What to include in your startup’s founders’ agreement

- What is a founders’ agreement?

- What to include in a founders’ agreement

- How to create a founders’ agreement in four steps

- Founders’ agreement vs. shareholders’ agreement

- Does my company need a founders’ agreement?

- Next steps once you have completed your founders’ agreement

No matter what industry you’re in or how the economy is performing, one of the biggest challenges that startups face is the ability of its co-founders to continue to collaborate well over time. That applies not only to business acquaintances launching a venture together but also to family members or lifelong friends who’ve decided to build a new business together.

Regardless of how well you get along with your co-founders, setting out—in writing—your individual roles and responsibility at the startup can minimize potential conflict or challenges and ease future decision-making. It can also protect the non-business relationships between co-founders from getting destroyed when their high-growth startup inevitably hits a rocky patch.

While there’s no legal requirement to have a founders’ agreement for a company, successful startups can grow quickly and the sooner you can formalize the terms of your relationship with your co-founders, the better. Ideally, you’d create a founders’ agreement before or during the process of incorporation. That’s because it’s so easy for misunderstandings to arise around issues such as each co-founders’ individual responsibilities and equity rights. That said, if you’ve already launched the business without a founders’ agreement, you should probably consider creating one now.

Think of your founders’ agreement like signing a prenuptial agreement before getting married. While you and you co-founders may all have the best intentions to see the company through and fairly distribute the company’s profits, having a founders’ agreement in place can avoid ambiguity and help the company endure when unforeseen personal or professional disputes arise. Conflict can impact any relationship, and it’s easier to resolve when you’ve agreed ahead of time (when emotions are not running high) on the best path forward.

Sure, talking about the failure of a company that hasn’t even begun yet can feel awkward, but data shows that fewer than one in five startups survives for more than five years, according to the Bureau of Labor Statistics. Having an open and honest dialogue is an important preventative measure for more difficult conversations later, and a founders’ agreement can serve as a blueprint for how to handle conflict or disagreements as your company grows.

A founders’ agreement also helps all parties align in terms of their expectations for the company. Here’s what you need to know about putting together a founders’ agreement, a critical document that can protect your startup:

What is a founders’ agreement?

A founders’ agreement is a type of contract outlining the terms (not covered in the operating agreement) agreed to by those launching a company together. One of the most important documents that a startup needs, the founders’ agreement is a binding contract that includes information about the governing of a business, including who owns the company, and the responsibilities and liabilities of each of those owners. Reaching alignment on these issues can protect both the co-founders and the owners and having such a document can signal to future investors that you’re taking the business seriously and thinking about its long-term viability.

What to include in a founders’ agreement

The exact terms of your founders’ agreement will vary based on your industry, location, and the arrangements you’ve made with your co-founders. While you may have already discussed the following issues verbally, having your common understanding in written form is important for the legal record. That said, a founders’ agreement does not need to be a particularly long agreement, but it should cover the following:

The names of the company and its co-founders

Even if the company name changes down the road, the founders’ agreement should include the working name of the startup, as well as the co-founders who have created it. This can prevent non-founding employees or others from incorrectly claiming a founder title later. This section might also include a brief description of the company’s mission and goals and its ownership structure.

Roles and responsibility of owners

This section of the founders’ agreement will be different for every company, but in general, the document should outline which functions of the company will fall under the leadership of each of the co-founders. Typically, you’ll want to lean into the strengths of each owner for the division of labor, so a co-founder with a sales background may handle revenue while their colleague with marketing experience focuses on that area of the business.

These roles will likely change over time as the business grows but formalizing each founders’ responsibilities early on will also help create a more efficient organization, since it will reduce confusion and the potential for redundant efforts in certain parts of the business. It can also serve as a useful record if one co-founder is not carrying out their duties as agreed.

Ownership of intellectual property

It’s important to decide upfront whether the intellectual property will belong to individual co-founders or to the company itself. In general, assigning the IP rights to the company will increase the value of the company and provide protection for the business. For example, if one founder holds the patent to a technology used to produce a specific product and that founder leaves, the business might not be able to continue using that technology without paying for or getting permission from that co-founder.

For that reason, venture capitalists typically prefer that a company owns it intellectual property because it minimizes the risk of future lawsuits or competition.

Shares distribution

This is the section of the founders’ agreement that spells out exactly who owns the company, and the division of that ownership between current founders and investors. The division of equity ownership will likely vary based on founders’ roles and previous capital contribution by both founders and investors, but it’s essential for all parties to align on the breakdown.

Vesting schedule

Many startups use a vesting schedule for founders and early employees, in which their equity vests over a period of time. While the vesting period can vary by company or by individual at the company, a common arrangement calls for 25% of shares to vest each year over a period of four years. This gives founders an incentive to remain with the company providing business continuity in those crucial early years.

Dispute resolution policies

Inevitably, there will be times when there is not a consensus among co-founders around the best path forward for the company. You can use your founders’ agreement to elucidate the path forward in such instances, including the potential for mediation or arbitration, if necessary.

Confidentiality

Many founders’ agreements include a confidentiality clause or non-disclosure section in which founders agree to keep trade secrets within the company.

Exit procedures

Even if all founders feel fully committed to the business now, priorities can change over time and one or more founders may want or need to exit the company. This section of the founders’ agreement should cover the terms of an exit, their ownership in the company, responsibility for liabilities, and their claim to future profits.

Keep in mind that allowing co-founders to maintain their ownership share of a company after they’re no longer working there can create “dead equity,” which can create additional challenges around creating equity incentives for other employees or in attracting investor capital.

You may also want to outline the way the company will deal with underperforming founders if other co-founders want to move the company in a different direction. In addition, some startups include a non-compete clause in their founders’ agreement to ensure that founders do not leave and use their experience and connections to build or join a competing enterprise.

How to create a founders’ agreement in four steps

1. Understand goals and roles

One of the benefits of creating a founders’ agreement is that it forces you and your co-founders to have discussions early on about your long-term plans for the startup and find common ground about how each of you will help the company achieve those goals. While such conversations may feel uncomfortable, getting on the same page now can minimize possible disagreements later.

2. Determine equity

Some startups evenly distribute equity among all the co-founders, while others allocate it based on other factors, including who came up with the original idea, who has invested the most capital, the experience level and connections of each of the co-founders, and who will run and scale the business. You may also want to set aside a portion of equity to give to future employees or use to raise capital from investors later.

3. Consult with a lawyer

Once you’ve settled on the basic terms of the agreement, you’ll want to work with a lawyer who can help you write a legally binding agreement based on those terms. Online templates provide a good starting place for the your founders’ agreement, but you should also have a lawyer look at the founders agreement template and tweak it suit your company’s specific needs and make sure it meets the legal requirements of your state.

Look for an attorney with experience offering legal services to startups in your industry. They may be able to offer insights or suggest changes that you would not otherwise consider. In addition, each co-founder may want to obtain their own legal advice on the document.

4. Double-check the agreement before signing

As with any important legal or financial document, it’s important to read and reread your founders’ agreement before signing it. If you have questions, ask your lawyer and make sure you understand and feel comfortable with the answer.

Founders’ agreement vs. shareholders’ agreement

A founders’ agreement is one type of shareholders’ agreement (also called a stockholders’ agreement), that’s used by the founders in the earliest days of a company’s existence to make sure that all parties are moving in lockstep. As the company scales over time, you’ll likely replace the founders’ agreement with a new shareholders’ agreement which outlines the procedures for a larger number of shareholders as well as the company board.

A shareholders’ agreement may include the fair market value of the business and individual shares, while a founders’ agreement is typically created too early in the life of the company for such valuations.

In addition to outlining ownership, a founders’ agreement or shareholders’ agreement should also lay out the rules around what an equity holder can do with their stock, including whether and how they can sell or gift it to outside parties.

Does my company need a founders’ agreement?

Yes. As long as your business has more than one founder, it should have a founders’ agreement, even if you’ve already orally discussed all of the issues that the agreement would cover. Signing a founders’ agreement is an important step that can protect your company from costly legal disputes later and provide a strong framework for resolving disagreements before they start.

This applies regardless of the size of your business. Even if you’re not planning on creating the next unicorn, disputes between co-founders can hurt even small businesses. The process of creating a founders’ agreement can ensure that everyone involved in the startup understand their role and is working together toward a shared goal.

Next steps once you have completed your founders’ agreement

Creating a founders’ agreement is just one crucial step in getting your startup off the ground. Below are other important steps your company should take:

Have a budgeting process

Having a handle on how much money is coming in or going out of your business at any given time is central to moving the business forward. In today’s uncertain economy, zero-based budgeting principles and stress-testing for different scenarios can help you make sure you’re on the right path from a financial perspective.

Determine funding and financing

Obtaining capital to run an early-stage startup is one of the biggest challenges faced by co-founders. In addition to investing your own cash or bank loans or investor capital, you might consider alternative funding methods, which can increase the valuation of the business although it typically also requires financial dilution of ownership shares.

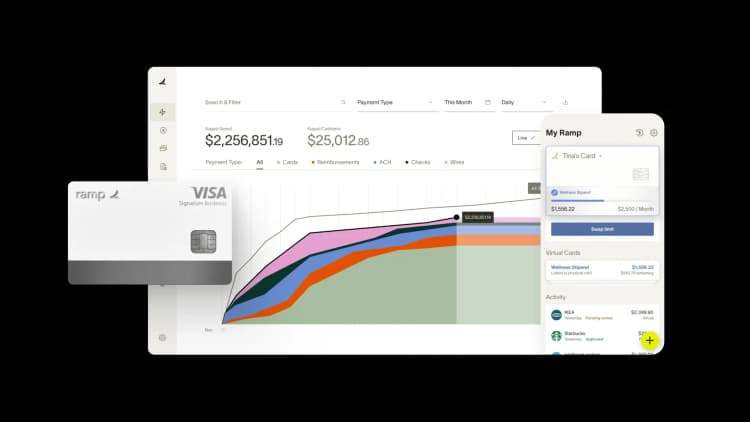

Open a credit card account

Establishing credit is also an important goal that most startups should focus on as early as possible. One way to do this is by opening a business credit or charge card, and giving your employees cards.

Doing this not only empowers employees to quickly execute purchasing decision (based on the company’s spend policies), but also eliminates the need for cumbersome expense-reimbursement procedures. Look for a credit card that provides cash back and offers easy-to-use spend controls.

Make the most of technology

In today’s digital-first world, making wise use of technology from the start can help you build the most nimble and efficient company possible. That means automating any repetitive, low-value functions and building a software stack that can grow with your business.

Manage spend

When a company is in startup mode and scaling quickly, it can be easy to overspend. By putting policies in place early to manage spend, you can set your company up for more efficient—and sustainable—growth.

Hire wisely

As the company begins to scale, hiring non-founders can help you bring your startup vision to life. Since hiring employees is expensive, you may want to start out working primarily with contractors. When you’re ready to add full-time workers, looks for workers who can fill in gaps in the founders’ expertise and who can mesh with the culture that you’re building.

Expect to pivot

One of the key business lessons that the past few years have taught entrepreneurs is the importance of agility within their startup. Whether you’re facing supply chain shortages, a global pandemic, or a founders’ departure, preparing for the unexpected and having the flexibility to change direction as needed will help your business survive.

While building a company is an extremely exciting time, it is also one in which you’re taking on significant financial risk. By creating and signing a sold founders’ agreement you can minimize those risks and protect both yourself and your company from issues that could arise from disagreements with your co-founders.

FAQs

Yes. A founders’ agreement is a legal document that should protect the interest of all founders in the case of future lawsuits or other challenges. Of course, you may amend a founders’ agreement as the company brings on additional employees or takes on outside investments.

As early as possible. If you have a business plan and partners with whom you’re seriously talking about starting a business, you should also be preparing a founders’ agreement.

Yes. Since a founders’ agreement is a legal document, it’s important that an attorney reviews it to make sure that the document confirms the terms that the co-founders have agreed it should include.

A founders’ vesting period is a clause, often found in a founders’ agreement, that how long a founder must work at a startup before taking ownership of their shares. Startups often use a founders’ vesting period, in which a founder takes ownership of an increasing percentage of shares over a timeframe of several years. Such a clause both incentivizes founders to stick with the company and provides some protections to the company and other co-founders in the case that one founder does depart.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits