- What is spend management

- Why spend management matters for your business

- Spend management vs. expense management

- Key challenges in spend management

- The spend management process

- Strategic benefits and ROI

- Effective tools and software solutions

- Tactics to improve your spend management strategy

- How to simplify procurement spend management

- Spend smarter with Ramp

Spend management is about controlling how your company spends money, from buying supplies to paying vendors and tracking expenses. Unlike general financial management, spend management focuses specifically on outgoing cash to help you spot waste and uncover savings opportunities. Modern platforms centralize purchase requests, cards, invoices, and reimbursements so finance teams have real-time visibility and automated controls.

In this article, you'll learn what spend management is, why it matters, how it works, and the best strategies and tools to optimize your business spending.

What is spend management

Spend management brings every part of company spending into one system. It connects policies, workflows, and data so employees follow the right process and finance teams have visibility before money goes out the door.

Key components of spend management

- Strategic procurement: Smart purchasing that gets you what you need at the best value. Standardize intake and route requests to the right approvers automatically.

- Spend analysis: Reviewing spending data to find savings opportunities. Use vendor-level views to identify overlap and consolidation opportunities.

- Vendor management: Building relationships with suppliers that benefit both sides. Track performance, renewals, and obligations in one system.

- Policy enforcement: Making sure all spending follows company rules and compliance requirements. Embed rules directly into workflows so compliance happens by default.

Why spend management matters for your business

Companies with good spend management typically cut costs by 5–15%. That’s money you can reinvest in growth or add directly to your bottom line. Teams also reclaim hours by automating expense approvals, coding, and reconciliation, shortening month-end close.

Spend management drives improvements in key areas:

- Financial visibility: See exactly where your money is going in real time and spot anomalies as they happen.

- Cost control: Find and eliminate unnecessary spending quickly by consolidating overlapping tools and contracts.

- Risk reduction: Protect against fraud, compliance issues, and supplier problems with clear ownership and audit trails.

- Strategic decision-making: Use spending data to make smarter decisions and connect budgets directly to requests.

When you know where every dollar goes, you can focus spending on what drives results. This helps you stay competitive and adapt quickly when business conditions change.

Spend management vs. expense management

While these two terms are often used interchangeably, they serve different purposes in business finance.

Spend Management oversees all company expenditures throughout the entire purchasing lifecycle—from planning and procurement to payment and analysis. It focuses on strategic cost control across all spending categories.

Expense Management specifically handles employee-initiated expenses like travel, meals, and reimbursements. It primarily deals with approving and reimbursing expenses employees have already incurred.

Here’s how the two compare:

| Aspect | Spend Management | Expense Management |

|---|---|---|

| Scope | All organizational expenditures (procurement, services, materials, etc.) | Primarily employee-initiated expenses (travel, meals, supplies) |

| Processes | Strategic sourcing, vendor management, contract negotiation, procurement, invoice processing | Expense reporting, receipt capture, reimbursement, travel booking |

| Tools | Comprehensive platforms with procurement, analytics, contract management, and supplier portals | Expense report software, receipt scanning apps, corporate card management |

| Business Impact | Strategic cost reduction, supplier optimization, improved cash flow, risk mitigation | Policy compliance, employee satisfaction, simplified reimbursement, reduced administrative burden |

Spend management is proactive—it influences purchasing decisions before money is spent. Expense management is reactive, processing specific types of employee expenditures after they occur. Both are important, but true financial visibility requires combining them into a single, connected process.

Key challenges in spend management

Even well-run organizations face challenges when managing spend effectively. The most common issues stem from disconnected systems, manual workflows, and limited data visibility.

Once you understand how spend management differs from expense management, it’s easier to see where many companies struggle to manage spending effectively.

Fragmented Data

Most organizations struggle with spending data scattered across multiple systems, departments, and formats. This happens when different teams use separate tools for purchasing, accounts payable, and expense management.

Without a unified view, you can't accurately analyze total spending or find savings opportunities. These blind spots lead to duplicate purchases, missed volume discounts, and inefficient resource allocation.

Lack of Visibility

Many businesses have limited real-time insight into current spending versus budgets. This visibility gap occurs when approval processes happen separately from financial systems or when there's a significant delay between purchases and financial reporting.

Without clear visibility, you make decisions based on outdated information, struggle to enforce spending policies, and miss opportunities to redirect funds when priorities change.

Manual Approval Workflows

Paper or email-based approvals slow everything down. They create delays, increase risk, and make it harder for teams to follow consistent processes. These manual workflows stick around because they’re familiar, but they drain time that could be spent on more impactful work.

The result is slower purchasing cycles, frustrated employees, and finance teams caught up in admin instead of strategy. Recognizing these challenges is the first step. The next is building a spend management process that replaces manual work with automation and better visibility.

The spend management process

The spend management process defines how spending moves from planning to payment. Each stage builds control, visibility, and accountability.

1. Spend plan definition

A spend plan maps how your company will use its money. It connects purchasing decisions to your budget and goals. An effective plan includes spending thresholds, approval requirements, and preferred vendors. Review it quarterly to keep it aligned with business needs. Publishing guidelines where people spend ensures expense policies are followed before purchases happen.

2. Procurement and sourcing

Smart procurement is about finding the right vendors at the right price. That means evaluating suppliers on reliability, quality, and delivery—not just cost. Automated intake forms and routing can shorten purchase cycles and ensure all required reviews happen upfront.

3. Automated invoice and payment flows

Manual invoice processing wastes time and increases errors. Automation routes invoices to the right approvers, eliminates data entry, and triggers payments on schedule. Modern systems connect directly to accounting platforms to sync data automatically, reducing costs and improving cash flow. Teams using Ramp automate these flows end to end, saving hours each month.

Business Size Considerations

Spend management needs evolve as organizations grow. The scale of your operations determines how complex your systems and processes should be.

Startups

Startups typically implement simplified versions of spend management focused on basic controls and visibility. They often begin with spreadsheets and email approvals before adopting dedicated software. Establishing strong habits early helps prevent cash flow problems as the company scales.

Small Businesses

Small businesses need more formalized processes as they handle larger transaction volumes and vendor relationships. Cloud-based spend management platforms give them enterprise-level functionality without major IT investment or maintenance.

Enterprises

Enterprises require comprehensive systems that handle complex approval hierarchies, multiple entities, and international compliance. These organizations benefit from standardized processes and advanced analytics while maintaining flexibility for individual business units.

Strategic benefits and ROI

Effective spend management delivers measurable returns through stronger visibility, control, and efficiency.

Real-time spend visibility

Seeing spending as it happens allows teams to catch issues immediately, not weeks later. Real-time reporting helps identify trends, unusual transactions, and opportunities for consolidation. For example, multiple teams buying from the same vendor can combine purchasing power for better rates.

Cost savings and risk reduction

Spend management drives both direct and indirect savings. Direct savings come from better pricing and contract terms, while indirect savings come from increased efficiency. Diversifying suppliers and maintaining clear contracts also helps reduce operational and financial risk.

Improved compliance

Automated systems enforce policies consistently, routing purchases through the right channels and keeping complete audit trails. This simplifies audits and supports tax compliance. Consistent processes build a culture of accountability and make spending predictable and easy to control.

Effective tools and software solutions

Technology makes effective spend management possible. The right systems automate manual work, centralize data, and simplify compliance. Choosing the best spend management software helps teams gain real-time visibility, reduce manual processes, and make faster financial decisions.

1. Spend management platforms

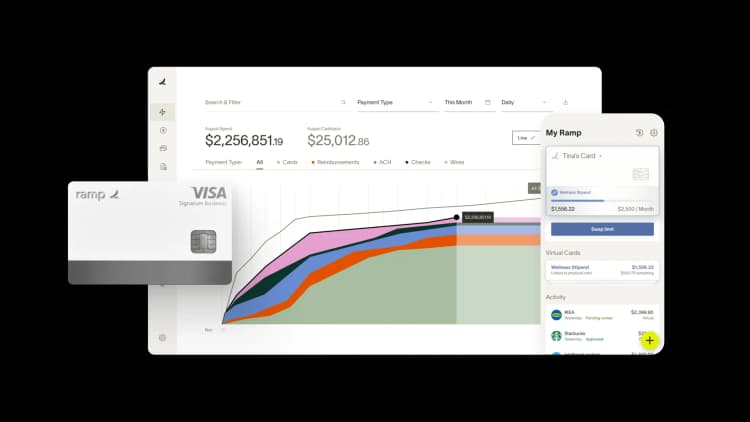

Modern spend management platforms handle everything from purchase requests to payments in one place. They automate workflows, offer analytics, and integrate with your other systems. Many also include business credit cards that automatically enforce policies and provide real-time tracking for every transaction. Ramp’s platform combines cards, reimbursements, bill pay, and vendor tracking in a single system to give finance complete visibility.

2. Enterprise-grade tools

Larger organizations need advanced capabilities for complex approvals, multiple entities, and cross-border operations. Enterprise solutions include robust reporting, supplier management, and compliance tools built to scale with growth.

3. Spend management services

Some companies use outside consultants to optimize spending or manage procurement. These experts analyze spending data, identify savings opportunities, and help implement best practices. Engaging consultants early can help create a spend taxonomy and savings roadmap before scaling in-house.

Tactics to improve your spend management strategy

Applying spend management best practices can strengthen financial performance and reduce manual work.

1. Centralize all spending data

Consolidating spend in one system eliminates blind spots and duplicate reporting. A single source of truth ensures consistent policy enforcement and accurate analysis. Unifying requests, cards, and bills under one platform creates cleaner reporting and easier forecasting.

2. Use procurement software effectively

Procurement tools standardize buying processes and provide digital records of all activities. This makes supplier management and negotiations more efficient. Mapping spend to contracts helps track utilization and avoid off-contract purchases.

3. Engage outside experts when needed

External consultants can identify gaps and share proven playbooks from similar companies. Set clear expectations and metrics for savings or efficiency improvements, then bring successful processes in-house once established.

How to simplify procurement spend management

Simplifying procurement helps businesses reduce costs and strengthen supplier relationships.

1. Streamline supplier onboarding

A slow vendor setup process delays purchases and increases risk. Create a digital onboarding workflow that collects all necessary information upfront, verifies tax and banking details automatically, and routes to a single point of contact.

2. Track procurement metrics

Measure what matters: spend by category, supplier performance, and contract compliance. Track savings compared to budget, percentage of spend under management, and on-time delivery rates. Review these monthly to stay focused on high-impact areas.

3. Explore outsourcing options

When internal bandwidth is limited, outsourcing specific functions like spend analysis or contract management can help. Choose providers with industry experience and clear service-level metrics, and ensure knowledge transfer back to your team.

Spend smarter with Ramp

Spend management is more than controlling costs. It’s about gaining the visibility and control you need to make better financial decisions. Ramp helps companies of all sizes automate spending, simplify approvals, and see where every dollar goes in real time.

With Ramp, finance teams can manage cards, reimbursements, bill payments, and vendor spend in one spend management platform. Built-in policies, real-time insights, and automated accounting integrations help you close the books faster while reducing manual work. Whether you’re managing a growing startup or scaling across multiple entities, Ramp gives you the tools to spend smarter and save more — explore the platform to see how it works.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits