Expense approval process: What it is and how to automate it

- What is the expense approval process?

- Benefits of automated expense approvals

- Key components of an automated expense approval system

- How to automate your expense approval process

- Best practices for automated expense approvals

- Common pitfalls to avoid

- How Ramp eliminates manual expense approvals

- Start automating with Ramp

A streamlined and transparent expense approval process empowers your employees to make business-critical purchases confidently and quickly. It also ensures purchases stay within budget. Unfortunately, a manual expense approval process can be time-consuming, tedious, and error-prone. With the right systems in place, you can automate key steps and make the entire experience smoother for everyone involved.

Automated expense approvals help you reduce manual work, enforce policies consistently, and give your finance team real-time visibility into spending, while keeping reimbursements moving without delays.

What is the expense approval process?

The expense approval process is the set of steps for reviewing and approving employee expense reports. A good expense approval process ensures spending complies with your company’s expense policy and that employees are reimbursed quickly for expenses they make on behalf of your business. This helps you avoid overspending and prevents expense fraud.

Types of expenses that require approval

Unless you have already preapproved the expense or provided a cash advance, every business expense should go through the proper expense approval workflow. Some common examples of expenses that need approval include:

- Business travel expenses, including airfare, hotels, car rentals, and other transportation

- Business meals, including meals during business travel

- Business mileage

- Customer entertainment

- Office supplies

- Equipment purchases or rentals

- Professional dues and licensing fees

- SaaS subscriptions

This list is far from exhaustive. The safest approach is to assume that every expenditure should go through your expense approval process.

Steps in the expense approval process

The expense approval process is usually pretty similar from one company to the next. It typically looks something like this:

- Employee makes a purchase: The expense approval process begins when an employee makes a purchase or otherwise incurs a business expense

- Employee submits the expense for approval: The employee adds the expense to an expense report and submits it for review. The report should include the amount, date, business purpose, and required documentation, like a receipt or credit card statement, for each expense.

- Expense undergoes review: A manager or finance team member reviews the expense report for accuracy, documentation, and compliance with your policy

- Expense is approved or denied: If the expense is legitimate and within company policy, it is approved. Otherwise, the approver may request more information or deny the request.

- Employee gets reimbursed: If the employee paid for the expense out of pocket, they receive a reimbursement, either by direct deposit or check

Common challenges with manual expense approval

A manual expense approval process may work when your team is small, but it becomes inefficient and difficult to manage as you grow. Some of the most common challenges include:

- Time-consuming data entry: Employees and finance teams spend hours entering amounts manually, attaching receipts, and routing reports through email

- Lost receipts and missing documentation: Paper receipts get misplaced or forgotten, leading to incomplete submissions and extra follow-up

- Delayed reimbursements: Manual reviews and back-and-forth communication slow down reimbursement timelines and frustrate employees

- Limited visibility into spending: Without automation, it’s hard to see spending patterns in real time or track budgets accurately

- Difficulty enforcing policies consistently: Managers may apply policies inconsistently, increasing the risk of errors, exceptions, and out-of-policy spending

Benefits of automated expense approvals

Integrating expense approval software into your expense management process has a lasting effect on your financial operations. These are a few of the key benefits:

- Efficiency: Automation removes time spent on manual entry and paper receipts. Your finance team no longer needs to review every line item in each expense report.11

- Compliance: Automated rules enforce your company policies, reducing the risk of errors and fraud and removing any guesswork around which expenses qualify for reimbursement

- Transparency: Automated workflows provide real-time reporting and dashboards that help you understand where money is going. You can track budgets easily and see how spending affects your bottom line.

- Cost savings: Automation saves time for employees and finance teams. You can also spot trends and adjust policies as needed, helping you stay within budget.

ROI of expense automation

Automating your expense approval process delivers a meaningful return on investment by reducing the time your finance team spends on manual reviews, data entry, and chasing receipts. With fewer touchpoints and fewer errors, the cost to process each expense report drops significantly.

Automation also improves the employee experience. Faster approvals and reimbursements reduce frustration and eliminate the typical back-and-forth that slows everything down.

Real-time visibility into spending helps your finance team manage cash flow more effectively, avoid surprises, and make better budgeting decisions.

Key components of an automated expense approval system

Modern expense automation tools work by standardizing your policies, capturing documentation quickly, and routing each expense through the right workflow. These are the core components that make automation effective.

Expense policy configuration

A strong automated system starts with clear policy rules built directly into your software. You can set spending limits by category, define approval hierarchies for different teams or amounts, and create role-based workflows that ensure expenses are reviewed by the right people. Once these rules are in place, the system can enforce them without requiring manual oversight.

Receipt capture and OCR technology

Automation also makes receipt collection easier. Employees can snap a photo of a receipt on their phone, and optical character recognition technology extracts key details like the merchant, date, and amount without manual data entry. Digital storage keeps every receipt organized and tied to the right transaction, which helps month-end close and audits go more smoothly.

Automated approval workflows

Automated workflows ensure each expense follows the correct review path. Rule-based routing sends expenses to the right approver based on amount, category, or department. Multi-level approval chains can be configured for higher-value or sensitive purchases, and exception handling automatically flags out-of-policy expenses for manual review.

How to automate your expense approval process

Here’s a simple five-step framework to help you transition from manual approvals to a fully automated, policy-driven workflow.

Step 1: Assess your current process

Start by mapping out how expenses move through your organization today. Document each step in your workflow, from submission to reimbursement, so you can see where delays or inconsistencies occur. Identify the biggest bottlenecks, whether it’s missing receipts, slow approvals, or manual entry, and estimate how much time and money you currently spend processing each expense report. This gives you a clear baseline to measure improvements against.

Step 2: Define your expense policy

Next, refine your expense policy so it’s clear and easy for employees to follow. Set straightforward spending guidelines, establish approval thresholds for different amounts or categories, and document any exceptions that require extra oversight. A strong policy ensures your automated system has the right rules to enforce from the start.

Create your expense policy with Ramp's template

Step 3: Choose the right expense management software

Look for software that aligns with your business needs and can scale as you grow. Prioritize platforms with features like mobile receipt capture, automated categorization, customizable workflows, and real-time reporting. Make sure the tool integrates with your existing accounting or enterprise resource planning systems to avoid manual syncing. Consider long-term scalability so you can avoid costly migrations later.

Step 4: Configure your automated workflows

Once you’ve selected your tool, build workflows that reflect your approval structure. Map out approval chains by role, department, or spend level. Set notification rules so employees and managers receive timely reminders, and add escalation paths for overdue or high-risk expenses.

Step 5: Train your team

Roll out your new system with clear training for everyone involved. Provide employees with simple instructions for submitting expenses, uploading receipts, and using mobile features. Train managers on how to review and approve expenses efficiently. Make sure your finance team understands how to administer the system, adjust workflows, and monitor compliance.

Best practices for automated expense approvals

To get the most value from your automated approval process, focus on these key best practices:

- Keep expense policies simple and clear so employees always know what’s allowed and what isn’t

- Set reasonable approval timeframes to prevent delays and keep reimbursements moving quickly

- Use mobile-friendly tools so employees can submit receipts and expenses wherever they are

- Review and update workflows regularly as your team, budgets, and processes evolve

Maintaining compliance and control

Strong compliance starts with the right safeguards. Make sure your system maintains a complete audit trail, sends alerts when expenses fall outside policy, and provides reliable reporting so your finance team can spot trends, address issues quickly, and keep spending aligned with your goals.

Common pitfalls to avoid

As you automate your expense approval process, watch for a few common mistakes that can slow adoption or reduce the impact of your system:

- Overcomplicating your workflow: Too many steps can slow approvals and frustrate employees

- Letting policies go stale: Outdated guidelines lead to inconsistent decisions and more exceptions

- Skipping employee training: Even the best tools fail without clear onboarding

- Ignoring integrations: Disconnected systems create manual work and increase the risk of errors

- Not tracking success metrics: Without data, it’s hard to measure improvements or adjust processes

Simplify your expense management with Ramp

How Ramp eliminates manual expense approvals

Manual expense approval processes drain countless hours from finance teams who find themselves chasing down receipts, cross-referencing policies, and routing requests through multiple approvers. The back-and-forth between employees and managers creates bottlenecks that delay reimbursements and frustrate everyone involved.

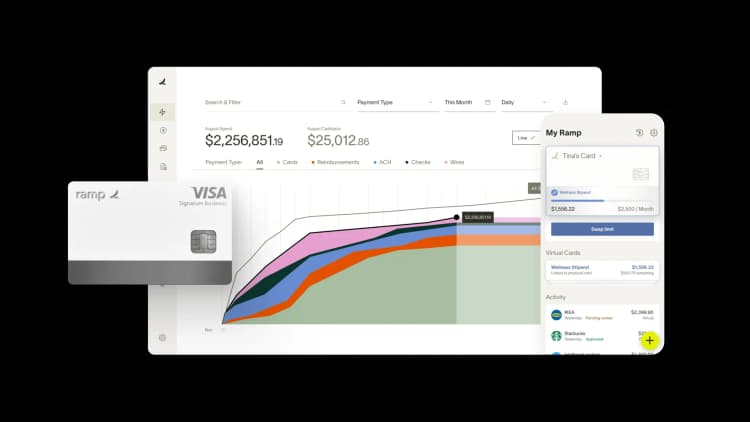

Ramp's expense management software transforms this tedious process through intelligent automation that enforces your policies without manual oversight. When employees make purchases with Ramp business cards, the platform automatically captures transaction details and matches them against your predefined spending rules.

Instead of waiting for month-end reports to catch policy violations, you'll receive real-time alerts when spending exceeds limits or falls outside approved categories.

Automated policy enforcement

The platform's automated approval workflows route expenses to the right approvers based on amount thresholds, merchant categories, or custom rules you define.

For instance, you can set all marketing expenses over $500 to require CMO approval, while routine office supplies under $100 auto-approve if they're from preapproved vendors. This eliminates the guesswork for employees and ensures consistent policy enforcement across your organization.

Effortless receipt capture

Receipt collection becomes effortless, as Ramp automatically prompts employees to upload documentation via text message immediately after each transaction. The system uses OCR technology to extract merchant names, amounts, and dates, eliminating manual data entry.

For recurring subscriptions or regular vendors, Ramp can even auto-categorize expenses based on historical patterns, further reducing your team's administrative burden.

Start automating with Ramp

Beyond expense approvals, Ramp extends automation across your entire finance stack. Track with Google Maps integration for accurate reimbursements. Use AI-powered insights to identify savings opportunities in your spending data. Schedule reports to run automatically so you always have the latest financial picture at your fingertips.

Ready to see how much time you could save? Try an interactive demo to experience Ramp's automation capabilities firsthand.

FAQs

The three rules of expense recognition include recording expenses when they are incurred, matching them to the revenues they help generate, and reporting them in the correct accounting period. These principles help maintain accurate financial statements and support consistent reporting.

QuickBooks expense management features allow your business to track spending, categorize expenses, capture receipts, and manage reimbursements. The system also integrates with many third-party expense tools for more advanced automation.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits