- What is share dilution?

- How share dilution works

- Share dilution: Common causes

- How to calculate stock dilution

- Effects of share dilution on stakeholders

- Managing and minimizing dilution

- Dilution tracker tools and cap table modeling tips

- Spend your capital smarter with Ramp

Share dilution happens when a company issues new shares and existing shareholders end up owning a smaller percentage of the business. For startups, dilution most often occurs during fundraising rounds, when creating employee option pools, or when convertible notes and SAFEs turn into equity. Understanding how dilution works helps founders and employees set expectations, model ownership over time, and make smarter decisions as the company grows.

Key takeaways:

- Share dilution occurs when you issue new shares and ownership percentages decrease

- Dilution is common in fundraising, employee equity plans, and convertible securities

- Calculate dilution by comparing your shares to total shares outstanding before and after issuance

- Dilution can still create value if the company grows faster than ownership shrinks

What is share dilution?

Share dilution refers to the reduction in an existing shareholder’s ownership percentage when a company issues new shares. Even though the number of shares you own stays the same, your slice of the company gets smaller because the total number of shares outstanding increases.

You’ll often see share dilution referred to as stock dilution or equity dilution. In practice, these terms describe the same outcome: ownership is spread across more shares, which can affect control, voting power, and how future value is divided.

Dilution doesn’t automatically mean your equity is worth less. If the new shares are issued to raise capital that helps the company grow faster or reach a higher valuation, the overall value of your stake can still increase even as your percentage ownership declines.

Share dilution vs. stock split

It’s easy to confuse share dilution with a stock split, but they affect ownership in very different ways. A stock split changes the number of shares you own without changing your percentage ownership, while dilution changes ownership percentages by introducing new shares.

- Stock split: Existing shareholders receive additional shares, but everyone’s ownership percentage stays the same

- Share dilution: New shares are issued to new owners, which reduces existing shareholders’ ownership percentages

With a stock split, the company’s total value stays the same and ownership remains proportional. With dilution, ownership shifts across shareholders, even if the company becomes more valuable overall. That’s why founders usually plan carefully for dilution but rarely worry about stock splits.

How share dilution works

Share dilution begins when a company creates and issues new shares. Those shares might go to investors, employees, or partners, depending on the situation.

Once issued, new shares increase the total shares outstanding on the cap table. Ownership percentages automatically adjust based on the new total. This is similar to how equity financing changes a company’s ownership structure over time.

Your ownership percentage is always your shares divided by total outstanding shares. If either number changes, your percentage changes. Issuing new shares doesn’t take shares away from you, but it changes the denominator in that equation. That’s why dilution is predictable if you model it early.

For example, imagine a company with 100 total shares where you own 50 shares, or 50% of the company. If the company issues 100 new shares to investors, you still own 50 shares, but there are now 200 total shares. Your ownership drops to 25%.

Types of share dilution

Share dilution can come from several sources, including new equity rounds, employee stock options, and simple agreement for future equity (SAFE) instruments. Each affects ownership slightly differently.

| Type of dilution | How it happens | Why it matters |

|---|---|---|

| Primary dilution from new equity financing rounds | The company issues new shares to investors in exchange for capital | Founders and existing investors see immediate ownership percentage reductions |

| Secondary dilution from employee stock options and convertible securities | Options and convertibles increase the future share count once exercised or converted | Dilution may not happen right away, but it’s reflected on a fully diluted basis |

| SAFE conversions and their dilutive effects | SAFEs convert into equity during a priced round, often at a discount or valuation cap | Conversion increases total shares at closing, sometimes more than founders expect |

A simple agreement for future equity, or SAFE, is a common early-stage financing instrument that gives investors the right to receive shares later, usually when the company raises a priced round. While SAFEs don’t dilute ownership immediately, they increase the total share count once they convert.

Authorized vs. outstanding shares

Authorized shares are the maximum number of shares a company can legally issue. Outstanding shares are the shares that have already been issued and are currently owned.

The difference between authorized and outstanding shares represents potential future dilution. If a company has a large number of authorized but unissued shares, it has flexibility to raise capital or create option pools later. That same flexibility also means dilution risk if those shares are eventually issued.

This is why your cap table matters. A clean, well-modeled cap table shows not just current ownership, but what ownership could look like after future financing events. Understanding this early helps you avoid surprises later.

Share dilution: Common causes

Share dilution usually happens for good reasons, but it’s still important to understand what triggers it. Most dilution events are tied to growth decisions that trade ownership for capital, talent, or strategic leverage.

Fundraising and venture capital

Venture rounds introduce new shareholders in exchange for capital. Each round increases the total share count, which reduces founder and early investor ownership percentages.

Series A, B, and C rounds often introduce meaningful new ownership blocks. While every deal is different, founders commonly see dilution fall within predictable ranges as companies scale:

- Series A rounds commonly dilute founders by about 20–25%

- Series B rounds often result in 15–20% additional dilution

- Series C and later rounds typically dilute 10–15%, depending on valuation and round size

Investor ownership stakes directly affect founder equity. If you sell 25% of the company in a round, your ownership drops by that amount unless you buy additional shares.

For example, you might start a company owning 100%. Before a Series A, you create a 15% option pool, reducing your ownership to 85%. After raising a Series A that sells 25% of the company, your ownership falls to roughly 63.75%. A Series B with 18% dilution would bring that closer to 52%, assuming no other changes.

Employee stock option plans

Employee stock option plans (ESOPs) help attract and retain talent, but they also contribute to dilution. These shares usually come from new issuances, which increases the total share count.

Early-stage startups often set aside 10–20% of equity for employees. While option grants don’t dilute ownership immediately, they increase the fully diluted share count as options vest over time.

In many venture rounds, investors require companies to expand the option pool before the round closes. When that happens, the dilution primarily affects founders rather than new investors.

Convertible securities

Convertible notes turn debt into equity, usually at the next priced round. When that conversion happens, the company issues new shares, which causes dilution. SAFEs work similarly, even though they are not debt.

Valuation caps and discounts determine how many shares these instruments convert into. Lower caps or larger discounts result in more shares issued to note or SAFE holders, which can increase dilution more than founders expect if it’s not modeled early.

Strategic partnerships and acquisitions

Some partnerships involve granting equity instead of paying cash. Stock-based acquisitions also issue new shares to acquire another company. In both cases, dilution is used to fund growth without immediate cash outlay.

How to calculate stock dilution

At its core, dilution is a math problem. When total shares outstanding increase, each existing share represents a smaller fraction of the company.

If you owned 500 shares out of 1,000 total, you owned 50%. If the company issues 1,000 new shares, you still own 500 shares, but that’s now only 25%. The mechanics are simple, even if the consequences feel complex.

Basic dilution formula

Calculate ownership percentage as:

Ownership % = (Your shares / Total outstanding shares) * 100

Let’s say you own 500 shares out of 1,000 before dilution. That means you own 50%.

Ownership % = 500 / 1,000 * 100 = 50%

After issuing 250 new shares, total shares become 1,250. Your ownership drops to 40%.

Ownership % = 500 / 1,250 * 100 = 40%

Calculating dilution from new investment

Assume a company raises $10 million at a $40 million pre-money valuation. The post-money valuation becomes $50 million. Investors now own $10 million / $50 million, or 20% of the company.

That 20% ownership comes from issuing new shares. Founders and existing shareholders are diluted proportionally. This is why pre-money and post-money valuation matter when negotiating a round.

Understanding pre-money vs. post-money valuation

Pre-money valuation is your company’s value before new investment. Post-money valuation includes the new capital after closing. Understanding the difference helps you anticipate how much ownership you’re trading in each round.

Fully diluted ownership calculation

Fully diluted ownership includes all potential shares, such as options, warrants, and convertible securities. This view assumes those instruments are exercised or converted.

For example:

- Your company has 1,000,000 outstanding common shares

- You own 600,000 shares, or 60% ownership

- Your company also has 200,000 employee stock options and a SAFE that will convert into 200,000 shares at the next priced round

On a fully diluted basis, total shares equal 1,400,000 (1,000,000 common + 200,000 options + 200,000 SAFE shares). Your ownership becomes 600,000 / 1,400,000, or about 42.9%.

Understanding fully diluted ownership helps you avoid surprises. If you only look at current outstanding shares, you may underestimate how much dilution will occur later.

Effects of share dilution on stakeholders

Share dilution affects everyone involved with a company, but the impact depends on role, timing, and expectations. Founders, employees, and investors all experience dilution differently.

Impact on founders and early employees

Share dilution affects founders and early employees in distinct ways, depending on how and when equity is granted. Understanding these effects helps you make rational decisions rather than emotional ones.

- Ownership percentage reduction: Each new share issuance reduces your slice of the company, even though your share count stays the same. Without proper modeling, this can feel discouraging or surprising.

- Voting power changes: Lower ownership percentages can reduce control, especially when preferred shareholders gain voting rights or board seats. Governance terms matter as much as economics.

- Potential value creation despite dilution: Dilution can still be positive if new capital significantly increases company value. A smaller percentage of a much larger company can be worth far more.

Impact on existing investors

Existing investors often negotiate pro-rata rights, which allow them to maintain their ownership percentage in future rounds. Anti-dilution provisions can protect investors during down rounds, but they may increase dilution pressure on founders and employees.

These terms are common in venture-backed companies and should be evaluated alongside valuation, not in isolation.

Diluted earnings per share

In public companies, dilution affects earnings per share (EPS). Diluted EPS assumes all convertible securities turn into shares, which provides a more conservative view of profitability.

While EPS is less relevant for early-stage startups, understanding diluted EPS becomes important as companies approach IPO or public-market reporting requirements.

Managing and minimizing dilution

Dilution is normal in growing companies, but it should still be managed intentionally. The goal isn’t to avoid dilution entirely. It’s to make sure dilution supports growth efficiently and aligns with long-term ownership goals.

Three negotiation strategies

Dilution is negotiable, even if it’s unavoidable. Smart founders focus on structuring rounds to protect long-term ownership.

- Higher valuations reduce dilution per dollar raised: A stronger valuation means issuing fewer shares for the same amount of capital. This approach helps preserve founder and employee ownership while still funding growth.

- Smaller rounds limit ownership loss: Raising only what you need can reduce immediate dilution and keep future options open. It also creates pressure to spend efficiently and hit milestones.

- Milestone-based funding spreads dilution over time: Reaching defined goals before raising again can unlock better terms later. This rewards execution with improved ownership outcomes.

Alternative funding options

Revenue-based financing provides capital without equity. Traditional debt financing avoids dilution but introduces repayment obligations. Grants and other non-dilutive funding can extend runway without affecting ownership.

Anti-dilution provisions

Anti-dilution clauses protect investors during down rounds. Full-ratchet provisions are more aggressive, while weighted-average provisions are more common. Understanding how these terms work helps founders evaluate how risk and dilution are shared across stakeholders.

Dilution tracker tools and cap table modeling tips

Tracking dilution accurately helps you avoid surprises and plan future fundraising rounds. Start simple, then upgrade your tools as your company’s equity structure becomes more complex.

Spreadsheet templates

Early-stage startups can manage ownership tracking in Excel or Google Sheets. A basic cap table should list shareholder names, share counts, and ownership percentages. You can duplicate the sheet to model future rounds and see how each scenario affects founder and investor stakes.

Your spreadsheet should include:

- Fully diluted ownership calculations, including unvested options

- Waterfall analysis for potential exit scenarios

- Conversion modeling for SAFEs and convertible securities

- Pro forma views for planned issuance of new shares

Specialized cap table software

Once you introduce multiple share classes, option grants, or convertible notes, manual spreadsheets become error-prone. Platforms such as Carta and Pulley automate dilution calculations, generate investor reports, and stay aligned with legal documents.

Key features to look for include:

- 409A valuations for employee option pricing

- Automated equity plan management

- Scenario modeling across multiple funding rounds

- Audit-ready records for investors and regulators

- Investor dashboards for transparency and reporting

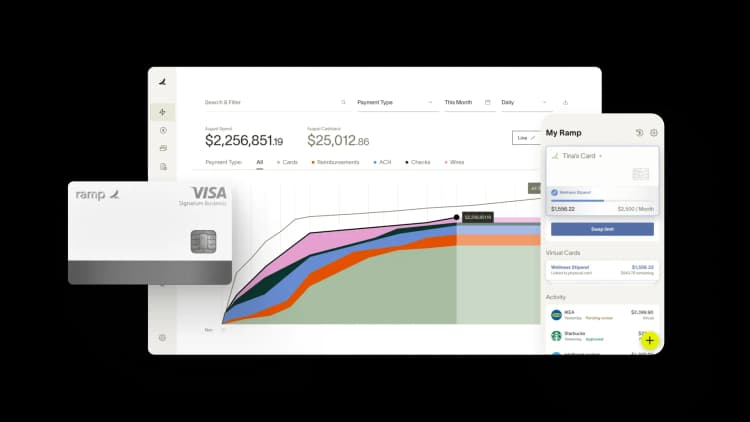

Spend your capital smarter with Ramp

Share dilution is a regular part of building a company, especially one that grows quickly. What matters is understanding dilution early and planning for it deliberately. When you model dilution scenarios, you can balance growth, control, and long-term value more effectively.

Ramp gives you real-time insights into cash flow and spending so you can forecast runway and plan your next raise with data, not guesswork. With clear visibility into where money is going, you can decide when to raise, how much to raise, and how to avoid unnecessary dilution.

When your expenses, accounting, and financial systems work together, you’re better positioned to raise on your own terms and preserve more equity over time. Explore Ramp to see how finance automation helps you scale efficiently while protecting what you’ve built.

FAQs

No. While dilution reduces ownership percentage, it doesn’t automatically reduce value. If issuing new shares helps the company grow faster or reach a higher valuation, shareholders can still end up with more valuable equity overall.

Dilution describes how ownership percentages change when new shares are issued. Valuation reflects what the company is worth. A higher valuation can offset dilution by increasing the value of each share, even if your percentage ownership declines.

There’s no single “normal” amount, but early venture rounds often dilute founders by 15–25%. What matters most is modeling outcomes ahead of time and understanding how each round affects long-term ownership, not hitting a specific benchmark.

Dilution itself can’t be undone, but its impact can be mitigated. Strong company performance, higher future valuations, or share buybacks can increase the value of remaining ownership, even if percentages don’t change.

Stock options increase the fully diluted share count. They may not dilute ownership immediately, but they reduce ownership once options are exercised or included in fully diluted calculations. That’s why option pools should always be factored into dilution models.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°