SaaS finance fundamentals: 15 essential metrics and benchmarks

- What is SaaS finance?

- The importance of sound SaaS finance for CFOs and investors

- 15 essential metrics every SaaS finance team needs to track

- Benchmark ranges for SaaS financials

- How to use metrics for forecasting and cash management

- Common mistakes in SaaS finance reporting

- Quick wins to improve SaaS financial reporting this quarter

- Turn SaaS finance metrics into better decisions with Ramp

Running a SaaS business means managing money differently from traditional companies. Instead of one-time sales, you’re working with recurring subscriptions, deferred revenue, and customer relationships that last for years.

For CFOs and finance leaders, managing recurring revenue isn’t just about accounting—it’s about proving growth efficiency and building investor confidence through consistent, transparent metrics.

That’s where SaaS finance metrics come in. They give you the visibility to connect growth, retention, and cash flow across your subscription model. Metrics like monthly recurring revenue (MRR), customer acquisition cost (CAC), and churn reveal how your business performs over time and where to focus resources.

What is SaaS finance?

SaaS finance is the financial management approach designed for subscription-based software businesses. It covers recurring revenue, deferred revenue, and the specialized reporting methods these companies need.

Traditional accounting recognizes revenue when a sale occurs, but SaaS companies spread revenue over the subscription term. For example, a $12,000 annual contract becomes $1,000 in recognized revenue each month, with the remainder held as deferred revenue.

SaaS finance metrics such as LTV, churn, and net revenue retention become critical for understanding performance. Strong SaaS financial reporting ensures these metrics are calculated consistently and presented clearly to stakeholders, from CFOs to investors.

The importance of sound SaaS finance for CFOs and investors

SaaS finance turns financial reporting into a framework for better decisions. It helps CFOs and finance leaders see how efficiently the business turns spending into recurring revenue and long-term growth.

With clear reporting on key metrics like customer lifetime value, churn, and net revenue retention, leadership can identify where to invest, when to raise capital, and how to price products for sustainable margins.

Accurate SaaS financial reporting also builds investor confidence. Because valuation often depends on how effectively a company converts spending into predictable recurring revenue, consistent metrics and transparent reporting are essential to securing funding and supporting strategic growth.

15 essential metrics every SaaS finance team needs to track

These core SaaS finance metrics reveal growth, efficiency, and retention. Tracking them consistently helps CFOs and finance leaders manage cash flow, improve forecasting, and communicate performance clearly to investors and boards.

1. Monthly recurring revenue (MRR)

MRR measures predictable subscription income each month. It’s the foundation for cash flow forecasting and growth planning for SaaS companies.

MRR = Customers * Average monthly subscription price

For example, say you have 100 customers each paying $500 monthly, your MRR equals $50,000.

2. Annual recurring revenue (ARR)

Annual recurring revenue (ARR) represents the yearly value of your subscriptions. It’s crucial for long-term planning, valuation, and fundraising.

ARR = MRR * 12

3. Customer acquisition cost (CAC)

CAC shows how much you spend to acquire each new customer, helping you assess whether growth spending is sustainable.

CAC = (Sales spend + Marketing spend) / New customers acquired

4. Customer lifetime value (LTV)

LTV captures total revenue from a customer relationship, guiding how much you can spend on acquisition and retention.

LTV = Average revenue per customer * Average customer lifespan

5. LTV-to-CAC ratio

This ratio compares customer value to acquisition cost. A healthy ratio of 3:1 or higher signals profitable acquisition.

LTV-to-CAC ratio = LTV / CAC

6. Gross margin

Gross margin is revenue minus direct service costs, such as hosting, support, and engineering salaries. It excludes operating expenses.

Gross margin = (Revenue – COGS) / Revenue

Higher margins. often 70–85% in SaaS, free resources for growth.

7. Churn rate

Churn rate shows the percentage of customers or revenue lost in a period, which can be an early signal of retention health. You can express churn in terms of both customers and revenue.

Customer churn = Lost customers / Starting customers

Revenue churn = Lost revenue / Starting revenue

8. Net revenue retention (NRR)

NRR measures revenue growth from existing customers after churn, downgrades, and expansions.

NRR = Current cohort revenue / Prior period revenue

NRR above 100% means customers spend more over time.

9. Average revenue per user (ARPU)

ARPU reflects the average revenue generated per customer, helping you refine pricing and segmentation.

ARPU = Total revenue / Total customers

10. Expansion revenue

Expansion revenue captures growth from upgrades, add-ons, or additional seats. It reduces reliance on new customer acquisition and drives healthy NRR.

11. Contraction revenue

Contraction revenue reflects lost revenue when customers downgrade plans or reduce seats. Spikes here often precede churn and can signal pricing or product fit issues.

12. Bookings

Bookings represent total contract value signed in a period, regardless of revenue recognition. A 3-year, $36,000 contract contributes $36,000 to bookings today, while recognition occurs monthly.

13. Deferred revenue

Deferred revenue is cash collected for services not yet delivered and appears as a liability until recognized. For a $12,000 annual contract, you recognize $1,000 monthly while the remainder stays deferred.

14. Burn rate

Burn rate measures how much cash your business spends each month; it determines runway and informs fundraising timelines.

Burn rate = Monthly expenses – Monthly revenue

15. Netash flow

Cash flow metrics track net movement of cash from operating, investing, and financing activities and indicate the health of core operations.

Net cash flow = Total cash inflows – Total cash outflows

Benchmark ranges for SaaS financials

Benchmark ranges vary significantly by company stage and size. Use the ranges below as directional guardrails and calibrate by ACV, pricing model, and growth strategy:

| Metric | Seed stage | Series A | Series B+ |

|---|---|---|---|

| MRR growth rate | 10–20% monthly | 5–10% monthly | 3–5% monthly |

| Gross margin | 60–70% | 70–80% | 75–85% |

| CAC payback period | ~12–18 months | ~9–12 months | <9 months |

| LTV:CAC ratio | ~2–3x | 3–4x | 4–5x+ |

| Net revenue retention | ~100% | 100–110% | 110–125% |

| Annual churn rate | 15–20% | 10–15% | 5–10% |

| Burn multiple | >2x | ~1.5–2x | <1.5x |

| Rule of 40 | Not applicable | ~20–30% | 40%+ |

Public SaaS companies reported steady net dollar retention at 110% for three quarters after declines from 2022 highs, with revenue growth stabilizing at 17%–18%. A growth rate of 30% for a $4 million SaaS business is below the median, while a growth rate of 30% for a $20 million SaaS business is above the median.

Note that early-stage companies prioritize growth over efficiency, often operating at higher burn rates to capture market share. As companies mature, however, the focus shifts toward sustainable unit economics and profitability.

How to use metrics for forecasting and cash management

Connecting your SaaS finance metrics to driver-based models creates accurate cash flow forecasting for hiring and fundraising. The key is linking customer behavior directly to financial outcomes.

1. Link metrics to a driver-based model

Connect customer metrics directly to revenue projections by building a model that flows from customer count through to cash collection. Start with your current customer base, then layer in new customer acquisition based on historical CAC and sales capacity.

Your churn and expansion rates drive the baseline revenue forecast. If you have 100 customers paying $1,000 monthly with 2% monthly churn and 1% expansion, you can model exactly how that cohort's revenue will evolve over time.

2. Build best-, base-, and worst-case scenarios

Use your metric ranges to model different growth trajectories and their cash implications. Your base case should reflect recent performance trends, while best and worst cases test the boundaries of what's possible.

For scenario planning, adjust key assumptions like CAC, churn rate, and sales efficiency. A worst-case scenario might assume a 50% higher CAC and a doubled churn rate, while your best-case models improve retention and shorten sales cycles. Tie these scenarios to cash flow forecasting so spending aligns with your confidence band.

3. Monitor capital efficiency

The Rule of 40 states that your growth rate plus profit margin should exceed 40%. A company growing 60% annually can afford to burn 20% of revenue, while one growing 20% needs to be profitable.

If growth slows, improve efficiency before it compresses runway; if growth is durable, invest where acquisition and expansion pay back quickly.

What are the most important SaaS finance metrics to track first?

For early-stage SaaS startups, focus on monthly recurring revenue, churn, and CAC. These three metrics show whether you can attract, retain, and grow a customer base without overspending.

Common mistakes in SaaS finance reporting

Even experienced finance teams run into pitfalls when tracking SaaS metrics. Avoiding these mistakes and investing in automation and standardized reporting ensures your SaaS finance metrics reflect the real health of your business:

- Inconsistent definitions: When sales, finance, and ops calculate churn differently, reporting becomes unreliable

- Misclassifying deferred revenue: Recognizing cash as revenue early distorts margins and misleads stakeholders

- Over-relying on spreadsheets: Excel doesn’t scale, introduces errors, and slows audits and board prep

- Ignoring efficiency metrics: Focusing only on top-line growth while skipping CAC payback or burn multiple weakens sustainability

Quick wins to improve SaaS financial reporting this quarter

You don’t need a full ERP rollout to see immediate results. These quick wins help SaaS finance teams improve accuracy, shorten the close, and build confidence in reporting.

| Win | How it helps | Tools to use |

|---|---|---|

| Automate revenue recognition | Eliminates spreadsheets, ensures ASC 606 compliance, reduces errors | Stripe Billing, Chargebee, Recurly |

| Shorten your close with real-time expense data | Captures spend from cards to ledger automatically; fewer month-end surprises | Ramp, Expensify, QuickBooks |

| Standardize metric definitions | A shared glossary makes MRR, CAC, churn consistent across teams | Internal docs, BI dashboards |

Turn SaaS finance metrics into better decisions with Ramp

Accurate SaaS finance metrics don’t just keep your books clean; they shape smarter business decisions. When investors and boards expect clarity, strong reporting is what builds confidence in your numbers.

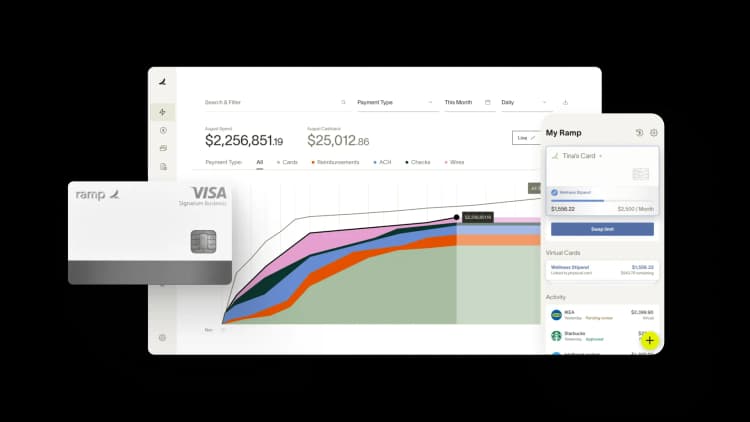

Ramp's financial operations platform makes that possible by eliminating manual work and giving you real-time visibility into your financial health. With automated reporting and integrations across your stack, your finance team can spend less time collecting data and more time driving strategy.

Try an interactive demo and see how Ramp helps SaaS companies turn metrics into insights that guide growth.

FAQs

Most teams switch near $1M ARR or when annual contracts become common. Accrual aligns revenue recognition with service delivery and meets investor expectations.

Investors prioritize net revenue retention, low churn, and strong unit economics. Companies with NRR above 120% and healthy gross margins tend to command premium multiples, especially when they meet the Rule of 40.

Teams connect MRR, churn, CAC, and expansion to driver-based models for scenario planning and budget decisions, improving forecasting accuracy and cash visibility.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°