Gross profit vs. net profit: differences, formulas, and strategies for growth

- What is gross profit?

- How gross profit guides business decisions

- What is net profit?

- Key applications of net profit

- Gross profit vs net profit

- Leveraging technology for profit optimization

- Net profit on financial statements

- Automate expense tracking to protect margins and boost profitability

Profits offer a direct snapshot of your business’s financial performance. Keeping a close eye on financial metrics, including margins, can help you determine whether you need to make changes to your business if it is not on financially stable footing.

However, gross profit and net profit differ significantly in how each metric measures financial performance. It's common for entrepreneurs and business leaders to confuse the two types of profit because they have many similarities.

You'll find both gross profits and net profits on a company's income statement. Both gross profit and net profit are backward-looking measures, focused on the amount of money a company made in a period that has already passed. But there are also some critical distinctions between the two.

What is gross profit?

Gross profit is the amount of money a company earns after accounting for the costs incurred to create those sales. Also called gross income, gross profit typically appears as a line when you prepare an income statement. Gross profit does not take operating expenses into account.

Gross Profit

Gross profit is a profitability metric showing the portion of revenue remaining once direct costs tied to production or delivery have been allocated.

Gross profit formula

To calculate gross profit, use the following formula:

Gross Profit = Total Revenue – Cost of Goods Sold (COGS)

For example, if your company generates $500,000 in revenue and incurs $300,000 in COGS, your gross profit would be $200,000.

The more money a company makes on each sale, the higher its gross profit. Companies use gross profits to pay for the operating costs of running a business.

Components of gross profit

You need two elements to calculate gross profit:

- Total Revenue: This is all income generated from sales before any deductions. It represents the total amount of money earned from selling your products or services.

- Cost of Goods Sold (COGS): These are all direct costs tied to producing your goods or delivering your services. COGS includes expenses like raw materials, direct labor, and manufacturing overhead directly associated with production. Knowing the difference between COGS and Operating Expenses is crucial for accurate financial reporting.

COGS includes several direct costs essential to your production process:

- Raw materials and inventory: These are the basic components required to create your product. Efficient sourcing and management of raw materials can significantly reduce production costs.

- Direct labor costs for production workers: This includes wages for employees who are directly involved in manufacturing your goods or providing your services. Optimizing labor efficiency can lead to substantial savings.

- Manufacturing overhead directly tied to production: These are costs such as equipment maintenance, utilities for the production facility, and depreciation of manufacturing equipment. Properly managing these overhead costs can improve your overall gross profit.

How gross profit guides business decisions

Gross profit is a measure of your company's revenue that does not take into account expenses such as rent, utilities, or taxes. The main reasons you need to know your gross profit include:

- Evaluating Production Efficiency: It helps you understand how effectively you're managing production costs relative to revenue generated.

- Pricing Decisions: Knowing your gross profit assists in setting competitive prices while ensuring profitability.

- Cost Management: Monitoring gross profit helps you identify areas where production costs might be reduced without sacrificing quality.

Investors, vendors, and financial institutions often request your gross profit data when evaluating partnerships or credit applications.

Understanding your gross revenue and your gross profit alone does not give you a complete financial picture of the company. It's essential to consider other financial metrics alongside gross profit.

What is net profit?

Net profit is the amount of total money a company earns after subtracting the cost of goods sold (COGS), as well as any other expenses incurred by the business, including operating expenses, interest payments, and taxes.Net profit is a more comprehensive measure of a company's financial health than gross profit, and it's a bit more complicated to calculate.

Net Profit

Net profit is the final measure of your business’s earnings, factoring in both direct costs (like production) and indirect costs (such as operating expenses, interest, and taxes). It appears at the “bottom line” of the income statement, offering a comprehensive snapshot of overall profitability.

In addition to direct costs, net profit also includes other types of non-sales revenue that a company receives, such as interest on investments or gains from the sale of an asset.

Net profit formula

To calculate net profit, use the following formula:

Net Profit = Total Revenue – Total Expenses

Or, breaking it down further:

Net Profit = Gross Profit – Operating Expenses – Interest Payments – Income Taxes

For example, if your company has a gross profit of $200,000, and total expenses (including operating expenses, interest, and taxes) amount to $150,000, your net profit would be $50,000.

Key applications of net profit

You need to know your company's net profit because it's the amount of money a company ultimately generates in a period. Net profit is the number that companies talk about when discussing their bottom line, and learning how to calculate net profit margin provides a realistic picture of your company's profitability and operational efficiency.

Net profit can help you make strategic decisions, such as ones on business expansion, investment opportunities, and cost management strategies. It also indicates whether your company is financially sustainable in the long term.

Further, investors or lenders might look at net profits as a way of determining whether it makes financial sense for them to put money into your business. Net profit also reflects your company's ability to generate profit after all expenses, which is crucial for sustainability and growth.

Net profit is also a measure of how much profit is available for reinvestment into the business, paying dividends to shareholders, or building reserves.

For modern businesses, maintaining healthy net profit margins requires careful balance, especially in competitive sectors where operational costs can quickly erode profitability. By keeping a close eye on net profit, businesses can adapt strategies to improve efficiency and competitiveness.

Gross profit vs net profit

Understanding gross profit and net profit is crucial because gross profit reveals how efficiently you generate revenue from production, while net profit shows your actual earnings after all business expenses. You calculate net profit by subtracting operating costs, taxes, and interest from your gross profit.

Key Differences

Aspect Gross Profit Net Profit Definition Profit after deducting COGS from total revenue Profit remaining after all expenses Formula Total Revenue – COGS Total Revenue – Total Expenses Components Considered Only direct production costs All business expenses

Leveraging technology for profit optimization

Using modern technology will help you make small targeted changes, and make better decisions, leading to significant improvements in your profit margin:

- Financial Software Integration: Use integrated accounting systems to combine accounting, invoicing, and expense management into a single platform for better visibility.

- Data Analytics: Use analytics to identify trends, forecast future performance, and make data-driven decisions.

- Automation: Automate routine tasks to reduce costs and free up resources for strategic initiatives.

Embracing technology not only improves efficiency but can also enhance operating profit by providing the agility needed to stay competitive in a rapidly changing business environment.

Remember that profit metrics should inform both short-term operational decisions and long-term strategic planning. By continuously monitoring and analyzing these metrics, you can make proactive decisions that drive growth and profitability.

Net profit on financial statements

Net profit typically appears as a line item on a company's income statement, representing the final figure after all revenues and expenses have been accounted for. It provides a clear picture of the company's profitability during a specific period.

Net profit does not typically appear on other financial documents, such as the cash flow statement or the balance sheet, but it is an essential figure for assessing overall financial performance.

You can also find the net profit on a profit and loss statement, which breaks down your gross income, cost of sales, and other overhead expenses.

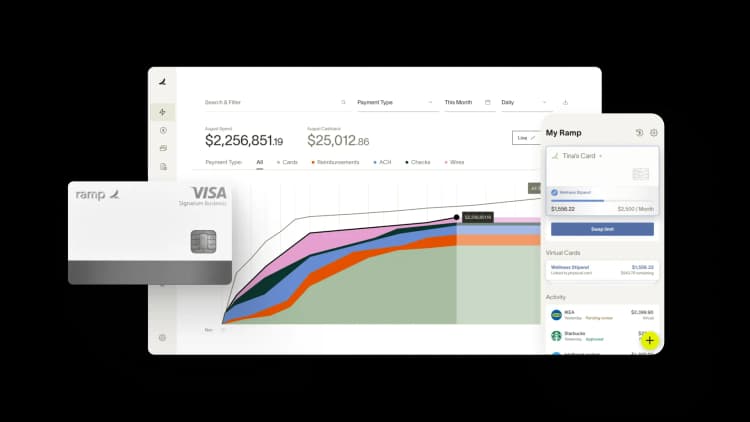

Automate expense tracking to protect margins and boost profitability

Manual expense processes drain profits in ways most businesses don't realize. Every hour spent chasing receipts, coding transactions, or reconciling spend is time your finance team can't dedicate to margin analysis or cost optimization.

Ramp's accounting automation software eliminates these profit leaks by automating the entire expense lifecycle. You'll gain real-time visibility into every dollar spent while your team reclaims 16+ hours every month previously lost to manual receipt collection and coding.

Here's how Ramp protects your bottom line:

- Real-time expense tracking: See spending as it happens across all departments and categories, so you can identify cost overruns before they impact your margins

- AI-powered coding: Ramp learns your accounting patterns and codes transactions automatically across all required fields, achieving a 67% increase in zero-touch codings compared to rules-only automation

- Automated receipt matching: Receipts are captured, matched, and stored automatically, eliminating the manual chase that delays month-end close and obscures true profitability

- Policy enforcement at point of purchase: Ramp blocks out-of-policy spend before it happens, preventing margin erosion from unauthorized or excessive expenses

- Faster close cycles: Close your books 3x faster and save 40+ hours every month, giving your team more time to analyze profitability drivers and optimize spending

Try a demo to see how Ramp helps businesses automate expenses and improve profit margins.

FAQs

Net income and net profits refer to the same thing. Both are terms referring to the amount of money a company makes after all its expenses.

Revenue is the amount of money that a company earns through sales of goods or services. Net profit, on the other hand, is a measure of the amount of money a company makes through sales and other sources, after paying out expenses, including production and labor costs, taxes, and interest on debt.

Yes. Net profit is the ultimate profit a business makes after all expense. Operating profit, however, is the amount of revenue a company has left over after deducting the cost of operations. That includes overhead expenses, such as rent or utility payments, but it does not take into account non-operational expenses, such as debt payments.

Net profit margin is a metric that shows how much net income every dollar of revenue produces. Typically, businesses express their net profit margin using a percentage.

Gross revenue is simply all of the money that a company earns through sales. Gross profit, on the other hand, is a measure of how of a company’s gross revenue it can keep after paying all its expenses.

Turnover and profit are both ways to measure a company’s revenue. Gross profit is the amount of money a company can keep after its expenses. Turnover, is another name for net sales, which is the total amount of money a company generates through sales.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits