Are unreimbursed employee expenses deductible?

- What are unreimbursed employee expenses?

- What were the previous rules?

- Can a W-2 employee write off business expenses?

- Who can deduct unreimbursed business expenses?

- What unreimbursed employee business expenses are tax-deductible?

- How to claim employee expense deductions

- Publication 529 and other IRS resources

- How Ramp simplifies tracking and managing unreimbursed employee expenses

Unreimbursed expenses are any business costs employees cover that aren't repaid by their employer. Broadly speaking, employees used to be able to write off these expenses on their income taxes.

But since the Tax Cuts and Jobs Act (TCJA) of 2017, the question of whether unreimbursed employee expenses are deductible has gotten more confusing. Here, we'll clarify what unreimbursed expenses are, explain the rules for who can deduct them, and provide tips for business owners and employees on this shifting topic.

What are unreimbursed employee expenses?

Unreimbursed employee expenses are any business costs employees pay out-of-pocket that their employer doesn’t reimburse. They can include any regular and necessary business expenses, such as costs related to business travel, tools and equipment, and more.

So what’s the difference between reimbursed and unreimbursed expenses? Both types of expenses are for business costs that employees pay with their own money. But any business expenses that are covered by your company’s reimbursement policy are considered reimbursable expenses and are repaid by the company.

Unreimbursed business expenses are not repaid to the employee. Before 2018, these expenses could be written off, but the TCJA changed the rules about what you can deduct, suspending certain deductions until 2025. Since then, the One Big Beautiful Bill Act has made these changes permanent.

What were the previous rules?

Before the TCJA suspended many miscellaneous itemized deductions starting in 2018 (and the One Big Beautiful Bill made many of these suspensions permanent), all W-4 employees could deduct unreimbursed employee expenses as miscellaneous itemized deductions on their federal tax returns.

But claiming those deductions wasn't really a great replacement for an expense reimbursement policy to begin with. Here’s why:

- Employees had to itemize deductions to benefit from the tax write-off

- These miscellaneous itemized deductions were subject to a 2% floor, meaning employees could only deduct the amount exceeding 2% of their adjusted gross income (AGI)

- A tax deduction isn't a dollar-for-dollar reduction on the employee's tax bill. Instead, such expenses reduce their taxable income. So, for example, a $1,000 tax deduction would save an employee in the 25% tax bracket about $250 in taxes.

Can a W-2 employee write off business expenses?

With the passage of the TCJA and the One Big Beautiful Bill Act, most employees can no longer offset their federal taxable income with unreimbursed business expenses. But if you file state taxes in Alabama, Arkansas, California, Hawaii, Maryland, Minnesota, New York, or Pennsylvania, you may still be able to deduct your reimbursed employee expenses.

Tax rules and regulations are ever-evolving, so if you live or work in one of these states, be sure to discuss with a tax professional to make sure you’re following the proper guidelines.

Who can deduct unreimbursed business expenses?

A handful of workers, including armed forces reservists, educators, and others, can still deduct unreimbursed employee expenses on their income tax returns. Here’s the full list of exceptions:

Armed forces reservists

U.S. Army, Navy, Air Force, Marine Corps, Coast Guard, National Guard, and Reserve Corps members can deduct certain unreimbursed travel expenses.

Qualified performing artists

Actors, musicians, and other types of performing artists can deduct unreimbursed business expenses if they meet the following criteria:

- Have at least two employers during the tax year

- Earn at least $200 from each employer

- Have $16,000 or less in AGI

- Have qualified expenses related to the performing arts exceeding 10% of their gross income from the performing arts

Fee-basis state or local government officials

Salaried government employees can't deduct unreimbursed employee expenses, but state or local government workers who receive fee-based compensation rather than a salary can.

Employees with impairment-related work expenses

Workers with physical or mental disabilities can deduct the cost of impairment-related work expenses that are necessary for them to be able to work. Impairment-related work expenses include any ordinary and necessary costs associated with attendant care services at work or other accommodations that are necessary so you can work.

Educators (special rules)

Teachers and other K–12 educators and administrators who are in school at least 900 hours during the school year can also deduct up to $300 in job-related expenses, such as classroom supplies.

What unreimbursed employee business expenses are tax-deductible?

Unreimbursed employee expenses must meet the same criteria as any other deductible business expense. According to IRS rules, deductible expenses must be both ordinary and necessary. Ordinary expenses are common and accepted in the trade or industry. Necessary expenses are helpful and appropriate for your trade or business.

Some common employee business expenses that meet the “ordinary and necessary” criteria include:

- Business travel: Costs for transportation, lodging, and incidental expenses during business trips

- Tools and equipment: Tools, equipment, and other materials needed to perform your work

- Training and education: Fees for professional development courses, workshops, conferences, and certifications to maintain or improve skills related to your job

- Dues and fees: Union dues or other fees for professional organizations related to the job

- Car expenses: Driving a personal vehicle for business purposes or paying transportation expenses such as tolls and parking fees to meet with a client or attend a work-related event

- Meal expenses: Business-related meals with clients, prospects, or co-workers, as well as meal costs incurred while traveling for business

- Work clothes: Uniforms or other clothing required for work that isn’t suitable for everyday wear

- Gifts: Gifts for clients and other business contacts valued up to $25 per person

- Home office expenses: Furnishings and equipment for a home office required for work

What doesn’t qualify?

Expenses that do not qualify, or non-deductible business expenses, include personal costs, such as non-business-related travel, childcare, or personal entertainment. Normal commuting costs, charitable donations, and fines or penalties are also considered non-deductible.

How to claim employee expense deductions

It’s important to follow the IRS guidelines carefully. All taxpayers who claim unreimbursed employee expenses on their tax returns need to keep proof of purchase records, such as receipts, canceled checks, or credit card statements, to prove they paid for the business expenses and weren't reimbursed.

Most employees who qualify for one of the above categories complete Form 2106 to calculate their deduction and then report it on Form 1040.

Filling out Form 2106

Form 2106 is relatively straightforward compared to other tax forms. In Part I of the form, you enter your expenses and any partial reimbursements received from your employer. Then, net the two figures to calculate your total unreimbursed business expenses.

Reservists, fee-basis public officials, and qualifying performing artists can report their total amount of unreimbursed business expenses as an above-the-line deduction on Schedule 1 of Form 1040, which means they can claim either the standard deduction or itemized deductions.

Driving your personal vehicle for work is a little more complicated. In that case, you need to complete Part II of Form 2106 and provide the total miles you drove during the year and the miles you drove for business. Then, you calculate your deduction using the standard mileage rate or actual vehicle expenses.

Educators are not required to file Form 2106 to claim the educator expense deduction. Instead, they report their deductions directly on Schedule 1 (Form 1040) as above-the-line deductions.

Itemizing vs. standard deduction

When filing your taxes, you have the choice of itemizing or taking the standard deduction. Generally, it’s in your best interest to choose the option that provides the greater tax benefit. Most employees will not benefit from itemizing unless they have really significant deductions.

That said, there are times when itemizing your deductions is required. Self-employed individuals should still complete a Schedule C to report their business deductions. Qualified disabled workers report unreimbursed employee expenses on Schedule A of Form 1040, which means they must choose to claim itemized deductions.

Recordkeeping tips

Whether you’re reimbursed or not for business expenses, it’s always a good idea to keep track of and document your expenses. This would include receipts, credit card or bank statements, and mileage logs if you travel with your personal vehicle.

One way, of course, is to hold onto the physical copies. But they can be easily lost or damaged. A better way is to use a receipt scanning app or other digital tool to keep track of your receipts.

The IRS has specific guidelines about documentation, depending on the type of expense. So it’s best to hold onto everything, both so you have what you need for your tax return and in case of a future audit.

Publication 529 and other IRS resources

While you can no longer claim miscellaneous deductions for unreimbursed employee expenses, IRS Publication 529 covers any exceptions for the groups described above. If you think you may fall into one of those categories, it’s important to understand Publication 529 to ensure you are accurately documenting your deductions.

The IRS also offers additional resources, including instructions for Form 2106 on employee business expenses and other related reimbursement information. It’s always best to head directly to the source with tax-related questions, as the IRS keeps its website updated with the latest developments.

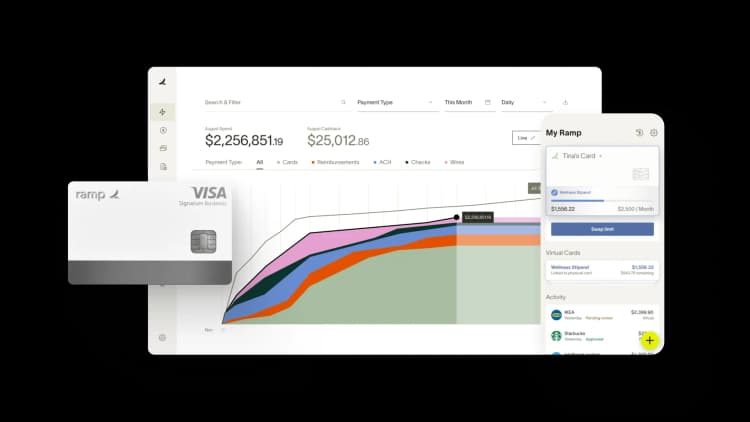

How Ramp simplifies tracking and managing unreimbursed employee expenses

Managing unreimbursed employee business expenses creates headaches for both employees and finance teams. Employees struggle to keep track of receipts and documentation needed for tax deductions, while finance teams lack visibility into these expenses that impact budgeting and compliance.

Ramp's expense management software transforms this process into a streamlined workflow. When employees incur business expenses that won't be reimbursed, they can still capture and categorize them within Ramp's platform using the mobile app's receipt scanning feature. This creates a comprehensive record of all business-related spending, whether reimbursed or not, giving employees the documentation they need come tax time.

The platform's automated expense categorization and real-time syncing with accounting systems means that all expense data—including unreimbursed items—stays organized and accessible. Employees can export their unreimbursed expense reports directly from Ramp when preparing their personal tax returns, complete with IRS-compliant documentation.

Meanwhile, finance teams maintain full visibility into total business-related spending patterns, helping them make informed decisions about expense policies and employee support. By centralizing all expense tracking in one platform, Ramp eliminates the manual spreadsheets and lost receipts that traditionally plague unreimbursed expense management.

Take control of all business expenses with Ramp

Beyond tracking unreimbursed expenses, Ramp's expense management platform helps you control costs across your entire organization. Block out-of-policy spending before it happens with real-time card controls, and automate approval workflows to keep your team moving fast.

Ready to see how Ramp can transform your expense management? Try an interactive demo and discover why customers save an average of 5% annually across all spending.

FAQs

The TCJA of 2017 didn’t change unreimbursed business expenses for self-employed individuals (who file via Schedule C or Schedule F). They are allowed to claim income deductions to offset self-employment tax.

Although you can’t deduct them on your federal return as an employee, some states still allow a deduction for unreimbursed business expenses. As of 2025, those states are Alabama, Arkansas, California, Hawaii, Maryland, Minnesota, New York, and Pennsylvania.

Business expenses that are both “ordinary and necessary,” per IRS guidelines—such as travel, tools, education, meals, and home office costs—may be deductible under certain conditions.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°