How to avoid common NetSuite implementation problems

- What causes ERP implementation failures?

- How to avoid ERP implementation failures

- Simplify your tech stack with Ramp

I joined Ramp as its first controller in March 2021 and initiated Ramp's transition to NetSuite with a small implementation team after six months on the job.

While the move was planned far in advance, it was a very busy time for our team as we had recently implemented a new payroll processor and gone through our first Big 4 audit. I contemplated delaying the migration to 2023 or implementing some temporary fixes, e.g., a parallel close software. I even created hundreds of new accounts in our old accounting software to better allocate expenses between products and departments, in addition to restating many prior periods (which, in retrospect, was a silly task).

However, after completing our first month-end close with NetSuite, I can breathe easy knowing that all the work was worthwhile as it ended up being beneficial for establishing a strong financial reporting process.

In this article, I’m highlighting lessons learned from our transition experience here at Ramp, as well as from experts at Countsy and Myers-Holum, who specialize in NetSuite implementation. We’ll cover some of the most common mistakes companies make when moving to NetSuite, what you can do to avoid them, and best practices for setting yourself up for success.

What causes ERP implementation failures?

Enterprise resource planning (ERP) implementation failures often come down to poor planning, rushed execution, or a lack of alignment across teams for the go-live date. One of the most common issues is starting without clear goals or a defined project scope. When teams don’t align on KPIs, timelines, or success metrics, the project can spiral into scope creep, miscommunication, and missed deadlines. Add in unrealistic expectations around budget or go-live timing, and it becomes even harder to deliver a system that actually supports long-term growth.

Another major culprit is data quality. Migrating messy, inconsistent, or incomplete records into your ERP only sets you up for reporting headaches down the line. It’s worth investing time upfront to audit, clean, and structure your financials—before you even start configuring NetSuite. But even with the right data, implementations can fall short if they’re siloed. ERP systems affect more than just finance. Without cross-functional input from operations, procurement, and leadership, the end result often fails to reflect how the business actually runs.

What are the 5 biggest challenges of ERP implementation?

The five biggest challenges of ERP implementation are delaying the migration too long, which increases costs and complexity; taking shortcuts during setup, leading to poor controls and audit risks; a lack of direct integrations, which creates manual work and data errors; unclear internal roles and approval structures, causing misalignment across teams; and dirty or unstructured financial data, which leads to issues during migration and post-launch reporting.

Change management is another hurdle. If your team doesn’t understand how the new system benefits them—or if they’re not properly trained—adoption will lag. Over-customization compounds the issue, creating complexity that makes it harder to scale or troubleshoot later.

How to avoid ERP implementation failures

Avoid these common mistakes when transitioning to NetSuite. Here’s how to work around ERP implementation problems.

Time your ERP migration before it’s too late

Waiting too long to make the leap can cost you both time and money. Moving to NetSuite earlier than you think can help you for three main reasons:

- You have less data to migrate and can start creating NetSuite records earlier

- You have fewer business processes that will be affected by the transition

- If you transition at a later stage, after you’ve fully outgrown more basic systems, the implementation will be much larger and take longer to complete

“If you’re an institutional venture-backed company that is scaling fast and raising more money, staying on a more lightweight accounting platform can become problematic. The longer you delay moving to NetSuite or an equally sophisticated platform, the more expensive and disruptive it can be,” says Gavin Block, Strategic Growth Lead, Countsy. “We prefer to move our clients to NetSuite on day one, even if they’re not using anywhere near the full functionality.”

One common pitfall is failing to define a clear project scope from the beginning. Without alignment on priorities, timelines, and success metrics across stakeholders and implementers, teams often encounter scope creep, internal misalignment, and stalled momentum.

Avoid shortcuts that undermine your ERP foundation

Shortcuts might seem attractive for completing the implementation by a certain time, but this can mean trouble down the road. Bypassing certain steps can mean that there isn’t a lot of segregation of duties, e.g., everyone on the team has administration access, which is usually a recipe for disaster (users can create/delete any transactions they want) and you're lacking approvals or review controls which might lead to inaccuracies and errors. These missteps can also create significant challenges when preparing for an audit.

“When companies that have taken shortcuts come to us, one of the biggest things we start with is taking a look under the hood and ensuring that all of the proper settings are in place and turning off features that they’re just not using,” says Colman Edwards, Director of Technology, Countsy.

By implementing carefully in phases—starting with financials, working on additions, completing the AR setup, and processing everything you have—you’ll ensure nothing is missed.

ERP implementations benefit from structured planning and agile execution. Even when you're under time pressure, it's worth investing in phased rollouts, detailed timelines, and internal ownership to reduce risk and keep teams focused on long-term value.

How hard is it to implement NetSuite?

Implementing NetSuite can be challenging without a proper plan, especially as your business scales—but with the right implementation partner, clean data, and phased rollout, the process becomes much more manageable. Success depends on your internal readiness and willingness to adopt best practices.

Integrate the right tools to reduce manual work

If a company isn’t using tools that directly integrate with NetSuite for the switch, they’re setting themselves up for a headache. Using a regular corporate card, sans automation, means there could be the possibility of going through multiple steps (pulling transactions, building out and coding them in a workbook, and importing them) and subsequently realizing that the memos or proper supports weren’t included. Your team member is then required to delete everything and reimport from the start. Using an automated tool for book keeping with direct integrations, like Ramp, reduces the likelihood of errors. Ramp has a direct integration with NetSuite across different offerings, such as cards and accounts payable, and can facilitate controls related to approvals and categorization of expenses.

Whenever possible, use purpose-built integrations or native connectors to minimize manual uploads and ensure consistency across systems.

Build cross-functional alignment and controls

From an internal readiness and change management perspective, your organization's leaders need to understand that the migration will affect not just the finance department. Departments across the board, e.g., finance, operations, procurement, etc., will also be impacted. By simply siloing and focusing on your own department, you’ll potentially create systems that aren’t good for the organization as a whole.

“Understand that there’s a potentially better way of doing things, and approach the transition process with your implementation partner in a systematic way. They can help you see your blind spots and introduce you to best practices that you may not be familiar with,” says Hamza Zia, Director, Solution Architecture, Myers-Holum.

Zia explains his recommendations for establishing org levels to ensure a successful transition:

- Level 1: Steering Committee. Creating a steering committee and meeting monthly can help leadership understand what’s happening with the implementation so they’re fully informed, as opposed to being blindsided via a lack of communication.

- Level 2: Project manager and administrator. Have a project manager or coordinator one level down who can work with an administrator you’ve elected internally. This administrator doesn't need to have NetSuite experience or be particularly tech-savvy. They simply need to understand the current business because, ultimately, they're taking that information, transposing it into NetSuite, and managing the platform for growth.

- Level 3: Business process owners. The business process owners are people within a certain role at the organization. These individuals know their operations best, meaning they can tell the implementation partner what is needed for a successful implementation and workflow process. Bridging this business process input with NetSuite-specific best practices is the gateway to success.

Many teams underestimate the effort required to drive internal adoption. Implementation success depends on consistent communication, clear roles, and ensuring that every department—not just finance—is involved in shaping the system.

Migrate clean, audit-ready financial data

Make sure your books and data are clean and complete before embarking on a transition. Bad data is still bad, even if you move it from one system to another.

“We’re not going to import really bad accounting records from whatever legacy system they have into NetSuite,” explains Block. “So we end up being the ones who have to do the cleanup prior to the migration, which can amount to a significant cost. We recommend that even just basic bookkeeping is better than nothing.”

You may want to consider giving your implementation partner temporary or read-only access so they can get a sense of not just the quantity of data but the quality of the accounting.

If you have an auditor or have been audited in the past, make sure to include your auditor in the process since they will need to verify and test that your data is properly migrated to NetSuite. They can also help you create templates and review your books in advance to ensure that the data is accurate and complete. Here’s what to expect and how to stay ahead if you’re preparing for your next (or first!) audit.

Don't assume your existing data is migration-ready. Clean it up, standardize formats, and test smaller batches before going all in.

Define reporting needs and segmentations early

Internal readiness is key for moving to NetSuite. If you’re moving from a platform with fewer customization options, you’ll find that you have many more classifications at your disposal in NetSuite. Take time to look at your current chart of accounts and segmentation structure and work backward. Decide on what you really need from a reporting standpoint and ensure your data is structured appropriately so you can start on the right foot.

One area of focus should be your master data migration. Zia notes that his team often sees many people from more basic systems solely departmentalizing on the chart of accounts, so they have salaries for G&A, salaries for R&D, salaries for sales and marketing, etc.

“We can take that, shrink their chart of accounts, and allow for a more slice and dice approach by taking redundant information baked into your general ledger and allowing you to segment that out—for example, into different departments outside the general ledger. This data approach with NetSuite will allow for a more flexible growth strategy with your ERP. In addition, this exact same strategy can also go towards your revenue structure as well.” Zia also states, “Confirm your current business processes around AP, AR, and if you have inventory, make sure you understand your current steps to mimic them in NetSuite. If you can't, it’s likely for the better, and you should adopt NetSuite best practices! It’s also key to examine additional workflows with your implementation partner that can be set up to automate some of the processes.”

Prioritize ERP essentials over nice-to-haves

If you’re focusing on what you’d like to have versus true business needs, you’re hindering your implementation’s effectiveness.

“Everyone wants that shiny new Tesla when they walk into the dealership, but it’s crucial to look beyond the bells and whistles and focus on the essentials,” says Zia. “Let’s say you’ve been on your existing systems for 20 years and have carved out bespoke functionality for your org. As you transition to a new system, you have to understand the concept of needs versus wants, meaning you need it to perform your day-to day business operations instead of simply wanting it.” The wants can be positioned for a future phase two so that in phase one, you’re going live with the most pertinent components necessary for success. Placing your priorities into buckets and phasing them out can help you avoid implementation fatigue and, more importantly, meet timelines to realize ROI.

Treat the ERP implementation process as a strategic opportunity

A transition is your opportunity to extract the data, closely examine it, and ask yourself strategic questions. Do you really want to put this data directly into NetSuite and repeat the same mistakes and shortcuts you made previously? Or is it worthwhile to take the time to carefully examine the data and work with your implementation partner to identify the best ways to position and streamline the data?

Instead of reluctantly moving to NetSuite, understand that it offers your team the chance to build out flexible new structures (e.g., GL, vendor, etc.) so that whatever happens next, your organization will have the fundamental accounting books and reports needed to support you through troughs and spikes. A finance transformation mindset can make all the difference.

By recognizing and avoiding the mistakes above, you’ll prime your finance team for an easy NetSuite transition. Remember to prioritize the most integral components that will contribute to your business’s success, ensure that your books are clean, and, above all, embrace the migration with an open mind.

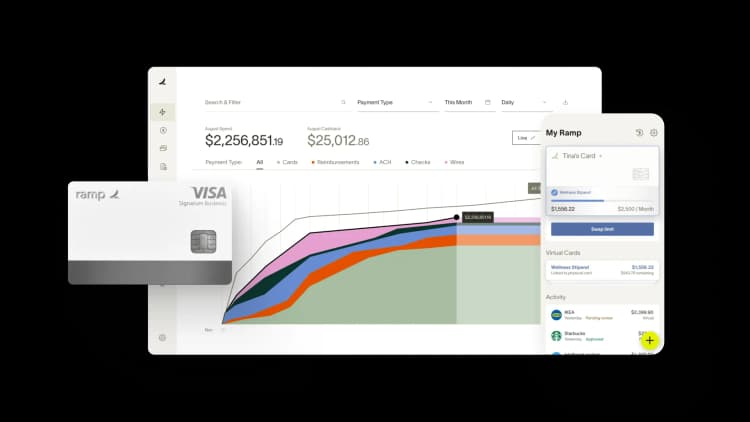

Simplify your tech stack with Ramp

ERP implementation isn’t just an IT or finance project—it’s a company-wide transformation. The more you prepare up front with clear objectives, flexible infrastructure, and cross-team ownership, the smoother your transition will be.

At Ramp, our journey to a successful NetSuite implementation taught us how critical it is to lay the right financial foundation—one that scales with your company’s growth, streamlines your processes, and supports fast, accurate reporting. That’s why we’ve invested heavily in building a deep, direct integration with NetSuite to make your transition and daily operations as seamless as possible.

With bi-directional syncing, real-time reconciliations, and multi-entity support, Ramp eliminates tedious manual work and gives finance teams the confidence to close their books faster—without compromising on accuracy. You can manage expenses, reimbursements, vendor payments, and purchase orders all in one place, with controls and approvals built in.

Thousands of companies use Ramp’s Built for NetSuite-certified integration to unify accounting, automate classifications, and reduce implementation headaches. Whether you’re planning your first NetSuite migration or looking to optimize your current setup, Ramp gives you the tools to move faster, stay compliant, and unlock smarter financial operations from day one.

Get started with Ramp’s NetSuite integration.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits