California) | Statutory penalties assessed per employee and pay period |

| Attorney’s fees | Employers may be required to cover the employee’s legal costs |

| Class or collective actions | Settlements and judgments that can reach significant amounts |

These costs can escalate quickly, particularly in states that allow employees to recover penalties and attorney’s fees in addition to back pay.

Operational and reputational impact

Beyond direct financial exposure, reimbursement disputes can disrupt normal business operations. Common consequences include:

- Lower employee trust and morale

- Increased turnover and recruiting challenges

- Negative impact on employer brand and public perception

- Time diverted from core business activities to manage complaints, audits, or litigation

Taken together, these risks make expense reimbursement compliance a material issue for both finance and HR teams, not just a payroll concern.

Creating a compliant expense reimbursement policy

A clear, written expense reimbursement policy is one of the most effective ways to reduce compliance risk. It sets expectations for employees, creates consistency in how expenses are handled, and provides documentation that can be critical if a reimbursement decision is later challenged.

An effective reimbursement policy typically addresses the following elements:

- Which types of expenses are eligible for reimbursement

- How reimbursement amounts are calculated, such as fixed rates or reasonable percentage methods

- Documentation requirements, including receipt thresholds and substantiation standards

- Submission deadlines and the process for submitting expense reports

- Approval workflows and decision-making authority

- Payment timelines, such as reimbursement on the next payroll cycle

- State-specific provisions or addendums where required

- A process for resolving disputes or denied claims

For multi-state employers, policies should be reviewed regularly to ensure they still align with current state and local laws. Even small changes in statutory language or enforcement priorities can affect whether a policy remains compliant.

Automate compliance with expense management technology

Manual reimbursement processes using spreadsheets and email are slow, error-prone, and create compliance risks. Automated expense management platforms are designed to solve these challenges.

Key features to look for in an expense management platform include:

- Mobile receipt capture with OCR technology

- Automated policy enforcement and approval routing

- Configuration for state-specific rules and limits

- Real-time compliance alerts and monitoring

- Direct integration with accounting and payroll systems

- A complete audit trail for all expenses

Seamless integration automatically syncs approved reimbursements to your general ledger and payroll, eliminating manual data entry and ensuring tax-compliant reporting.

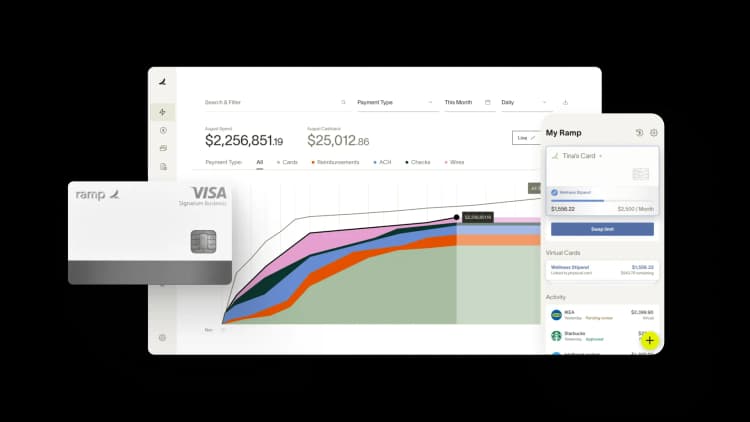

How Ramp simplifies expense compliance for remote teams

Managing expense reimbursements for remote employees across different states can quickly become a compliance nightmare. Each state has its own tax laws, reimbursement requirements, and documentation standards that finance teams must navigate. When you're dealing with employees across the U.S., keeping track of varying per diem rates, mileage reimbursement limits, and tax implications for each jurisdiction can overwhelm even the most organized finance department.

Ramp's expense management software transforms this complex process into a streamlined workflow. The platform's intelligent categorization system recognizes expense types and can apply custom rules based on employee location and state regulations. For instance, when a remote employee in California submits a home office expense, Ramp can automatically flag which items qualify for reimbursement under California's specific remote work laws.

The real game-changer is Ramp's automated policy enforcement engine. Instead of manually reviewing each expense against multiple state requirements, you can configure custom approval workflows that automatically route expenses based on amount thresholds, expense categories, and employee locations. This means your New York employee's client dinner automatically follows different approval paths and documentation requirements than your Florida employee's travel expenses, all without manual intervention.

Ramp also maintains detailed audit trails for every transaction, capturing timestamps, approvals, and supporting documentation in a centralized system. This comprehensive recordkeeping proves invaluable during tax audits or compliance reviews. Rather than scrambling to piece together receipts and approval emails across multiple states, you have instant access to organized, compliant documentation that satisfies even the strictest state requirements.

Take control of your expense management with Ramp

Beyond multi-state compliance, Ramp delivers powerful features that save your company time and money. Real-time spending insights let you spot trends and anomalies before they become problems. Automated receipt matching eliminates hours of manual data entry. And seamless integrations with your existing accounting software mean expense data flows directly into your books without duplicate work.

Ready to see the difference? Explore our interactive demo environment and discover why companies using Ramp save an average of 5% annually across all spending.

FAQs

Timelines vary by state. Iowa and New Hampshire require it within 30 days, while Pennsylvania allows 60 days. California requires "prompt" reimbursement, which is widely interpreted as 30 days. A best practice is to pay within the next pay cycle.

Yes, as long as the limits are reasonable and don't prevent employees from being reimbursed for necessary costs required by state law. Document the rationale for your limits, such as market rates for internet service in a specific area.

Generally, no. If an employee has the option to work in a fully equipped company office but chooses to work from home, the home office expenses are typically not considered "necessary." Be sure to document this arrangement in writing.

Reimbursements are not taxable if your program is structured as an IRS-compliant accountable plan. If it's a non-accountable plan, reimbursements are considered wages and are subject to income and payroll taxes.

You must update their reimbursement terms based on the laws of their new home state. This is especially critical if they move to a state with stricter requirements like California or Illinois.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits