Supplier risk management: Transforming vulnerabilities into strategic advantages

- Understanding supplier risk management

- How supplier risk differs from other types of operational risk

- 5 types of supplier risk to actively manage

- How do you identify and classify supplier risks?

- Using supplier risk insights to strengthen business decisions

Supplier risk management helps businesses identify, assess, and mitigate threats before they cause damage. Delays, compliance issues, and financial instability can impact cost, operations, and reputation. With risk management, you can ensure your critical vendors stay reliable, compliant, and aligned with your business goals.

Understanding supplier risk management

Supplier Risk Management

Supplier risk management (SRM) is the process of identifying, assessing, and reducing the risks associated with third-party vendors. It helps businesses protect their operations from disruptions caused by financial failure, compliance issues, delivery delays, or geopolitical instability.

Every supplier introduces a level of risk. Some impact daily operations, while others can affect product quality, brand reputation, or even legal compliance. Without a plan to manage those risks, businesses leave themselves exposed.

Around 84% of procurement leaders say supplier risk is a top priority, but only 15% have full visibility into their supply base. That gap creates blind spots that lead to missed deadlines, budget overruns, and operational breakdowns.

Supplier risk management allows finance and procurement teams to act early. It creates a structured approach to tracking supplier performance, analyzing risk exposure, and building controls into vendor selection and contracting.

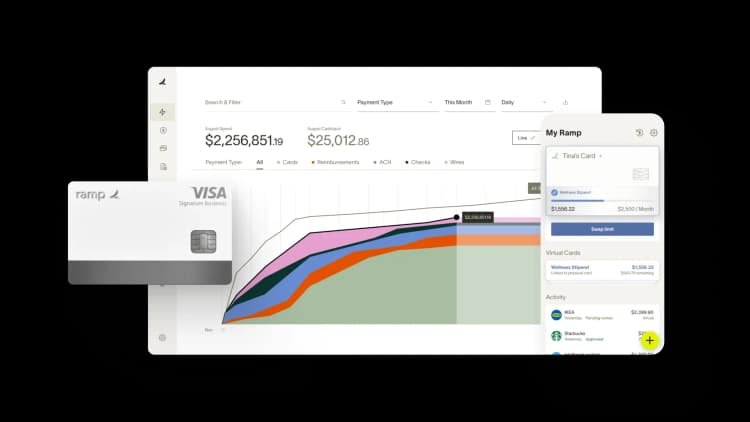

Ramp helps simplify supplier risk management strategy by giving businesses a single platform to track vendor transactions, contracts, and spending. With automated insights into vendor activity and real-time visibility into renewal terms, teams can monitor risks across their supplier base without relying on scattered spreadsheets or disconnected systems.

How supplier risk differs from other types of operational risk

Operational risk refers to any threat that disrupts a company's ability to run day-to-day activities. These risks are often internal, like system outages, process failures, fraud, or human error. Supplier risk comes from external partners that a business depends on but does not directly control.

That difference changes how you manage risk. You can monitor, test, and correct internal risks in-house. With supplier risk, your control is limited. You must rely on third-party performance, financial stability, and compliance.

Supplier risk is multidimensional. It includes financial instability, supply chain delays, labor disruptions, cybersecurity vulnerabilities, legal non-compliance, and geopolitical issues. Each supplier adds a new layer of exposure, and the more suppliers you have, the harder it becomes to perform risk assessment.

While operational risks affect one part of the business, supplier risks have cross-functional impact. A vendor delay might hold up production, increase support issues, delay revenue recognition, and disrupt financial forecasting.

There is also a scale factor. Many businesses work with hundreds or even thousands of vendors across multiple regions. Most organizations say they lack adequate tools to track potential risks across their full vendor base. That makes it difficult to catch early warning signs, like missed compliance filings or deteriorating financial health.

Supplier risk evolves fast. Political instability, environmental events, or regulatory changes can turn a low-risk supplier into a critical vulnerability overnight. Unlike internal risks, which change slowly, supplier risk shifts with global conditions, often without warning.

Supplier risk stands apart because it's external, complex, interdependent, and dynamic. Managing it requires different tools, more collaboration, and proactive strategies beyond traditional operational risk management.

5 types of supplier risk to actively manage

Not all supplier risks have the same impact. Some threaten operations directly, while others create financial, legal, or reputational exposure that builds over time.

Different types of supplier risks exist because vendors play different roles across the business. A raw materials supplier carries a different risk profile than a cloud software vendor. Each touchpoint adds vulnerabilities, shaped by geography, regulation, service level, and financial health.

1. Financial risk

Financial risk is the threat that a supplier can’t meet its obligations due to poor cash flow, insolvency, or declining credit health. If a key vendor fails financially, it can interrupt deliveries, delay services, or trigger costly contract disputes.

This risk often shows up without warning. A supplier might mask cash problems until invoices go unpaid or products stop arriving. That’s why financial risk requires active monitoring throughout the supplier relationship.

Warning signs include missed payments, frequent contract renegotiations, or sudden changes in leadership. If you know where to look, publicly available financial statements, credit scores, and payment histories can offer early insights.

When left unchecked, a financially unstable supplier can disrupt operations, increase costs, and put compliance at risk. Managing this risk starts with visibility and ends with having a plan if things go south.

2. Operational risk

Operational risk is the chance that a supplier can’t deliver goods or services as promised. This includes delays, product defects, quality control issues, or capacity failures that directly affect your business output.

These risks hit hardest when they interrupt core operations. A late shipment can slow production, a faulty part can trigger product recalls, and a service outage can bring systems to a halt. Supply chain disruptions have increased by 88% year-over-year, with factory shutdowns and logistics failures topping the list. Most of these disruptions came from operational issues, not financial or regulatory ones.

Unlike financial risk, operational failures often start small. A late order or minor error may seem isolated until patterns emerge. Tracking delivery performance, error rates, and fulfillment times can help catch problems early.

Operational risk also rises with complexity. If a supplier manages multiple product lines, depends on subcontractors, or operates across borders, even small disruptions can have a ripple effect across the supply chain.

To reduce exposure, businesses should define clear service level agreements (SLAs), build buffer inventory where possible, and regularly audit supplier performance.

3. Compliance risk

Compliance risk is the possibility that a supplier violates laws, regulations, or contractual obligations. This can put your business at legal, financial, or reputational risk.

This can include labor violations, environmental non-compliance, data privacy breaches, or failure to meet industry-specific standards. If a supplier cuts corners, your business could face audits, fines, or public backlash.

Regulators are increasing scrutiny. In the U.S., the Department of Justice has expanded third-party liability enforcement. In the EU, due diligence laws now hold companies accountable for human rights and environmental practices in their global supply chains.

Compliance risk is especially high with offshore or high-volume vendors. Gaps in local oversight, complex subcontracting, and fast-moving regulations make it harder to catch violations early.

Businesses need documented supplier policies, audit rights, and clear compliance clauses to manage this risk in every contract. Tools like compliance checklists, certifications, and third-party risk platforms help monitor activity and flag concerns.

Ramp’s vendor management tools support compliance by centralizing vendor records, contracts, and policy documents. Teams can set reminders for upcoming audits, flag expiring certifications, and store compliance-related notes. This reduces the risk of missed obligations and makes it easier to demonstrate compliance during reviews or investigations.

4. Geopolitical risk

Geopolitical risk refers to the impact of political instability, trade restrictions, sanctions, or conflict on your supplier network. These risks can disrupt production, block shipments, and increase costs, often without warning.

Service providers operating in politically sensitive regions face higher exposure. A change in leadership, new trade policy, or civil unrest can halt operations overnight. In some cases, entire supply routes are shut down due to war, embargoes, or diplomatic tensions.

Most supply chain leaders say they are concerned about geopolitical instability affecting their operations. Events like Brexit, U.S.-China tariffs, and the war in Ukraine have shown how quickly political shifts can create business-wide consequences.

This risk extends beyond physical goods. Shifting laws and cross-border restrictions may also affect digital infrastructure, data storage, and intellectual property.

Businesses that rely on single-country sourcing face the highest risk. Lack of diversification leaves little flexibility when conditions change.

To reduce exposure, map your supply chain risks geographically, monitor global developments, and build regional alternatives where possible. Include force majeure and trade compliance clauses in contracts with overseas vendors.

5. Cybersecurity risk

Cybersecurity risk is the threat that a supplier's systems are breached, exposing your business to data loss, ransomware, or operational shutdowns. When a vendor with system access or shared platforms is compromised, your organization becomes a target, too.

This risk isn’t limited to IT vendors. Any supplier that stores customer data, processes transactions, or integrates with your ERP can create vulnerabilities. Even trusted long-term partners can fail to follow security practices.

Common gaps include outdated software, poor access controls, or a lack of encryption. Suppliers may sometimes not even notify you when incidents occur, delaying your response and increasing damage.

To manage this risk, businesses should require security certifications (like SOC 2 or ISO 27001), review access permissions regularly, and include breach notification clauses in every contract.

How do you identify and classify supplier risks?

Supplier risk identification typically sits with procurement, finance, and vendor risk management teams. Each team plays a role. Procurement gathers vendor data, finance reviews financial exposure, and risk teams assess broader business impact. Legal and compliance teams may also be involved for high-risk vendors.

This process isn’t a one-time task. Risk profiles change as suppliers grow, enter new markets, or face regulatory pressure. That’s why classification should happen on a set schedule, which is quarterly for critical suppliers and at least annually for others.

- Step 1: Map your supplier network. Start by identifying every supplier your business relies on. Document what each one delivers, which departments depend on them, and where they are located. This gives you a clear view of your exposure points. Without this foundation, it’s easy to overlook vendors that pose serious risks to operations or compliance.

- Step 2: Gather risk-related data. Once your supplier list is in place, collect relevant risk data for each one. Focus on financial stability, legal history, regulatory compliance, cybersecurity posture, and geographic footprint. For critical vendors, go deeper by requesting audit reports or certifications. The more context you have, the better you can assess their reliability.

- Step 3: Assess impact and likelihood. Evaluate each supplier by asking two questions: How badly would it hurt your business if this supplier failed? And how likely is that failure based on what you know? A supplier that handles essential infrastructure or high-volume orders likely has a higher impact. They move into higher-risk territory if they also show signs of financial or operational strain.

- Step 4: Classify suppliers into risk tiers. Use the results from your assessment to group suppliers into tiers, including high, medium, or low risk. Suppliers with high impact and a high likelihood of failure need the most attention. These are the vendors where proactive risk mitigation, frequent reviews, and contingency planning matter most. Classifying helps focus your time and resources where they’re needed.

- Step 5: Monitor and update regularly. Supplier risk is not static. A vendor’s risk profile can change quickly due to financial shifts, mergers, political events, or compliance lapses. Review high-risk vendors quarterly and others at least once a year. Use tools that track changes in credit scores, sanctions, or cyber incidents so your team can respond before a disruption happens.

Using supplier risk insights to strengthen business decisions

Supplier management can help you make smarter, more confident decisions across the business. By understanding your risks, you can negotiate better contracts, improve vendor selection, and respond faster when issues arise.

Strong visibility into supplier risk also helps finance teams improve forecasting and budget planning. When you know which vendors carry exposure, you can prepare for potential delays or cost changes before they hit the bottom line.

Risk insights also create leverage. When teams bring real data into supplier conversations, they can push for higher standards, better terms, or alternative options if needed. These insights move procurement from reactive to strategic.

Ramp’s vendor management solution turns raw vendor data into actionable insights. With features like Seat Intelligence and Price Intelligence, teams can see which tools are underused, benchmark costs, and cut unnecessary spending while reducing exposure to vendor-related risks. This gives finance and procurement teams a stronger foundation for strategic planning and vendor negotiations.

FAQs

Supplier risk focuses on identifying potential threats, like financial instability or compliance failures, before they cause disruption. Vendor performance management tracks how well a supplier meets agreed expectations over time. Both are connected, but risk management is proactive, while performance management is more operational and ongoing.

Common signs include frequent invoice errors, missed deliveries, lack of communication, sudden pricing changes, or expired certifications. These indicators often appear before larger issues emerge, and regular monitoring helps catch them before they escalate into potential disruptions.

A strong supplier risk policy should outline risk categories, assessment criteria, review frequency, escalation protocols, and documentation requirements. It should also define roles across teams and include steps for onboarding, monitoring, and offboarding vendors.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits