Expense reimbursement policy tips and best practices

- What is an expense reimbursement policy?

- Why do you need an expense reimbursement policy?

- Key elements of a reimbursement policy

- Expense reimbursement policy best practices

- Compliance and regulatory considerations

- Tips for enforcing your corporate reimbursement policy

- Common challenges with reimbursing expenses

- How Ramp simplifies expense reimbursement policy enforcement

- Put your expense reimbursement policy on autopilot

An expense reimbursement policy is a set of guidelines that outlines how employees can request repayment for business-related expenses they covered with their own money. Whether you're a startup with five employees or an enterprise with thousands, having a well-defined policy keeps everyone on the same page while protecting your business from financial and legal risks.

Without clear guidelines, you'll likely face endless back-and-forth on paperwork, frustrated employees waiting weeks for reimbursements, and potential compliance issues that could trigger audits or penalties. The good news is that with the right framework and tools, you can simplify the entire process and keep all your employees happy—finance included.

In this post, we'll explain what an expense reimbursement policy is, cover best practices for creating a policy for your business, discuss tax implications, and provide tips for enforcing your policy.

What is an expense reimbursement policy?

An expense reimbursement policy is a set of guidelines that specify how employees are repaid for expenses they covered on your business’s behalf. The policy defines:

- Which expenses qualify for reimbursement

- How to report expenses

- The approval process for how and when employees will be reimbursed

- What kind of documentation they need to provide to support reimbursement requests

An expense reimbursement policy is essential for virtually every business where employees spend money on their behalf. Small and medium-sized businesses need clear guidelines for travel, supplies, and client meals, while large enterprises face more complex challenges managing thousands of employees. Nonprofits must also demonstrate that spending aligns with their mission and meets donor restrictions.

A well-designed policy creates transparency, maintains compliance, and improves financial operations while giving employees peace of mind about reimbursement procedures.

Why do you need an expense reimbursement policy?

If your employees are spending their own money for work-related expenses, you need a corporate reimbursement policy. Here are a few reasons why creating a policy is in your best interest:

- Promotes fairness and transparency: A good policy makes sure all employees are treated fairly when they spend their money for business purposes and provides transparency around how reimbursement requests are approved

- Effectively manages expenses: By setting clear guidelines around which expenses are reimbursable and to what extent, the policy helps control and manage costs

- Optimizes tax benefits: The policy aids in accurately accounting for tax-deductible expenses, ensuring your business can take full advantage of tax benefits and remain in compliance with IRS rules

- Prevents expense fraud: Through clear documentation requirements and approval processes, the policy helps you detect and prevent fraudulent expense claims

- Streamlines the reimbursement process: The policy establishes standardized procedures for submitting, reviewing, and processing expense claims, reducing delays and administrative burden for both employees and finance teams

Without a clear policy, you expose your business to expense fraud, tax compliance issues, loss of financial control, and more manual paperwork. When guidelines are unclear, employees might submit personal expenses as business costs, and morale suffers when reimbursement processes are inconsistent or delayed.

For example, say Sarah from marketing is approved for a $200 reimbursement for a "client dinner," while Tom from sales is denied for a similar expense. Meanwhile, Jake claims his gym membership as a wellness expense. Finance spends hours questioning receipts, employees grow frustrated with inconsistent decisions, and the company faces potential tax issues from unclear documentation.

A well-crafted expense reimbursement policy eliminates confusion, protects your business from fraud and compliance issues, and keeps your team happy.

Key elements of a reimbursement policy

A well-designed expense reimbursement policy protects your organization while ensuring employees receive fair compensation for legitimate business expenses. Clear guidelines prevent confusion and streamline the entire process.

Here are some key elements to include in your company reimbursement policy:

- Eligible and ineligible expenses: Define which expense categories qualify for reimbursement, while clearly stating ineligible expenses. Include specific dollar limits and pre-approval requirements for high-value items.

- Submission procedures and required documentation: Establish clear deadlines for expense report submission, typically within 30–60 days of the expense date. Require original receipts, detailed descriptions of business purposes, and any necessary supporting documentation such as meeting agendas or client information.

- Approval workflow and timelines: Create a logical approval chain based on expense amounts and employee seniority. Specify who can approve what dollar amounts and set realistic timelines for each approval stage, ensuring managers review submissions promptly to avoid payment delays.

- Payment methods and timing: Outline how employees will receive reimbursements, whether through direct deposit, check, or payroll integration. Set clear expectations for processing times, typically 5–10 business days after final approval, and communicate any delays proactively.

- Recordkeeping and audit requirements: Specify how long employees and the organization must retain expense records, usually 3–7 years depending on local regulations. Detail audit procedures and consequences for policy violations, including potential repayment of inappropriate reimbursements.

- Policy exceptions and escalation process: Provide guidance for handling unusual circumstances or expenses that fall outside standard guidelines. Establish clear escalation procedures for disputes or special situations, ensuring fair resolution while maintaining policy integrity.

An effective expense reimbursement policy balances employee needs with organizational controls. Regular policy reviews help keep your guidelines relevant and compliant with changing business requirements.

Eligible vs. ineligible expenses

Reimbursable business expenses typically include costs like travel expenses, meals during business meetings, office supplies, and mileage covered while performing job-related duties.

Here are some common types of eligible expenses you’ll find in most reimbursement policies:

- Business travel expenses: Airfare, hotel accommodations, rental cars, taxi and rideshare fares, tolls, and even parking fees for business trips and employee travel

- Mileage reimbursements: Employees who use their personal vehicle for work-related travel are usually entitled to mileage reimbursements. The standard mileage rate set by the IRS encompasses gas, wear and tear, car insurance, and depreciation.

- Office supplies: This includes pens, printer paper, light bulbs, and cleaning supplies deemed necessary to run your business

- Training and development: Out-of-pocket expenses for trainings related to employees' job responsibilities

- Meals: Business meals with clients or customers, with other employees during business meetings, or while traveling for work-related purposes

Non-reimbursable expenses tend to include:

- Personal entertainment and recreation: Movie tickets, gym memberships, sporting events, concerts, or any leisure activities that don't serve a legitimate business purpose, even if they occur during business trips

- Alcoholic beverages: Beer, wine, spirits, or cocktails purchased individually or as part of meals, unless specifically approved under company guidelines

- Personal vehicle violations: Parking tickets, speeding fines, traffic violations, or any penalties incurred while driving personal or company vehicles

- Luxury or excessive accommodations: Airfare upgrades, premium hotel suites, exorbitant meals, or upgraded services that exceed reasonable business standards when other options are available

- Personal care and grooming: Haircuts, spa treatments, dry cleaning, toiletries, clothing, or other items purchased for personal use during business travel, as these are considered normal personal care expenses

You can find a comprehensive list of reimbursable business expenses in IRS Publication 334.

Submission and approval process

A clear submission and approval process helps employees understand how to request reimbursements while giving managers proper oversight and control over company spending decisions.

The process should include:

- A step-by-step overview of how employees should submit expenses. Provide an expense report template for consistency and ease.

- A list of required documentation, such as expense receipts and invoices

- An explanation of who approves expenses and how long approval typically takes

Clear submission and approval workflows reduce admin work, speed up reimbursement timelines, and maintain financial accountability while keeping employees informed and satisfied.

Expense reimbursement policy best practices

Creating an effective reimbursement policy requires a clear understanding of your company’s needs and your employees’ spending patterns. With that in mind, here are some best practices to get you started on your expense reimbursement policy:

1. Define what qualifies as a reimbursable expense (with examples)

One of the most important purposes of your expense reimbursement policy is to control spending. That means your policy should clearly define what qualifies as a business expense, what expenses will and won’t be reimbursed, and the maximum amount you’ll reimburse by expense type.

Try to offer example scenarios so employees can visualize how they should use the policy in real life. Consider something like this:

Sarah needs to travel out of town for a client meeting. According to the policy, her transportation and lodging are both reimbursable expenses, and she has a $75 per diem rate for meals. Sarah books a round-trip flight and a hotel room for two nights and keeps all the receipts. Upon return, she submits an expense report with all her receipts attached, per the policy guidelines.

The report is then reviewed by her manager, who finds she spent $95 for meal expenses on her first day of travel, $20 more than her per diem. Sarah’s manager returns the report and asks her to amend it to reflect the policy’s travel meal guidelines.

An example scenario like this can help everyone understand the process of incurring, documenting, reviewing, and receiving reimbursements for business-related expenses.

2. Define how employees should create expense reports

This is where you establish your expense reporting process, including requirements for proper documentation of reimbursable expenses, the deadline for submitting expense reports, and procedures for disputing expense report rejections.

If you have a modern expense management automation platform, the reporting process is usually quick and painless. A manual process requires more work for everyone involved. In either case, the reporting process will be similar:

- Employee incurs an expense

- Employee prepares an expense report, with all required documentation attached

- Employee submits their expense reimbursement requests

- Report undergoes review

- Report is approved or rejected

It’s especially important that your expense reimbursement policy is clear about the need for documentation and receipts, particularly if you plan to write off deductible expenses on your taxes. Make sure to define what you’ll accept as proof of purchase, including:

- Physical receipts

- Invoices

- E-receipts

- Digital photos or scans

A well-defined expense reporting process with clear documentation requirements helps maintain compliance, accelerates reimbursements, and reduces disputes while supporting tax deduction accuracy for your business.

3. Establish your approval process and delegate responsibilities

You also need a process for expense approval and reimbursement by your finance team. Some questions to think about include:

- Who will review and approve expense reports?

- When will employees receive repayment?

- How will employees receive reimbursements—through direct deposit, cash, or some other method?

Your policy should clearly state who’s responsible for approvals to keep everything moving smoothly. Be sure to design your approval workflow in such a way that no one is responsible for approving their own expense report, which could present the risk of expense fraud.

It’s also important to clarify your timeframe for approval and reimbursement. You can include reimbursement as part of an employee’s regular paycheck or issue a separate payment, whatever works best for your organization and workflow. But to avoid frustration, make sure reimbursement doesn’t take more than a couple weeks.

4. Review and launch your policy

Once you’ve completed the documentation, you may want to run a trial with a small group of employees to see how the policy works in practice. This also gives employees the chance to provide feedback, which could reveal some areas of improvement.

After incorporating feedback, you’re ready to communicate your reimbursement policy to all employees through channels such as email, company meetings, or your company’s internal communication platform. Your policy should be clear, easy to follow, and easy to locate or bookmark so employees can find it when they need to.

From there, it’s important to periodically review the policy. Quality and compliance audits check that the policy remains relevant and that your team is actually using it. Then, you can update as necessary based on feedback or changes to company procedures.

5. Use technology to improve the process

Implementing expense management software can significantly reduce the administrative burden on both employees and your finance team. Digital platforms allow employees to snap photos of receipts on their phones, automatically categorize expenses, and submit reports with just a few taps. Many solutions also integrate with your existing accounting software.

Look for features such as automatic mileage tracking, currency conversion for international travel, and real-time spending alerts that help employees stay within policy limits. Some platforms even use AI to flag potential policy violations before reports are submitted, saving your team time during the approval process.

The right technology also provides reporting capabilities, giving you insights into spending patterns and helping you identify opportunities to negotiate better rates with preferred vendors. When employees can easily submit compliant expense reports and managers can quickly review and approve them, the entire process becomes more efficient and less frustrating.

6. Monitor for compliance and fraud

Regular monitoring helps make sure employees are following your expense policy and protects your organization from fraudulent claims. Set up periodic audits where you review a sample of expense reports to check for policy compliance, proper documentation, and any unusual spending patterns.

Pay attention to red flags such as duplicate submissions, receipts that appear altered, or expenses that seem excessive for the type of business activity. Consider implementing spending limits and approval thresholds that require additional oversight for larger expenses. When you do discover policy violations, address them promptly.

Compliance and regulatory considerations

Getting expense reimbursements right matters because the IRS has specific rules that affect both your company and employees. Under accountable plan requirements, businesses must reimburse only legitimate business expenses, require proper documentation within 60 days, and have employees return excess advances within 120 days.

When you follow these rules, reimbursements stay non-taxable for employees. Skip the requirements, and those payments become taxable income subject to payroll taxes. This means maintaining detailed records with receipts, business purposes, and dates becomes essential. During audits, the IRS expects complete documentation proving each expense was business-related and properly approved through your established process.

Aside from IRS regulations, certain states and even some municipalities require employee reimbursements by law. As you start creating your policy, you should be aware of any legal obligations you have based on your location, or locations where you have remote employees working, so you can tailor your expense reimbursement policy to meet them.

IRS guidelines and accountable plans

An accountable plan is the IRS framework that allows businesses to reimburse employee expenses without treating the repayment as taxable income. When handled correctly, this designation protects both your company and employees from unnecessary tax burdens.

Your expense reimbursement policy must meet these IRS criteria to qualify as an accountable plan:

- Business connection: Expenses must have a clear business purpose and be incurred while performing services for the employer

- Timely submission: Employees must substantiate expenses within 60 days of incurring them

- Adequate substantiation: Documentation must include amount, time and place, business purpose, and business relationship of people involved

- Return of excess amounts: Employees must return any unspent advances or overpayments within 120 days

The IRS provides detailed guidance in Publication 463. This resource outlines specific documentation requirements and explains how different expense types should be handled to maintain your accountable plan status.

Tips for enforcing your corporate reimbursement policy

After rolling out your reimbursement policy, you need to enforce it to control costs and avoid expense fraud. Here are a few tips:

- Provide regular policy training: Conduct periodic refresher sessions to ensure all employees stay current with policy requirements and procedures. This proactive approach prevents innocent violations and reinforces the importance of proper expense management.

- Use consistent approval workflows: Establish clear approval hierarchies and stick to them for every expense submission. When managers apply the same standards across all employees, it eliminates confusion and prevents claims of unfair treatment.

- Give prompt feedback on rejections: When you deny expenses, provide specific explanations about which policy requirements weren't met. This helps employees learn from mistakes and submit compliant expense reports in the future.

- Perform random expense audits: Periodically review a sample of approved expenses to make sure they meet policy standards. This practice catches issues early and demonstrates that the company actively monitors compliance.

- Define clear consequences for violations: Define specific penalties for policy violations, from warnings for minor infractions to disciplinary action for repeated or serious breaches. Having documented consequences helps managers address problems consistently.

When everyone knows the rules and follows them consistently, your expense policy becomes an effective tool for controlling costs while maintaining employee trust and regulatory compliance.

Common challenges with reimbursing expenses

While a clear and effective policy helps solve most issues, you might face some challenges when reimbursing your employees. They include:

- Non-compliance with policies: Employees submitting unauthorized expenses can cause headaches for your processes and your budget. Make sure employees have been properly trained and have easy access to the reimbursement policy for reference.

- Delays in submitting reports: Reimbursement can be held up if your team isn't submitting their expense reports in a timely manner. Identify and address bottlenecks to accelerate the process.

- Manual inefficiencies: If you’re handling your expense reports and reimbursements manually, it could take time and energy that could be better spent elsewhere in your business. Consider automating the reimbursement process.

Addressing these common challenges through proper training, timely submissions, and finance automation will create a smoother, more efficient expense reimbursement system for your organization.

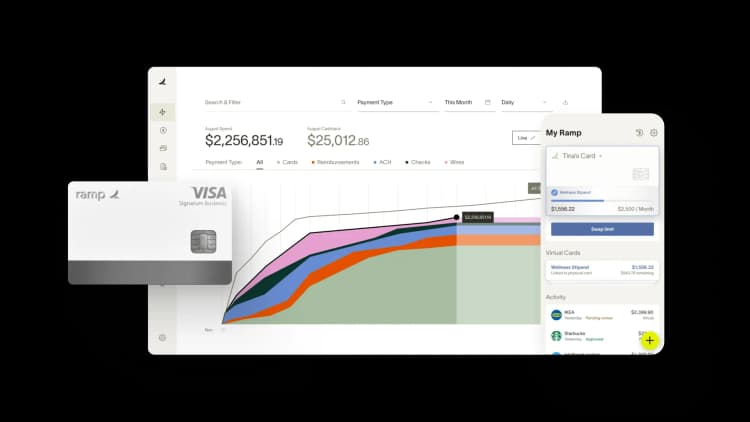

How Ramp simplifies expense reimbursement policy enforcement

Creating and enforcing expense reimbursement policies often feels like herding cats. You're juggling manual receipt collection, chasing down missing documentation, and trying to ensure employees follow spending guidelines, all while processing reimbursements quickly enough to keep your team happy. The result? Finance teams spend countless hours on administrative tasks instead of strategic work, and policy violations slip through the cracks.

Ramp transforms this chaotic process through automated expense management that enforces your policies before spending happens. With Ramp's corporate cards, you can set granular spending controls at the merchant, category, or individual level.

Need to limit software subscriptions to $500 per month? Done. Want to restrict travel bookings to approved vendors? Easy. These controls work in real time, automatically declining transactions that fall outside your policy parameters. This means no more awkward conversations about out-of-policy expenses after the fact—your policies enforce themselves.

For expenses that do require reimbursement, Ramp's receipt matching technology eliminates the manual chase. Employees simply snap a photo of their receipt, and Ramp automatically matches it to the corresponding transaction, extracting merchant details, amounts, and categories. The platform flags missing receipts and sends automated reminders, ensuring you maintain complete documentation for audit purposes. Your accounting team can review and approve reimbursements in bulk, cutting processing time from days to minutes.

Perhaps most importantly, Ramp provides real-time visibility into all spending across your organization. Finance leaders can spot policy violations as they happen, identify spending trends, and adjust policies based on actual usage data. Instead of discovering problems during month-end close, you're proactively managing expenses throughout the month. The result is a reimbursement process that practically runs itself while maintaining the control and compliance your business needs.

Put your expense reimbursement policy on autopilot

Ramp's modern finance operations platform handles the heavy lifting of enforcing your expense reimbursement policy, allowing your staff to focus on more strategic work. More than 50,000 businesses have saved 27.5 million hours with Ramp. What could your team do with that kind of time savings?

Try an interactive demo and see how Ramp can help.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits