- What is alternative funding?

- Alternative financing benefits

- What are the popular alternative business finance options?

- How Ramp can help you with alternative funding for small business

- Need working capital to fuel your business? Consider Ramp

Fundraising is an ongoing activity for every business, not just startups. Working capital is required for operations, salaries, expansion, product development, marketing, and other expenses. It can also be a key component when calculating valuation. Acquiring this capital through traditional bank loans is one way to get it, but this process is often arduous, and many small businesses don’t get approved.

Luckily, it’s no longer the only way.

In this article, we’ll go over some alternative business funding options that may be a good fit for businesses looking to extend their working capital to fund essential business expenses.

What is alternative funding?

Alternative funding is any type of business financing that comes from sources other than traditional bank loans. It generally falls into two categories: equity funding (also known as equity financing), and debt funding. The former helps to increase the valuation of the business, but it requires financial dilution of ownership shares. The latter creates a liability, or debt, that needs to be paid back within agreed-upon terms.

Many businesses are turning to alternative funding like inventory financing, in lieu of traditional loans because they offer more flexible terms and build value. With a good business plan and evidence of scalability, a business can raise more money from alternative sources with limited downside. A loan or line of credit from a bank or credit union simply puts the company in debt, which may not be ideal for some (if they even get approved at all).

Before reviewing the types of alternative funding available, calculate how much money you need to raise and why you need it. Will it help you develop a minimum viable product (MVP) to go to market? Are you going to use it for salaries and operating expenses? Will it slow down your burn rate? Investors and lenders will want answers to these questions before moving forward.

Alternative financing benefits

There are some clear benefits to choosing alternative financing options instead of more traditional bank loans. To start, most alternative inventors and lenders are more concerned with business credit, and not your personal history, such as your credit score. But there are many more benefits to consider:

Faster approvals

Alternative funding often provides clients with streamlined applications compared to traditional banks. On that note, banks, if they’ll even approve you for that kind of money, can take weeks to process your application. And when you’re in need of funding, these weeks can make a huge difference in your business’ viability.

Better interest rates

Alternative lenders expect to get paid back, but their terms and conditions are often better than what the bank has to offer. When it comes to equity funding, investors will negotiate funding in exchange for a certain amount of equity in your business, removing the pressure of interest rates and monthly payments.

Simplified paperwork

Have you ever applied for a business loan from a bank (or similar financial institution)? The paperwork required to compile appropriate documents can be tough to navigate, as traditional lenders are notorious for factoring in multiple financial record types.

Alternative funding is different. In some cases, you might only need to sign one document. The terms and conditions are simpler because you won’t need to deal with variable interest rates, indemnity clauses, or amortization schedules.

Increased valuation

This is a benefit exclusive to equity funding. Adding more working capital to a company, even though you’re diluting ownership shares, increases the valuation of the business. This could come in handy when it comes time to go public or exit via sale, but it’s also a risk. The company needs to grow after the funding becomes available for the equity distribution to pay off.

What are the popular alternative business finance options?

Business owners often think of funding in two categories: equity and debt. Those are the major financing sources, but they’re not the only ones. We’ve also added franchising and bootstrapping here, plus several subcategories for equity and debt funding.

For simplicity, we’ve broken this down into six financing alternatives for your business.

Option #1: Equity funding

Equity funding involves accepting money from an investor in exchange for an equity stake in your company. The amount of that equity is determined by the valuation of the company and the amount of money being invested. Equity funding can be acquired from the following sources:

- Crowdfunding: This is a popular equity funding method. There are several crowdfunding platforms, such as Fundable and Kickstarter, where you can post your ideas or objectives and offer equity in exchange for business funding. Many smaller companies use crowdfunding sites to prove there is an interest in the product or service they’re offering.

- Angel investors: High net worth individuals who provide financing for startup companies and entrepreneurs are known as “angel investors”. They could be someone you meet through a network, a mutual connection, or a close friend with deep pockets. Either way, that “angel” could help you get your business started.

- Venture capital firms: Crowdfunding and angel investors are good for startups and smaller companies. Venture capital firms are where you’ll find the money to grow into something substantial. In exchange for equity, a venture capitalist could fund your pre-seed, seed, or growth stage. VC investments range from $100K to several million dollars.

Option #2: Debt funding

Also known as debt financing, debt funding acts in an opposite manner to equity funding. In this case, small business owners take out a loan to finance their business. In return, they agree to repayment terms with the creditor, which often revolve around interest rates and payment due dates.

Here are some common small business loan funding alternatives:

- SBA loans: The US Small Business Administration (SBA) works in conjunction with local banks to partially guarantee loans for startups and small businesses. These count as alternative financing because the terms are more flexible than a normal bank loan, interest rates are lower, and the qualifying criteria is less stringent. We put together an SBA loan calculator tool to help you find the best payment terms for your business.

- Venture debt: Companies that are funded by venture capital can qualify for venture debt offered by specialized lenders. This option is often used to extend the cash runway or cover capital expenses as the startup scales between equity rounds. Like SBA lenders, venture debt lenders may be able to offer flexible terms and low interest rates.

- Revenue-based financing: Companies with recurring revenue models (e.g., SaaS, payments) can work with specialty lenders to access capital in exchange for, or underwritten per, future revenue. Also known as a recurring revenue loan, this option allows companies to scale on their terms, leveraging future sales to drive near and long-term growth.

- Peer-to-peer lending: Several popular business loan sites are run by peer-to-peer lenders. Think of it as a group of investors pooling their money to assist business owners like yourself. Terms and interest rates vary and can run high with certain sites, but the P2P lending approval criteria are typically lenient

Option #3: Franchising

Small companies that want to become big, multinational corporations can put together a franchise program to grow their annual revenues. Think restaurants, convenience stores, and gyms. One notable example of a franchise model that’s worked out very well is McDonald’s. The company started out as a single hamburger stand in 1955. Last year, their revenue was over $20 billion. All because they chose to franchise their idea.

Option #4: Bootstrapping

A common misconception about bootstrapping is that the business owner needs to cover everything out of pocket. That’s not true. Bootstrapping refers to an entrepreneur building a company from personal finances, but it also means that growth happens by using operating revenue. To bootstrap is to grow without giving up any equity.

Option #5: Merchant cash advances

This alternative funding option is very useful for small businesses that need to cover immediate, short-term expenses or cash-flow shortages, such as invoice financing. The merchant cash advance (MCA) provider injects a lump sum into the small business and takes a percentage of its debit and credit card sales to cover the loan (and any additional fees). Given that MCAs charge fees as factor rates (often 1.1-1.5), and that small businesses often struggle to organize funding, a merchant cash advance should only be used as a last resort. Otherwise, a small business owner may easily end up with an expensive, long-term loan to repay.

How Ramp can help you with alternative funding for small business

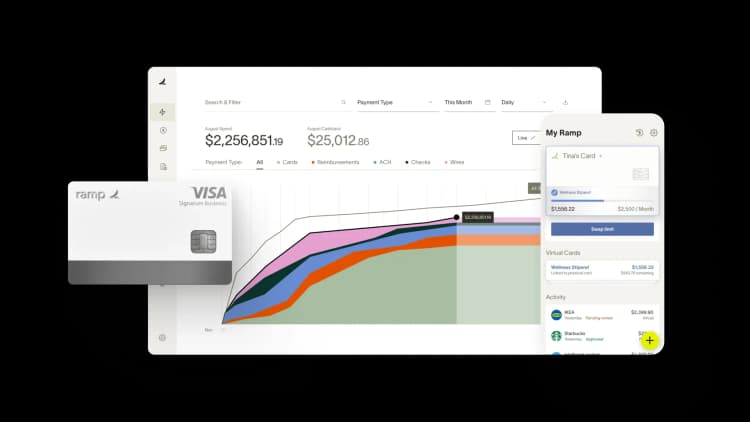

Through our platform, businesses can access the working capital they need to grow their business faster, while having the finance automation tools at their disposal to manage it. We can even help you build your business credit. Here’s how:

1. Commerce sales-based underwriting

Unlike some revenue-based lenders, Ramp has reasonable banking and revenue requirements to offer you the credit bandwidth you need to cover expenses and finance growth. This is particularly useful for companies with limited funds in the bank or e-commerce companies that need financing since they are working with such small margins. Ramp can assist in both of those scenarios.

2. Expense management

Getting the funds to start and grow your company is only half the equation. Managing those funds by controlling expenses and tracking cashflow is how a company reaches profitability. Ramp has the tools to help you do this. We offer real-time expense tracking, spending controls, and API integrations with your go-to accounting software to keep it all in order.

3. Building credit

Utilizing our commerce sales-based underwriting and controlling your spending are two great ways to build business credit. And since Ramp is a charge card, there's no need to worry about carrying a balance month-to-month, incurring interest, or pesky utilization ratios to calculate.

Need working capital to fuel your business? Consider Ramp

Running a business is hard, and accessing working capital to help streamline your day-to-day operations can be an even bigger chore. With Ramp, you can access the working capital you need, faster, with our commerce-sales-based underwriting process.

Our new offering gives businesses access to credit limits higher than traditional corporate cards. And our finance automation platform gives you the tools you need to manage expenses, vendors, bill payments, and more. Learn more about Ramp today.

FAQs

One of the most common examples of alternative financing is venture capital. This is where an investor (VC) offers money in exchange for an equity stake in the company.

Alternative lending is a system outside of traditional loans that can provide business loans on flexible terms with lower interest rates. A common example of this is revenue-based financing, where the company borrows against its future revenues.

The answer to this depends on the industry. Technology and biotech firms rely heavily on venture funding. Smaller companies and start-ups often begin with crowdfunding, angel investors, or even funding appeals on social media if they don’t take out a traditional loan to get started.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits