- What is an S corp?

- Top S corp tax benefits

- How S corp taxes work

- S corp vs. LLC tax comparison

- Additional S corp tax advantages

- S corp taxes: Potential drawbacks

- How to elect S corp status

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

An S corporation (S corp) is a federal tax election that allows qualifying businesses to pass income through to owners while reducing certain employment taxes. S corp tax benefits primarily come from pass-through taxation, payroll tax savings on owner compensation, and access to deductions like the qualified business income deduction.

For business owners earning consistent profits, S corp taxes can offer meaningful savings compared to sole proprietorship, partnership, or default LLC taxation. These advantages tend to matter most once you’re paying yourself regularly and generating enough net income for payroll tax savings to outweigh added compliance costs.

What is an S corp?

An S corporation is a business that has elected to be taxed under Subchapter S of the Internal Revenue Code, allowing income, losses, deductions, and credits to pass directly to shareholders. Those amounts are then reported on shareholders’ individual tax returns.

It’s important to separate tax status from legal structure. An S corp is not a standalone entity like an LLC or a C corporation. Instead, eligible LLCs and C corporations can elect S corp tax treatment by filing IRS Form 2553. The underlying legal entity stays the same, but the way the IRS taxes income changes.

Many business owners choose S corp status to reduce payroll taxes. Under IRS rules, self-employment income is generally subject to a combined 15.3% Social Security and Medicare tax. S corps allow owners to split compensation between salary and distributions, which can reduce the portion of income subject to that tax.

S corps must also comply with specific IRS requirements, including ownership limits, stock restrictions, and annual filing obligations such as Form 1120S.

S corp eligibility requirements

Not every business qualifies for S corp status. To maintain pass-through tax treatment, the IRS imposes several eligibility rules:

- 100 shareholder limit: An S corp can’t have more than 100 shareholders, though certain family members may be treated as a single shareholder under IRS rules

- U.S. citizens or residents only: Shareholders must be U.S. citizens or resident aliens; nonresident aliens can’t own S corp shares

- One class of stock rule: All shares must have identical rights to distributions and liquidation proceeds, though voting and nonvoting shares are allowed

- Eligible entity types: Only LLCs and C corporations can elect S corp taxation; partnerships and sole proprietorships must convert first

Top S corp tax benefits

S corps appeal to many business owners because they combine pass-through taxation with payroll tax flexibility. When structured correctly, these benefits can lower your overall tax liability while avoiding the double taxation that applies to C corporations.

Pass-through taxation advantage

S corps avoid double taxation by passing profits directly to shareholders. The business itself generally does not pay federal income tax. Instead, owners report their share of income on Schedule E of their personal tax returns.

C corporations, by contrast, pay corporate income tax at the entity level. Shareholders then pay personal income tax again when dividends are distributed. Under current law, the federal corporate tax rate is 21%.

| Feature | S corporation | C corporation |

|---|---|---|

| Entity-level income tax | None | 21% federal |

| Shareholder tax on profits | Yes | Yes |

| Dividend taxation | N/A | Taxed again |

| Payroll tax flexibility | Yes | Limited |

Assume your business earns $150,000 in net profit. In a C corporation, the company pays 21% corporate tax, leaving $118,500. If that amount is distributed as dividends, shareholders pay tax again at individual rates. In an S corp, the full $150,000 passes through to shareholders and is reported on their personal returns through Schedule K-1, even if some of the cash stays in the business.

Self-employment tax savings

One of the most compelling reasons to elect S corp status is the potential reduction in self-employment taxes. The IRS sets the self-employment tax rate at 15.3%, which covers Social Security and Medicare. S corp owners who work in the business must pay themselves a reasonable salary that is subject to payroll taxes. Remaining profits can be taken as distributions, which are not subject to self-employment tax.

For example, if an S corp generates $100,000 in profit and the owner pays themselves a $60,000 salary, payroll taxes apply only to that salary. The remaining $40,000 distribution avoids the 15.3% self-employment tax, resulting in approximately $6,120 in payroll tax savings.

Qualified business income deduction

S corp owners may also qualify for the qualified business income (QBI) deduction, which allows eligible taxpayers to deduct up to 20% of qualified pass-through income.

The deduction is subject to income thresholds, wage limits, and industry restrictions. Service-based businesses may see the deduction phase out at higher income levels, while businesses with significant wages or assets are more likely to benefit.

If available, this corporate tax strategy can reduce your business’s taxable income without requiring additional spending or restructuring.

How S corp taxes work

S corps file an annual informational return using Form 1120S. The form reports income, deductions, and credits, but the corporation itself generally does not pay federal income tax. Instead, each shareholder receives a Schedule K-1 that shows their share of income to report on their personal tax return.

Shareholder basis plays a key role in how S corp taxes work. Basis affects whether distributions are taxable and how much loss a shareholder can deduct. It typically starts with capital contributions, increases with income, and decreases with losses and distributions.

Reasonable salary requirements

The IRS requires S corp shareholders who perform services for the business to receive reasonable compensation. While there’s no fixed formula, the IRS evaluates salary based on the facts and circumstances of each business.

Factors commonly considered include job duties, experience, time spent working, industry norms, and company profitability. Paying yourself too little salary to maximize distributions is a common audit trigger.

If the IRS determines that compensation is unreasonably low, it can reclassify distributions as wages and assess back payroll taxes, penalties, and interest. This makes documentation critical. Common mistakes include:

- Paying no salary while taking distributions

- Using identical salaries regardless of role or workload

- Failing to document how compensation was determined

Distributions vs. salary

Salary paid by an S corp is subject to payroll taxes and reported on a W-2. Distributions are reported on Schedule K-1 and are not subject to self-employment tax.

The optimal mix depends on your role, income level, and risk tolerance. Maintaining payroll records, compensation benchmarks, and written support for your salary helps balance tax efficiency with IRS compliance.

S corp vs. LLC tax comparison

Both S corps and LLCs offer pass-through taxation at the federal level, but they differ significantly in how payroll taxes apply. For many business owners, that difference determines whether an S corp election actually lowers total taxes.

Without an S corp election, LLC owners typically pay self-employment tax on all business income. Electing S corp status changes that treatment by allowing owners to split compensation between salary and distributions.

| Feature | LLC default taxation | LLC with S corp election |

|---|---|---|

| Self-employment tax | Applies to all income | Applies to salary only |

| Payroll requirements | Minimal | Required |

| Annual tax filing | Schedule C | Form 1120S |

| Ongoing compliance | Lower | Higher |

In practice, S corp elections tend to make financial sense once net income reaches roughly $40,000 to $60,000 per year. Below that range, the cost of payroll services, tax preparation, and additional filings often offsets payroll tax savings. Above it, the ability to avoid self-employment tax on distributions can produce meaningful net savings.

When to choose S corp over LLC or C corp

S corp status can be a good fit when your business generates consistent profits and you’re actively working in the company. It’s often best suited for:

- Small businesses seeking to reduce taxes on self-employment income

- Owners who can pay themselves a reasonable salary and take additional profits as distributions

- Companies with 100 or fewer shareholders operating primarily in the U.S.

- Businesses that want pass-through taxation with more control over payroll tax exposure

By contrast, default LLC taxation may be a better option if you want flexibility without added administrative burden. This structure is often preferred by freelancers, consultants, and sole proprietors with lower or inconsistent income.

C corporations are typically a better fit for businesses planning to raise venture capital, issue multiple classes of stock, or reinvest profits at scale. While they offer growth flexibility, they don’t provide the same payroll tax advantages as S corps.

Additional S corp tax advantages

Beyond payroll tax savings, S corps offer additional tax advantages that can support long-term financial planning. These benefits tend to matter most once your business has steady income and established payroll processes.

Retirement plan benefits

S corp owners can sponsor retirement plans such as a solo 401(k) and make both employee and employer contributions. Employer contributions are based on salary rather than total business profit, which reinforces the importance of paying reasonable compensation. When structured correctly, these plans allow owners to defer taxes while saving more for retirement than many other small business structures allow.

Health insurance deductions

S corp shareholders who own more than 2% of the business may be able to deduct health insurance premiums, provided the company establishes the policy and includes the cost in the shareholder’s wages. To remain compliant, the deduction must be reported properly on payroll and reflected on the shareholder’s personal tax return. Incorrect setup can result in lost deductions or IRS issues.

S corp taxes: Potential drawbacks

S corp status isn’t always the best option. While it can reduce certain taxes, it also introduces additional administrative complexity and compliance obligations. S corps must run payroll, file annual informational returns, and maintain documentation to support owner compensation. These requirements add ongoing costs for payroll services, tax preparation, and accounting support.

The IRS also scrutinizes S corps more closely than some other pass-through structures, particularly when owner salaries appear unreasonably low. Businesses with inconsistent income, international ownership, or limited administrative capacity may find the structure restrictive.

State-level rules can further limit the benefits. Some states impose franchise taxes, minimum fees, or entity-level taxes on S corps, which can reduce or eliminate expected savings.

How to elect S corp status

Electing S corp status changes how your business is taxed, not how it’s legally formed. To make the election, you must file IRS Form 2553 and meet all eligibility requirements.

To elect S corp status, follow these steps:

- Check eligibility: Your business must meet IRS requirements, including having no more than 100 shareholders and being a domestic corporation

- Obtain shareholder approval: All shareholders must agree to the election of S corporation status

- File articles of incorporation: To legally form your business corporation, you must file articles of incorporation, such as your legal corporate name and number of shares, with the appropriate state authority

- Submit Form 2553: Complete and file Form 2553 with the IRS to elect S corp tax status

The IRS may accept late elections with reasonable cause, but approval isn’t guaranteed.

S corp status: Key state-level items to check

Electing S corp status is a federal decision, but state tax rules can significantly affect whether the election actually saves you money. Before filing, it’s worth reviewing how your state treats S corporations.

- Does your state recognize the federal S election automatically? Many states follow the federal election, but some require a separate state-level S corp election or apply special rules to how S corp income is taxed

- Does your state impose S corp taxes, franchise taxes, or minimum fees? Some states charge S corporations a minimum tax or franchise tax even if the business is unprofitable. For example, California taxes S corps at 1.5% of net income and imposes an $800 minimum franchise tax

- Does your city or locality tax businesses? Even in tax-friendly states, cities may impose gross receipts taxes or annual business fees. If you operate locally, these costs can reduce expected savings

- Does your company operate across multiple states? Businesses with multistate operations may need to file in more than one jurisdiction and apportion income based on receipts, payroll, or property, which adds complexity

- How does your state treat deductions and pass-through income? Some states decouple from federal rules, meaning deductions or pass-through benefits allowed at the federal level may not apply in the same way at the state level

- What ongoing filings does your state require? Annual reports, state tax returns, and entity maintenance filings can add recurring costs that should be factored into your decision

S corp filing requirements

To maintain S corp status, your business must meet specific filing and reporting requirements each year. Missing or incorrect filings can trigger penalties or jeopardize your S election:

- Form 1120S: File this annual informational return to report your S corp’s income, deductions, and distributions

- Schedule K-1: Provide each shareholder with a Schedule K-1 showing their share of income, deductions, and credits

- Payroll tax filings: Report salaries and wages, including owner compensation, using the appropriate federal and state payroll tax forms

- State filings: Submit any required state tax returns, franchise tax filings, and annual reports to remain in good standing

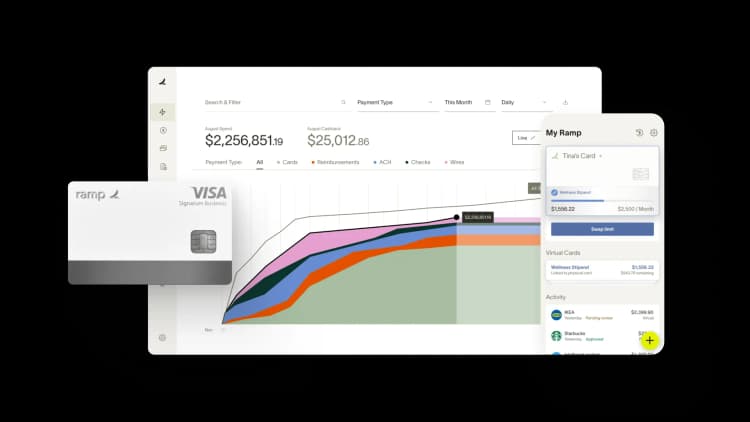

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

The information provided in this article does not constitute accounting, legal, or financial advice and is for general informational purposes only. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business.

FAQs

An S corp allows you to report business income on your personal tax return, but only the salary portion is subject to self-employment tax. The remaining distributions are not subject to self-employment tax.

Yes, S corp owners can deduct the cost of their health insurance premiums for themselves and their families, which provides a significant tax advantage.

An S corp allows you to reduce self-employment taxes by paying yourself a reasonable salary and taking the rest of your earnings as distributions, which are not subject to self-employment tax.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°