What is a financial controller? Role, skillset, and responsibilities

- What is a financial controller?

- Why the controller role matters to growing companies

- Core duties and responsibilities of a financial controller

- Essential skills and qualifications for the controller position

- Steps to become a financial controller

- Controller vs. CFO vs. finance manager

- When to hire your first controller and what it costs

- KPIs and metrics every controller should track

- How modern software transforms financial controllership

- Free your controller to focus on strategy with Ramp

A financial controller is your company’s chief accounting officer. They manage daily financial operations, oversee accounting teams, and ensure accurate financial reporting that leadership can trust for decision-making. Understanding the role and its benefits helps you know when to hire one and what to expect.

Controllers bridge the gap between bookkeeping and executive leadership. While a bookkeeper records transactions and a CFO sets financial strategy, the controller ensures financial data is reliable and processes run smoothly. They turn raw numbers into insights that drive smarter decisions and make sure the company meets compliance standards.

What is a financial controller?

A financial controller is a senior-level accounting professional responsible for strategic financial management, regulatory compliance, and the integrity of your financial statements. They lead accounting operations, supervise general ledger maintenance, and act as the link between finance teams and senior management.

Unlike bookkeepers, controllers own the entire accounting function. They establish accounting policies, oversee internal controls, and deliver timely, accurate reports. In short, they’re the financial analyst of your business’s accounting operations, responsible for turning financial information into practical insights.

What is controllership in finance?

Finance controllership encompasses the function and department responsible for financial oversight, reporting, and strategic support to leadership. It includes all activities related to maintaining accurate books, preparing financial statements, and providing insights that inform business decisions.

Controllership extends beyond basic bookkeeping to include budgeting, forecasting, and financial analysis. The function ensures financial data flows accurately through your organization while maintaining controls that protect assets and prevent errors.

Why the controller role matters to growing companies

Controllers provide the financial discipline, insights, and stability that enable growth. They turn piecemeal financial processes into organized systems that scale with your business while reducing the risk of costly errors or compliance failures.

During growth phases, controllers become especially valuable by establishing processes before problems arise. They implement controls that prevent expense fraud, create reporting structures that provide visibility, and build financial foundations that support expansion.

Controllers also free up executive time by handling complex financial operations. Instead of your CEO or founder managing month-end close or chasing down expense reports, a controller handles these tasks while providing clear, actionable financial insights to leadership.

Core duties and responsibilities of a financial controller

Financial controllers balance tactical accounting tasks with strategic finance. Their responsibilities typically include:

- General accounting: Oversee the general ledger, maintain the chart of accounts, and review journal entries to ensure accurate recordkeeping

- Financial reporting: Prepare income statements, balance sheets, and P&L reports that comply with GAAP or IFRS. Ensure reports meet regulatory compliance and support decision-making.

- Month-end and year-end close: Manage closing checklists, assign responsibilities, and use finance automation to streamline processes while maintaining accuracy

- Internal controls and risk management: Design approval workflows, segregation of duties, and fraud prevention controls. Monitor risks and update policies to protect assets.

- Budgeting and forecasting: Lead the budget process, consolidate departmental plans, perform variance analysis, and update forecasts based on real-time performance data

- Cash flow and expense oversight: Supervise accounts payable and receivable teams, enforce expense policies, and negotiate vendor terms to support financial health

- Audit and tax coordination: Prepare documentation for external auditors, manage tax filings, and ensure compliance with evolving regulations

- Team leadership: Manage accounting staff, support professional development, and lead finance collaboration with stakeholders across the business

Who reports to the controller?

Controllers take on direct oversight of core accounting teams. In smaller companies, that may mean supervising individual contributors in accounts payable, accounts receivable, payroll, and revenue accounting. In larger organizations, controllers may manage accounting managers who lead each of these functions.

In both cases, the controller ensures financial data is accurate, reporting is timely, and internal controls are consistently followed across the team.

Essential skills and qualifications for the controller position

Successful controllers combine technical expertise with leadership and soft skills. They need accounting knowledge to ensure accuracy, analytical capabilities to provide insights, and interpersonal skills to guide teams and stakeholders.

Technical finance skills

- Deep knowledge of GAAP, IFRS, and financial accounting principles

- Experience preparing and reviewing financial statements and reports

- Proficiency with ERP systems, accounting software, and financial data tools

- Ability to perform forecasting, variance analysis, and cost accounting

- Strong analytical skills to investigate trends and interpret financial information

- Familiarity with regulatory compliance and internal controls

Leadership and soft skills

- Leadership skills to manage accounting staff and support career development

- Communication skills to translate financial data for non-finance stakeholders

- Decision-making ability to balance accuracy with business needs

- Mindset to connect strategic financial management with company goals

- Collaboration skills to work across departments and with senior management

Education and certifications

- Bachelor’s degree in accounting, finance, or business administration

- MBA or master’s degree in accounting for some advanced or high-profile roles

- Professional certifications such as CPA (Certified Public Accountant), CMA (Certified Management Accountant), or CFA (Chartered Financial Analyst)

- Relevant licensure, depending on region

- Years of experience in public accounting or corporate accounting roles

Steps to become a financial controller

The career path to financial controller typically spans 8–15 years and requires the right mix of education, certifications, and experience. Each stage builds the technical and leadership skills needed to oversee financial operations and guide strategic decisions.

1. Earn the right degree

Most controllers start with a bachelor’s degree in accounting, finance, or business finance. A master’s degree in accounting or an MBA can accelerate advancement by deepening financial knowledge and broadening business perspective.

2. Build accounting experience

Early roles in public accounting or corporate accounting provide a foundation in financial reporting, auditing, and internal controls. Experience as a staff or senior accountant, accounting manager, or assistant controller develops the technical and operational expertise needed for senior-level positions.

3. Obtain certifications

Professional designations signal credibility and open doors. A CPA license demonstrates mastery of financial accounting and reporting, while a CMA highlights management accounting and financial strategy skills. Some controllers also pursue the CFA for a broader finance focus.

4. Develop leadership and systems skills

Controllers need leadership skills to manage teams and collaborate with stakeholders across departments. Technical proficiency with ERP platforms, accounting software, and automation tools is equally important to streamline processes and provide real-time financial information.

5. Advance to senior roles

Progression through roles like accounting manager or assistant controller prepares candidates for the controller position. According to the Bureau of Labor Statistics, employment of financial managers, including controllers, is projected to grow 15% from 2024 to 2034, which is much faster than the average growth rate for all occupations. This creates steady opportunities for qualified professionals.

Controller vs. CFO vs. finance manager

Understanding the hierarchy and distinctions between financial roles helps you build an effective finance organization. Each position serves specific functions within the financial leadership structure:

| Role | Primary focus | Reporting structure | Key responsibilities | Typical company size |

|---|---|---|---|---|

| Finance manager | Specific financial functions | Reports to controller or CFO | Budget analysis, financial planning, departmental support | All sizes |

| Controller | Operational finance and accounting | Reports to CFO or CEO | Accounting operations, compliance, financial reporting | $10M+ revenue |

| CFO | Strategic finance and leadership | Reports to CEO and/or board | Strategy, fundraising, investor relations, M&A | $50M+ revenue |

Controller vs. CFO

Controllers focus on operational finance: ensuring accurate books, timely reporting, and efficient processes. They look backward at historical data and inward at current operations to maintain financial integrity.

CFOs focus on strategic finance: setting financial strategy, managing investor relationships, and driving long-term value creation. They look forward at growth opportunities and outward at market conditions to position the company for success.

Controller vs. finance manager

Controllers hold broader authority over the entire accounting function and typically manage multiple teams or departments. They set accounting policies, oversee compliance, and are ultimately responsible for the accuracy of all financial reporting.

Finance managers typically focus on specific areas like financial planning and analysis (FP&A), treasury, or operational finance support. They report to controllers or CFOs and handle more specialized financial functions rather than overseeing the entire accounting operation.

Controller vs. comptroller: What's the difference?

The terms "controller" and "comptroller" are often used interchangeably and refer to the same role. The spelling difference is largely historical, with "comptroller" being an older variant that persists in certain industries. Government entities and some traditional industries still use "comptroller," while most private companies use "controller." Regardless of spelling, the responsibilities and qualifications are essentially the same.

When to hire your first controller and what it costs

Timing your first controller hire requires balancing financial resources with operational needs. Most companies benefit from a controller when they reach certain growth milestones or face increasing financial complexity.

Signs you need a controller

Several indicators suggest it's time to hire a controller for your growing business:

- Your monthly close takes more than 10 days

- Manual processes dominate your accounting workflows

- Compliance requirements are becoming complex or overwhelming

- You're preparing for fundraising or acquisition

- Financial reports are frequently late or inaccurate

- Your CEO or founder spends significant time on financial operations

- You lack visibility into cash flow or financial performance

- Audit findings highlight control weaknesses

- Department heads complain about budget tracking

- You're expanding into new markets or product lines

Typical controller salary ranges

Controller compensation varies significantly based on company size, industry, location, and required experience. Factors influencing salary include company revenue, team size, industry complexity, and whether the role includes CFO responsibilities.

Geographic location plays a major role, with controllers in major metropolitan areas commanding higher salaries than those in smaller markets. Industry also matters: Controllers in financial services or healthcare often earn more due to regulatory complexity.

With all that said, national salary benchmarks for controllers range from around $150,000 on the lower end to more than $200,000 on the high end.

KPIs and metrics every controller should track

Key performance indicators (KPIs) help financial controllers measure efficiency, highlight risks, and demonstrate value to leadership. These metrics show how well financial operations are running and where improvements are needed:

- Days to close: Measures how long it takes to finalize financial statements after period end. Best-in-class teams close within 5 days. Shorter close times free controllers to focus on analysis and strategic support rather than manual reporting.

- Budget vs. actual variance: Compares planned budgets to real results. Controllers don’t just report differences; they explain why they happened, whether due to timing, volume shifts, or true performance gaps. This context supports better decision-making and financial planning.

- Cash conversion cycle: The cash conversion cycle tracks how quickly a company turns inventory and receivables into cash. A shorter cycle means stronger cash flow and working capital management. Controllers improve this metric by negotiating payment terms, accelerating collections, or optimizing inventory.

- Spend under management: Shows what percentage of spending follows approval policies and procurement processes. Higher percentages mean better control and fewer surprises. Controllers raise this number by enforcing expense policies, using automation, and educating employees.

How modern software transforms financial controllership

Technology allows financial controllers to offload manual processes and focus on strategic decisions. Automation, along with thoughtful integrations with the rest of your finance stack, reduces errors, accelerates reporting, and gives leadership real-time visibility into performance.

Automating expense and vendor management

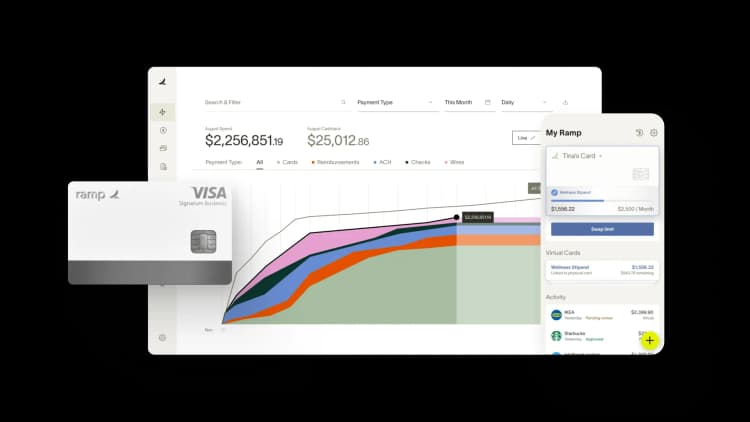

Comprehensive finance operations platforms like Ramp can capture receipts automatically, enforce expense policies, and route approvals without manual input. Integrated vendor management tools handle contracts, payment scheduling, and spend analysis, freeing controllers from routine tasks.

Real-time reporting and analytics

Software such as NetSuite Planning and Budgeting or Power BI delivers daily insights into cash position, budget status, and spending trends. Controllers can spot anomalies faster, leverage predictive analytics, and shift from reactive fixes to proactive financial management.

Integrations with ERP and accounting systems

A fully integrated tech stack reduces duplicate data entry and reconciliation work. When expense, payroll, and other financial operations flow directly into a single source of truth, controllers maintain data accuracy while streamlining accounting processes.

Free your controller to focus on strategy with Ramp

A financial controller’s value comes from guiding decisions, not chasing receipts. Ramp automates the manual work that consumes controllers’ time so they can concentrate on strengthening financial health and advising leadership.

By shifting routine tasks off their plate, controllers gain the bandwidth to analyze performance, refine budgets, and deliver the real-time insights executives need. Instead of spending hours reconciling expenses or managing approvals, they can partner with the CFO and senior management on growth opportunities.

Ramp’s finance operations platform gives controllers the visibility and control they need without the administrative burden. The result is more accurate reporting, faster closes, and financial leaders who are free to focus on strategy instead of paperwork.

FAQs

A controller is a job title representing a senior position in the accounting hierarchy, while CPA is a professional certification. Many controllers hold CPA credentials, which enhance their qualifications but don't determine their organizational rank.

Smaller companies often have one person handling both controller and CFO functions until they reach sufficient scale to justify separate roles. This combined position, sometimes called "Head of Finance" for title purposes, handles both operational accounting and strategic finance.

Controllers prepare for audits by ensuring all reconciliations are complete, documentation is organized, and supporting schedules are ready for auditor review. They coordinate with audit teams to understand requirements, timeline, and specific risk areas requiring focus.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits