What is a personal guarantee? How it works and what founders should know

- What is a personal guarantee?

- How does a personal guarantee work?

- What does a personal guarantee require?

- Types of personal guarantees

- Pros and cons of personal guarantees

- Tips and best practices for guarantors

- Special considerations: SBA loans and other exceptions

- Alternatives to signing a personal guarantee

- Get a corporate card without being a guarantor

Personal guarantees can create a tough decision for first-time founders and serial entrepreneurs alike. Should you provide a personal guarantee to access credit for your business, or should you explore alternative ways to get the funds you need? We take a closer look at how personal guarantees work, the risks involved, and when you should take a different approach entirely.

What is a personal guarantee?

A personal guarantee is a legally binding agreement to be held personally responsible for repaying business debt if your company can’t meet its obligations. Sometimes called a founder guarantee, entrepreneurs often provide guarantees to secure loans or business credit cards for startups, existing businesses, and solopreneur ventures.

Unlike a corporate guarantee, which is backed only by the business, a personal guarantee extends liability to your individual assets and credit profile. As a result, lenders are more willing to approve your funding application because it gives them the power to collect from your personal assets if repayments stop. That’s why it’s crucial to understand the type of guarantee you’re signing.

How does a personal guarantee work?

When you take out a loan or business line of credit with a personal guarantee, you become liable if the business can’t pay. Your company receives the funds, but if it can't make the scheduled payments, the lender can pursue repayment from your personal assets.

By signing, you assume both legal and financial responsibility for the debt. The guarantee remains in place for the life of the loan, and your obligations don’t disappear just because your business is struggling or shuts down. If the business defaults, the lender can demand repayment directly from you through your personal assets, legal action, or both.

Legal obligations and liability

A personal guarantee isn’t symbolic; it’s a binding legal contract. When you sign, you agree to cover your business's debt if it defaults or otherwise can't fulfill its obligations. Depending on the terms, you may also be on the hook for interest, penalties, collection costs, and the lender’s legal fees.

Many agreements structure liability as joint and several liability. That means if multiple founders or partners sign, the lender can pursue any one of you for the full balance owed, not just your share. Even if you own only part of the business, the lender could still hold you responsible for 100% of the debt until you repay them.

Impact on personal assets and credit

A personal guarantee extends beyond your business, putting your personal assets at risk. Depending on the agreement, this can include:

- Real estate, such as your home or investment property

- Vehicles

- Bank accounts and savings

- Retirement accounts

- Other valuable personal property

If the lender seizes assets or pursues a judgment, your personal credit report will also reflect the default. Missed payments, charge-offs, or bankruptcy filings tied to the guarantee can damage your credit score for years, making it harder to qualify for mortgages, personal loans, or even new business credit down the road.

What does a personal guarantee require?

The short answer? A lot. Lenders and corporate card issuers want proof that you can back your promise.

Founder and business records

You need to explain who you are, your management credentials, and your business. Alongside this overview, you need to give the lender your personal financial statements. Every owner, partner, or stockholder owning at least 20% of the business should be ready to do the same.

Your business’s credit needs

Provide a detailed estimate of how much capital you need to launch or expand. This includes how much you have now and how much you’ll need to borrow.

Financial forecasts for the business

This can include month-by-month revenue projections, cash flow projections, and any assumptions about expenses and profit for the first 2–4 quarters. Here, the lender wants to assess your financial culture.

Collateral you can pledge

As noted above, this could include your home, vehicles, investment accounts, or retirement funds. In short, any liquid asset or non-liquid asset that you can give up in case you default. You need to include the market value of these assets, too.

Types of personal guarantees

There are two types of personal guarantees: Limited and unlimited. The difference matters because one caps your liability while the other could put all your personal assets at risk if you can’t honor the repayment terms.

Limited founder guarantee

A limited guarantee places a cap on your liability. Lenders can collect only up to a certain dollar amount or percentage of the outstanding balance from each guarantor. These are common when multiple principals share responsibility for a loan. The benefit is that your exposure is limited, and lenders may offer lower rates in exchange.

Unlimited founder guarantee

An unlimited personal guarantee carries the greatest risk. As the guarantor, you're responsible for repaying the entire loan amount, plus interest and potentially legal fees, if your business defaults. The Small Business Administration’s (SBA) loan program is one example. Many SBA loans require unlimited guarantees from any borrower with a 20% ownership stake.

Special clauses and variations

In addition to limited and unlimited guarantees, lenders may include other terms:

- Bad boy clauses: Trigger full liability if you commit fraud, misuse funds, or act in bad faith

- Continuing guarantees: Keep your liability in place as you add new credit or debts until you revoke the guarantee

- Joint and several liability: Allows the lender to pursue any one guarantor for the full balance, even if others also signed

Pros and cons of personal guarantees

Cash flow and working capital are probably top of mind in the early days of your business. A personal guarantee is one way to overcome obstacles created by a “thin” credit history or a subpar credit score, both of which can prevent you from accessing business credit. There are other benefits, too:

Pros

- Founder guarantees boost your loan application’s appeal to lenders

- Guarantor status may help you get favorable interest rates

- Your business has the credit it needs to grow once the lender approves you

Personal guarantees are far from problem-free for you as the guarantor. If your business fails or declares bankruptcy, the lender can still demand repayment from you. Here are the drawbacks:

Cons

- Losing personal assets and wealth could take a toll on your personal future

- Your personal credit score can take a major hit if the lender enforces the guarantee, making it harder for you to qualify for future personal or business loans

- The long-term consequences can be severe, such as bankruptcy

Tips and best practices for guarantors

If you’re considering signing a personal guarantee, proceed with caution. Lenders require detailed documentation, and the terms can have long-term consequences for your finances. Before you agree, carefully review the guarantor application requirements and the lender’s documentation. Here are some key steps to take:

1. Understand business spend

Make sure you’re confident in your business’s long-term viability, especially if you’re a co-owner considering a personal guarantee. This entails becoming active in all aspects of the business to guarantee that no financial problems lurk around the corner.

2. Understand your exposure

Find out exactly what the lender or credit card issuer can require if you default. As mentioned earlier, you may be responsible for the loan’s principal and interest, late fees, collection costs, and the lender’s legal expenses.

3. Get a legal opinion

Ask your lawyer and accountant to review the guarantee agreement itself. These professionals can spot terms you might miss, explain your liability in plain language, and suggest changes you could negotiate before signing.

4. Pause before signing on the dotted line

Only vouch for a business that you wholly or primarily own. If your ownership stake is small or your relationship with your business partners is fraught, think twice before putting pen to paper.

Personal guarantees can still be enforceable even after you’ve sold out of the business, which means someone else’s bad financial management or just plain misfortune can put your personal assets at risk in the future.

Special considerations: SBA loans and other exceptions

Personal guarantees are almost always required if you apply for a Small Business Administration loan. In fact, the SBA mandates that anyone with a 20% or greater ownership stake must sign an unlimited personal guarantee. This means you’re personally responsible for the full loan amount, plus interest and fees, if your business can’t repay.

There are very few exceptions to this rule, even for startups and LLCs. Government-backed programs view personal guarantees as a safeguard for taxpayer-funded capital. Higher-risk industries such as restaurants or construction may also face stricter requirements.

Alternatives to signing a personal guarantee

Personal guarantees are common, but they’re not your only option. Depending on your situation, you may be able to:

- Seek non-guaranteed financing: Some lenders offer small business loans or lines of credit that don’t require guarantees, though approval is harder and terms may be stricter

- Use business credit cards without guarantees: Certain corporate and business credit cards don’t require a personal guarantee and can help separate business and personal liability

- Offer collateral instead: A secured loan backed by business assets such as equipment or receivables may reduce or remove the need for a personal guarantee

Get a corporate card without being a guarantor

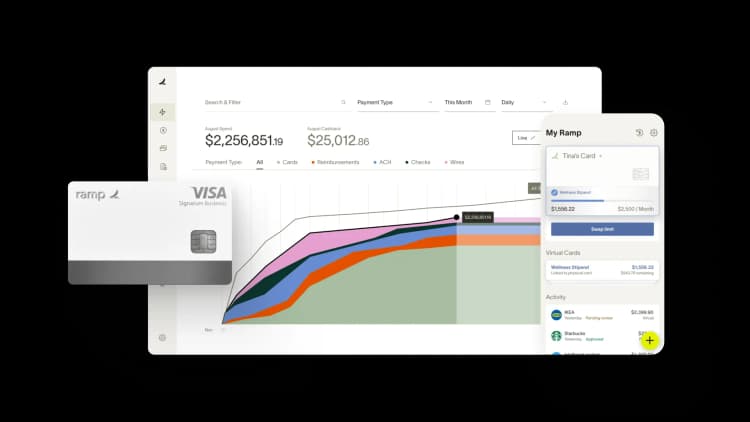

Ramp believes you shouldn’t have to put your personal assets at risk to access the cash you need to build your business.

The Ramp Business Credit Card doesn’t require a personal credit check or personal guarantee, and there’s no impact on your personal credit history. Instead, we base your credit limit on business fundamentals such as revenue and funding, not your personal finances.

Benefits of the Ramp Business Credit Card

Ramp offers more than just financing. When you're approved for Ramp's corporate card, you get access to a comprehensive finance operations platform:

- Expense management software that automatically categorizes expenses and collects receipts, all but eliminating expense reports

- Accounts payable automation that lets you pay bills by check, card, ACH, or international wire

- Unlimited physical and virtual credit cards for employees with custom spending limits at the card, individual, team, or merchant level

- Integrations with popular accounting platforms and enterprise resource planning (ERP) systems, including QuickBooks Online, NetSuite, and Xero

Ready to learn more? See how Ramp can support your startup.

FAQs

An example of a personal guarantee is when a founder applies for a business loan and is required to post personal assets as collateral. The lender claims these assets if the business fails to meet the loan terms.

It’s difficult, but not impossible. You can sometimes remove a personal guarantee by refinancing the loan, negotiating with the lender after your business has built a strong credit profile, or paying down a significant portion of the balance. Some lenders may also agree to release the guarantee if you provide collateral or other security as an alternative.

You may void a personal guarantee if you signed the agreement under fraud, duress, or misrepresentation, or if the lender materially changes the loan terms without your consent. Otherwise, guarantees remain enforceable until you fully repay the debt or the lender formally releases you in writing.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits