What is a cash management account and how does it work?

- What is a cash management account?

- How cash management accounts work

- CMA vs. checking, savings, and brokerage accounts

- Key features of cash management accounts

- FDIC vs. SIPC: What’s actually protected

- Pros and cons of cash management accounts

- Who should use a CMA and when

- Is a CMA right for your business?

- How to choose the right CMA

- Opening and funding a CMA step by step

- Taxes and escheatment basics

- When to use CMA with a debit card

- Manage cash smarter with Ramp

A cash management account (CMA) combines banking convenience with investment flexibility, giving finance teams a smarter way to manage operating cash. These hybrid accounts sweep uninvested funds into FDIC-insured program banks to earn interest while maintaining liquidity.

For business owners and finance teams, CMAs simplify liquidity management by consolidating balances, automating yield on idle cash, and improving visibility across accounts, all without sacrificing access or security.

What is a cash management account?

A cash management account (CMA) is a hybrid account that combines checking, savings, and investing features. Offered by brokerages and fintechs, it automatically sweeps uninvested cash into partner banks so your balance earns interest while staying liquid for accounts payable, transfers, or debit card purchases.

Unlike a traditional checking or savings account, a CMA isn’t held directly at one bank. Instead, your funds move between a network of FDIC-insured institutions, often called program banks, which can expand your coverage beyond the standard $250,000 limit. You can typically pay bills, send wires, or make deposits from the same dashboard used to monitor balances and interest earned.

How cash management accounts work

A cash management account operates through a sweep program managed by a brokerage or fintech provider. When your business deposits funds, the CMA automatically moves, or sweeps, those balances into one or more FDIC-insured partner banks. Each bank provides up to $250,000 in FDIC coverage, protecting large deposits while earning interest-bearing yields.

Behind the scenes, the provider maintains records of where each portion of your balance is held. You continue to access the full amount through a single platform, using debit cards, ACH transfers, wire payments, or bill pay, just like a traditional business checking account.

Because the process happens daily and automatically, your uninvested cash continues to earn yield without affecting day-to-day liquidity. Many providers also link CMA balances to your brokerage account, enabling seamless transfers into money market mutual funds or other short-term investment products when needed.

CMA vs. checking, savings, and brokerage accounts

Cash management accounts share traits with checking, savings, and brokerage accounts, combining features of all three. The table below shows how they compare in terms of yield, access, and protection:

| Feature | Cash management account | Checking account | Savings account | Brokerage account |

|---|---|---|---|---|

| Provider type | Brokerage firms, fintechs | Banks, credit unions | Banks, credit unions | Brokerage firms |

| Typical yield | Competitive, tiered APY | Low or none | Moderate to high APY | 0% on idle cash |

| Insurance | FDIC on swept deposits; SIPC for brokerage custody | FDIC up to $250K per bank | FDIC up to $250K per bank | SIPC (not FDIC) |

| Debit card | Yes | Yes | Limited | Sometimes |

| Check writing | Often available | Yes | Limited | Sometimes |

| Bill pay/ACH | Yes | Yes | Limited | Limited |

| Money market access | Money market accounts or mutual funds | No | Sometimes | Yes (mutual funds) |

| Transaction limits | Generally unlimited; provider policies may apply | Unlimited | Bank policies may limit withdrawals | Varies |

| Minimum balance | Often $0 | Varies | Often higher | Varies |

For business finance teams, this hybrid structure offers the best of both worlds: high-yield returns on operating cash and on-demand liquidity for everyday payments.

Key features of cash management accounts

Cash management accounts offer six key features that make them valuable for managing business liquidity. Each feature combines convenience, yield, and protection to improve how finance teams handle cash flow:

1. High-yield sweeps

Uninvested cash automatically moves into FDIC-insured partner banks, where it earns competitive annual percentage yields (APY), often higher than traditional savings accounts. The sweep process runs daily, so every dollar of idle cash continues working for your business.

2. Multi-bank FDIC coverage

Funds distribute across a network of program banks, each providing up to $250,000 of FDIC insurance per depositor, a structure similar to multi-bank protection in treasury management systems. That means a CMA working with 10 banks could protect up to $2.5 million in total deposits while maintaining full access to liquidity.

3. Real-time debit card access

Even as your cash is swept among partner banks, your business retains immediate access through a linked debit card, allowing the same flexibility as corporate credit cards for daily expenses. Most CMAs also offer ATM fee reimbursements, check writing, and mobile check deposit, making them practical for daily expenses or reimbursements.

4. Online bill pay and ACH transfers

CMAs support bill pay, ACH transfers, and sometimes wire payments for larger or international transactions. These tools make it easy to manage vendor payments, payroll, and other operating expenses directly from your account.

5. Direct deposit and integrations

Many CMAs allow direct deposit for incoming funds and integrate with accounting software such as QuickBooks, NetSuite, or Xero. This connection simplifies bank reconciliations and improves real-time visibility into your company’s cash position.

6. Automation and overdraft protection

Some providers link CMAs with brokerage accounts or money market mutual funds, allowing excess cash to be invested automatically or transferred to cover overdrafts. Finance teams can also set rules for maintaining target balances or automating short-term investments.

FDIC vs. SIPC: What’s actually protected

Before opening a cash management account, it’s important to understand how your funds are protected. FDIC and SIPC protections apply to different parts of your account.

FDIC insurance

- Covers deposits at partner banks: When your CMA sweeps funds into FDIC-insured program banks, those deposits are protected up to $250,000 per depositor, per bank, per ownership category

- Can extend into the millions: Many CMA providers partner with 10 or more member FDIC banks, meaning total coverage can reach $2.5 million or more

- Backed by a government agency: If a partner bank fails, the FDIC pays insured balances directly; your funds don’t depend on the brokerage’s solvency

- Important caveat: FDIC coverage applies only to cash held at program banks, not to funds still at the brokerage or invested in securities

SIPC protection

- Covers brokerage custody, not bank deposits: The SIPC protects cash and securities held by your brokerage firm, up to $500,000 per account (including $250,000 for cash)

- Applies if the brokerage fails: SIPC steps in when a brokerage firm becomes insolvent, not when a bank does. It replaces missing assets, not lost value from market changes

- No coverage for interest or investment performance: SIPC doesn’t protect against falling interest rates, bank insolvency, or investment losses

- Shifts as funds move: Once your CMA provider sweeps cash into a partner bank, protection automatically switches from SIPC to FDIC

FDIC insurance safeguards your deposits, while SIPC protection applies to brokerage custody. Together, they create layered security, but only if you understand where your cash sits and how your provider allocates it across program banks.

Pros and cons of cash management accounts

Cash management accounts give businesses a powerful mix of yield, protection, and liquidity. But like any financial tool, they come with trade-offs. Here’s how the advantages and limitations compare:

CMA pros

- Earn higher yields on idle cash: CMAs often pay competitive APY, comparable to high-yield savings or money market accounts, helping your business make the most of short-term balances

- Expand FDIC protection: Funds are spread across multiple program banks, extending FDIC insurance well beyond the $250,000-per-bank limit

- Simplify liquidity management: Consolidate deposits, operating cash, and short-term investments in one dashboard for real-time visibility into your company’s cash flow

- Improve accessibility: Use debit cards, ACH transfers, and bill pay for day-to-day operations while still earning interest

- Integrate with accounting tools: Connect your CMA to systems such as NetSuite or QuickBooks to streamline reconciliation and reporting

- Reduce manual effort: Automate sweeps, transfers, and balance targets to maintain liquidity without constant oversight

CMA cons

- Variable interest rates: APYs fluctuate with the market and Federal Reserve policy, creating yield uncertainty during rate changes

- No physical branches: Most CMA providers are online-only, which can limit access for businesses that handle frequent cash deposits

- Coverage overlap risks: If you already hold deposits with a partner bank, those balances count toward the same FDIC insurance limit

- Potential fees: Some providers charge transaction fees, wire fees, or set minimum balance requirements to access higher APY tiers

- Taxable interest income: All interest earned is reported on Form 1099-INT and taxed as ordinary business income

A CMA can boost your yield and simplify treasury operations, especially for companies with large or fluctuating balances, but you’ll need to manage rate changes, coverage overlap, and fee structures carefully.

Who should use a CMA and when

Cash management accounts work best for businesses maintaining cash balances above $50,000 that want to maximize returns without sacrificing liquidity. Companies with fluctuating cash flows benefit from the flexibility to earn interest during peak periods while maintaining full access during lean times.

Professional service firms, SaaS companies, and e-commerce businesses often find CMAs ideal because they hold significant cash reserves between operating cycles and need strong working capital management.

These businesses can earn meaningful interest on customer prepayments, tax reserves, or funds earmarked for future investments without locking money into term deposits.

CMAs also suit businesses transitioning from startup to growth phase. As cash reserves build, the enhanced FDIC coverage and higher yields become increasingly valuable, while the integrated investment options support treasury management strategies as the company matures.

Is a CMA right for your business?

A cash management account can be a smart move for businesses that manage large cash balances and want to earn yield without sacrificing liquidity. The decision depends on how your team handles day-to-day operations, cash flow timing, and account visibility.

When a CMA makes sense

If your company regularly maintains more than $50,000 in operating or reserve cash, a CMA can help that money work harder. These accounts offer competitive APYs similar to high-yield savings accounts while keeping funds available for bill pay, payroll, and vendor payments.

They also consolidate multiple accounts into a single platform, improving cash visibility and easing reconciliation through integrations with accounting software. For remote or distributed teams, CMA debit cards and virtual cards simplify spending controls while keeping every transaction in view.

A CMA is particularly useful for growth-stage companies that have moved beyond startup banking but aren’t yet ready for a full treasury management system. It provides the flexibility to earn yield on idle funds and the agility to support fast-moving operating needs.

When a CMA may not fit

A CMA might not be ideal for businesses that still depend on branch-based banking or frequent cash deposits. Because most providers are online-only, physical transactions and in-person services are limited.

It can also be less effective for companies that require fixed interest rates for predictable budgeting or already hold significant balances across FDIC program banks, where additional coverage may not apply.

The takeaway for finance teams

For many growing companies, a CMA strikes the right balance between return, protection, and accessibility. It gives finance leaders a modern way to manage liquidity, earning yield on idle cash while keeping capital available for growth opportunities.

How to choose the right CMA

Choosing the right cash management account (CMA) comes down to understanding how each provider handles coverage, yield, and usability. The best fit depends on your business’s liquidity needs, technology stack, and growth goals.

FDIC coverage limits

- Know how far protection extends: Compare how many program banks each provider partners with and the resulting total FDIC insurance. Some CMAs offer coverage up to $5 million or more, while others cap around $1–2 million.

- Review transparency and control: Look for providers that publish their full partner bank lists and let you customize how your funds are allocated across them. This helps avoid coverage overlap with banks where you already hold deposits.

Interest rates and APY tiers

- Evaluate how yields scale: Providers may offer higher annual percentage yield (APY) on balances below a certain threshold and lower rates above it

- Confirm how often rates adjust: Because CMA yields fluctuate with the market, verify whether the provider updates rates daily, weekly, or monthly. Frequent updates can make earnings less predictable but more responsive to rate hikes.

Fees and account terms

- Watch for hidden costs: Review monthly maintenance fees, wire or transaction charges, and minimum balance requirements. Some CMAs waive fees if you maintain a set balance; others charge regardless of size.

- Check ATM access and reimbursements: Understand limits on ATM fee reimbursements, international withdrawals, and cross-border transaction fees if your team travels or pays vendors abroad

Integrations and automation

- Prioritize accounting connectivity: Seamless data flow into systems such as QuickBooks, NetSuite, or Xero saves hours on reconciliation and reporting

- Look for API access: If your finance team relies on automation, choose providers that offer open APIs for custom workflows, real-time balance tracking, and automated fund transfers

User experience and support

- Test the platform: A clear dashboard, easy transfers, and instant transaction visibility make day-to-day management smoother

- Check customer service quality: Compare response times, support channels, and service-level guarantees. Dedicated business support often distinguishes leading CMA providers from consumer-focused ones.

The best CMA for your business combines high-yield returns, robust FDIC protection, and reliable automation within a platform your team actually enjoys using.

Opening and funding a CMA step by step

Opening a cash management account is a fast, fully digital process that usually takes less than a week. Most providers automate verification and bank linking so finance teams can start earning interest on idle cash almost immediately. The steps below outline what to prepare and how to get your account running smoothly:

| Step | What to do | Why it matters |

|---|---|---|

| 1. Gather KYC documentation | Collect your EIN, formation documents (articles of incorporation or organization), and operating agreements. Each authorized signer should provide a government ID and proof of address. | Verifies business identity and satisfies Know Your Customer (KYC) requirements |

| 2. Complete the online application | Submit company details, ownership information, and expected transaction volume. Most digital applications take 15–30 minutes and return preliminary approval within 1–2 business days. | Speeds setup and ensures your CMA provider understands your company’s structure and cash activity |

| 3. Link existing bank accounts | Connect operating accounts through Plaid or micro-deposit verification. Once verified, initiate your first transfer to fund the CMA. | Enables transfers between your current banks and your new CMA for initial and ongoing funding |

| 4. Configure sweep preferences | Choose how deposits are distributed across program banks—by maximum FDIC coverage, highest yield, or specific allocation targets | Ensures deposits earn the best available APY while remaining fully FDIC-insured |

| 5. Set up users and permissions | Assign access levels by role: view-only for analysts, transaction approval for managers, and admin rights for CFOs. Enable multi-factor authentication for security. | Maintains internal controls and safeguards against unauthorized activity. |

| 6. Enable payment tools | Activate debit cards, bill pay, ACH transfers, wire capabilities, and mobile check deposit once the account is funded. | Makes your CMA functional for day-to-day operations and outgoing payments. |

Once documents and funding are complete, most CMAs are fully active within 3–5 business days.

Taxes and escheatment basics

Understanding how a cash management account is taxed and what happens to inactive balances helps you avoid surprises at year-end or during audits.

Tax reporting and interest income

- All interest is taxable: Any yield earned in a CMA counts as ordinary business income and appears on IRS Form 1099-INT

- Timing depends on accounting method: Accrual-basis businesses record interest as it’s earned, even if not yet received, whereas cash-basis businesses report income when it’s credited to the account

- State taxes may apply: Some states tax all interest income, while others exempt certain types of business income or specific entities, such as nonprofits or S corps

State escheatment rules

- Dormant accounts are subject to unclaimed property laws: Most states require providers to transfer unclaimed balances to the state after 3–5 years of inactivity

- Automated sweeps don’t count as activity: Interest accrual or sweep transfers alone usually don’t reset inactivity clocks. You must log in, make a transaction, or communicate with the provider to stay active.

- Recovering escheated funds takes time: Claiming funds from a state unclaimed property office often requires paperwork and proof of ownership, so prevention is easier than recovery

Avoid escheatment with periodic activity.

Assign an internal owner for every CMA and schedule periodic activity, such as a small transfer or statement download, to prevent escheatment.

Stay compliant by recording interest income consistently and maintaining minimal account activity. Both small administrative steps can prevent costly year-end corrections and avoid losing access to dormant funds.

When to use CMA with a debit card

Debit card functionality transforms cash management accounts from passive savings vehicles into active operating accounts. This feature is most valuable for businesses with frequent travel expenses, regular vendor payments, or distributed teams that need payment access.

Companies with remote employees benefit from issuing CMA debit cards for approved expenses while maintaining centralized control and real-time visibility. The combination of earning interest during float periods and eliminating reimbursement processes creates operational efficiency.

Businesses managing multiple revenue streams also find CMA debit cards useful. You can receive customer payments, earn interest on the balance, and pay expenses directly without maintaining separate accounts or transferring funds between institutions.

The debit card feature can also serve as backup payment infrastructure. If primary business credit cards face issues or limits, CMA debit cards provide immediate access to your cash reserves for critical purchases or unexpected expenses.

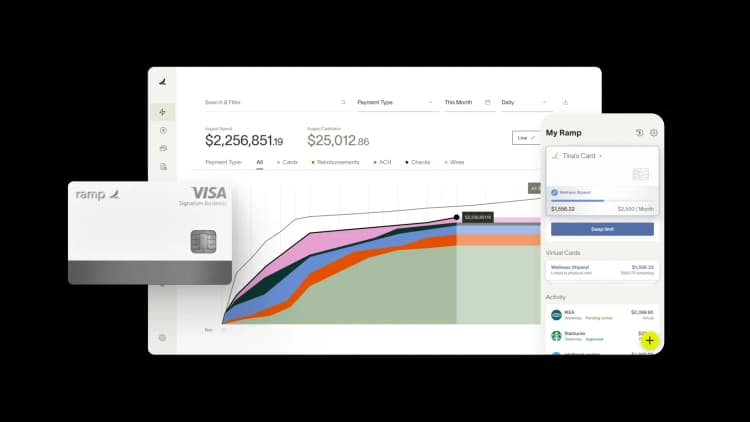

Manage cash smarter with Ramp

A cash management account helps your business earn more on idle cash, but pairing it with automated expense management can create even greater efficiency.

Ramp gives finance teams real-time visibility into spending, helps enforce policies automatically, and integrates seamlessly with your accounting software and CMA provider. With unified financial data across corporate cards, bill pay, and cash balances, your team can see exactly when to hold cash for yield and when to deploy it for growth.

Ready to modernize your cash management strategy? Explore how Ramp automates expense management, speeds reconciliation, and strengthens liquidity management, all from one intuitive platform.

FAQs

Yes. Most CMA providers offer business-specific accounts with features such as multi-user permissions, accounting integrations, and API access for automation. Business CMAs often include higher FDIC coverage through multiple program banks and more robust reporting tools than consumer versions.

Yes—typically CMAs allow transfers into money market mutual funds or other short-term investment vehicles, though options vary by provider. For advanced trading or complex investment products, you’ll need a separate brokerage account linked to your CMA.

Standard ACH transfers usually settle within one to three business days, similar to traditional bank transfers. Some providers offer same-day or next-day ACH for a fee, and wire transfers often clear within hours. Internal transfers between your CMA and brokerage account are usually instant.

Yes. CMA providers typically pay variable APY on uninvested cash, often matching or exceeding high-yield savings rates. Your earnings will fluctuate with market interest rates and provider-specific tiers.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits