How to choose accounting software for your business

- Step 1: Assess your current state

- Step 2: Define your business needs

- Step 3: Establish your budget

- Step 4: Research and compare solutions

- Step 5: Test through demos and trials

- Step 6: Make your decision and implementation plan

- Common mistakes to avoid

Accounting software is the system of record for your finances, shaping how you track cash, manage expenses, close the books, and make decisions. Choosing the wrong platform can cost real time and money through rework, data migrations, and retraining as your business grows. A practical, step-by-step framework helps you evaluate options based on how your business actually operates, not just what a tool promises.

Step 1: Assess your current state

Before you evaluate new accounts payable software, you need a clear picture of how your accounting works today. That means documenting your current systems, identifying what slows your team down, and understanding where errors or delays originate.

Evaluate your current system

Start by assessing whether your accounting processes are mostly manual, partially automated, or fully digital. Many businesses operate in a hybrid state, using spreadsheets alongside basic accounting tools.

Manual processes tend to increase risk as transaction volume grows. Spreadsheets can’t enforce controls, approvals get lost in inboxes, and version control quickly becomes a problem. Digital tools reduce some of that friction, but only when they’re well integrated and consistently used across the team.

Common errors and inefficiencies often show up as:

- Duplicate data entry across systems, which increases mistakes and slows close

- Delayed reconciliations that make it hard to trust real-time financial data

- Inconsistent categorization that leads to inaccurate reports and tax issues

Next, estimate how much time your team spends on accounting tasks each week or month, including expense reconciliation, invoicing, bill payments, reporting, and the month-end close process. Time spent fixing errors is often one of the highest hidden costs of inadequate accounting software.

Identify pain points

Once you understand your current setup, document the specific challenges it creates. These pain points often appear as daily frustrations rather than obvious system failures, so input from anyone who touches accounting data is essential.

Pay close attention to workflow bottlenecks such as:

- Approval delays that slow payments and reimbursements, frustrate employees and vendors, and obscure your true cash position

- Manual expense reviews that don’t scale and often create month-end backlogs

- Limited visibility into spend, forcing decisions based on outdated or incomplete data

Each bottleneck represents a process your next accounting system should improve, not simply replicate. If compliance or reporting issues are part of the problem, note those as well. Missing audit trails, inconsistent documentation, or difficulty producing financial statements on demand are strong indicators that your current setup can’t support your business as it grows.

Step 2: Define your business needs

With your current state mapped out, shift your focus to the specific needs you want from accounting software. Separating essential requirements from nice-to-have features helps you avoid overpaying for complexity you won’t use or underinvesting in capabilities you’ll quickly outgrow.

Core accounting requirements

At a minimum, your accounting software should support your invoicing and billing workflows, including creating invoices, tracking payments, and managing receivables without relying on manual follow-up.

Expense tracking is another core requirement, especially as teams grow. Look for tools that support:

- Real-time expense capture, which reduces end-of-month backlogs and manual uploads

- Automated categorization to improve reporting accuracy and save review time

- Clear audit trails that provide context for every transaction and supporting documentation

Financial reporting capabilities should match how you actually run the business. That means reliable profit and loss statements, balance sheets, and cash flow reports that update automatically and can be filtered by department, project, or entity.

Tax preparation features matter even if you work with an external accountant. Look for software that supports sales tax or value-added tax calculations, produces clean exports for filings and year-end close, and maintains consistent categorization aligned with business tax requirements.

Business-specific considerations

Industry requirements can shape your software needs more than expected. Service businesses may prioritize project tracking, while ecommerce companies need inventory management and integrations with payment processors.

User access and permissions are equally important. As your team grows, role-based access ensures employees only see what’s relevant to their job, reducing risk while improving accountability.

Clearly define integration requirements:

- Customer relationship management systems should sync with accounting software to reduce manual entry, prevent billing errors, and improve visibility into customer-level profitability

- Payment processors should integrate so transactions, fees, and refunds flow directly into your books without manual reconciliation

- Banks and corporate card programs should connect directly to provide real-time transaction feeds and faster reconciliations

Finally, think about scalability. The right accounting software should grow with you, supporting higher transaction volumes, additional users, and more complex reporting without forcing a complete system change.

Step 3: Establish your budget

Your budget should account for more than subscription fees. Defining cost boundaries upfront keeps the selection process realistic and helps you avoid surprises after implementation.

Understanding pricing models

Most modern accounting tools use subscription pricing, while some legacy systems still rely on one-time licenses with ongoing maintenance fees. Subscription models are more common for cloud-based accounting software and typically include updates and basic support.

Per-user pricing is another major factor, especially as your team grows:

- Small businesses often pay $20–$70 per user per month

- Mid-size businesses typically fall in the $70–$150 range

- Enterprise pricing varies widely and usually requires custom quotes

Some platforms also use transaction-based pricing tied to invoice volume, payments processed, or the number of connected accounts. These costs can increase quickly as your business scales, even if your user count stays the same.

Calculate total cost of ownership

Subscription fees are only part of the cost. Implementation and training often require more time and effort than expected, even for intuitive tools.

Data migration can add meaningful expense, particularly if you’re moving from spreadsheets or legacy accounting systems. Cleaning historical data, validating balances, and testing reports takes time whether handled internally or with outside help.

Ongoing support and add-ons also affect long-term cost. Premium support tiers, advanced reporting modules, payroll, and integrations can significantly increase what you pay over time. Accounting for these costs upfront helps ensure the software you choose remains viable as your business grows.

Step 4: Research and compare solutions

With clear requirements and a defined budget, you’re ready to evaluate options methodically instead of comparing tools at random. A structured approach keeps the focus on fit rather than feature volume.

Create your shortlist

Start by identifying accounting software that aligns with your business size, industry, and operational complexity. Peer recommendations, professional advisors, and software review sites can help surface options, but prioritize recent feedback that reflects current product capabilities.

To narrow your list three to five contenders:

- Eliminate tools that don’t meet your core requirements

- Remove options that exceed your realistic budget

- Prioritize platforms with strong integrations, permissions, and support

Once you have a shortlist, document your must-have and nice-to-have features so every option is evaluated against the same criteria.

Feature comparison matrix

A side-by-side comparison makes trade-offs easier to see and discuss internally. It also helps keep evaluations grounded in requirements rather than marketing claims.

| Feature category | Must-have | Nice-to-have |

|---|---|---|

| General ledger | ✔ | |

| Automated expense sync | ✔ | |

| Multi-entity reporting | ✔ | |

| User permissions and approvals | ✔ | |

| Custom dashboards and reporting | ✔ | |

| Inventory management | ✔ | |

| Project or job costing | ✔ |

Use this matrix to score each shortlisted option consistently. If a tool can’t meet must-have requirements, it should be eliminated early, even if it offers attractive secondary features.

Step 5: Test through demos and trials

Hands-on testing is where theoretical fit meets day-to-day usability. Demos and free trials help you confirm whether accounting software supports real workflows before you commit.

Maximize free trials

During trials, focus on the workflows your team uses every week rather than edge cases. Test expense submission, approvals, reconciliations, and financial reporting to see how intuitive the system feels in practice.

Pay close attention to how easily users can navigate the interface and complete tasks without training. Accounting software that integrates well with existing tools, including platforms compatible with QuickBooks accounting software, should reduce friction instead of shifting work elsewhere.

Adoption matters because it determines value. Even feature-rich tools fail if teams avoid using them consistently.

Demo best practices

Use demos to ask targeted questions about how the system behaves in real scenarios:

- How approvals, permissions, and controls are configured

- Which integrations are native versus supported through third parties

- How reporting performance changes as data volume and users increase

Involve stakeholders from finance, operations, and leadership so feedback reflects actual needs. Testing realistic scenarios, such as month-end close or budget reviews, provides a clearer picture of how the software will perform over time.

Step 6: Make your decision and implementation plan

After testing finalists, the goal is to make a clear decision and roll out the software without disrupting day-to-day operations. A structured decision process and realistic implementation plan reduce risk and speed adoption.

Decision framework

Use a scoring system that weighs features, usability, cost, and scalability based on your priorities. A simple scorecard keeps the final decision objective and makes it easier to explain internally:

| Evaluation criteria | Weight | Option A | Option B | Option C |

|---|---|---|---|---|

| Usability | 30% | 4 | 5 | 3 |

| Integrations | 25% | 5 | 3 | 4 |

| Total cost of ownership | 20% | 3 | 4 | 5 |

| Security and controls | 15% | 4 | 4 | 4 |

| Scalability | 10% | 3 | 5 | 4 |

Score each option on a consistent scale, then compare weighted totals to support a clear, objective decision.

Getting buy-in from stakeholders matters as much as the score itself. When teams understand how a tool addresses documented pain points, adoption happens faster and resistance drops.

Once you’ve selected the best accounting software for your business, contact the provider and confirm key contract details:

- Pricing for future users and modules: Understand how costs change as you add users, entities, or advanced features

- Data ownership and export options: Confirm you retain full ownership of your financial data and can export it in usable formats

- Support expectations: Clarify what level of onboarding and customer support is included versus billed separately

Is it difficult to implement accounting software?

Implementation complexity depends on your business size, the software type, and how much customization you need. Small businesses can often set up cloud-based tools in a few hours, while larger organizations using enterprise resource planning systems may require months of configuration and training.

Implementation roadmap

| Business size | Typical timeline | Key implementation steps |

|---|---|---|

| Small business | 2–4 weeks | System setup, data import, basic training |

| Mid-size business | 1–3 months | Data migration, integrations, role-based access |

| Large or complex organizations | Several months | Custom configuration, phased rollout, advanced training |

Regardless of size, validate balances and reports before going live, align training to user roles, and define success metrics early, such as faster close cycles or reduced manual work.

Common mistakes to avoid

Choosing accounting software is as much about avoiding missteps as it is about selecting features. A thoughtful selection process helps prevent issues that can be costly and difficult to unwind later.

Critical pitfalls in the selection process

One of the most common mistakes businesses make is skipping foundational analysis and jumping straight into software demos. Without a clear understanding of current workflows, pain points, and requirements, teams end up evaluating tools based on surface-level impressions rather than operational fit.

Common pitfalls include:

- Choosing software before documenting current workflows

- Letting price or brand recognition drive the decision

- Failing to define must-have versus nice-to-have features

- Excluding key stakeholders from the evaluation process

Over-buying features you won’t use

More features do not automatically create more value. Advanced modules for automation, forecasting, or customization may sound appealing, but they can overwhelm teams that do not need that level of complexity.

Overly complex systems often slow adoption. When users struggle to navigate bloated interfaces, they revert to spreadsheets or manual workarounds, undermining the investment in new accounting software.

Underestimating implementation time

Many businesses assume cloud-based accounting software can be implemented in a few days. In practice, implementation includes data migration, configuration, user training, and workflow changes.

Rushing this process increases the risk of errors and reporting inconsistencies during the transition. It also places extra strain on finance teams expected to maintain normal operations while onboarding a new system.

Ignoring integration capabilities

Failing to evaluate integrations early often results in fragmented systems that require manual data entry and reconciliation. Over time, these gaps increase error rates and reduce confidence in financial data as transaction volume grows.

When accounting software connects seamlessly with banks, secure payment systems, and operational tools, teams spend less time fixing data and more time analyzing it.

Failing to consider mobile access needs

Mobile access is no longer optional for distributed teams and frequent spenders. When employees cannot submit expenses, upload receipts, or review approvals on the go, delays accumulate and slow month-end processes.

Limited mobile functionality also reduces real-time visibility into spend. Accounting software that supports mobile workflows improves responsiveness, adoption, and overall financial control.

Control spend in real time with Ramp

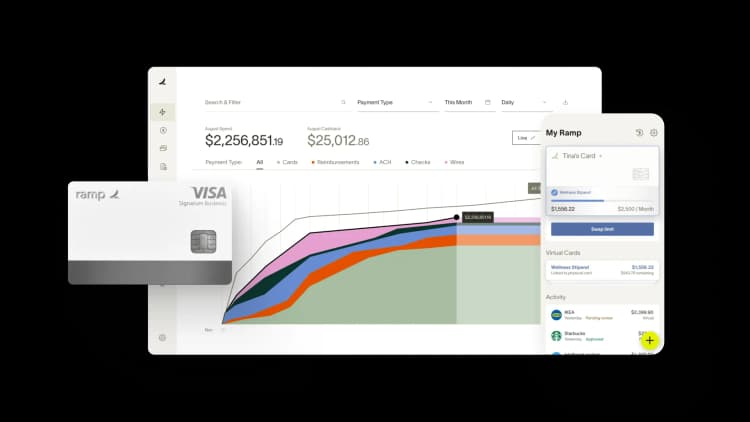

Choosing accounting software doesn’t stop at the general ledger. The most effective finance stacks connect accounting systems with real-time spend management so transactions are controlled before they ever hit the books.

Ramp’s accounting automation software enforces spending policies at the point of purchase, giving finance teams visibility and control across corporate cards, reimbursements, and bill pay. You set limits, approval workflows, and category rules once, and Ramp applies them automatically.

Ramp helps finance teams stay in control by:

- Enforcing spending policies automatically at the transaction level

- Providing real-time visibility into company spend in a single dashboard

- Collecting and matching receipts automatically to ensure every transaction is documented

Try a demo to see how finance teams use Ramp to control spend in real time.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits