Enterprise ready: Announcing our Built for NetSuite integration

- Close your books 5x faster

- Built for enterprises: Multi-entity support and other advanced features

- Get Ramp for free

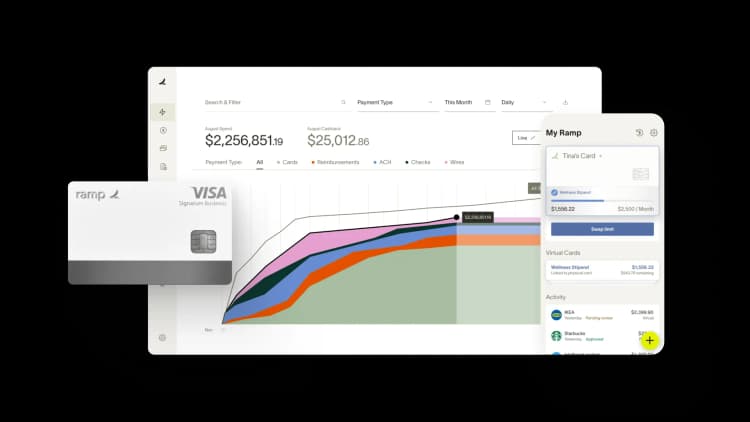

We’re proud to announce that Ramp is an official Built for NetSuite partner. When you use our NetSuite integration, you can have full confidence that our platform meets the high standards of enterprise security, data privacy, and product quality required for NetSuite partners. Ramp and NetSuite is a powerful combination that allows you to automate your accounting reconciliation for speedier month-end close.

Close your books 5x faster

One of the biggest wastes of time for finance teams is manual coding of transactions. Use Ramp with NetSuite to streamline much of this tedious work.

Our integration brings your NetSuite accounting fields into Ramp, such as category, department, location, and more. You can then create smart mapping rules within Ramp to automatically code card transactions based on MCC codes. Review your coded expenses in our accounting dashboard, then sync them to your GL in one click.

"You can have full confidence that our platform meets the high standards of enterprise security, data privacy, and product quality required for NetSuite partners"

You can also pre-code accounting fields on Ramp cards before you issue them to save time. This is helpful for employees whose expenses span across multiple departments, locations, and projects—issue a card for each set of expenses that should be coded separately. Or require cardholders to code classify their own transactions before they submit their expenses, based on the expense policy that their card is tied to. When it's time to close your books, the system will flag any changes they make so you can review their edits before approving and syncing their transactions.

We offer all of these options to help you eliminate manual coding and streamline the reconciliation of your expenses with speed and precision.

Built for enterprises: Multi-entity support and other advanced features

What makes our integration especially powerful for enterprises is our built-in support for multiple entities, something not offered by any other NetSuite integrations. If you’ve got multiple subsidiaries, construction sites, or properties, our software allows you to easily sync transactions across unlimited entities, all within a single dashboard. You can also split transactions directly on Ramp across multiple categories, locations, departments, projects, and more.

Beyond coding automation, our spend management platform is purpose-built to save you valuable time on other day-to-day financial operations. Employees can use Ramp to submit receipts for reimbursements instead of juggling multiple disjointed expense solutions. That means you can track card transactions and reimbursements in a single dashboard. Seamlessly pay team members with next-day ACH payments and sync these payments automatically to your GL.

Another way we save you time is with our Slack integration. Manage card approvals and get spending alerts directly in Slack.

Best of all, with Ramp, you’ll no longer spend time chasing employees for receipts and memos. The software automatically sends reminders to your team members to collect the info required by your expense policies. They can easily submit receipts and memos via text or email, which get automatically matched, verified, and synced to your GL in real-time.

When it comes to reporting, get a full view of transactions across the entire company in real-time. Easily filter by department, vendor, and employee directly in Ramp and immediately pinpoint areas where spend is increasing. Export your company’s entire purchase history and get a full audit trail of spend requests, approvals, and reviews.

On top of accounting automation, Ramp offers the most sophisticated card controls in the industry to block out-of-policy spend. You can set:

- Recurring spend limits

- Transaction amount limits

- Category and merchant restrictions

- Auto-locking capability

- Multi-step approval workflows for card and reimbursement requests

“No other card company has tried to help us spend less. That alignment is incredible when your business is trying to grow and make a profit at scale.” - Aron Susman, CFO at Ro & NetSuite customer

Get Ramp for free

Start using the most advanced corporate card and spend management software available today to automate your NetSuite accounting. Your team will love the efficiency gains and time they get back to focus on more strategic tasks. Learn more about Ramp’s NetSuite integration.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits