How do business grants work? A guide for startups and small businesses in 2025

- What is a business grant?

- How business grants differ from loans and equity

- Who offers small business grants today?

- Types of grants for startups and small businesses

- Startup eligibility checklist for 2025

- Step-by-step application process

- How long does it take to receive grant funds?

- Grant compliance, taxes, and reporting

- Pros and cons of business grants

- Where to find active grant databases

- Tools to track grant spending and stay audit-ready

- How Ramp can help with grant management

This post is from Ramp's contributor network—a group of professionals with deep experience in accounting, finance, strategy, startups, and more.

Interested in joining? Sign up here.

Business grants are among the most sought-after funding opportunities for small business owners and startups. Unlike a business loan, which requires repayment to a lender, grants deliver financial assistance you don’t have to repay. But these funds come with challenges: strict eligibility requirements, fierce competition, and ongoing compliance requirements.

Federal, state, and local grants are available through government agencies, the Small Business Administration (SBA), nonprofits, and corporate sponsors. Each program supports different types of businesses and has specific requirements about how you can use funds. Understanding these rules can mean the difference between securing capital and wasting months on an unsuccessful grant application.

What is a business grant?

A business grant is non-repayable financial assistance provided by the federal government, state governments, corporations, or nonprofit organizations to support defined business development projects. Unlike business loans that rely on credit and repayment, or equity investments that require ownership stakes, grants don’t dilute your control or drain cash flow. However, they carry specific requirements.

Grants typically fund targeted initiatives, not general operating expenses. You might receive a grant to advance research and development (R&D), support entrepreneurship in rural communities, or launch sustainable business practices. But you can’t use those same funds to cover costs such as rent or existing payroll unless they directly tie to the project’s purpose.

How business grants differ from loans and equity

Choosing between grants, loans, and equity depends on your business needs and growth goals. Each option has distinct trade-offs:

| Grants | Loans | Equity | |

|---|---|---|---|

| Repayment required | No | Yes, with interest | No |

| Ownership given up | None | None | Yes, partial ownership |

| Use restrictions | Highly restricted to specific projects | Flexible, with some limitations | Minimal restrictions |

| Application process | Competitive grant application | Credit-based approval with a lender | Due diligence and negotiation |

| Ongoing obligations | Compliance audits and progress reports | Monthly payments | Board seats, voting rights |

| Typical funding amount | $10k–$2M | $5k–$5M+ | $100k–$10M+ |

| Time to receive funds | 3–12 months | Days to weeks | 2–6 months |

Government grants may seem like free money, but they’re tied to strict rules and reporting. A business loan offers faster access but creates repayment obligations that affect cash flow. Equity provides significant capital but dilutes your ownership stake.

The best choice depends on your funding strategy, risk tolerance, and long-term vision.

Who offers small business grants today?

Government programs are among the most common sources of small business grants, but corporations, nonprofits, and other foundations also offer business grants.

Federal government programs

The federal government offers the largest pool of grant funding, but also the toughest competition. The SBA doesn’t directly award small business grants, but it connects you with federal funding opportunities through its partners and SBA.gov resources.

The USDA provides rural businesses with development grants ranging from $10,000 to $500,000. Research-focused programs, such as the Small Business Innovation Research (SBIR) and the Small Business Technology Transfer (STTR), can award up to $2 million for research and development projects that support agency missions in defense, healthcare, and technology.

State governments and local grants

States and municipalities fund economic development through targeted grant programs with smaller applicant pools than federal initiatives. These state grants and local grants often focus on business development, job creation, or revitalization projects tied to community priorities.

Municipal grant opportunities may provide $5,000 to $50,000 if you commit to hiring local residents or operating in designated zones. Check your state’s economic development agency and your city’s business office for active funding programs.

Corporate grants and foundations

Companies fund corporate grants through social responsibility initiatives. For example, FedEx runs an annual small business grant contest, while Visa supports women entrepreneurs.

Private and nonprofit organizations also play a role. The Kauffman Foundation invests in entrepreneurship education, and the Gates Foundation backs global health projects. Industry-specific foundations frequently support initiatives that advance their fields.

Nonprofit and community funding sources

Community Development Financial Institutions (CDFIs) often pair financial assistance with small grants, particularly for underserved areas. Nonprofit organizations, chambers of commerce, and incubators may provide awards ranging from $1,000 to $25,000.

These smaller grant programs often combine funding with mentorship, training, and other business resources. They may not match the size of federal or state awards, but their streamlined application process makes them more accessible for new entrepreneurs.

Types of grants for startups and small businesses

Different types of grants target different business needs. Here’s how the main categories compare:

| Grant type | Purpose | Typical award size | Examples/programs |

|---|---|---|---|

| Innovation and R&D | Funds research and development to advance new technologies and commercialization | Phase I up to $275k; Phase II up to $1.8M | SBIR, STTR, state technology grants |

| Job creation & workforce development | Supports hiring, employee training, and workforce expansion tied to economic development | $5k–$50k per job created; training grants cover 50–90% of costs | US Department of Labor training grants, state hiring incentives |

| Sustainability & clean tech | Promotes environmental initiatives and business development in clean energy | $10k–$500k+ | EPA Environmental Justice grants, state clean energy offices, climate-focused nonprofit organizations |

| Underrepresented founder programs | Provides targeted funding for women, veterans, and minority-owned businesses | $4k–$25k (often smaller but easier to access) | Amber Grant Foundation, Halstead Grant, SBA Women’s Business Centers, StreetShares Foundation |

Startup eligibility checklist for 2025

Before you apply for a grant, confirm that your startup meets the program’s eligibility requirements. Review these common criteria across federal, state, and private grant programs:

Legal entity and registration

Most grants require you to be an established business with proper registration:

- Form a recognized legal entity, such as an LLC or corporation; sole proprietorships rarely qualify

- Maintain good standing with state agencies and the IRS (no unpaid taxes or regulatory violations)

- Have an Employer Identification Number (EIN) and all required business licenses

Industry and project fit

Grant makers fund specific initiatives, not general operations:

- Align your business plan with the program’s goals (e.g., clean energy, rural development, or job creation)

- Check for industry exclusions; gambling, cannabis, adult entertainment, and speculative real estate are usually ineligible

- Highlight how your project advances economic development or addresses community business needs

Founder demographics

Many grants support underrepresented entrepreneurs:

- Women-owned and minority-owned businesses can access targeted funding programs

- Veterans may qualify for SBA and nonprofit grants with proper documentation, such as DD Form 214

- Some programs require certification from the SBA or state authorities to confirm eligibility

Financial health and compliance

Strong financials prove you can manage grant funding responsibly:

- Maintain at least 6 months of operating history, though some startup business grants accept earlier-stage firms

- Provide accurate financial statements and organized financial records

- Separate business banking from personal accounts and track expenses by category

- Some programs require matching funds, often 10–50% of the award, so be ready to invest alongside the grant

Partnerships and support

Collaborations can strengthen your grant application:

- Programs may encourage partnerships with universities, nonprofits, or other businesses

- Working with a professional grant writer or your local Small Business Development Center (SBDC) can improve your application quality

- Leverage free business resources such as SCORE mentors or SBA-affiliated training to prepare your documents

Step-by-step application process

Winning a grant takes more than filling out forms. The application process can stretch over months and requires organization, persistence, and attention to detail. Breaking it into clear steps helps you focus on what matters most: Matching your startup to the right funding programs, preparing strong documentation, and presenting a compelling case to reviewers.

Step 1: Research and shortlist programs

Scan databases such as Grants.gov, SBA.gov, and your state’s economic development websites. Focus on grant opportunities where you meet every eligibility requirement. Don’t waste time on long shots. Keep a simple tracker with deadlines, documents, and funding amounts to prioritize the most realistic fits.

Step 2: Gather financial and legal documents

Strong documentation builds credibility. Collect and organize the following digitally in labeled folders—many programs request similar files, so prep once and reuse:

- Business formation papers like LLC articles and incorporation documents

- Financial statements and financial records

- Business tax returns, and sometimes personal

- A current business plan with projections

- Certifications, especially if you’re applying as minority-owned or veteran-owned

Step 3: Write the grant proposal

A professional grant writer or your local SBDC can help refine proposals. Your proposal should clearly connect project goals to community or business development outcomes. Include:

- Project description: Specific deliverables, timelines, and outcomes

- Budget breakdown: Detailed categories with realistic estimates

- Expected results: Metrics showing job creation, innovation, or social impact

Step 4: Submit and track status

Submit early—federal grant programs often see last-minute portal crashes. Save confirmation receipts and track submissions. Follow each program’s rules on communication; some allow questions, others don’t.

Step 5: Prepare for interviews or pitch panels

If you advance, you may present to reviewers. Prepare a concise deck with your project, team, and partnerships that strengthen execution. Be ready to defend budget assumptions, risk mitigation, and long-term sustainability beyond the grant.

How long does it take to receive grant funds?

Timelines vary by grant program, but most awards take months from application to disbursement. Knowing what to expect helps you manage cash flow effectively and set realistic milestones. Some programs pay everything up front, while others reimburse expenses or release funds after milestones.

Build these lags into your cash flow forecasting so you’re not left covering costs without funding in hand:

| Grant source | Typical timeline | Payment structure |

|---|---|---|

| Federal grants | 3–6 months (up to 12 for research-focused programs such as SBIR/STTR) | Lump sum, reimbursement, or milestone-based |

| State grants | 60–120 days after award notification | Lump sum or reimbursement |

| Local grants | 30–90 days, depending on municipality | Usually lump sum payments |

| Corporate & foundation grants | 2–4 months | Lump sum or milestone-based |

| Nonprofit/community grants | ~30–60 days | Lump sum, typically smaller amounts |

Grant compliance, taxes, and reporting

Winning a grant is only the beginning. Staying compliant ensures you keep your funds and remain eligible for future funding opportunities.

Allowable vs. unallowable costs

Grant agreements spell out what you can and can’t spend money on. When in doubt, confirm with the program officer before spending.

- Allowable costs: Equipment, materials, staff time tied directly to the project, and some overhead directly attributable to the grant

- Unallowable costs: Entertainment, alcohol, lobbying, personal expenses, or costs already funded by another source

Quarterly or milestone reporting

Most government grants and foundation awards require periodic reporting. Missing deadlines can trigger clawbacks or disqualification from future grant programs.

- Quarterly reports: Narrative updates, financial statements, and proof of progress

- Milestone-based reports: Submitted after hitting project goals, such as prototype completion, hiring commitments, or research benchmarks

Tax treatment and IRS reporting

Grant funds usually count as taxable income.

- Awards over $600 generate Form 1099-G, which must be included in your return

- Some specific grants (e.g., disaster relief, certain research) may qualify for special treatment

- Work with a tax advisor to manage obligations and maximize allowable deductions

Pros and cons of business grants

Grants provide valuable funding sources for entrepreneurs, but they aren’t right for every situation.

Advantages

- No repayment required: Keep 100% of the funds, with no interest or principal to repay

- No equity dilution: Retain full ownership and control of your business

- Credibility boost: A grant award validates your project and attracts other funding opportunities

- Networking opportunities: Connect with program officers, other grantees, and potential partnerships

- Stronger planning discipline: The application process forces you to refine your business plan and financial projections

Disadvantages

- Highly competitive: Popular grant programs often have success rates under 10%

- Restricted use: Funds must go toward approved initiatives and documented expenses

- Time-intensive: Proposals can take 40–80 hours of preparation and revisions

- Compliance burden: Ongoing reports, audits, and strict eligibility requirements continue through the grant period

- Slow funding timeline: Months may pass between application, approval, and receiving funds

- One-time support: Most grants do not renew automatically, so you’ll need other funding programs for long-term growth

Where to find active grant databases

Finding the right grant often takes as much work as applying. The most reliable sources range from federal portals to industry groups and state governments:

Grants.gov and SBA resources

Grants.gov is the federal government’s central portal, listing over 1,000 active grant opportunities across more than two dozen agencies. You can filter by agency, eligibility, and award size, and set up email alerts for new programs.

The SBA doesn’t operate its own grant database, but SBA.gov provides guidance and connects you to funding sources. Local SBDCs also offer free support for navigating federal and state programs.

Industry-specific portals

Many trade associations and industry councils track sector-specific funding programs. For example, the National Restaurant Association posts updates on hospitality-focused grant opportunities, while the Technology Councils of North America highlights funding for tech startups.

Professional associations in healthcare, manufacturing, and agriculture also announce specific grants in newsletters and member-only databases.

Local and regional sites

State and municipal governments run their own grant programs to spur economic development. Your state’s business or economic development agency website should be your first stop, followed by city or county business development offices.

Regional chambers of commerce and metropolitan planning organizations also maintain listings of local grants, often with smaller applicant pools and shorter timelines than federal awards.

Tools to track grant spending and stay audit-ready

Managing a grant responsibly means tracking every dollar. The right tools help you stay compliant, optimize cash flow management, and reduce the risk of oversights and errors. These features help simplify compliance and reporting:

- Expense controls: Set up project codes or cost centers so each purchase maps to the correct grant. This makes it easy to prove how funds were used.

- Receipt matching: Digital receipt capture prevents documentation gaps that can trigger audit findings; the best expense management software can handle this automatically

- Accounting integration: When grant tracking connects to your core accounting system, you can eliminate duplicate entry and always know your remaining balance

How Ramp can help with grant management

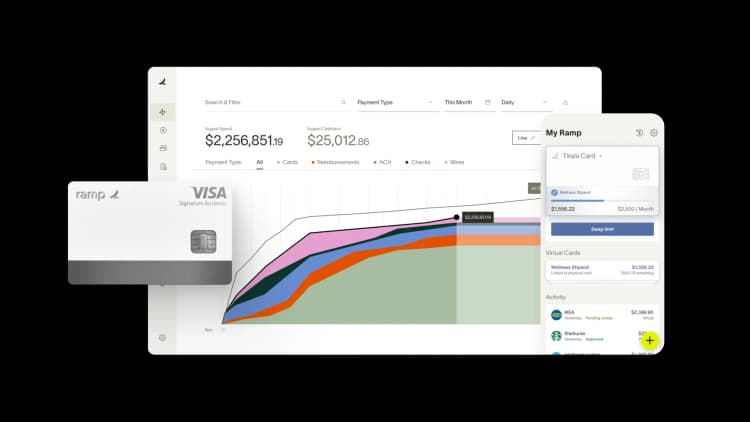

Winning a grant is a milestone. Managing it well is what fuels long-term growth. Manual spreadsheets and paper receipts put your funding and future eligibility at risk. Ramp’s all-in-one finance operations platform gives you everything you need to stay compliant without the manual overhead.

Issue virtual cards for grant-related purchases, assign them to specific projects, and set spending limits from day one. Capture and match every receipt automatically, so you’ll never scramble to prove how you spent your money. And because Ramp integrates directly with your accounting system, reports are always audit-ready.

Whether you’re focused on better expense management, streamlined reporting, or accounting automation, Ramp keeps your grant funding organized and transparent.

Ready to simplify grant management? Try an interactive demo.

FAQs

The success rate for first-time grant applicants depends on the program. Federal grants often fund fewer than 15% of applications, while local grants and state governments may approve 30–40%. Your chances improve with each grant application as you refine your approach.

You can combine multiple grants, but you must disclose all funding sources. Grant makers want to avoid duplicate spending, with two programs paying for the same laptop, for example. Build a clear budget showing how each award supports different parts of the project.

Late reports can suspend payments or even force repayment of funds. Chronic noncompliance may disqualify you from future grant programs. Use calendar reminders or business resources like your Small Business Development Center (SBDC) to stay on track.

In most cases, business grants are taxable. The IRS requires you to report grant funds as income, and you’ll receive Form 1099-G for awards over $600. An experienced tax professional can help you manage reporting and deductions tied to financial assistance.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°