- What is spend management software and why does it matter?

- Key features to look for in spend management software

- Compare top spend management tools

- 6 of the best spend management platforms reviewed

- Ramp

- Spendesk

- BILL Spend & Expense

- Expensify

- Teampay

- Coupa

- Choose Ramp for smarter spend management

Manual finance processes cause limited visibility, inconsistent policy enforcement, and slow approvals. Spend management software fixes these issues by unifying expenses, procurement, and accounts payable into one system—giving finance teams proactive control and real-time insights.

This guide explains what spend management software is, the key features to look for, and how to choose the best platform for your business.

What is spend management software and why does it matter?

Spend management software goes beyond basic expense tracking tools that only track reimbursements or receipts. A true platform manages the full spending lifecycle—from request to payment—while enforcing policies and providing analytics. It brings together expense management, procurement, and accounts payable in one system.

The benefits of spend management software:

- Real-time visibility into spend by department, project, or category.

- Automation that speeds up approvals and reduces manual data entry.

- Policy enforcement to block out-of-policy purchases and flag exceptions.

- Cost control through analytics that highlight waste, savings opportunities, and vendor consolidation.

In short, spend management solution eliminates errors, enforces consistency, and gives finance leaders the visibility they need to make better decisions.

Key features to look for in spend management software

When evaluating vendors, connect each feature to the problem it solves:

- Automated workflows cut processing time from days to minutes and maintain a clear audit trail.

- Real-time visibility and controls help track budgets, flag unusual activity, and prevent end-of-month surprises.

- Corporate card management issues physical and virtual cards with customizable limits and automatic coding.

- Receipt capture and matching speeds up reimbursements and ensures compliance by pairing receipts with transactions.

- ERP and accounting integrations sync approved transactions directly into your general ledger.

- Reporting and analytics provide insights to benchmark performance and identify savings opportunities.

- Policy enforcement ensures consistent rule application, requiring approvals for exceptions and blocking unauthorized purchases.

- Vendor management consolidates supplier data and contracts to simplify renewals and negotiations.

Together, these features automate manual tasks, enforce compliance, and give you the data needed to optimize spending and make better financial decisions.

Compare top spend management tools

This table shows leading spend management softwares side by side. Use it to quickly spot which platforms align with your needs for features, integrations, pricing, and fit.

Tool | Best For | G2 Rating | Starting Price | Pricing | Free Trial/Promo |

|---|---|---|---|---|---|

Ramp | Businesses of all sizes, from startups to large enterprises | 4.8 | Free | $15/user/mo. for Ramp Plus, Enterprise pricing available | Unlimited free tier |

Spendesk | Startups Mid-market | 4.6 | Quote-based | Tiered subscription plans | No free plan (demo only) |

BILL Spend & Expense | Small businesses | 4.5 | Free | Free plan with revenue from interchange; enterprise pricing available | Unlimited free tier |

Expensify | Small Businesses Mid-marke | 4.5 | $5/user/mo. (Collect) | $5 Collect, $9 Control | 7-day free trial |

Teampay | Mid-market | 4.4 | Quote-based | Custom plans by company size, features, and modules | No free plan (demo only) |

Coupa | Large enterprises | 4.02 | Quote-based | Enterprise modules priced separately | No free plan (demo only) |

*G2 ratings are current as of January 2026.

6 of the best spend management platforms reviewed

Managing company spend is increasingly complex as businesses scale across teams, regions, and payment methods. The right platform helps finance teams track expenses, enforce policies, and gain real-time visibility. Below, we’ve reviewed six of the best spend management software providers in 2026—Ramp, Spendesk, BILL Spend & Expense, Expensify, Teampay, and Coupa—so you can find the one that fits your business.

Ramp

Ramp combines corporate cards, expense management, bill payments, and procurement into a single platform. It is designed for fast-growing startups and mid-market companies that want to streamline financial operations and uncover savings opportunities.

Key features

- AI-powered savings insights and automation

- Unlimited virtual and physical cards with spend controls

- Automated receipt scanning and real-time expense tracking

- Procurement workflows including vendor management and contract tracking

- Policy enforcement to prevent out-of-policy spending

Integrations

Ramp integrates with QuickBooks, Xero, NetSuite, and Sage Intacct, along with HRIS platforms such as Rippling and Workday. It also connects with thousands of other apps via Zapier.

Pros

- Ramp’s automation and AI insights help companies actively identify cost savings.

- The platform consolidates cards, bill pay, and procurement in a single interface, reducing the need for multiple vendors.

- Its implementation is fast and intuitive, making it easy for small finance teams to adopt.

Cons

Ramp’s international features are still expanding, which may create limitations for global organizations.

Pricing

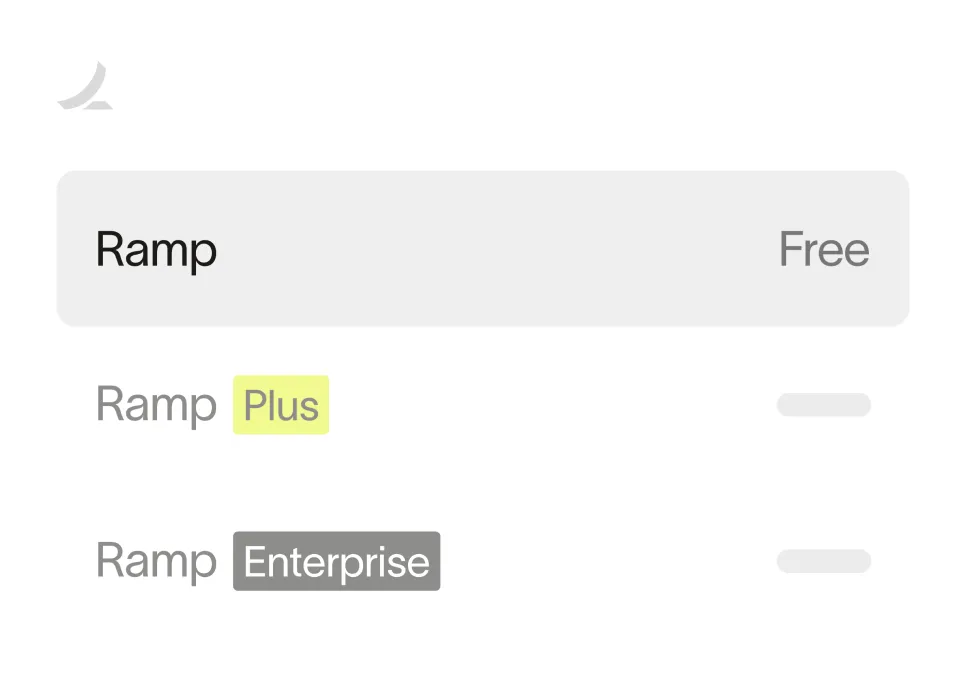

- Ramp’s core platform is free, with revenue generated through interchange fees on card usage.

- Ramp Plus costs $15 per user per month and unlocks advanced controls and customization.

- Enterprise pricing is available for larger organizations—contact for a custom quote.

Best for

Ramp is ideal for businesses of all sizes, from startups to enterprises. Its free core platform suits growing teams, while Ramp Plus and enterprise plans scale for larger organizations.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Spendesk

Spendesk is an all-in-one spend management solution with strong adoption in Europe. It provides centralized control while giving employees flexible payment options.

Key features

- Physical and virtual cards with customizable limits

- Invoice processing with approval workflows

- Expense reimbursements and budget management

- Real-time dashboards and analytics

- Multi-entity and multi-currency capabilities

Integrations

Spendesk integrates with NetSuite, QuickBooks, and Xero, along with HRIS systems and banks through its API.

Pros

- Spendesk’s multi-entity and multi-currency support makes it an excellent choice for European businesses operating across borders.

- Its dashboards and real-time controls give finance teams strong visibility into spend without overcomplicating workflows.

Cons

- Spendesk has a smaller North American presence compared to enterprise vendors.

- It offers fewer advanced procurement features than platforms like Coupa.

Pricing

Spendesk offers subscription-based, tiered pricing without per-active-user charges. Plans vary by company size and features, with custom quotes available.

Best for

Spendesk is designed for startups and mid-market businesses, especially those operating in Europe or managing multi-entity, multi-currency needs.

BILL Spend & Expense

BILL Spend & Expense, previously Divvy, combines corporate cards, expense tracking, and basic AP automation. It is designed for small and midsize businesses, particularly those already using BILL’s accounts payable and receivable products.

Key features

- Real-time spend controls on physical and virtual cards

- Automated categorization of expenses

- Simple approval workflows and reimbursements

- Budget management and analytics

- Seamless integration with BILL’s AP/AR platform

Integrations

BILL Spend & Expense integrates with QuickBooks, Xero, NetSuite, and Sage Intacct.

Pros

- The platform integrates tightly with BILL’s AP/AR solutions, making it ideal for businesses already in the BILL ecosystem.

- Its card-based spend controls and real-time budget tracking are easy to set up and use.

Cons

BILL Spend & Expense lacks advanced procurement and supplier management features, making it less suitable for larger enterprises.

Pricing

BILL Spend & Expense is free to use, with revenue generated primarily from interchange fees on card spend. Additional transaction fees may apply depending on services.

Best for

BILL Spend & Expense works well for small and mid-market businesses, particularly QuickBooks or Xero users who want card-first spend management integrated with BILL’s AP/AR platform.

Expensify

Expensify focuses on streamlined expense management with an emphasis on ease of use and rapid deployment. It is popular among small to midsize businesses.

Key features

- SmartScan receipt capture with OCR

- Automatic credit card import and policy enforcement

- Next-day employee reimbursements

- Basic approval workflows

- Corporate card management and travel booking via partners

Integrations

Expensify integrates with accounting systems such as QuickBooks and Xero, along with HRIS platforms and travel booking tools.

Pros

- Expensify is quick to implement and employees find its mobile app simple and intuitive.

- Next-day reimbursements improve employee satisfaction.

- Flexible active-user pricing keeps costs low for companies with occasional expense reporters.

Cons

Expensify lacks advanced procurement and approval customization, making it less suitable for larger enterprises.

Pricing

- The Collect plan starts at $5 per active user per month.

- The Control plan begins at $9 per active user per month when billed annually.

Best for

Expensify suits small and mid-market businesses, as well as teams within larger organizations, that want a simple, user-friendly expense reporting solution.

Teampay

Teampay is a spend management platform designed to give employees flexibility while maintaining finance team control. It automates the purchasing process from request through reconciliation, making it a strong fit for distributed, fast-growing organizations.

Key features

- Virtual and physical cards with customizable spend limits

- Pre-approval workflows to control spend before purchases are made

- Real-time expense tracking and budget visibility

- Automatic categorization and reconciliation of transactions

- Multi-entity and multi-currency support for global teams

Integrations

Teampay integrates with NetSuite, QuickBooks, Xero, Sage Intacct, and leading collaboration tools like Slack and Microsoft Teams, enabling employees to make purchase requests directly in chat.

Pros

- Pre-approval workflows prevent out-of-policy spend before it happens.

- Employee-friendly interface encourages adoption and compliance.

- Strong collaboration tool integrations streamline requests and approvals.

- Works well for distributed teams managing purchases across multiple departments.

Cons

- Focused more on pre-approvals than advanced procurement or AP automation.

- Pricing can be higher than lightweight SMB-focused expense tools.

- May be more robust than very small businesses need.

Pricing

Teampay does not publish list pricing. Plans are custom and vary by company size, feature set, and selected modules.

Best for

Teampay is best for mid-market companies that want to empower employees to make purchases while keeping finance teams in control through pre-approvals and real-time visibility.

Coupa

Coupa is a comprehensive Business Spend Management platform that goes beyond expense management to cover procurement, sourcing, invoicing, and supplier management. It is built for global enterprises with complex financial operations.

Key features

- Guided procurement and sourcing workflows

- Invoice management with advanced matching

- Expense tracking with automated policy enforcement

- Supplier information management and benchmarking

- AI and community intelligence for spend optimization

Integrations

Coupa connects with major ERP systems such as SAP and Oracle, as well as HRIS platforms and industry-specific solutions.

Pros

- Coupa provides an enterprise-grade suite that covers sourcing through payment, offering unmatched breadth.

- Its supplier network and community insights deliver benchmarking and risk monitoring unavailable in smaller tools.

- Compliance and regulatory features are particularly strong for highly regulated industries.

Cons

- Coupa’s implementations are lengthy and resource-intensive, requiring significant IT and finance involvement.

- The platform is costly, making it impractical for smaller organizations.

Pricing

Coupa uses custom enterprise pricing based on modules, company size, and deployment scope.

Best for

Coupa is built for large enterprises with complex procurement, sourcing, and compliance requirements, especially those with global operations.

How to choose the right spend management software

Selecting a spend management platform comes down to finding the right fit for your company’s needs today while ensuring it can scale with you tomorrow. Here are the key areas to focus on when evaluating options:

1. Identify your business needs

Document your current pain points and workflows. If manual reconciliations are slowing your team down, automation should be a priority. If compliance is inconsistent, focus on platforms with real-time policy enforcement. Match the solution to the problems you need to solve, not just a feature checklist.

2. Factor in company size and growth

Small businesses often benefit from simple, user-friendly platforms that employees adopt quickly. Larger organizations usually need software that supports complex approval chains, multiple entities, and global compliance. Think about scalability—your platform should handle growing headcount and transaction volume without forcing a costly switch.

3. Check integrations and compatibility

Strong integrations with your accounting, ERP, HR, and banking systems are essential. The best platforms automatically sync transactions with the general ledger, eliminating manual entry and reconciliation. Poor integrations create silos and more work for finance teams.

4. Evaluate cost and ROI

Look beyond subscription pricing to include implementation, training, and support costs. Compare that total investment to the time savings and cost reductions you expect from automation and policy control. Many companies see efficiency gains offset the platform’s cost within the first year.

5. Prioritize usability and adoption

Even the most advanced system won’t deliver value if employees struggle to use it. Look for an intuitive interface, strong mobile app, and simple receipt capture. Role-based permissions should give finance teams full control without complicating the process for employees, and multi-currency support ensures the platform works seamlessly across global teams.

6. Review security and compliance

A good platform should help you meet audit and regulatory requirements while keeping sensitive data secure. Features like built-in audit trails, SOC 2 compliance, and GDPR readiness are critical, especially for companies in regulated industries or with international operations.

Choose Ramp for smarter spend management

The best spend management software depends on your company’s size, industry, and goals—but the right solution should give you visibility, control, and automation across every dollar spent. By considering your requirements, integrations, ROI, usability, and compliance, you can find a platform that not only fixes today’s challenges but also scales with your growth.

Ramp makes that choice simple. As the only platform that combines corporate cards, expense management, bill payments, and procurement in one place, Ramp delivers the automation and insights companies need to save time and money. With a free core platform, deep integrations, and powerful AI-driven savings tools, Ramp is built to help businesses of all sizes manage spend more effectively.

See why over 50,000 companies choose Ramp to streamline their finances and start saving from day one and explore our spend management platform today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits