How to check your US Bank business credit card application status

- How can I check my US Bank business credit card application status?

- Why is my credit card application pending?

- Get approved for a Ramp card in 1-3 days on average

If you have recently submitted an application for a business credit card from US Bank and are anxious to know the status of your request, there are multiple convenient methods available to check for updates. US Bank offers a simple process for applicants to stay informed about the progress of their application, including online options and other means.

In this guide, we will walk you through the step-by-step process of checking the status of your US Bank business credit card application. We will begin with the fast and convenient online method and then discuss other ways to obtain this information.

How can I check my US Bank business credit card application status?

Online method

- Access the US Bank website: Open your browser and visit the official US Bank website at www.usbank.com.

- Log in to your account: Click on the ‘Log in’ button located on the homepage and enter your username and password. Ensure you have an online account set up; if not, you may need to create one.

- Navigate to credit card details: Once logged in, look for the 'Credit Cards' section in the main menu or dashboard, which often includes a link to application statuses.

- Check your application status: Click on the 'Application Status' link or tab to view the status of your business credit card application. This section will provide details on whether your application is approved, pending, or requires additional information.

Phone method

- Gather necessary information: Before you call, make sure you have your Social Security Number and other pertinent details related to your application handy. This will help expedite the process when verifying your identity.

- Call customer service: Dial 800-947-1444, the dedicated number for US Bank credit card services.

- Navigate the call menu: Follow the voice prompts to direct your call to the appropriate service regarding credit card application statuses. You may need to press specific numbers as instructed by the automated system.

- Verify your identity: Once connected with a customer service representative, you'll need to verify your identity by providing the personal information you prepared earlier.

- Request application status: Ask the representative for an update on your business credit card application status.

- Receive status update: The representative will provide you with the current status of your application, informing you whether it has been approved, is still pending, or if additional information is required.

Branch method

- Locate a nearby US Bank branch: Use the US Bank website or a map application to find the nearest branch location.

- Prepare necessary documents: Bring identification and any relevant information regarding your credit card application to the branch. This may include your application reference number and personal identification.

- Visit the branch: Go to the branch during its operating hours. It's best to visit during less busy times if possible.

- Speak with a bank representative: Once at the branch, ask to speak with a representative about the status of your business credit card application.

- Receive your application update: The representative will access your application details and provide you with an update on its status.

How long does the U.S. Bank take to approve a business credit card?

The approval process for a U.S. Bank business credit card typically concludes within a week or two after the application is submitted. This timeline allows for a thorough evaluation of the business and personal credit details provided in your application. For a smoother and quicker approval, ensuring that your personal and business credit profiles are strong and your application details are comprehensive is advisable. This prep work can help you meet U.S. Bank's creditworthiness criteria and streamline the approval process.

How hard is it to get a U.S. Bank business credit card?

Securing a U.S. Bank business credit card generally requires a good to excellent personal and business credit history. The bank evaluates several factors including your credit score, business revenue, the length of time your business has been operational, and your business type. Applicants with a robust credit profile and a well-established business are more likely to be approved.

Why is my credit card application pending?

When your credit card application is listed as "pending," it usually indicates that the issuer needs more time to evaluate your application. This could be due to the need for additional verification of your personal or financial information or high application volumes at the issuer's end.

Reasons for a pending status might include:

- Incomplete application: Missing or incorrectly filled information requires the issuer to seek correct details.

- Credit review: Extensive checking of your credit history may be necessary, particularly if there are any inconsistencies or if your credit score is close to the issuer's threshold.

- Verification processes: Further steps may be needed to verify your identity, income, or employment, especially if initial documents are insufficient or unclear.

- Fraud checks: Issuers perform detailed examinations to prevent fraud, which may delay the processing if anomalies are detected.

- Operational delays: High volumes of applications, technical issues, or internal procedural delays can also lead to longer processing times.

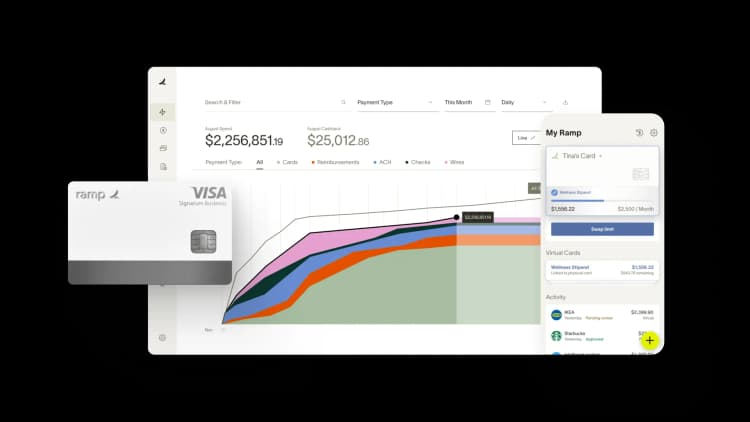

Get approved for a Ramp card in 1-3 days on average

Ramp's corporate card differs from traditional business credit cards as it doesn't require a credit check or personal guarantee, streamlining the approval process to approximately one day.

Additionally, Ramp cards offer sophisticated spend management capabilities and an unlimited number of free physical and virtual cards for employees. Key features of the Ramp card include:

- No annual or setup fees: Start using Ramp’s corporate card and expense management software without any fees.

- Expense management tools: Implement controls on spending, automate the collection of receipts, and simplify expense reporting.

- Accounting integrations: Ramp interfaces smoothly with major accounting software like QuickBooks, Xero, Sage Intacct, and NetSuite, significantly speeding up the book-closing process by up to eight times.

Disclaimer: Content on Ramp's blog may change, and opinions are those of the authors and not necessarily Ramp's. The information in this article is provided in good faith for general informational purposes, but does not constitute accounting, legal, or financial advice. Please contact an accountant, attorney, or financial advisor to obtain advice with respect to your business. Ramp is not liable for any losses or damages.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits