Maximizing customer lifetime value: Formula, strategies, and insights

- What is customer lifetime value?

- Why CLV matters

- How to calculate customer lifetime value

- How to improve customer lifetime value

- CLV and customer segmentation

- Challenges of tracking and calculating CLV

- Improve your customer lifetime value with Ramp's accounting automation

This post is from Ramp's contributor network—a group of professionals with deep experience in accounting, finance, strategy, startups, and more.

Interested in joining? Sign up here.

As startups and small businesses grow, understanding metrics and data will give them insights to stay ahead of their competition or in some cases, just stay afloat.

Oftentimes, business owners are overwhelmed with the amount of financial metrics they hear about and their advisors aren't putting the right metrics in front of them.

One of our favorite financial metrics that all businesses should try to track is "Customer Lifetime Value". The customer lifetime value metric shows how much a customer will be worth to a business over the period of their relationship.

Understanding this number will allow you to set your sales and marketing budget, improve operations, and cut out unnecessary spending in other areas.

What is customer lifetime value?

Customer lifetime value (CLV) represents the total revenue a business can expect from a single customer over their entire relationship with the company. It's an essential metric for understanding your customer base and predicting total revenue.

Customer lifetime value formula

The customer lifetime value formula is simple but powerful. Here’s how to calculate it:

CLV = (Average Purchase Value) * (Average Purchase Frequency) * (Average Customer Lifespan)

This is how the formula breaks down:

- Average purchase value: The average amount spent by a customer per transaction

- Average purchase frequency: The number of times a customer makes a purchase in a given period—typically a year

- Average customer lifespan: The average length of time a customer continues purchasing from your business

For example, let’s say a customer spends $50 per purchase, buys four times a year, and remains a customer for 5 years. Using the formula, the CLV would be:

CLV = $50 * 4 * 5 = $1,000

This calculation helps you estimate the future revenue that one customer can bring, guiding decisions around marketing strategies, customer acquisition, and retention.

Why CLV matters

Customer Lifetime Value (CLV) affects nearly every aspect of a business. Understanding your CLV helps you make better business decisions that drive growth and profitability, particularly when paired with strategic budgeting to allocate resources effectively:

1. Informed decision-making

The CLV of new customers versus existing customers helps you to make more strategic decisions about marketing efforts, resource allocation, and long-term planning. For example, you can allocate more budget to retaining high-value customers who have higher lifetime value rather than spending heavily on acquiring new customers with uncertain value.

- Predictive power: CLV provides predictive insights into future cash flow and long-term profitability. By understanding the expected lifetime value of customers, you can make more confident decisions about future investments, staffing, and marketing.

- Cost-effective marketing: Knowing CLV allows businesses to evaluate the customer acquisition cost (CAC) against the revenue generated over a customer’s lifetime, which can also be influenced by business credit scores. If the cost to acquire a customer is too high compared to their CLV, you can adjust your marketing strategies to focus on the most profitable customer segments.

2. Customer retention and loyalty

Focusing on customer retention is one of the most cost-effective ways to increase CLV, and properly managing business expenses ensures you can reinvest savings into retention efforts without sacrificing profitability. It costs significantly less to retain existing customers than to acquire new ones, which makes customer loyalty a cornerstone of long-term business success.

- Loyal customers: Loyal customers often spend more over time, engage more frequently with the brand, and refer new customers. Investing in customer loyalty programs, offering personalized experiences, and improving the customer experience increases CLV by nurturing loyalty.

- Churn reduction: Churn rate is the enemy of CLV. High churn means that customers are leaving before their lifetime value is fully realized. By addressing the causes of churn—whether it’s poor customer service, inadequate onboarding, or lack of product value—you can reduce churn rates and significantly increase your CLV.

3. Revenue forecasting and growth planning

CLV gives you an estimate of the revenue each customer will bring over time. This helps with revenue forecasting, which is crucial for effective financial planning.

- Long-term growth: By understanding the CLV of different customer segments, you can identify which segments are more likely to drive sustainable growth. For instance, you might discover that high-value customers in a specific demographic group or customer journey stage are the most profitable, and you can tailor your messaging and offers to these segments to maximize growth.

- Strategic investments: When you have a clear picture of CLV, you can make smarter decisions about where to invest in product development, customer service, and marketing efforts. For instance, if you know your loyal customers generate high CLV, you may decide to invest in an advanced CRM system or improve your onboarding process to retain those customers for longer.

4. Optimizing the entire customer lifecycle

From the first touchpoint to long-term customer relationships, CLV helps you optimize every stage of the customer lifecycle.

- Onboarding: A strong onboarding process can dramatically increase CLV by ensuring customers fully understand and get the most value from the product or service. Businesses with high CLV focus on onboarding as a critical touchpoint in the customer journey.

- Customer behavior: By analyzing customer behavior, you can predict when a customer is at risk of leaving or when they may be ready for an upsell or cross-sell opportunity. This allows you to take action that increases CLV—whether that’s engaging with customers at risk of churn or offering them additional products or services to increase their lifetime value.

5. Maximizing profitability

Ultimately, CLV is about increasing profitability. The goal is to identify and retain the most valuable customers for the long haul, which directly impacts the company’s profit margins.

- High-value customers: High-value customers are those who not only make frequent purchases but also stick around for a long period of time. Identifying these most valuable customers and tailoring your business strategies to retain them will maximize profit margins.

- Cost-effective retention strategies: By investing in customer retention programs, you can reduce your dependency on new customer acquisition, which can be expensive. Using CLV analysis, focus on cost-effective ways to engage and retain customers, so you improve your bottom line.

How to calculate customer lifetime value

Different advisors will calculate this metric slightly differently, so it’s important to remain consistent in your measurements over various periods.

To calculate customer lifetime value (CLV), look at the gross profit margin (GPM) on the profit and loss statement (P&L). GPM is calculated as Revenue less Cost of Goods Sold. Cost of Goods Sold may also be listed as Cost of Sales. An inventory-based company may use "Cost of Good Sold" while a service-based company may call it "Cost of Sales."

Some advisors may recommend using the net profit margin vs gross profit margin. Given the variations in general and administrative expenses, we prefer the gross profit margin to more accurately look at the profitability of a customer.

Gross Profit Margin: By using information from the company’s profit and loss statement (on an accrual basis, if possible)

Gross profit margin per customer: After you have calculated the company’s GPM, you'll take the GPM and divide it by the number of unique customers the business has.

For example, if one customer buys from the business five times, that customer will be counted as one customer and not five customers.

Determine the “GPM per customer” by taking the gross profit divided by the number of unique customers.

Gross Profit / # Unique Customers = GPM per Customer

Determining the average customer's "lifetime" or how long they stay with the business (i.e., 3 years) can be more of an art than a science for a small business with limited data. If your business has only been around for a few years, we recommend reviewing industry statistics to help approximate the lifetime value of the customer.

Customer lifetime value: Calculated by taking the gross profit per customer and multiplying it by the average customer lifetime.

Step | Description |

|---|---|

Calculate Average Purchase Value | Determine the average amount spent per transaction by dividing your total sales by the number of transactions. |

Find Average Purchase Frequency | Find how often customers make purchases each year by dividing the number of purchases by the number of customers. |

Determine Average Customer Lifespan | Find the average length of time customers stay engaged with your business. |

Multiply the values together | Multiply the Average Purchase Value, Average Purchase Frequency, and Average Customer Lifespan to get your Customer Lifetime Value (CLV). |

Real-world example

A cold brew company just started making a new nitro blend and they have a gross profit margin (GPM) of $500,000, and they have a total of 1000 customers for this product line.

The gross profit per customer is $500,000 GPM / 1000 customers = $500.

This niche coffee company has done research to determine that their average customer stays with them for 10 years, given how addicting their nitro blend is.

Thus, their customer lifetime value from this product line is $5,000 ($500 * 10 years).

CLV for different business models

The way you calculate and leverage CLV can vary across different business models. Here’s how it applies to different industries:

- SaaS (Software as a Service): In SaaS businesses, CLV is often impacted by churn rates, as customers may cancel subscriptions after a short period. To improve CLV, focus on reducing churn, increasing customer satisfaction, and providing continuous value to customers.

- eCommerce: In eCommerce, CLV is influenced by repeat purchases. You should aim to upsell and cross-sell complementary products, while also driving brand loyalty and customer loyalty programs to boost purchase frequency.

- Retail: For retail businesses, CLV often involves both online and offline purchases. Integrating customer data from multiple channels helps get a more accurate picture of CLV.

How to improve customer lifetime value

Improving CLV enhances business profitability and fosters long-term customer relationships, especially when using business accounting software to track and analyze customer transactions efficiently. By focusing on retaining high-value customers, optimizing their experience, and continuously adding value, you can increase CLV across the board. Key strategies to improve customer lifetime value include:

1. Customer retention strategies

Focusing on customer retention is one of the most effective ways to increase CLV. Retaining existing customers not only helps reduce churn, but also encourages repeat business, which boosts purchase frequency and extends the average customer lifespan.

- Personalized experiences: Delivering a personalized experience increases customer satisfaction and loyalty. Use customer data to tailor your communications, offers, and recommendations based on each customer's preferences and behaviors. Personalization creates a sense of value, which enhances customer loyalty.

- Loyalty programs: Offering a loyalty program rewards customers for their repeat business. By giving customers points, discounts, or exclusive offers based on purchase history, you can encourage them to come back. This increases purchase frequency and reinforces brand loyalty.

- Customer success programs: Onboarding and proactive customer support build customer retention. A successful onboarding process helps customers understand how to use the product or service, leading to greater satisfaction and less churn. Consider providing ongoing support through tutorials, check-ins, and educational content that help customers achieve their goals.

Make customer support a priority. High-quality customer support can make a huge difference in improving customer retention rates. A customer who feels heard and supported is more likely to stay loyal.

2. Upselling and cross-selling

Upselling and cross-selling are proven techniques for boosting CLV. By encouraging customers to purchase higher-value items or complementary products, you can significantly increase average order value and extend the customer relationship.

- Upselling: Offer customers upgrades or premium versions of the products they already purchase. For example, if a customer buys a basic software package, offer them a premium version with additional features or a longer-term subscription at a discounted price. Make sure the upsell makes sense and adds value to their experience.

- Cross-selling: This involves offering related products that complement a customer’s original purchase. For example, if a customer buys a laptop, suggest accessories such as a mouse, keyboard, or case. Use customer behavior data and insights from their purchase history to recommend relevant products that they may need.

- Bundles: Offer product bundles at a discount, providing more value and encouraging customers to purchase more. For example, a skincare brand might bundle cleanser, toner, and moisturizer at a discounted rate to encourage customers to buy multiple products in one transaction.

3. Enhance the customer experience

Providing an exceptional customer experience (CX) is key to improving CLV. Customers who have positive interactions with your brand are more likely to remain loyal and recommend your products to others, ultimately leading to increased lifetime value.

- Omnichannel experience: Make sure customers have a consistent experience across all touchpoints, whether they’re interacting with your brand through social media, your website, or in-store. Provide seamless transitions between different channels, and allow customers to engage with your brand in the way that’s most convenient for them.

- Customer feedback: Actively solicit customer feedback to understand pain points and areas for improvement. Use surveys, reviews, or direct conversations to gather valuable insights. By listening to your customers, you can refine your customer experience to keep them satisfied.

- Respond quickly: In a world of instant gratification, fast responses to customer inquiries are a must. Use tools such as live chat or chatbots for quick resolutions and make customers feel valued. Fast, effective service keeps customers happy and increases the likelihood of their return.

Act on customer feedback. When customers see you’re listening to their feedback and taking action on it, it enhances their trust in your brand and encourages them to stay longer.

4. Focus on high-value customers

Not all customers are equal. By identifying and focusing on the high-value ones, you can significantly improve CLV. These customers are more likely to engage with your brand over time and refer others, increasing the value they bring to your business.

- Segmentation: Segment your customer base based on CLV and target your efforts toward loyal customers who are most likely to generate higher value. Focus your marketing strategies on these best customers and personalize offers and rewards to further engage them.

- Customer journey mapping: Understand the customer journey for your high-value customers. Track their touchpoints with your brand and identify opportunities to engage them at critical moments. By improving their experience at each stage of the journey, you increase the likelihood that they’ll stay longer and purchase more.

- Targeting at-risk customers: Using predictive analytics, identify customers who are at risk of churn, and take proactive steps to engage them. This could involve special offers, personalized communications, or resolving issues that may be making them unhappy.

5. Offer exceptional onboarding

The first interaction a customer has with your product or service can set the tone for the entire relationship. A well-executed onboarding process ensures that customers understand the value of your product and become engaged users, which can extend their customer lifespan.

Strategy | Description |

|---|---|

Guided onboarding | Provide a step-by-step guide or a tutorial to help new customers understand the core features of your product or service. A successful onboarding experience can ensure that customers are more likely to make repeat purchases and remain loyal over time. |

Incentivize engagement | Offer incentives for new customers to engage with your product early, such as discounts on future purchases or free trials of premium features. Incentives encourage early engagement and help customers realize the value of your offering quickly. |

Ongoing education | Keep educating your customers about your product's full potential. Offering webinars, tutorials, or knowledge bases helps customers get more out of their purchase, leading to greater satisfaction and retention. |

CLV and customer segmentation

Effective customer segmentation allows you to tailor your marketing strategies to the right audience.

Here’s how segmentation impacts CLV:

- High-value customers: Identify your most valuable customers and tailor personalized offers, discounts, and services to retain them

- Low-value customers: These customers may require different strategies, such as targeted upselling or providing incentives to increase purchase frequency

Use data-driven insights for customer segmentation. Leverage customer data to create more granular segments based on factors like purchase behavior, demographics, and lifetime value. This allows you to tailor your marketing strategies to meet the specific needs of each group and improve customer satisfaction.

Challenges of tracking and calculating CLV

Tracking and calculating CLV comes with its challenges, especially when you don’t have accurate or real-time customer data and insights into operating expenses, which can impact your ability to effectively manage profits. Common issues include:

- Data silos: Ensure customer data is centralized and easily accessible

- Granular data: Get detailed insights into customer behavior and purchase frequency to calculate CLV accurately

Invest in CRM systems. Tools such as CRMs and analytics platforms can help centralize customer data and improve your ability to track CLV effectively.

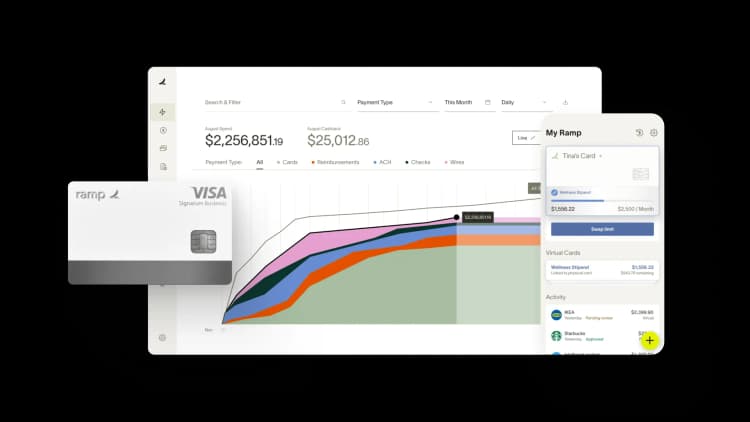

Improve your customer lifetime value with Ramp's accounting automation

Effective management of customer data and financial processes is essential for optimizing your business's long-term growth and profitability.

By automating key accounting tasks, streamlining financial reporting, and ensuring accurate tracking of customer-related expenses, you can improve decision-making and enhance overall efficiency. Ramp’s accounting automation software simplifies this process by providing real-time insights into your financial operations, freeing up valuable time, and reducing errors.

Ramp revolutionizes accounting with its automated solution, seamlessly integrating corporate cards, invoices, and reporting tools. Empower your finance team to focus on strategic growth while Ramp handles tedious tasks such as categorizing transactions and ensuring compliance. Discover how Ramp’s accounting automation can improve your CLV and drive business success.

The information provided in this article does not constitute accounting, legal or financial advice and is for general informational purposes only. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business.

FAQs

Churn rates directly impact CLV by reducing the average customer lifespan. Reducing churn helps improve CLV by keeping customers engaged longer.

Tools such as CRM systems, Google Analytics, and specialized CLV calculators can help track and calculate CLV with real-time data.

Use CLV to identify high-value customers who generate the most revenue over time. Focus your marketing efforts on these customers.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°