How to build business credit: Step-by-step guide

- Why building business credit matters

- How to build business credit, step by step

- How long does it take to build business credit?

- How to check and monitor your business credit

- Common mistakes to avoid when building business credit

- Build business credit and control spending with Ramp

Establishing strong business credit is key to your company’s long-term financial health. Strong business credit makes it easier to get financing, negotiate better terms, and protect your personal assets.

Why building business credit matters

Strong business credit is more than just a number; it’s a foundation for financial stability and growth. With a solid credit profile, your company can get:

- Better financing opportunities: A strong credit profile improves approval odds and unlocks better interest rates, rewards, and repayment terms

- Easier access to capital: Good credit attracts investors and opens access to bank loans and lines of credit or alternative funding

- Protection of personal assets: Separating business and personal credit shields your savings, home, and other assets from business liabilities, and helps you qualify without a personal guarantee

- Improved cash flow: Good credit helps you secure financing quickly and manage cash flow during downturns or growth periods

- Increased negotiating power: A strong business credit score gives you leverage when negotiating contracts and vendor terms

On the other hand, neglecting business credit can limit your access to capital, force you to accept unfavorable loan terms, and blur the line between personal and business risk. Over time, that can slow your company’s growth and expose you to unnecessary financial strain.

How to build business credit, step by step

An established business credit report can help you get higher credit approvals, better interest rates, and better repayment terms on business lines of credit and loans.

You may wonder, “What steps should I take to establish business credit for a new company?” Here are five key steps to help you build business credit fast as a small business owner:

1. Formalize your business entity and get an EIN

The first step to establishing your business credit is to form a legal entity, such as a limited liability company (LLC) or corporation. This separates your personal credit history and finances from your business finances and gives you limited liability protection.

Note, sole proprietorships often face challenges building business credit because lenders usually tie borrowing activity to their personal credit rather than a separate business profile.

You’ll also need to get an Employer Identification Number (EIN). This is a business tax ID issued by the IRS that allows you to file your business taxes and open a business bank account. When applying for business credit cards, an EIN is used to report your credit activity to business credit bureaus.

2. Open a business bank account

A dedicated business bank account is essential for separating personal and business finances. It helps track your business’s income and expenses more accurately, allowing you to keep your personal credit separate from business liabilities.

To open a business checking account or savings account, you'll have to provide your business's EIN, legal documents, and other information to verify your business's identity.

3. Register with business credit bureaus

A D-U-N-S number, issued by Dun & Bradstreet, is a unique identifier that helps build your business credit report. Many loan providers and potential partners, especially large suppliers or government agencies, require a D-U-N-S number to verify your business's creditworthiness.

It also helps establish your business in Dun & Bradstreet's PAYDEX Score system, which lenders use to evaluate your payment history. You can apply for a D-U-N-S number for free on the Dun & Bradstreet website, and it’s a critical step toward building credit with major business credit reporting agencies.

4. Open net 30 accounts or establish tradelines with vendors

Build credit by opening accounts with vendors that extend trade credit, such as net 30 terms. Consistently paying on time boosts your score and can qualify you for net 60, net 90, or higher credit limits. Examples of starter vendors that report include Uline, Grainger, and Quill.

5. Use a business credit card responsibly

Open a business credit card or business line of credit that reports to bureaus using your EIN. Pay your statement in full and on time to avoid interest, protect your payment history, and qualify for higher limits over time.

To find the best business credit card for your startup, new business, or LLC, compare options based on your credit profile, spending habits, and preference for rewards or low rates.

Bonus step: Keep your accounts open

Maintaining longstanding business credit accounts helps build a good business credit score. Business credit bureaus, like Dun & Bradstreet, Experian, and Equifax, consider the length of your credit history when calculating your score. The longer your accounts remain open and in good standing, the more it demonstrates your business’s creditworthiness.

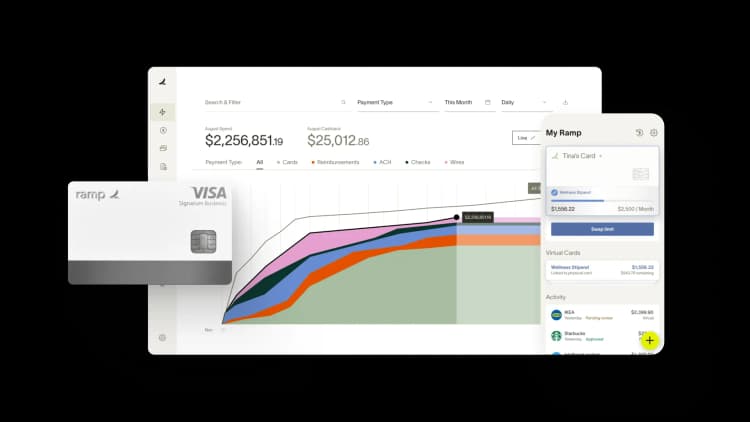

Discover Ramp's corporate card for modern finance

How long does it take to build business credit?

Building business credit is a step-by-step process that can take anywhere from a few months to a couple of years. It typically takes 3 to 6 months for an initial score and 1 to 2 years to establish strong credit. The speed depends on factors like making timely payments, maintaining low credit utilization, and having multiple trade lines reporting to business credit bureaus.

How fast can you get a good business credit score?

- In 3–6 months, you can establish a basic score if you use vendors that report

- In 6–12 months, you can achieve a strong business credit score

- In 2–3 years, you can qualify for major business funding opportunities

During the first year, you may start seeing small improvements in your business credit score if you open accounts, pay bills on time, and use your business credit card responsibly. However, achieving a solid credit profile that qualifies your business for more significant loans and favorable terms usually takes 2–3 years of diligent financial management.

The timeline depends on several factors, including how quickly you establish credit accounts, how consistently you make payments, and how often your vendors and creditors report your activity to business credit bureaus.

What is a good business credit score?

A good business credit score depends on the scoring model used:

Bureau/model | Good score | Note |

|---|---|---|

Dun & Bradstreet PAYDEX | 80+ / 100 | Indicates prompt payments |

Experian Business | 76+ / 100 | Low risk |

Equifax Credit Risk | 700+ / 992 | Favorable |

FICO SBSS | 140+ / 300 | SBA minimum; 155–165 ideal |

How to check and monitor your business credit

You can request business credit reports from Dun & Bradstreet, Experian Business, and Equifax Business. Reviewing these reports regularly helps you confirm that your company details, payment history, and credit utilization are accurate.

If you find errors, file a dispute with the bureau and provide supporting documents so the issue can be corrected. Ongoing monitoring is important because it helps you catch problems early and maintain a strong credit profile.

Common mistakes to avoid when building business credit

It takes time and discipline to get business credit and small mistakes can slow your progress. Here are some common mistakes to avoid and how to steer clear of them:

- Mixing finances: Mixing personal and business finances prevents building a clear credit profile. Always use a dedicated business account.

- Missing payments: Missing payments damages your score. Set up reminders or autopay to stay current.

- Not registering: If you don’t register with credit bureaus, your payment history won’t be tracked. Get a D-U-N-S number and ensure vendors report.

- Relying on personal credit: Leaning on personal credit limits financing options and puts assets at risk. Apply for business accounts that report to bureaus.

- Ignoring reports: Failing to review reports lets errors or fraud go unnoticed. Check them regularly and dispute inaccuracies.

Build business credit and control spending with Ramp

Building business credit is one of the most important steps you can take to support long-term growth. Ramp makes that process easier by combining credit building with powerful tools to help you manage and optimize your company’s finances.

The Ramp Business Credit Card reports to the major business credit bureaus, helping you build business credit. Unlike traditional business credit cards, it also comes with built-in expense management software that allows you to keep tight controls on spending, receipt tracking, and monthly payments.

There are no annual fees, interest fees, or foreign transaction fees. To apply for Ramp, all you need is a registered business with at least $25,000 in a U.S. business bank account.

Try a demo to see if Ramp is right for your business.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°