What is a variance report? (and how to create one)

- What is a variance report?

- How to create a variance report

- How to analyze a variance report

- Catch budget variances early with Ramp's real-time expense tracking

Creating a budget is an essential task for any well-run business. It gives executives and management teams an estimate of what the company income and expenses will be for an upcoming quarter or year. The word “estimate” is the key term in that description. Budgets don’t portray the actual results—think of them as an “educated guess.”

In other words, the final amounts of income and expenses at the end of the period will differ from what is projected in the budget. That difference is called a “variance,” and it’s important for getting a fuller picture of the financial well-being of a company. Variances can be positive or negative, indicating where budget projections exceed or fall short of the actual numbers.

What is a variance report?

A variance report is a written document that shows the deviations between the projected income and expenses listed on the budget and the actual numbers reported at the end of the period. The variance report lists the difference for each line item as both a number and a percentage.

With accurate reporting, a variance report is a valuable spend management tool that can be used to adjust cash outflows and provide realistic revenue expectations to company executives and business owners. It informs decision-making on how to cut costs, increase operating income, and create a more accurate budget going forward.

Variance reporting should be done regularly as part of the overall budgeting process. The exact cadence is dependent upon the type of business. Long waiting periods between variance reports can lead to wide disparities on budget line items. Companies that forego this process often find that their existing budgets are inaccurate after several reporting periods have gone by—this can cause a cascading effect across the business.

How to create a variance report

The easiest way to create a variance report is with an Excel spreadsheet. You can use the “data analysis” plugin if you prefer or opt to build the report from scratch. There are also Excel templates that might suit your company needs. If you choose to custom build in Excel, begin by creating a spreadsheet with these five column headers.

The first three columns are for entering data, so no formulas are required for them. The "Description" column is to label the line item. “Forecast” comes directly from the budget. “Actual” is the actual number for that line item at the end of the period. Columns D and E are where the variance is calculated and displayed as either a number or percentage.

As an example, let’s assume that cell B1 contains a budget item for “office supplies” with a forecasted amount of $1000, but cell C1 has the actual amount spent on office supplies for that period at $1200. That’s a variance of 20%, or $200 from the budget. Since this is an expense, the variance would be listed as a negative number because the company went over budget.

Separating revenue and expenses on a variance report

A variance report needs to be readable for it to be effective, so presentation is important. For best results, it’s recommended that you place revenue line items and expense line items in separate sections. They can be on the same page, but there should be a clear distinction between the two. For instance, the revenue section would have the following:

- Revenue

- Cost of Goods Sold (COGS)

- Gross Profit

- EBITDA

- Net Income

Position the revenue section at the top of the variance report because it will garner the most attention. The “Expense” section, with line items that come directly from your company’s expense report, goes below that because it will be longer and therefore more tedious to go through in an executive business meeting. As a general point, most execs want to concentrate on revenue.

Calculating variance percentage and dollar amount

Let’s go back to the office supply example above.

The forecasted cost for office supplies was $1,000 (Column B, Cell 1) and the actual cost (Column C, Cell 1) was $1,200. To calculate the variance as a percentage, the formula would be [(C1/B1)-1] * 100. Plug in the numbers and that’s 1200 ÷ 1000 = 1.20 – 1 = .20 * 100 = +20% over budget.

The same formula works for a number coming in under budget. Let’s assume that the actual number was $800 spent on office supplies for the period instead of $1000. The math looks like this: 1000 ÷ 800 = 0.80 – 1 = -0.20 * 100 = -20% under budget. If you enter the formula once and use autofill, Excel will calculate each line item for you.

As for the absolute value for column E, that’s done by simple subtraction. In this example, it would be C1-B1, so in the first case it’s 1200-1000 = +$200. In the second, it’s 800-1000 = -$200. Reading those numbers side-by-side with a percentage can tell you how much you need to increase or decrease expenses. Figuring out how to do that happens in the analysis phase.

How to analyze a variance report

Some companies add a column between columns A and B where they can record the actual number from the previous period. This is done for analysis purposes and can be expanded to include multiple quarters or years if that’s deemed necessary. Being able to track variance across time can be valuable in determining how effective budget changes have been.

One of the goals of a variance report is to detect excessive spending and eliminate waste. It can be used for cost analysis and tail spend management, kept as a record of historical changes in revenue, or used by business owners to prepare their budget. To accomplish all that, it needs to include an analysis.

Analyzing a variance report involves more than just entering numbers and calculating percentages. A true analysis also includes an explanation for each variance. Why did expenses go up in that area? Is there a reason revenue is down this quarter? These are some of the many questions a variance report analysis is expected to answer.

Variances come in two categories, positive and negative, and most companies allow an acceptable margin for both that can be attributed to inflation, cost increases, or unforeseen market conditions. If this margin exists, it should be stated clearly on the variance report, along with the reasoning and methodology behind incorporating it.

The final step is to outline the potential effects of each variance on the company. If that effect is negative, include a proposed solution to correct it. If it’s positive, explore ways to expand on the trend and include those suggestions in your report. You won’t need to get too detailed, but at least offer a starting point for the business owner to develop a strategy.

What positive variance means

A positive variance, also called favorable variance, is when actual revenue is higher than budgeted revenue and actual expenses are lower than budgeted expenses. These numbers normally work in concert with one another, but it is possible to have a positive variance on revenue with a negative variance on expenses. That’s why the two sections should be analyzed separately.

This is important. Seeing a positive variance in revenue and just assuming expenses are down could be costly to the business. A positive variance, like a negative variance, should be investigated. Businesses should review the transaction data for accuracy, examine price changes, and look for areas where cost reductions may have led to the variance.

What negative variance means

A negative variance is the opposite of a positive variance. Revenue is less than what was forecasted, and expenses are more. In this case, it’s up to the analyst to determine the cause of these scenarios and offer potential solutions. For instance, how can the company cut costs in their office supply orders? Perhaps using a new supplier would solve that problem.

Organize the presentation carefully before sharing it with ownership. If a solution for a negative variance is complicated, draft an addendum and attach it to the report rather than trying to outline it on the spreadsheet. The analyst can’t be held responsible for the variance, but they can be faulted for a shoddy presentation. Be meticulous and organized.

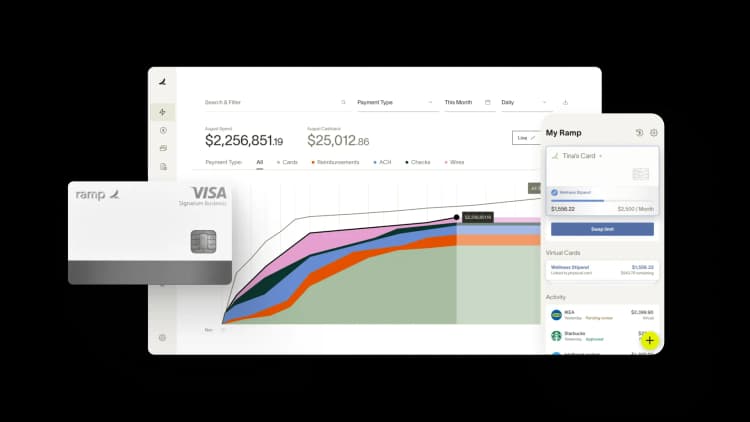

Catch budget variances early with Ramp's real-time expense tracking

Budget variances sneak up on finance teams when visibility is delayed and tracking is manual. By the time you spot overspending in a monthly report, the damage is done and corrective action is reactive rather than preventive.

Ramp's accounting automation software detects variances as they happen and gives you the tools to correct course before budgets spiral. You set spending limits at the department, team, or project level, and Ramp monitors every transaction against those thresholds in real time. When spend approaches or exceeds a limit, Ramp sends automated alerts so you can intervene, whether that means freezing a card, adjusting a limit, or having a conversation with a budget owner.

Here's how Ramp helps you stay on top of budget variances:

- Real-time expense tracking: Monitor spend against budgets as transactions post, so you always know where you stand without waiting for month-end reports

- Automated alerts: Receive notifications when spending approaches or exceeds budget thresholds, giving you time to act before variances become problems

- Granular controls: Set limits by department, team, merchant category, or project to track spend exactly where it matters most

Try a demo to see how Ramp helps finance teams detect and correct budget variances before they impact the bottom line.

FAQs

This depends on what you want to analyze. A variance report usually shows the differences between projected income/expenses and actual income/expenses, so a budget or income projection and income statement or balance sheet broken down by category is typically required.

To run a variance analysis, you first need a statement with projected income and expenses broken down by category. Then, you compare these statements category by category with the actual income and expenses over a given period. Finally, you tally the total to determine what the variance is, whether it’s positive or negative, and which categories account for the deviation.

Understanding the types of variances in your business’s budget can help you adjust your plans and future forecasting, as well as work out current discrepancies. This can lead to increased cash flow and other benefits to your business.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits