PO number vs invoice number: How are these different?

- PO number vs invoice number: Key differences

- PO number vs invoice number: A quick comparison

- How Ramp Bill Pay connects purchase orders and invoices automatically

- Why finance teams choose Ramp for PO and invoice management

Understanding the difference between PO numbers and invoice numbers is crucial for businesses looking to avoid delays, errors, and miscommunication, especially when managing high volumes of transactions.

At its core, a PO number is a unique identifier tied to a purchase order—a document businesses use to request and authorize the purchase of goods or services. An invoice number, on the other hand, is a unique code issued by the seller on an invoice to request payment.

Let’s break down their roles and differences so you can use both effectively.

PO number vs invoice number: Key differences

Purchase orders and invoices serve distinct yet complementary roles in managing purchases and payments. Here, we’re zeroing in on the PO and invoice numbers specifically—but if you’re looking for a broader breakdown, here's how POs and invoices differ.

What is a PO number?

A PO number is a unique identifier assigned to a purchase order. It helps track orders, manage budgets, and maintain transparency between buyers and suppliers. Businesses use PO numbers to ensure that purchases are authorized and match internal records, making financial oversight smoother.

For a deeper dive into purchase orders and their significance, check out our in-depth guide on POs, but to keep it short, a PO numbers matter because of:

- Budget control: Ensures purchases are pre-approved, preventing overspending.

- Order tracking: Makes it easy to reference and monitor the status of orders.

- Reduced errors: Avoids confusion by aligning orders with deliveries and invoices.

- Audit trail: Provides documentation for financial audits and internal reviews.

For example, imagine your company orders 500 office chairs. By assigning a PO number, you can quickly track the order status, confirm delivery, and match the PO to the corresponding invoice for payment. This process minimizes billing discrepancies and keeps records organized.

What is an invoice number?

An invoice number is a unique identifier included on an invoice issued by the seller to request payment. Invoice numbers ensure accurate payment tracking and make it easy to reference past transactions during audits or disputes.

In short, here’s why invoice numbers matter:

- Payment tracking: Helps businesses monitor which invoices have been paid, are pending, or overdue.

- Recordkeeping: Ensures a clear history of financial transactions.

- Dispute resolution: Simplifies identifying and resolving payment issues.

- Cash flow management: Supports accurate financial planning by tracking payment timelines.

For instance, if a supplier sends an invoice for the 500 office chairs mentioned earlier, the invoice number helps your AP team confirm the payment request aligns with the original PO and the received delivery. This alignment ensures accurate, timely payments.

PO number vs invoice number: A quick comparison

PO numbers come first, initiating the purchasing process and ensuring authorization, while invoice numbers arrive later, serving as formal payment requests. Together, they help businesses track transactions end-to-end, reduce errors, and maintain organized financial records.

For businesses, aligning PO and invoice numbers is like connecting two critical pieces of a puzzle—ensuring orders are fulfilled accurately and payments are made seamlessly.

Here’s a summarized breakdown of what we reviewed:

Criteria | PO number | Invoice number |

|---|---|---|

Purpose | Tracks purchase authorization | Tracks payment requests |

Issuer | You (the buyer) issue the PO number to the seller. | The seller assigns the invoice number. |

Timing | Before purchase | After goods/services are delivered |

Fixed status | Fixed throughout the order lifecycle | Fixed once the invoice is issued |

Relation to transaction | Initiated the purchase process | Finalized the payment process |

Accounting | Helps in budgeting, planning, and managing procurement processes | Helps in AP processes, payment reconciliation, and financial reporting |

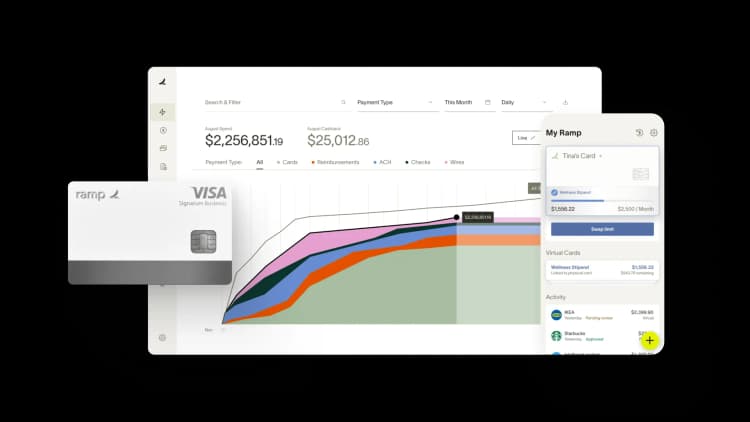

How Ramp Bill Pay connects purchase orders and invoices automatically

Ramp Bill Pay is an autonomous AP platform that eliminates the manual work of matching invoices to purchase orders. Four AI agents handle transaction coding, fraud detection, approval summaries, and card-based payments—while automated PO matching verifies every line item before payment goes out. With up to 99% accurate OCR capturing invoice and PO details instantly, Ramp processes invoices 2.4x faster than legacy AP software1.

Use Ramp as a standalone AP solution for PO and invoice management, or connect it with corporate cards, expenses, and procurement for unified spend control. Teams using Ramp also report up to 95% improvement in financial visibility2.

Top features

Manually reconciling purchase orders against invoices wastes time and lets discrepancies slip through. Ramp's touchless, autonomous automation handles the entire workflow:

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Four AI agents: Automatically code transactions using historical patterns, detect fraud before payments go out, generate approval summaries with vendor history and pricing analysis, and complete card-eligible payments directly in vendor portals

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Procurement: Manage purchase requests and vendor approvals before spend happens

- Roles and permissions: Enforce separation of duties with granular user controls

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- AI-assisted GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Reconciliation: Close books faster with automatic transaction matching

Why finance teams choose Ramp for PO and invoice management

Ramp sets the bar for touchless AP—accurate matching, clean data capture, and faster processing without the manual reconciliation. Run it as a dedicated PO-to-payment solution or integrate it across your spend stack for complete oversight.

Over 2,100 finance professionals on G2 rate Ramp 4.8 out of 5 stars, ranking it the easiest AP software to use. Teams highlight accurate PO matching, fewer invoice errors, and streamlined closes as top reasons they switched.

Ramp's free tier includes core AP automation. Ramp Plus unlocks advanced matching and approval features at $15 per user per month, with enterprise pricing available on request.

PO and invoice matching shouldn't be manual. Ramp automates it. Learn more about Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits