Mastering business finances: How to pay bills on time

- Why is managing small business finances so important?

- 8 tips for managing business finances

- Best practices for paying bills on time

- How Ramp’s AP automation simplifies on-time payments

- Why finance teams choose Ramp

Managing small business finances can feel like juggling a dozen priorities at once. From tracking expenses to forecasting cash flow, staying on top of your money is a balancing act—and paying bills on time is a crucial piece of the puzzle.

With money constantly flowing in and out of your business, it’s easy to lose track of what’s due and when. This is where a solid financial plan comes in. By creating systems to stay organized, you can avoid late payments, maintain healthy vendor relationships, and build a strong financial foundation for your business.

Below, we’ll share actionable tips for mastering small business finances.

Why is managing small business finances so important?

Small business success hinges on financial control and paying bills on time is a clear sign of financial health, keeping vendors happy and building strong credit. Late payments, on the other hand, can lead to penalties, strained relationships, and supply chain disruptions—especially for small businesses with tight cash flow.

With the right plan and tools, small businesses can turn financial management into a strategic advantage.

8 tips for managing business finances

Managing business finances is about building systems that work for your business today and scale with it tomorrow. These tips are straightforward, actionable, and designed to keep your finances on track.

1. Separate personal and business finances

Blurring the line between personal and business finances can cause major headaches. A dedicated business bank account and credit card make it easier to manage cash flow, track expenses, and avoid financial confusion. It’s a simple step that prevents complications come tax season and keeps your records crystal clear.

2. Create a realistic budget

Your budget is the financial roadmap for your business. Start by outlining your fixed and variable costs, accounting for any seasonal fluctuations or one-off expenses. The key is to make it realistic—overestimating income or underestimating expenses can set you up for failure.

3. Categorize and track all expenses

Knowing exactly where your money goes gives you the power to cut unnecessary costs and optimize spending. Categorize every expense, from rent to office supplies, and use accounting software to keep everything organized. Regularly reviewing these categories can reveal trends and opportunities for savings.

4. Understand and chart your cash flow

Cash flow is the heartbeat of your business. Create a cash flow statement to visualize how money moves in and out of your business. Understanding these patterns lets you plan payments effectively and avoid shortfalls when bills are due.

5. Choose and implement the right accounting software

Not all accounting software is created equal. Find a tool that matches your needs—whether that’s tracking invoices, automating payroll, or integrating with payment platforms. Good software saves time, reduces errors, and makes managing your finances far less daunting.

6. Build an emergency fund as a safety net

Unexpected expenses happen. An emergency fund acts as a financial cushion, protecting your business from cash flow shocks like equipment breakdowns or unexpected market downturns. Setting aside even a small percentage of your monthly revenue can provide peace of mind when the unexpected strikes.

7. Plan for and pay business taxes on time

Missed tax payments can result in penalties that drain your resources. Stay on top of deadlines by setting aside funds throughout the year and using tools that simplify tax tracking. Hiring a tax professional or using dedicated software can help ensure nothing is missed.

8. Reinvest profits into the business

Growth doesn’t happen without reinvestment. Use profits strategically to upgrade technology, expand your team, or boost marketing efforts. Reinvesting in your business helps ensure its long-term success while maintaining financial stability.

Every smart financial move you make today builds a stronger foundation for your business tomorrow. These tips are your toolkit for creating a business that’s resilient, agile, and ready for growth.

What's the difference between billing and invoicing?

While often used interchangeably, billing and invoicing serve different purposes. Billing is the broader process of requesting and tracking customer payments, including setting up pricing models and managing accounts. Invoicing is the specific document—a formal payment request for goods or services delivered.

Best practices for paying bills on time

In addition, paying bills on time is essential for protecting your financial reputation. Here are a few best practices to use alongside our tips for managing small business finances:

- Create a payment schedule: Organize all bills according to their due dates and amounts. Use spreadsheets or software to avoid missing payments.

- Set up reminders: Use digital calendars, to-do list apps, or software notifications to stay on top of payment due dates. Automated reminders help avoid missing important deadlines, especially for busy business owners managing multiple invoices.

- Enroll in autopay: Automate recurring payments to avoid missing deadlines. Autopay ensures bills are paid on time, even if you're too busy or forget.

- Double-check payment accuracy: Always verify payments for accuracy to avoid costly errors. AP management software can scan invoices and eliminate manual entry mistakes, ensuring all records are accurate and up-to-date.

- Negotiate payment terms: Talk to vendors about extending due dates or securing early payment discounts. Flexible terms can reduce financial pressure, while alternatives like invoice factoring can help maintain cash flow and timely payments.

- Monitor cash flow: Track cash flow regularly to ensure enough funds are available for bills. Spend management tools like Ramp provide real-time tracking, helping you avoid overspending and predict future expenses more effectively.

- Automate what you can: Leverage AP automation tools for invoice matching, reminders, and recurring payments. Automating routine tasks reduces human error and frees up time, making it easier to ensure bills are always paid on time.

Falling behind on payments can lead to costly late fees, interest charges, and even legal consequences, adding unnecessary strain to your finances. Beyond the immediate costs, late payments can damage vendor relationships and lower your credit score.

That’s why setting up organized systems, including automated bill payments, is essential for staying ahead of your financial obligations.

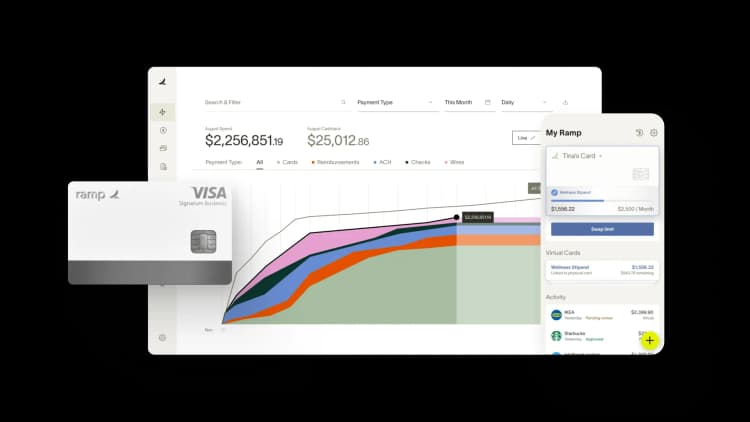

How Ramp’s AP automation simplifies on-time payments

Paying invoices doesn’t have to be a time-consuming or stressful process. With the right tools, managing due dates and avoiding late fees becomes seamless and efficient.

Ramp Bill Pay’s autonomous AP platform streamlines payment processes by eliminating data entry and consolidating all payments in one place. Four AI agents handle transaction coding, fraud detection, approval summaries, and card-based payments—processing invoices from capture to payment without manual intervention. With up to 99% accurate OCR extracting every line item, Ramp moves invoices through your workflow 2.4x faster than legacy AP software1.

Use Ramp as a standalone invoice automation solution or connect it with corporate cards, expenses, and procurement for unified spend visibility. Teams on Ramp report up to 95% improvement in financial visibility2.

Ramp's touchless, autonomous automation provides:

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Approval agent: Generates comprehensive summaries with vendor history, contract details, PO matching, and pricing comparisons—then recommends approval or rejection

- Fraud prevention agent: Flags suspicious activity before payments go out, including unexpected banking detail changes, suspicious vendor email domains, and unverified accounts

- Custom approval workflows: Build multi-level approval chains with role-based routing tailored to your org structure

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Roles and permissions: Enforce separation of duties with granular user controls

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Batch payments: Process multiple vendor payments in a single batch

- International payments: Send wires to 185+ countries with global spend management support

- Recurring bills: Automate regular payments with recurring bill templates

- Real-time ERP sync: Connect bidirectionally with NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- Reconciliation: Close books faster with automatic transaction matching

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Vendor onboarding: Collect W-9s, match TINs, and track 1099 data directly in the platform

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Ramp Vendor Network: Access verified vendors who skip additional fraud checks for faster payments

Why finance teams choose Ramp

Ramp delivers touchless invoice automation—accurate capture, intelligent coding, and faster approvals without the manual overhead. Run it as a dedicated AP solution or integrate it across your financial stack for end-to-end control.

Over 2,100 finance professionals on G2 rate Ramp 4.8 out of 5 stars, making it the easiest AP software to use. Teams highlight faster processing, fewer errors, and cleaner reconciliation as top reasons they love Ramp.

Ramp's free tier includes core AP automation. Ramp Plus unlocks advanced features at $15 per user per month, with enterprise pricing available on request.

Invoice management shouldn't be manual. Ramp automates it.

Try Ramp's invoice management software.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits